Initiates Q1 2017 Outlook and Adjusts FY

2017 Outlook for Changes in Currency

ANSYS, Inc. (NASDAQ:ANSS), today reported fourth quarter and FY

2016 revenue growth of 8% and 5%, respectively, in constant

currency. Recurring revenue, which is comprised of lease license

and annual maintenance revenue, totaled 71% of revenue for the

fourth quarter and 74% for the year. For the quarter, the

Company reported 7% and 8% growth in diluted earnings per share on

a GAAP and non-GAAP basis, respectively, and 8% and 6% GAAP and

non-GAAP diluted earnings per share growth, respectively, for the

full year. The results for the fourth quarter and for the

year include a charge of $4.7 million, or $0.03 per share,

associated with an employment-related settlement. This charge

was not previously included in the outlook provided by management

in its November 3, 2016 earnings press release.

Ajei Gopal, ANSYS president & CEO, stated, “The demand for

ANSYS' portfolio has never been stronger. The merger of the

physical and digital worlds is creating an unprecedented

disruption, resulting in amazing new products such as self-driving

vehicles, personalized medical devices and smart buildings.

But the complexity required to develop these products is immense.

ANSYS is the only company with the depth and breadth of simulation

capabilities to empower our customers to bring this next generation

of products to the market.”

“I am very pleased with our strong finish to the year and am

encouraged by our early progress on our 2017 initiatives. The

underlying fundamentals of our business performed within

expectations as evidenced by our record revenue and deferred

revenue and backlog, all while maintaining continued strong

margins" said Gopal. “I am very encouraged by our progress in

sales growth initiatives in North America and Asia-Pacific, which

grew 10% and 12% in constant currency, respectively. Our

European business had some challenges, and we have made changes to

improve our sales execution. We saw continued improvements in

our channel partners’ performance, most notably in China and India,

where we had strong double-digit growth for the quarter and the

full year. During Q4 we had thirty-seven customers with orders in

excess of $1 million, including eight enterprise agreements,

bringing the total number of enterprise agreements to eighteen for

2016, three above our previous projection.”

Maria Shields, ANSYS CFO, stated, “To continue to strengthen our

position, as part of our 2017 annual planning process, we are

implementing a workforce realignment that is intended to accelerate

investments toward strategic initiatives and higher growth

opportunities, while also allowing the Company to maintain the

gross and operating margins that we communicated last

November. Through this realignment, we intend to reduce

expenses across the business and to reallocate resources and

ongoing investments to align with the Company's future plans.

These actions resulted in GAAP restructuring charges of $3.4

million ($2.4 million, net of tax) in the fourth quarter and are

expected to result in additional charges in 2017 of approximately

$10 to $15 million ($7 - $10 million, net of tax) for one-time

severance benefits and other costs related to the

realignment. The majority of the 2017 charges are currently

expected to be recorded in the first quarter of 2017, with the

remainder being recorded in the second quarter. The Company

anticipates that substantially all of the cash payments related to

these charges will be made in 2017.”

Financial Results

ANSYS' fourth quarter and fiscal year 2016 financial results are

presented below. The 2016 and 2015 non-GAAP results exclude the

income statement effects of acquisition adjustments to deferred

revenue, the impact of stock-based compensation,

acquisition-related amortization of intangible assets and

acquisition-related transaction costs. The 2016 fourth

quarter and fiscal year non-GAAP results also exclude restructuring

charges.

GAAP and non-GAAP results reflect:

| |

GAAP |

|

Non-GAAP |

| (in millions,

except percentages and per share data) |

Q4 2016 |

|

Q4 2015 |

|

% Change |

|

Q4 2016 |

|

Q4 2015 |

|

% Change |

| Revenue |

$ |

270.6 |

|

|

$ |

251.6 |

|

|

8 |

% |

|

$ |

270.6 |

|

|

$ |

252.0 |

|

|

7 |

% |

| Net income |

$ |

70.0 |

|

|

$ |

68.0 |

|

|

3 |

% |

|

$ |

86.1 |

|

|

$ |

82.4 |

|

|

4 |

% |

| Earnings per share |

$ |

0.80 |

|

|

$ |

0.75 |

|

|

7 |

% |

|

$ |

0.98 |

|

|

$ |

0.91 |

|

|

8 |

% |

| Operating profit

margin |

35.8 |

% |

|

38.5 |

% |

|

|

|

|

45.1 |

% |

|

47.5 |

% |

|

|

| Operating cash

flow |

$ |

96.2 |

|

|

$ |

109.2 |

|

|

(12 |

)% |

|

|

|

|

|

|

| |

GAAP |

|

Non-GAAP |

| (in millions,

except percentages and per share data) |

YTD 2016 |

|

YTD 2015 |

|

% Change |

|

YTD 2016 |

|

YTD 2015 |

|

% Change |

| Revenue |

$ |

988.5 |

|

|

$ |

942.8 |

|

|

5 |

% |

|

$ |

988.6 |

|

|

$ |

944.5 |

|

|

5 |

% |

| Net income |

$ |

265.6 |

|

|

$ |

252.5 |

|

|

5 |

% |

|

$ |

322.9 |

|

|

$ |

313.4 |

|

|

3 |

% |

| Earnings per share |

$ |

2.99 |

|

|

$ |

2.76 |

|

|

8 |

% |

|

$ |

3.63 |

|

|

$ |

3.42 |

|

|

6 |

% |

| Operating profit

margin |

38.1 |

% |

|

37.5 |

% |

|

|

|

|

47.0 |

% |

|

47.5 |

% |

|

|

| Operating cash

flow |

$ |

356.8 |

|

|

$ |

367.5 |

|

|

(3 |

)% |

|

|

|

|

|

|

The non-GAAP financial results highlighted

above, and the non-GAAP financial outlook for 2017 discussed below,

represent non-GAAP financial measures. Reconciliations of these

measures to the appropriate GAAP measures, for the three months and

twelve months ended December 31, 2016 and 2015, and for the

2017 financial outlook, are included in the condensed financial

information included in this release.

2017 Financial Outlook

The Company's first quarter and fiscal year 2017

revenue and earnings per share guidance is provided below. The

Company last provided its guidance on November 3, 2016. The

previously provided fiscal year 2017 guidance has been updated to

reflect changes in currency exchange rates, as well as the

Company's announced realignment initiatives. The revenue and

earnings per share guidance is provided on both a GAAP and a

non-GAAP basis. Non-GAAP financial measures exclude the income

statement effects of acquisition accounting adjustments to deferred

revenue, stock-based compensation expense, acquisition-related

amortization of intangible assets, restructuring charges and

acquisition-related transaction expenses.

First Quarter 2017 Guidance

The Company currently expects the following for the quarter

ending March 31, 2017:

- GAAP and non-GAAP revenue in the range of $237.0 - $246.0

million

- GAAP diluted earnings per share of $0.51 - $0.63

- Non-GAAP diluted earnings per share of $0.81 - $0.85

Fiscal Year 2017 Guidance

The Company currently expects the following for the fiscal year

ending December 31, 2017:

- GAAP and non-GAAP revenue in the range of $1.010 - $1.045

billion

- GAAP diluted earnings per share of $2.84 - $3.16

- Non-GAAP diluted earnings per share of $3.63 - $3.83

Conference Call Information

ANSYS will hold a conference call at 8:30 a.m. Eastern

Time on February 23, 2017 to discuss fourth quarter

and FY 2016 results. The Company will provide its prepared remarks

on the Company’s investor relations homepage and as an exhibit in

its Form 8-K in advance of the call to provide shareholders and

analysts with additional time and detail for analyzing its results

in preparation for the conference call. The prepared remarks will

not be read on the call - only brief remarks will be made prior to

the Q&A session.

To participate in the live conference call, dial 855-239-2942

(US) or 412-542-4124 (Canada & Int’l). The call will be

recorded and a replay will be available approximately one hour

after the call ends. The replay will be available for 10 days by

dialing 877-344-7529 (US), (855) 669-9658 (Canada) or 412-317-0088

(Int’l) and entering the passcode 10100291. The archived webcast

can be accessed, along with other financial information, on ANSYS'

website at

http://investors.ansys.com/events-and-presentations/events.aspx.

| |

| ANSYS, INC. AND SUBSIDIARIES |

| Condensed Consolidated Balance

Sheets |

| (Unaudited) |

| |

| (in

thousands) |

December 31, 2016 |

|

December 31, 2015 |

|

ASSETS: |

|

|

|

| Cash

& short-term investments |

$ |

822,860 |

|

|

$ |

784,614 |

|

| Accounts

receivable, net |

107,192 |

|

|

91,579 |

|

|

Goodwill |

1,337,215 |

|

|

1,332,348 |

|

| Other

intangibles, net |

172,619 |

|

|

220,553 |

|

| Other

assets |

360,640 |

|

|

300,810 |

|

| Total

assets |

$ |

2,800,526 |

|

|

$ |

2,729,904 |

|

| LIABILITIES

& STOCKHOLDERS' EQUITY: |

|

|

|

| Deferred

revenue |

$ |

403,279 |

|

|

$ |

364,644 |

|

| Other

liabilities |

188,842 |

|

|

170,833 |

|

|

Stockholders' equity |

2,208,405 |

|

|

2,194,427 |

|

| Total

liabilities & stockholders' equity |

$ |

2,800,526 |

|

|

$ |

2,729,904 |

|

| ANSYS, INC. AND SUBSIDIARIES |

| Condensed Consolidated Statements of

Income |

| (Unaudited) |

| |

| |

Three Months Ended |

|

Twelve Months Ended |

| (in thousands,

except per share data) |

December 31, 2016 |

|

December 31, 2015 |

|

December 31, 2016 |

|

December 31, 2015 |

| Revenue: |

|

|

|

|

|

|

|

| Software

licenses |

$ |

161,506 |

|

|

$ |

149,450 |

|

|

$ |

568,174 |

|

|

$ |

555,105 |

|

|

Maintenance and service |

109,122 |

|

|

102,197 |

|

|

420,291 |

|

|

387,648 |

|

| Total

revenue |

270,628 |

|

|

251,647 |

|

|

988,465 |

|

|

942,753 |

|

| Cost of sales: |

|

|

|

|

|

|

|

| Software

licenses |

9,155 |

|

|

8,057 |

|

|

28,860 |

|

|

29,105 |

|

|

Amortization |

9,548 |

|

|

9,837 |

|

|

38,092 |

|

|

38,755 |

|

|

Maintenance and service |

20,275 |

|

|

19,098 |

|

|

79,908 |

|

|

79,386 |

|

| Total

cost of sales |

38,978 |

|

|

36,992 |

|

|

146,860 |

|

|

147,246 |

|

| Gross profit |

231,650 |

|

|

214,655 |

|

|

841,605 |

|

|

795,507 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

| Selling,

general and administrative |

85,950 |

|

|

71,963 |

|

|

269,515 |

|

|

253,603 |

|

| Research

and development |

45,560 |

|

|

41,392 |

|

|

183,093 |

|

|

168,831 |

|

|

Amortization |

3,174 |

|

|

4,357 |

|

|

12,755 |

|

|

19,394 |

|

| Total

operating expenses |

134,684 |

|

|

117,712 |

|

|

465,363 |

|

|

441,828 |

|

| Operating income |

96,966 |

|

|

96,943 |

|

|

376,242 |

|

|

353,679 |

|

| Interest expense |

(46 |

) |

|

— |

|

|

(221 |

) |

|

(325 |

) |

| Interest income |

1,099 |

|

|

704 |

|

|

4,209 |

|

|

2,829 |

|

| Other income (expense),

net |

47 |

|

|

153 |

|

|

85 |

|

|

582 |

|

| Income before income

tax provision |

98,066 |

|

|

97,800 |

|

|

380,315 |

|

|

356,765 |

|

| Income tax

provision |

28,083 |

|

|

29,779 |

|

|

114,679 |

|

|

104,244 |

|

| Net income |

$ |

69,983 |

|

|

$ |

68,021 |

|

|

$ |

265,636 |

|

|

$ |

252,521 |

|

| Earnings per share –

basic: |

|

|

|

|

|

|

|

| Earnings

per share |

$ |

0.81 |

|

|

$ |

0.77 |

|

|

$ |

3.05 |

|

|

$ |

2.82 |

|

| Weighted

average shares |

86,198 |

|

|

88,626 |

|

|

87,227 |

|

|

89,561 |

|

| Earnings per share –

diluted: |

|

|

|

|

|

|

|

| Earnings

per share |

$ |

0.80 |

|

|

$ |

0.75 |

|

|

$ |

2.99 |

|

|

$ |

2.76 |

|

| Weighted

average shares |

87,811 |

|

|

90,549 |

|

|

88,969 |

|

|

91,502 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ANSYS, INC. AND SUBSIDIARIES |

| Reconciliation of Non-GAAP

Measures |

| (Unaudited) |

| |

| |

Three Months Ended |

| |

December 31, 2016 |

|

December 31, 2015 |

| (in thousands,

except percentages and per share data) |

As Reported |

|

Adjustments |

|

Non-GAAP Results |

|

As Reported |

|

Adjustments |

|

Non-GAAP Results |

| Total revenue |

$ |

270,628 |

|

|

$ |

— |

|

|

$ |

270,628 |

|

|

$ |

251,647 |

|

|

$ |

360 |

|

(3 |

) |

$ |

252,007 |

|

| Operating income |

96,966 |

|

|

25,124 |

|

(1 |

) |

122,090 |

|

|

96,943 |

|

|

22,780 |

|

(4 |

) |

119,723 |

|

| Operating profit

margin |

35.8 |

% |

|

|

|

45.1 |

% |

|

38.5 |

% |

|

|

|

47.5 |

% |

| Net income |

$ |

69,983 |

|

|

$ |

16,141 |

|

(2 |

) |

$ |

86,124 |

|

|

$ |

68,021 |

|

|

$ |

14,396 |

|

(5 |

) |

$ |

82,417 |

|

| Earnings per share –

diluted: |

|

|

|

|

|

|

|

|

|

|

|

| Earnings

per share |

$ |

0.80 |

|

|

|

|

$ |

0.98 |

|

|

$ |

0.75 |

|

|

|

|

$ |

0.91 |

|

| Weighted

average shares |

87,811 |

|

|

|

|

87,811 |

|

|

90,549 |

|

|

|

|

90,549 |

|

(1) Amount represents $12.7 million of amortization expense

associated with intangible assets acquired in business

combinations, $8.8 million of stock-based compensation expense,

$3.4 million of restructuring charges and $0.2 million of

transaction expenses related to business combinations.

(2) Amount represents the impact of the adjustments to operating

income referred to in (1) above, adjusted for the related

income tax impact of $9.0 million.

(3) Amount represents the revenue not reported during the period

as a result of the acquisition accounting adjustment associated

with the accounting for deferred revenue in business

combinations.

(4) Amount represents $14.2 million of amortization expense

associated with intangible assets acquired in business

combinations, $8.2 million of stock-based compensation expense and

the $0.4 million adjustment to revenue as reflected in (3)

above.

(5) Amount represents the impact of the adjustments to operating

income referred to in (4) above, adjusted for the related

income tax impact of $8.4 million.

| |

| ANSYS, INC. AND SUBSIDIARIES |

| Reconciliation of Non-GAAP

Measures |

| (Unaudited) |

| |

Twelve Months Ended |

| |

December 31, 2016 |

|

December 31, 2015 |

| (in thousands,

except percentages and per share data) |

As Reported |

|

Adjustments |

|

Non-GAAP Results |

|

As Reported |

|

Adjustments |

|

Non-GAAP Results |

| Total revenue |

$ |

988,465 |

|

|

$ |

103 |

|

(1 |

) |

$ |

988,568 |

|

|

$ |

942,753 |

|

|

$ |

1,725 |

|

(4 |

) |

$ |

944,478 |

|

| Operating income |

376,242 |

|

|

88,114 |

|

(2 |

) |

464,356 |

|

|

353,679 |

|

|

94,665 |

|

(5 |

) |

448,344 |

|

| Operating profit

margin |

38.1 |

% |

|

|

|

47.0 |

% |

|

37.5 |

% |

|

|

|

47.5 |

% |

| Net income |

$ |

265,636 |

|

|

$ |

57,286 |

|

(3 |

) |

$ |

322,922 |

|

|

$ |

252,521 |

|

|

$ |

60,854 |

|

(6 |

) |

$ |

313,375 |

|

| Earnings per share –

diluted: |

|

|

|

|

|

|

|

|

|

|

|

| Earnings

per share |

$ |

2.99 |

|

|

|

|

$ |

3.63 |

|

|

$ |

2.76 |

|

|

|

|

$ |

3.42 |

|

| Weighted

average shares |

88,969 |

|

|

|

|

88,969 |

|

|

91,502 |

|

|

|

|

91,502 |

|

(1) Amount represents the revenue not reported during the period

as a result of the acquisition accounting adjustment associated

with the accounting for deferred revenue in business

combinations.(2) Amount represents $50.8 million of amortization

expense associated with intangible assets acquired in business

combinations, $33.3 million of stock-based compensation expense,

the $0.1 million adjustment to revenue as reflected in

(1) above, $3.4 million of restructuring charges and $0.4

million of transaction expenses related to business

combinations.(3) Amount represents the impact of the adjustments to

operating income referred to in (2) above, adjusted for the

related income tax impact of $30.8 million.(4) Amount represents

the revenue not reported during the period as a result of the

acquisition accounting adjustment associated with the accounting

for deferred revenue in business combinations.(5) Amount represents

$58.1 million of amortization expense associated with intangible

assets acquired in business combinations, $34.0 million of

stock-based compensation expense, the $1.7 million adjustment to

revenue as reflected in (4) above and $0.8 million of transaction

expenses related to business combinations.(6) Amount represents the

impact of the adjustments to operating income referred to in

(5) above, adjusted for the related income tax impact of $33.8

million.

| |

| ANSYS, INC. AND SUBSIDIARIES |

| Reconciliation of Forward-Looking

Guidance |

| Quarter Ending March 31, 2017 |

| |

Earnings Per

Share Range - Diluted |

| U.S. GAAP

expectation |

$0.51

- $0.63 |

| Adjustment to exclude

acquisition-related amortization |

$0.08

- $0.09 |

| Adjustment to exclude

stock-based compensation |

$0.06

- $0.08 |

| Adjustment to exclude

restructuring charges |

$0.08 - $0.13 |

| Non-GAAP

expectation |

$0.81 - $0.85 |

| |

|

| ANSYS, INC. AND SUBSIDIARIES |

| Reconciliation of Forward-Looking

Guidance |

| Year Ending December 31, 2017 |

| |

Earnings Per

Share Range - Diluted |

| U.S. GAAP

expectation |

$2.84

- $3.16 |

| Adjustment to exclude

acquisition-related amortization |

$0.34

- $0.36 |

| Adjustment to exclude

stock-based compensation |

$0.25

- $0.30 |

| Adjustment to exclude

restructuring charges |

$0.08 - $0.13 |

| Non-GAAP

expectation |

$3.63 - $3.83 |

| |

|

Use of Non-GAAP Measures

The Company provides non-GAAP revenue, non-GAAP

operating income, non-GAAP operating profit margin, non-GAAP net

income and non-GAAP diluted earnings per share as supplemental

measures to GAAP regarding the Company's operational performance.

These financial measures exclude the impact of certain items and,

therefore, have not been calculated in accordance with GAAP. A

detailed explanation and of each of the adjustments to such

financial measures is described below. This press release also

contains a reconciliation of each of these non-GAAP financial

measures to its most comparable GAAP financial measure.

Management uses non-GAAP financial measures (a) to evaluate

the Company's historical and prospective financial performance as

well as its performance relative to its competitors, (b) to

set internal sales targets and spending budgets, (c) to

allocate resources, (d) to measure operational profitability

and the accuracy of forecasting, (e) to assess financial

discipline over operational expenditures and (f) as an

important factor in determining variable compensation for

management and its employees. In addition, many financial analysts

that follow the Company focus on and publish both historical

results and future projections based on non-GAAP financial

measures. The Company believes that it is in the best interest of

its investors to provide this information to analysts so that they

accurately report the non-GAAP financial information. Moreover,

investors have historically requested and the Company has

historically reported these non-GAAP financial measures as a means

of providing consistent and comparable information with past

reports of financial results.

While management believes that these non-GAAP financial measures

provide useful supplemental information to investors, there are

limitations associated with the use of these non-GAAP financial

measures. These non-GAAP financial measures are not prepared in

accordance with GAAP, are not reported by all of the Company’s

competitors and may not be directly comparable to similarly titled

measures of the Company’s competitors due to potential differences

in the exact method of calculation. The Company compensates for

these limitations by using these non-GAAP financial measures as

supplements to GAAP financial measures and by reviewing the

reconciliations of the non-GAAP financial measures to their most

comparable GAAP financial measures.

The adjustments to these non-GAAP financial measures, and the

basis for such adjustments, are outlined below:

Acquisition accounting for deferred revenue and its

related tax impact. Historically, the Company has

consummated acquisitions in order to support its strategic and

other business objectives. In accordance with the fair value

provisions applicable to the accounting for business combinations,

acquired deferred revenue is often recorded on the opening balance

sheet at an amount that is lower than the historical carrying

value. Although this acquisition accounting requirement has no

impact on the Company's business or cash flow, it adversely impacts

the Company's reported GAAP revenue in the reporting periods

following an acquisition. In order to provide investors with

financial information that facilitates comparison of both

historical and future results, the Company provides non-GAAP

financial measures which exclude the impact of the acquisition

accounting adjustment. The Company believes that this non-GAAP

financial adjustment is useful to investors because it allows

investors to (a) evaluate the effectiveness of the methodology

and information used by management in its financial and operational

decision-making, and (b) compare past and future reports of

financial results of the Company as the revenue reduction related

to acquired deferred revenue will not recur when related annual

lease licenses and software maintenance contracts are renewed in

future periods.

Amortization of intangible assets from acquisitions and

its related tax impact. The Company incurs

amortization of intangible assets, included in its GAAP

presentation of amortization expense, related to various

acquisitions it has made. Management excludes these expenses and

their related tax impact for the purpose of calculating non-GAAP

operating income, non-GAAP operating profit margin, non-GAAP net

income and non-GAAP diluted earnings per share when it evaluates

the continuing operational performance of the Company because these

costs are fixed at the time of an acquisition, are then amortized

over a period of several years after the acquisition and generally

cannot be changed or influenced by management after the

acquisition. Accordingly, management does not consider these

expenses for purposes of evaluating the performance of the Company

during the applicable time period after the acquisition, and it

excludes such expenses when making decisions to allocate resources.

The Company believes that these non-GAAP financial measures are

useful to investors because they allow investors to

(a) evaluate the effectiveness of the methodology and

information used by management in its financial and operational

decision-making, and (b) compare past reports of financial

results of the Company as the Company has historically reported

these non-GAAP financial measures.

Stock-based compensation expense and its related tax

impact. The Company incurs expense related to

stock-based compensation included in its GAAP presentation of cost

of software licenses; cost of maintenance and service; research and

development expense; and selling, general and administrative

expense. Stock-based compensation (benefit) incurred in connection

with the Company's deferred compensation plan held in a rabbi trust

includes an offsetting benefit (charge) recorded in other income

(expense). Although stock-based compensation is an expense of the

Company and viewed as a form of compensation, management excludes

these expenses for the purpose of calculating non-GAAP operating

income, non-GAAP operating profit margin, non-GAAP net income and

non-GAAP diluted earnings per share when it evaluates the

continuing operational performance of the Company. Management

similarly excludes income (expense) related to assets held in a

rabbi trust in connection with the Company's deferred compensation

plan. Specifically, the Company excludes stock-based compensation

and income related to assets held in the deferred compensation plan

rabbi trust during its annual budgeting process and its quarterly

and annual assessments of the Company's and management's

performance. The annual budgeting process is the primary mechanism

whereby the Company allocates resources to various initiatives and

operational requirements. Additionally, the annual review by the

board of directors during which it compares the Company's

historical business model and profitability to the planned business

model and profitability for the forthcoming year excludes the

impact of stock-based compensation. In evaluating the performance

of senior management and department managers, charges related to

stock-based compensation are excluded from expenditure and

profitability results. In fact, the Company records stock-based

compensation expense into a stand-alone cost center for which no

single operational manager is responsible or accountable. In this

way, management is able to review, on a period-to-period basis,

each manager's performance and assess financial discipline over

operational expenditures without the effect of stock-based

compensation. The Company believes that these non-GAAP financial

measures are useful to investors because they allow investors to

(a) evaluate the Company's operating results and the

effectiveness of the methodology used by management to review the

Company's operating results, and (b) review historical

comparability in the Company's financial reporting as well as

comparability with competitors' operating results.

Restructuring charges and the related tax

impact. The Company occasionally incurs expenses for

restructuring its workforce included in its GAAP presentation of

cost of software licenses; cost of maintenance and service;

research and development expense; and selling, general and

administrative expense. Management excludes these expenses for the

purpose of calculating non-GAAP operating income, non-GAAP

operating profit margin, non-GAAP net income and non-GAAP diluted

earnings per share when it evaluates the continuing operational

performance of the Company, as it generally generally does not

incur these expenses as a part of its operations. The Company

believes that these non-GAAP financial measures are useful to

investors because they allow investors to (a) evaluate the

Company's operating results and the effectiveness of the

methodology used by management to review the Company's operating

results, and (b) review historical comparability in the

Company's financial reporting as well as comparability with

competitors' operating results.

Transaction costs related to business

combinations. The Company incurs expenses for

professional services rendered in connection with business

combinations, which are included in its GAAP presentation of

selling, general and administrative expense. These expenses are

generally not tax-deductible. Management excludes these

acquisition-related transaction expenses for the purpose of

calculating non-GAAP operating income, non-GAAP operating profit

margin, non-GAAP net income and non-GAAP diluted earnings per share

when it evaluates the continuing operational performance of the

Company, as it generally would not have otherwise incurred these

expenses in the periods presented as a part of its operations. The

Company believes that these non-GAAP financial measures are useful

to investors because they allow investors to (a) evaluate the

Company's operating results and the effectiveness of the

methodology used by management to review the Company's operating

results, and (b) review historical comparability in the

Company's financial reporting as well as comparability with

competitors' operating results.

Non-GAAP financial measures are not in accordance with, or an

alternative for, GAAP. The Company's non-GAAP financial measures

are not meant to be considered in isolation or as a substitute for

comparable GAAP financial measures, and should be read only in

conjunction with the Company's consolidated financial statements

prepared in accordance with GAAP.

The Company has provided a reconciliation of the non-GAAP

financial measures to the most directly comparable GAAP financial

measures as listed below:

| GAAP Reporting

Measure |

|

Non-GAAP

Reporting Measure |

| Revenue |

|

Non-GAAP Revenue |

| Operating Income |

|

Non-GAAP Operating

Income |

| Operating Profit

Margin |

|

Non-GAAP Operating

Profit Margin |

| Net Income |

|

Non-GAAP Net

Income |

| Diluted Earnings Per

Share |

|

Non-GAAP Diluted

Earnings Per Share |

About ANSYS, Inc.

If you’ve ever seen a rocket launch, flown on an airplane,

driven a car, used a computer, touched a mobile device, crossed a

bridge, or put on wearable technology, chances are you’ve used a

product where ANSYS software played a critical role in its

creation. ANSYS is the global leader in engineering simulation. We

help the world’s most innovative companies deliver radically better

products to their customers. By offering the best and broadest

portfolio of engineering simulation software, we help them solve

the most complex design challenges and create products limited only

by imagination. Founded in 1970, ANSYS employs thousands of

professionals, many of whom are expert M.S. and Ph.D.-level

engineers in finite element analysis, computational fluid dynamics,

electronics, semiconductors, embedded software and design

optimization. Headquartered south of Pittsburgh, Pennsylvania,

U.S.A., ANSYS has more than 75 strategic sales locations throughout

the world with a network of channel partners in 40+ countries.

To join the simulation conversation, please visit: www.ansys.com/Social@ANSYS.

Forward Looking Information

Certain statements contained in this press release regarding

matters that are not historical facts, including, but not limited

to, statements regarding our projections for revenue and earnings

per share for the first quarter of 2017, fiscal year 2017 (both

GAAP and non-GAAP to exclude acquisition accounting adjustments to

deferred revenue, acquisition-related amortization, stock-based

compensation expense, acquisition-related transaction costs and

restructuring charges and related tax impacts); statements about

management's views concerning the Company's prospects and outlook

for 2017, including statements and projections relating to the

impact of stock-based compensation, statements regarding

management's use of non-GAAP financial measures, statements

regarding the Company’s workforce realignment and its intended

impacts, the expected timing of recording additional restructuring

charges, and statements regarding the debt and breadth of our

simulation capabilities or our ability to empower our customers to

bring the next generation of products to the market are

"forward-looking" statements (as defined in the Private Securities

Litigation Reform Act of 1995). Because such statements are subject

to risks and uncertainties, actual results may differ materially

from those expressed or implied by such forward-looking statements.

All forward-looking statements in this press release are subject to

risks and uncertainties including, but not limited to, the risk

that adverse conditions in the global and domestic markets will

significantly affect ANSYS’ customers’ ability to purchase products

from the Company at the same level as prior periods or to pay for

the Company’s products and services, the risk that declines in the

ANSYS’ customers’ business may lengthen customer sales cycles, the

risk of declines in the economy of one or more of ANSYS’ primary

geographic regions, the risk that ANSYS’ revenues and operating

results will be adversely affected by changes in currency exchange

rates or economic declines in any of the countries in which ANSYS

conducts transactions, the risk that the assumptions underlying

ANSYS' anticipated revenues and expenditures will change or prove

inaccurate, the risk that ANSYS has overestimated its ability to

maintain growth and profitability and control costs, uncertainties

regarding the demand for ANSYS' products and services in future

periods, uncertainties regarding customer acceptance of new

products, the risk that the Company may need to change its pricing

models due to competition and its potential impact on the Company’s

financial results, the risk that ANSYS' operating results will be

adversely affected by possible delays in developing, completing or

shipping new or enhanced products, the risk that enhancements to

the Company's products or products acquired in acquisitions may not

produce anticipated sales, the risk that the Company may not be

able to recruit and retain key executives and technical personnel,

the risk that third parties may misappropriate the Company’s

proprietary technology or develop similar technology independently,

the risk of unauthorized access to and distribution of the

Company’s source code, the risk of the Company’s implementation of

its new IT systems, the risk of difficulties in the relationship

with ANSYS’ independent regional channel partners, the risk that

ANSYS may not achieve the anticipated benefits of its acquisitions

or that the integration of the acquired technologies or products

with the Company’s existing product lines may not be successful,

and other factors that are detailed from time to time in reports

filed by ANSYS, Inc. with the Securities and Exchange Commission,

including ANSYS, Inc.'s 2016 Annual Report and Form 10-K. We

undertake no obligation to publicly update or revise any

forward-looking statements, whether changes occur as a result of

new information or future events, after the date they were

made.

ANSYS and any and all ANSYS, Inc. brand,

product, service and feature names, logos and slogans are

registered trademarks or trademarks of ANSYS, Inc. or its

subsidiaries in the United States or other countries. All

other brand, product, service and feature names or trademarks are

the property of their respective owners.

Visit www.ansys.com for more information. The

ANSYS IR App is now available for download

on iTunes and Google Play. ANSYS also has a strong

presence on the major social channels. To join the simulation

conversation, please visit: www.ansys.com/Social@ANSYS

ANSS-F

Contact:

Investors: Annette Arribas, CTP

724.820.3700

annette.arribas@ansys.com

Media:

Tom Smithyman

724.820.4340

tom.smithyman@ansys.com

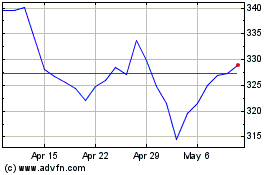

ANSYS (NASDAQ:ANSS)

Historical Stock Chart

From Mar 2024 to Apr 2024

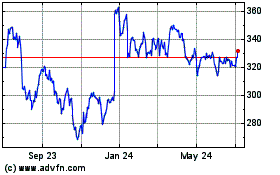

ANSYS (NASDAQ:ANSS)

Historical Stock Chart

From Apr 2023 to Apr 2024