AMERICAN BUSINESS BANK (Bank) (OTCBB: AMBZ) today reported net

income of $11,460,000 for the year ended 2014. Earnings per share

(basic) for 2014 were $1.93 versus $2.30 in 2013. The Bank’s “core”

earnings per share were $1.79 for 2014 versus $1.55 in 2013. Shares

outstanding at the end of the year totaled 5,947,935.

“This has been a tremendous year for our bank, despite the

interest rate, regulatory and competitive headwinds we have

experienced. It proves the fundamentals don’t change,” said Robert

Schack, Chairman.

Leon Blankstein, President and CEO, added “We are proud of the

increases that we saw in our balance sheet, with ten percent added

to our deposit base and fourteen percent growth in total

loans.”

“The growth in loans is especially important, as they represent

our highest earning assets,” said Wes Schaefer, Vice Chairman and

CFO.

Total assets increased 14% or $193 million to $1.535 billion at

December 31, 2014, as compared to $1.342 billion at December 31,

2013. The loan portfolio (net) increased 14%, or $78 million, to

$646 million at December 31, 2014, as compared to $568 million at

December 31, 2013. Deposits increased 10%, or $125 million, to

$1.364 billion at December 31, 2014, as compared to $1.239 billion

at December of 2013. To fund the asset growth, the borrowings from

the Federal Home Loan Bank increased from $5 million in 2013 to $41

million in 2014.

During 2014, Net Interest Income increased $1,357,000, or 3%, to

$40,892,000 from $39,535,000 in 2013.

Non-Interest income during 2014 decreased $4,225,000, or 56%, to

$3,354,000 from $7,579,000 in 2013. This decrease was centered

mainly in the reduction of investment gains that were taken to

increase capital in 2013.

Non-Interest expense during 2014 increased $1,624,000, or 6%, to

$26,790,000 from $25,166,000 in 2013. Increases in the “Other

Expense” category mentioned in the Income Statement below were

driven by extra cost incurred in customer related expenses,

professional fees, promotion expenses and regulatory fees.

Asset quality at year-end remains excellent, with zero

non-performing loans and no OREO. At the end of December 2014, the

allowance for loan losses stood at $12,543,000, or 1.91% of

loans. During the twelve months ended December 31st of 2014,

the Bank has a net recovery of previously charged-off loans,

totaling $493,000.

AMERICAN BUSINESS BANK headquartered in downtown Los Angeles

offers a wide range of financial services to the business

marketplace. Clients include wholesalers, manufacturers, service

businesses, professionals and non-profits. The Bank has opened four

Loan Production Offices in strategic areas including our Orange

County Office in Irvine, our South Bay Office in Torrance, our San

Fernando Valley Office in the Warner Center and our Inland Empire

Office in Ontario.

American Business Bank Figures in $000, except per

share amounts

CONSOLIDATED BALANCE SHEET (unaudited)

As of:

December December Change 2014

2013 %

Assets: Cash & Equivalents $ 25,145 $

42,300 -40.6 % Fed Funds Sold 19,000 46,000 -58.7 % Interest

Bearing Balances 278 28 892.9 %

Investment Securities:

US Agencies 502,443 337,469 48.9 % Mortgage Backed Securities

108,471 143,841 -24.6 % State & Municipals 176,682 160,492 10.1

% Other 3,048

3,098 -1.6 % Total Investment

Securities 790,644 644,900 22.6 %

Gross Loans:

Commercial Real Estate 409,240 343,496 19.1 % Commercial &

Industrial 196,153 187,716 4.5 % Other Real Estate 47,799 41,936

14.0 % Other 5,211

6,438 -19.1 % Total Gross Loans 658,403

579,586 13.6 % Allowance for Loan &

Lease Losses (12,543 ) (11,152 ) 12.5 %

Net Loans 645,860 568,434 13.6 % Premises & Equipment 1,420 849

67.3 % Other Assets 52,522

39,614 32.6 %

Total Assets $ 1,534,869

$ 1,342,125 14.4 %

Liabilities: Demand Deposits $ 695,461 $

576,792 20.6 % Money Market 589,796 586,497 0.6 % Time

Deposits and Savings 79,187

75,922 4.3 % Total Deposits 1,364,444 1,239,211 10.1

% FHLB Advances / Other Borrowings 41,000 5,000 720.0 %

Other Liabilities 10,028

2,098 378.0 %

Total

Liabilities $ 1,415,472

$ 1,246,309 13.6 %

Shareholders' Equity: Common Stock &

Retained Earnings $ 119,794 $ 107,546 11.4 % Accumulated

Other Comprehensive Income / (Loss) (397 )

(11,730 ) -96.6 %

Total Shareholders'

Equity $ 119,397

$ 95,816 24.6 %

Total

Liabilities & Shareholders' Equity $

1,534,869 $ 1,342,125

14.4 %

Capital Adequacy: Tangible

Common Equity / Tangible Assets 7.78 % 7.14 % -- Tier 1 Leverage

Ratio 7.96 % 7.68 % -- Tier 1 Capital Ratio / Risk Weighted Assets

15.54 % 15.98 % -- Total Risk-Based Ratio 16.76 % 17.23 % --

Per Share Information: Common Shares

Outstanding 5,947,935 5,933,978 -- Book Value Per Share $ 20.07 $

16.15 24.3 % Tangible Book Value Per Share $ 20.07 $ 16.15 24.3 %

American Business Bank Figures in $000, except

per share amounts

CONSOLIDATED INCOME STATEMENT

(unaudited) For the 12-month period ended:

December December Change

2014 2013 %

Interest Income: Loans & Leases $

27,682 $ 25,141 10.1 % Investment Securities

14,742 16,225 -9.1 %

Total Interest Income 42,424 41,366 2.6 %

Interest Expense: Money Market, NOW Accounts

& Savings 1,183 1,340 -11.7 % Time Deposits 282 359 -21.4 %

Repurchase Agreements / Other Borrowings 67

132 -49.2 % Total Interest Expense

1,532 1,831 -16.3 % Net Interest Income 40,892 39,535

3.4 % Provision for Loan Losses (898 )

(1,800 ) -50.1 % Net Interest Income After

Provision for Loan Losses 39,994 37,735 6.0 %

Non-Interest Income: Deposit Fees 1,378 1,170

17.8 % Realized Securities Gains 1,162 6,599 -82.4 % Other

814

(190 ) -528.4 % Total Non-Interest Income 3,354 7,579 -55.7

%

Non-Interest Expense:

Compensation & Benefits 15,581 15,398 1.2 % Occupancy &

Equipment 2,163 1,986 8.9 % Other

9,046 7,782

16.2 % Total Non-Interest Expense 26,790 25,166 6.5 %

Pre-Tax Income 16,558 20,148 -17.8 % Provision for Income

Tax (5,098 ) (6,655 )

-23.4 %

Net Income $

11,460 $ 13,493 -15.1 % Less:

After-Tax Realized Securities Gains $ 804 $ 4,419

Core

Net Income $ 10,656 # $

9,074 17.4 %

Per Share

Information: Average Shares Outstanding (for the year)

5,941,876 5,869,399 -- Earnings Per Share - Basic $ 1.93 $ 2.30

-16.1 % Earnings Per Share " CORE" - Basic $ 1.79 $ 1.55

16.0 %

American Business Bank Figures in $000, except

per share amounts

December

December Change 2014

2013 %

Performance Ratios Return on Average Assets

(ROAA) 0.80 % 1.02 % -- Return on Average Equity (ROAE) 10.49 %

13.39 % -- Return on Average Assets " CORE" (ROAA) 0.75 %

0.69 % -- Return on Average Equity " CORE" (ROAE) 9.75 % 9.00 % --

Asset Quality Overview

Non-Performing Loans $ - $ - NA Loans 90+Days Past Due

4 -

NA Total Non-Performing Loans $ 4 $ - NA Restructured Loans

(TDR's) $ 715 2,587 -72.4 % Other Real Estate Owned 0 0 --

ALLL / Gross Loans 1.91 % 1.92 % -- ALLL / Non-Performing

Loans * NA NA -- Non-Performing Loans / Total Loans * 0.00 % 0.00 %

-- Non-Performing Assets / Total Assets * 0.00 % 0.00 % -- Net

Charge-Offs $ (493 ) $ 1,060 -- Net Charge-Offs / Average Gross

Loans -0.08 % 0.19 % -- * Excludes Restructured Loans

AMERICAN BUSINESS BANKWes E. SchaeferVice Chairman and Chief

Financial Officer(213) 430-4000

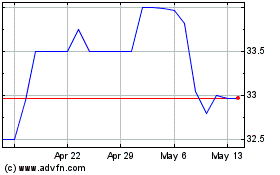

American Business Bank (QX) (USOTC:AMBZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

American Business Bank (QX) (USOTC:AMBZ)

Historical Stock Chart

From Apr 2023 to Apr 2024