AMSC (NASDAQ:AMSC), a global solutions provider serving wind and

power grid industry leaders, today reported financial results for

its third quarter of fiscal 2016 ended December 31,

2016.

Revenues for the third quarter of fiscal 2016

were $27.1 million, compared with $25.8 million for the same period

of fiscal 2015. Revenues in both the Wind and Grid segments

increased year-over-year.

AMSC’s net loss for the third quarter of fiscal

2016 decreased to $2.8 million, or $0.20 per share, from $3.0

million, or $0.22 per share, for the same period of fiscal 2015.

The Company’s non-GAAP net loss for the third quarter of fiscal

2016 was $2.9 million, or $0.21 per share, which was improved

compared with a non-GAAP net loss of $4.9 million, or $0.36 per

share, in the same period of fiscal 2015. Please refer to the

financial table below for a reconciliation of GAAP to non-GAAP

results.

Cash, cash equivalents and restricted cash at

December 31, 2016 totaled $26.0 million, compared with $26.6

million at September 30, 2016.

“Revenues were seasonally stronger in our Wind

segment in the third quarter, while our Grid revenues continued to

achieve year-over-year growth,” said Daniel P. McGahn, President

and CEO, AMSC. “In the third quarter, we demonstrated significant

improvement in our operating results relative to the first and

second quarters of fiscal 2016, with positive operating cash flow

in the third quarter. We expect our revenues in the fourth

quarter of fiscal 2016 to be strong as well.”

Business OutlookFor the fourth

quarter ending March 31, 2017, AMSC expects that its revenues will

be in the range of $22.0 million to $26.0 million. The Company’s

net loss for the fourth quarter of fiscal 2016 is expected to be

less than $5.5 million, or $0.39 per share. The Company's non-GAAP

net loss (as defined below) is expected to be less than $5.0

million, or $0.36 per share. The Company expects a minimal cash

burn of less than $2.0 million in the fourth quarter.

Conference Call ReminderIn

conjunction with this announcement, AMSC management will

participate in a conference call with investors beginning at 10:00

a.m. Eastern Time today to discuss the Company’s financial results

and business outlook. Those who wish to listen to the live or

archived conference call webcast should visit the “Investors”

section of the Company’s website at http://www.amsc.com/investors.

The live call also can be accessed by dialing 888-240-1347

and using conference ID 6209539.

About AMSC (NASDAQ:AMSC)AMSC generates the

ideas, technologies and solutions that meet the world’s demand for

smarter, cleaner … better energy™. Through its Windtec™ Solutions,

AMSC provides wind turbine electronic controls and systems, designs

and engineering services that reduce the cost of wind energy.

Through its Gridtec™ Solutions, AMSC provides the engineering

planning services and advanced grid systems that optimize network

reliability, efficiency and performance. The Company’s solutions

are now powering gigawatts of renewable energy globally and are

enhancing the performance and reliability of power networks in more

than a dozen countries. Founded in 1987, AMSC is headquartered near

Boston, Massachusetts with operations in Asia, Australia, Europe

and North America. For more information, please visit

www.amsc.com.

AMSC, Windtec, Gridtec, and Smarter, Cleaner …

Better Energy are trademarks or registered trademarks of American

Superconductor Corporation. All other brand names, product names,

trademarks or service marks belong to their respective holders.

Forward-Looking StatementsThis press release

contains forward-looking statements within the meaning of Section

21E of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”). Any statements in this release about our

expectations regarding anticipated financial results, strong

revenues in the fourth quarter and other statements containing the

words “believes,” “anticipates,” “plans,” “expects,” “will” and

similar expressions, constitute forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. Such forward-looking statements represent management’s

current expectations and are inherently uncertain. There are a

number of important factors that could materially impact the value

of our common stock or cause actual results to differ materially

from those indicated by such forward-looking statements. These

important factors include, but are not limited to: A significant

portion of our revenues are derived from a single customer, Inox,

and shipments to Inox may not occur in the time frame we expect; We

have a history of operating losses and negative operating cash

flows, which may continue in the future and require us to secure

additional financing in the future; Our operating results may

fluctuate significantly from quarter to quarter and may fall below

expectations in any particular fiscal quarter; Our financial

condition may have an adverse effect on our customer and supplier

relationships; Our success in addressing the wind energy market is

dependent on the manufacturers that license our designs; Our

success is dependent upon attracting and retaining qualified

personnel and our inability to do so could significantly damage our

business and prospects; We rely upon third-party suppliers for the

components and subassemblies of many of our Wind and Grid products,

making us vulnerable to supply shortages and price fluctuations; We

may not realize all of the sales expected from our backlog of

orders and contracts; Our success depends upon the commercial use

of high temperature superconductor (“HTS”) products, which is

currently limited, and a widespread commercial market for our

products may not develop; Growth of the wind energy market depends

largely on the availability and size of government subsidies and

economic incentives; We have operations in and depend on sales in

emerging markets, including India and China, and global conditions

could negatively affect our operating results or limit our ability

to expand our operations outside of these countries; We face risks

related to our intellectual property; We face risks related to our

legal proceedings; and the important factors discussed under the

caption “Risk Factors” in Part 1. Item 1A of our Form 10-K for the

fiscal year ended March 31, 2016, and our other reports filed with

the SEC. These important factors, among others, could cause actual

results to differ materially from those indicated by

forward-looking statements made herein and presented elsewhere by

management from time to time. Any such forward-looking statements

represent management’s estimates as of the date of this press

release. While we may elect to update such forward-looking

statements at some point in the future, we disclaim any obligation

to do so, even if subsequent events cause our views to change.

These forward-looking statements should not be relied upon as

representing our views as of any date subsequent to the date of

this press release.

| UNAUDITED CONSOLIDATED STATEMENTS OF

OPERATIONS |

| (In thousands, except per share

data) |

|

|

| |

Three months ended December 31, |

|

Nine months ended December 31, |

| |

2016 |

|

2015 |

|

2016 |

|

2015 |

| Revenues |

|

|

|

|

|

|

|

|

|

| Wind |

$ |

18,248 |

|

|

$ |

17,229 |

|

|

$ |

36,822 |

|

|

$ |

48,976 |

|

| Grid |

8,900 |

|

|

8,543 |

|

|

22,178 |

|

|

19,523 |

|

| Total

revenues |

27,148 |

|

|

25,772 |

|

|

59,000 |

|

|

68,499 |

|

| |

|

|

|

|

|

|

|

|

|

| Cost of revenues |

22,107 |

|

|

19,263 |

|

|

50,992 |

|

|

55,758 |

|

| |

|

|

|

|

|

|

|

|

|

| Gross profit |

5,041 |

|

|

6,509 |

|

|

8,008 |

|

|

12,741 |

|

| |

|

|

|

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

| Research

and development |

2,985 |

|

|

2,759 |

|

|

8,804 |

|

|

8,924 |

|

| Selling,

general and administrative |

6,077 |

|

|

7,023 |

|

|

19,640 |

|

|

21,331 |

|

|

Impairment loss |

— |

|

|

— |

|

|

— |

|

|

779 |

|

|

Amortization of acquisition related intangibles |

39 |

|

|

39 |

|

|

118 |

|

|

118 |

|

| Total

operating expenses |

9,101 |

|

|

9,821 |

|

|

28,562 |

|

|

31,152 |

|

| |

|

|

|

|

|

|

|

|

|

| Operating loss |

(4,060 |

) |

|

(3,312 |

) |

|

(20,554 |

) |

|

(18,411 |

) |

| |

|

|

|

|

|

|

|

|

|

| Change in fair value of

derivatives and warrants |

101 |

|

|

(1,092 |

) |

|

667 |

|

|

409 |

|

| Gain on sale of

minority interest |

325 |

|

|

2,511 |

|

|

325 |

|

|

2,511 |

|

| Interest expense,

net |

(89 |

) |

|

(238 |

) |

|

(331 |

) |

|

(841 |

) |

| Other income (expense),

net |

873 |

|

|

(20 |

) |

|

481 |

|

|

(1,189 |

) |

| Loss before income tax

expense |

(2,850 |

) |

|

(2,151 |

) |

|

(19,412 |

) |

|

(17,521 |

) |

| |

|

|

|

|

|

|

|

|

|

| Income tax (benefit)

expense |

(82 |

) |

|

806 |

|

|

1,036 |

|

|

2,256 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

$ |

(2,768 |

) |

|

$ |

(2,957 |

) |

|

$ |

(20,448 |

) |

|

$ |

(19,777 |

) |

| |

|

|

|

|

|

|

|

|

|

| Net loss per common

share |

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

(0.20 |

) |

|

$ |

(0.22 |

) |

|

$ |

(1.49 |

) |

|

$ |

(1.52 |

) |

|

Diluted |

$ |

(0.20 |

) |

|

$ |

(0.22 |

) |

|

$ |

(1.49 |

) |

|

$ |

(1.52 |

) |

| |

|

|

|

|

|

|

|

|

|

| Weighted average number

of common shares outstanding |

|

|

|

|

|

|

|

|

|

|

Basic |

13,792 |

|

|

13,539 |

|

|

13,746 |

|

|

13,052 |

|

|

Diluted |

13,792 |

|

|

13,539 |

|

|

13,746 |

|

|

13,052 |

|

| UNAUDITED CONSOLIDATED BALANCE

SHEET |

| (In thousands, except per share

data) |

| |

| |

December 31,

2016 |

|

March 31, 2016 |

|

ASSETS |

|

|

|

|

|

| Current assets: |

|

|

|

|

|

| Cash and

cash equivalents |

$ |

25,063 |

|

|

$ |

39,330 |

|

| Accounts

receivable, net |

15,863 |

|

|

|

19,264 |

|

|

Inventory |

19,442 |

|

|

|

18,512 |

|

| Prepaid

expenses and other current assets |

3,097 |

|

|

|

5,778 |

|

|

Restricted cash |

795 |

|

|

|

457 |

|

| Total

current assets |

64,260 |

|

|

|

83,341 |

|

|

|

|

|

|

|

|

| Property,

plant and equipment, net |

45,114 |

|

|

|

49,778 |

|

|

Intangibles, net |

436 |

|

|

|

854 |

|

|

Restricted cash |

140 |

|

|

|

934 |

|

| Deferred

tax assets |

115 |

|

|

|

96 |

|

| Other

assets |

176 |

|

|

|

315 |

|

| Total

assets |

$ |

110,241 |

|

|

$ |

135,318 |

|

| |

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

| |

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

| Accounts payable and

accrued expenses |

$ |

18,354 |

|

|

$ |

23,156 |

|

| Note payable, current

portion, net of discount of $47 as of December 31, 2016 and $42 as

of March 31, 2016 |

1,453 |

|

|

|

2,624 |

|

| Derivative

liabilities |

2,560 |

|

|

|

3,227 |

|

| Deferred revenue |

15,997 |

|

|

|

12,000 |

|

| Total

current liabilities |

38,364 |

|

|

|

41,007 |

|

| |

|

|

|

|

|

| Note payable, net of

discount of $133 as of March 31, 2016 |

— |

|

|

|

1,367 |

|

| Deferred revenue |

7,974 |

|

|

|

9,269 |

|

| Deferred tax

liabilities |

63 |

|

|

|

63 |

|

| Other liabilities |

47 |

|

|

|

63 |

|

| Total

liabilities |

46,448 |

|

|

|

51,769 |

|

| |

|

|

|

|

|

| Stockholders'

equity: |

|

|

|

|

|

| Common stock |

143 |

|

|

|

141 |

|

| Additional paid-in

capital |

1,014,365 |

|

|

|

1,011,813 |

|

| Treasury stock |

(1,371 |

) |

|

(881 |

) |

| Accumulated other

comprehensive (loss) income |

(712 |

) |

|

660 |

|

| Accumulated

deficit |

(948,632 |

) |

|

(928,184 |

) |

| Total

stockholders' equity |

63,793 |

|

|

83,549 |

|

| Total

liabilities and stockholders' equity |

$ |

110,241 |

|

|

$ |

135,318 |

|

| UNAUDITED CONSOLIDATED STATEMENTS OF CASH

FLOWS |

| (In thousands) |

| |

| |

Nine months ended December 31, |

| |

2016 |

|

2015 |

| Cash flows from

operating activities: |

|

|

|

| |

|

|

|

| Net

loss |

$ |

(20,448 |

) |

|

$ |

(19,777 |

) |

|

Adjustments to reconcile net loss to net cash used in operations:

|

|

|

|

|

Depreciation and amortization |

5,606 |

|

|

6,050 |

|

|

Stock-based compensation expense |

2,266 |

|

|

2,542 |

|

|

Impairment loss |

— |

|

|

746 |

|

| Provision

for excess and obsolete inventory |

1,074 |

|

|

1,835 |

|

| Write-off

prepaid taxes |

— |

|

|

289 |

|

| Gain from sale of

minority interest investments |

(325 |

) |

|

(2,155 |

) |

| Change in fair value of

derivatives and warrants |

(667 |

) |

|

(409 |

) |

| Non-cash interest

expense |

127 |

|

|

290 |

|

| Other non-cash

items |

(937 |

) |

|

694 |

|

| Changes in operating

asset and liability accounts: |

|

|

|

| Accounts

receivable |

3,213 |

|

|

(7,156 |

) |

|

Inventory |

(2,294 |

) |

|

3,288 |

|

| Prepaid

expenses and other current assets |

2,283 |

|

|

5,800 |

|

| Accounts

payable and accrued expenses |

(4,031 |

) |

|

(34 |

) |

| Deferred

revenue |

3,598 |

|

|

198 |

|

| Net cash

used in operating activities |

(10,535 |

) |

|

(7,799 |

) |

| |

|

|

|

| Cash flows from

investing activities: |

|

|

|

| Net cash

provided by investing activities |

357 |

|

|

4,856 |

|

| |

|

|

|

| Cash flows from

financing activities: |

|

|

|

| Net cash

(used in)/provided by financing activities |

(3,657 |

) |

|

19,202 |

|

| |

|

|

|

| Effect of exchange rate

changes on cash and cash equivalents |

(432 |

) |

|

(312 |

) |

| |

|

|

|

| Net (decrease)/increase

in cash and cash equivalents |

(14,267 |

) |

|

15,947 |

|

| Cash and cash

equivalents at beginning of year |

39,330 |

|

|

20,490 |

|

| Cash and cash

equivalents at end of year |

$ |

25,063 |

|

|

$ |

36,437 |

|

| RECONCILIATION OF GAAP NET INCOME (LOSS) TO NON-GAAP

NET INCOME (LOSS) |

| (In thousands, except per share data) |

|

|

| |

Three months ended December 31, |

|

Nine months ended December 31, |

| |

2016 |

|

2015 |

|

2016 |

|

2015 |

| Net loss |

$ |

(2,768 |

) |

|

$ |

(2,957 |

) |

|

$ |

(20,448 |

) |

|

$ |

(19,777 |

) |

| Gain on sale of

interest in minority investments, net of tax effect

|

(325 |

) |

|

(2,354 |

) |

|

(325 |

) |

|

(2,354 |

) |

| Stock-based

compensation |

613 |

|

|

708 |

|

|

2,266 |

|

|

2,542 |

|

| Amortization of

acquisition-related intangibles |

39 |

|

|

39 |

|

|

118 |

|

|

118 |

|

| Impairment loss |

— |

|

|

— |

|

|

— |

|

|

779 |

|

| Consumption of zero

cost-basis inventory |

(478 |

) |

|

(1,543 |

) |

|

(1,118 |

) |

|

(3,612 |

) |

| Change in fair value of

derivatives and warrants |

(101 |

) |

|

1,092 |

|

|

(667 |

) |

|

(409 |

) |

| Non-cash interest

expense |

30 |

|

|

83 |

|

|

127 |

|

|

290 |

|

| Tax effect of

adjustments |

77 |

|

|

|

— |

|

|

179 |

|

|

— |

|

| Non-GAAP net loss |

$ |

(2,913 |

) |

|

$ |

(4,932 |

) |

|

$ |

(19,868 |

) |

|

$ |

(22,423 |

) |

| |

|

|

|

|

|

|

|

| Non-GAAP net loss per

share |

$ |

(0.21 |

) |

|

$ |

(0.36 |

) |

|

$ |

(1.45 |

) |

|

$ |

(1.72 |

) |

| Weighted average shares

outstanding - basic and diluted |

13,792 |

|

|

13,539 |

|

|

13,746 |

|

|

13,052 |

|

| Reconciliation of Forecast GAAP Net Loss to Non-GAAP

Net Loss |

| (In millions, except per share data) |

| |

| |

Three months ending |

| March 31, 2017 |

| Net loss |

$ |

(5.5 |

) |

|

Stock-based compensation |

|

0.6 |

|

|

Consumption of zero-cost inventory |

|

(0.1 |

) |

| Non-GAAP net loss |

$ |

(5.0 |

) |

| Non-GAAP net loss per

share |

$ |

(0.36 |

) |

| Shares outstanding |

|

14.0 |

|

|

|

|

|

Note: Non-GAAP net loss is defined by the

Company as net loss before stock-based compensation; amortization

of acquisition-related intangibles; consumption of zero cost-basis

inventory; non-cash interest expense; change in fair value of

derivatives and warrants; and other unusual charges, net of any tax

effects related to these items. The Company believes non-GAAP net

loss assists management and investors in comparing the Company’s

performance across reporting periods on a consistent basis by

excluding these non-cash, non-recurring or other charges that it

does not believe are indicative of its core operating performance.

The Company also regards non-GAAP net loss as a useful measure of

operating performance to complement operating loss, net loss and

other GAAP financial performance measures. In addition, the Company

uses non-GAAP net loss as a factor in evaluating management’s

performance when determining incentive compensation and to evaluate

the effectiveness of its business strategies.

Generally, a non-GAAP financial measure is a

numerical measure of a company's performance, financial position or

cash flow that either excludes or includes amounts that are not

normally excluded or included in the most directly comparable

measure calculated and presented in accordance with GAAP. The

non-GAAP measures included in this release, however, should be

considered in addition to, and not as a substitute for or superior

to, operating income, cash flows, or other measures of financial

performance prepared in accordance with GAAP. A reconciliation of

non-GAAP to GAAP net loss is set forth in the table above.

AMSC Contact:

Brion D. Tanous

AMSC Investor Relations

Phone: 424-634-8592

Email: Brion.Tanous@amsc.com

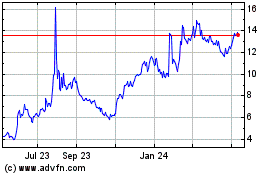

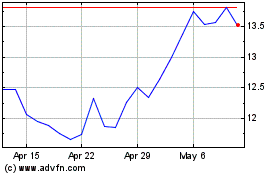

American Superconductor (NASDAQ:AMSC)

Historical Stock Chart

From Mar 2024 to Apr 2024

American Superconductor (NASDAQ:AMSC)

Historical Stock Chart

From Apr 2023 to Apr 2024