AMCON Distributing Company (“AMCON”) (NYSE MKT:DIT), an Omaha,

Nebraska based consumer products company is pleased to announce

fully diluted earnings per share of $2.62 on net income available

to common shareholders of $1.8 million for the fiscal quarter ended

June 30, 2016.

“The convenience sector continues to embrace fresh and on-the-go

food offerings that enhance their ability to effectively compete

against quick service restaurants for consumer dollars,” said

Christopher H. Atayan, AMCON’s Chairman and Chief Executive

Officer. Atayan continued, “AMCON has developed robust programs and

expanded its capabilities in foodservice and technology to support

our customers as they continue to evolve their stores. We have a

long-term commitment to building partnerships with our customers

and suppliers alike.” He further noted, “we are actively seeking

acquisitions that can benefit from our extensive platform of

customer service.”

For the third fiscal quarter, the wholesale distribution segment

reported revenues of $326.9 million, operating income of $4.9

million, and operating income before depreciation and amortization

of $5.3 million. Our retail health food segment reported revenues

of $6.5 million, an operating loss of $0.1 million, and break even

operating income before depreciation and amortization for the same

period.

“Our customers can count on our sales and marketing teams’

expertise in store design, product and program selection, and

product placement to help them maximize sales and profitability

particularly during the critical peak sales season. The investments

we’ve made in our refrigerated trucking fleet have proven to be a

competitive advantage as we are increasingly placing more emphasis

on our foodservice offerings,” said Kathleen M. Evans, President of

AMCON’s Wholesale Distribution segment.

“We are proactively taking steps to respond to the competitive

environment that we operate in. We are focused on developing an

enhanced shopping experience that builds on our key historical

strengths of customer service and product selection,” said Eric

Hinkefent, President of AMCON’s Retail Health Food Segment.

“We take a conservative approach to managing our balance sheet.

The emphasis we place on working capital and liquidity provides us

a competitive advantage in both of our business segments. We are

able to move decisively when opportunities manifest themselves,”

said Andrew C. Plummer, AMCON’s Chief Financial Officer. “We were

pleased to close the June 30, 2016 quarter with shareholders’

equity of $62.2 million and consolidated debt of $17.2

million.”

AMCON is a leading wholesale distributor of consumer products,

including beverages, candy, tobacco, groceries, foodservice, frozen

and chilled foods, and health and beauty care products with

locations in Illinois, Missouri, Nebraska, North Dakota, South

Dakota and Tennessee. AMCON also operates fifteen (15) health and

natural product retail stores in the Midwest and Florida. The

retail stores operate under the names Chamberlin's Market &

Cafe www.chamberlins.com and Akin’s Natural Foods Market

www.akins.com.

This news release contains forward-looking statements that are

subject to risks and uncertainties and which reflect management's

current beliefs and estimates of future economic circumstances,

industry conditions, Company performance and financial results. A

number of factors could affect the future results of the Company

and could cause those results to differ materially from those

expressed in the Company's forward-looking statements including,

without limitation, availability of sufficient cash resources to

conduct its business and meet its capital expenditures needs and

the other factors described under Item 1.A. of the Company’s Annual

Report on Form 10-K. Moreover, past financial performance should

not be considered a reliable indicator of future performance.

Accordingly, the Company claims the protection of the safe harbor

for forward-looking statements contained in the Private Securities

Litigation Reform Act of 1995 with respect to all such

forward-looking statements.

Visit AMCON Distributing Company's web site

at: www.amcon.com

AMCON Distributing Company and

Subsidiaries

Condensed Consolidated Balance

Sheets

June 30, 2016 and September 30,

2015

June September 2016 2015

(Unaudited) ASSETS Current assets: Cash $ 414,997 $

219,536 Accounts receivable, less allowance for doubtful accounts

of $0.8 million at June 2016 and $0.9 million at September 2015

33,932,942 31,866,787 Inventories, net 50,670,660 60,793,478

Deferred income taxes 1,404,470 1,553,726 Income taxes receivable —

113,238 Prepaid and other current assets 5,446,628

2,125,908 Total current assets 91,869,697 96,672,673

Property and equipment, net 12,362,980 12,753,145 Goodwill

6,349,827 6,349,827 Other intangible assets, net 3,825,561

4,090,978 Other assets 289,287 317,184

$ 114,697,352 $ 120,183,807

LIABILITIES AND

SHAREHOLDERS’ EQUITY Current liabilities: Accounts payable $

17,997,838 $ 17,044,726 Accrued expenses 6,847,950 7,224,963

Accrued wages, salaries and bonuses 3,423,813 3,282,354 Income

taxes payable 363,114 — Current maturities of long-term debt

359,737 351,383 Total current liabilities

28,992,452 27,903,426 Credit facility 13,708,439 20,902,207

Deferred income taxes 3,785,570 3,696,098 Long-term debt, less

current maturities 3,113,288 3,384,319 Other long-term liabilities

29,826 34,860 Series A cumulative, Convertible Preferred

Stock, $.01 par value 100,000 shares authorized and issued, and a

total liquidation preference of $2.5 million at both June 2016 and

September 2015 2,500,000 2,500,000 Series B cumulative, Convertible

Preferred Stock, $.01 par value 80,000 shares authorized, 16,000

shares issued and outstanding at both June 2016 and September 2015,

and a total liquidation preference of $0.4 million at both June

2016 and September 2015 400,000 400,000 Shareholders’

equity: Preferred stock, $.01 par value, 1,000,000 shares

authorized, 116,000 shares outstanding and issued in Series A and B

referred to above — — Common stock, $.01 par value, 3,000,000

shares authorized, 587,185 shares outstanding and issued at June

2016 and 621,104 shares outstanding and issued at September 2015

7,197 7,061 Additional paid-in capital 16,676,738 15,509,199

Retained earnings 57,209,248 53,527,606 Treasury stock at cost

(11,725,406 ) (7,680,969 ) Total shareholders’ equity

62,167,777 61,362,897 $ 114,697,352

$ 120,183,807

AMCON Distributing Company and

Subsidiaries

Condensed Consolidated Unaudited

Statements of Operations

for the three and nine months ended

June 30, 2016 and 2015

For the three months ended

June For the nine months ended June 2016

2015 2016 2015 Sales (including excise taxes

of $98.9 million and $101.5 million, and $284.9 million and $285.9

million, respectively) $ 333,398,723 $ 334,456,509 $ 951,856,098 $

937,333,849 Cost of sales 314,235,192

314,957,889 896,190,425 880,575,362

Gross profit 19,163,531 19,498,620

55,665,673 56,758,487 Selling,

general and administrative expenses 15,335,808 15,405,676

45,951,300 47,072,555 Depreciation and amortization 512,543

542,307 1,655,173

1,709,469 15,848,351 15,947,983

47,606,473 48,782,024 Operating income

3,315,180 3,550,637 8,059,200

7,976,463 Other expense (income):

Interest expense 188,798 242,266 562,654 673,783 Other (income),

net (35,552 ) (20,853 ) (98,634 )

(63,907 ) 153,246 221,413

464,020 609,876 Income from operations before

income tax expense 3,161,934 3,329,224 7,595,180 7,366,587 Income

tax expense 1,310,000 1,333,000

3,241,000 3,055,000 Net income 1,851,934

1,996,224 4,354,180 4,311,587 Preferred stock dividend requirements

(48,642 ) (48,643 ) (146,462 ) (145,928

) Net income available to common shareholders $ 1,803,292 $

1,947,581 $ 4,207,718 $ 4,165,659 Basic

earnings per share available to common shareholders $ 3.03 $ 3.16 $

6.91 $ 6.78 Diluted earnings per share available to common

shareholders $ 2.62 $ 2.69 $ 6.07 $ 5.85 Basic weighted

average shares outstanding 596,112 615,822 609,240 614,723 Diluted

weighted average shares outstanding 707,300 741,183 717,875 737,325

Dividends declared and paid per common share $ 0.18 $ 0.18 $

0.82 $ 0.54

AMCON Distributing Company and

Subsidiaries

Condensed Consolidated Unaudited

Statements of Cash Flows

for the nine months ended June 30, 2016

and 2015

2016 2015 CASH FLOWS FROM

OPERATING ACTIVITIES: Net income $ 4,354,180 $ 4,311,587

Adjustments to reconcile net income from operations to net cash

flows from operating activities: Depreciation 1,389,756 1,435,719

Amortization 265,417 273,750 (Gain) loss on sale of property and

equipment (69,215 ) 5,103 Equity-based compensation 1,050,644

910,920 Deferred income taxes 238,728 133,493 Provision (recovery)

for losses on doubtful accounts (39,000 ) 193,000 Provision for

losses on inventory obsolescence 2,014 132,793 Other (5,034 )

(6,034 ) Changes in assets and liabilities: Accounts

receivable (2,027,155 ) (207,224 ) Inventories 10,120,804

(6,393,734 ) Prepaid and other current assets (3,320,720 ) 942,531

Other assets 27,897 118,531 Accounts payable 924,567 242,760

Accrued expenses and accrued wages, salaries and bonuses 2,825

1,505,917 Income taxes payable 476,352

(1,022,572 ) Net cash flows from operating activities 13,392,060

2,576,540 CASH FLOWS FROM INVESTING ACTIVITIES: Purchase of

property and equipment (1,013,988 ) (812,624 ) Proceeds from sales

of property and equipment 112,157 24,000

Net cash flows from investing activities (901,831 ) (788,624

) CASH FLOWS FROM FINANCING ACTIVITIES: Net payments on bank

credit agreements (7,193,768 ) (774,559 ) Principal payments on

long-term debt (262,677 ) (255,157 ) Repurchase of common stock

(4,044,437 ) — Dividends paid on convertible preferred stock

(146,462 ) (145,928 ) Dividends on common stock (526,076 ) (348,732

) Withholdings on the exercise of equity-based awards

(121,348 ) (213,605 ) Net cash flows from financing

activities (12,294,768 ) (1,737,981 ) Net

change in cash 195,461 49,935 Cash, beginning of period

219,536 99,922 Cash, end of period $

414,997 $ 149,857 Supplemental disclosure of

cash flow information: Cash paid during the period for interest $

576,681 $ 677,163 Cash paid during the period for income taxes

2,525,920 3,944,080 Supplemental disclosure of non-cash

information: Equipment acquisitions classified as accounts payable

51,874 8,483 Issuance of common stock in connection with the

vesting and exercise of equity-based awards 1,174,981 1,240,842

.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160718006236/en/

AMCON Distributing CompanyChristopher H. Atayan,

402-331-3727

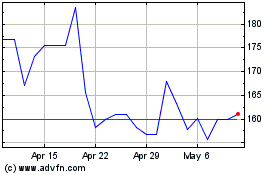

AMCON Distributing (AMEX:DIT)

Historical Stock Chart

From Mar 2024 to Apr 2024

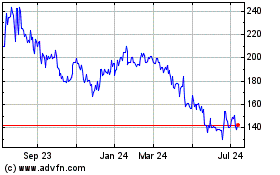

AMCON Distributing (AMEX:DIT)

Historical Stock Chart

From Apr 2023 to Apr 2024