AMCON Distributing Company (“AMCON”) (NYSE MKT:DIT), an Omaha,

Nebraska based consumer products company is pleased to announce

fully diluted earnings per share of $1.04 on net income available

to common shareholders of $0.7 million for the fiscal quarter ended

March 31, 2015.

“We are making a number of targeted investments within our

wholesale business. In particular, we continue to develop our

technology infrastructure and proprietary applications to enhance

our customers’ experience and profitability. Additionally, we are

expanding our refrigerated and temperature controlled trucking

fleet. These investments are specifically designed to capitalize on

our convenience store customers increasing demand for new

foodservice offerings and technological needs,” said Christopher H.

Atayan, AMCON’s Chairman and Chief Executive Officer. He further

noted “We expect that we will continue to invest in our wholesale

business to maintain our leadership position in the industry and

are seeking acquisitions that can benefit from our extensive

platform of customer services.”

“In late March, we hosted our annual spring trade show in Kansas

City. This is our largest customer event of the year and once

again, we enjoyed outstanding attendance from both existing and

prospective customers. Our sales and merchandising teams are

working closely with customers as the spring sales season kicks

off. As convenience store traffic increases, fully capturing and

maximizing this opportunity is an important focus for our

customers,” said Kathleen M. Evans, President of AMCON’s Wholesale

Distribution Segment.

“The retail health food operating environment in the markets we

operate remains highly competitive. Both national and regional

chains are pursuing aggressive expansion efforts and continue to

open new stores. Our management team has been focused on a variety

of initiatives designed to enhance the operating economics of each

retail store. These efforts include a targeted focus on the major

business drivers such as inventory rationalization, merchandising,

store staffing mix, and expense management,” said Eric Hinkefent,

President of AMCON’s Retail Health Food Segment.

Each of AMCON’s business segments reported solid quarters. The

wholesale distribution segment reported revenues of $279.2 million

and operating income before depreciation and amortization of $3.0

million for the second fiscal quarter of 2015. The retail health

food segment reported revenues of $8.2 million and operating income

before depreciation and amortization of $0.6 million for the same

period.

“We actively manage our working capital and seek opportunities

to use our liquidity to our benefit,” said Andrew C. Plummer,

AMCON’s Chief Financial Officer. Plummer added, “We are also using

the lower cost energy environment to make additional investments in

our refrigerated fleet. These capital improvements enhance our

ability to support our foodservice business but the refrigeration

also increases overall fuel consumption company wide. We were

pleased to close the March 31, 2015 quarter with shareholders’

equity of $58.6 million and consolidated debt of $35.9

million.”

AMCON is a leading wholesale distributor of consumer products,

including beverages, candy, tobacco, groceries, foodservice, frozen

and chilled foods, and health and beauty care products with

locations in Illinois, Missouri, Nebraska, North Dakota, South

Dakota and Tennessee. AMCON also operates sixteen (16) health and

natural product retail stores in the Midwest and Florida. The

retail stores operate under the names Chamberlin's Market &

Cafe www.chamberlins.com and Akin’s Natural Foods Market

www.akins.com.

This news release contains forward-looking statements that are

subject to risks and uncertainties and which reflect management's

current beliefs and estimates of future economic circumstances,

industry conditions, Company performance and financial results. A

number of factors could affect the future results of the Company

and could cause those results to differ materially from those

expressed in the Company's forward-looking statements including,

without limitation, availability of sufficient cash resources to

conduct its business and meet its capital expenditures needs and

the other factors described under Item 1.A. of the Company’s Annual

Report on Form 10-K. Moreover, past financial performance should

not be considered a reliable indicator of future performance.

Accordingly, the Company claims the protection of the safe harbor

for forward-looking statements contained in the Private Securities

Litigation Reform Act of 1995 with respect to all such

forward-looking statements.

Visit AMCON Distributing Company's web site

at: www.amcon.com

AMCON Distributing Company and Subsidiaries

Condensed Consolidated Balance Sheets March 31, 2015 and

September 30, 2014 March

September 2015 2014 (Unaudited)

ASSETS Current assets: Cash $ 189,559 $ 99,922

Accounts receivable, less allowance for

doubtful accounts of $0.9 million and $0.8 million at March 2015

and September 2014, respectively

30,847,526 33,286,932 Inventories, net 65,521,673 43,635,266

Deferred income taxes 1,353,082 1,606,168 Prepaid and other current

assets

3,325,626

5,034,570 Total current assets 101,237,466

83,662,858 Property and equipment, net 13,388,517 13,763,140

Goodwill 6,349,827 6,349,827 Other intangible assets, net 4,273,478

4,455,978 Other assets

336,357

448,149 $ 125,585,645

$ 108,679,952

LIABILITIES AND SHAREHOLDERS’ EQUITY Current liabilities:

Accounts payable $ 16,627,660 $ 16,412,895 Accrued expenses

5,978,844 6,891,308 Accrued wages, salaries and bonuses 1,977,298

2,647,969 Income taxes payable 26,476 1,603,614 Current maturities

of long-term debt

346,057

341,190 Total current liabilities 24,956,335

27,896,976 Credit facility 31,963,666 15,081,783 Deferred

income taxes 3,469,673 3,484,204 Long-term debt, less current

maturities 3,561,053 3,735,702 Other long-term liabilities 134,980

139,003

Series A cumulative, convertible preferred

stock, $.01 par value 100,000 shares authorized, issued, and

outstanding, and a total liquidation preference of $2.5 million at

both March 2015 and September 2014

2,500,000 2,500,000

Series B cumulative, convertible preferred

stock, $.01 par value 80,000 shares authorized, 16,000 shares

issued and outstanding at both March 2015 and September 2014, and a

total liquidation preference of $0.4 million at both March 2015 and

September 2014

400,000 400,000

Shareholders’ equity:

Preferred stock, $.01 par value, 1,000,000

shares authorized, 116,000 shares outstanding and issued in Series

A and B referred to above

— —

Common stock, $.01 par value, 3,000,000

shares authorized, 615,822 shares outstanding at March 2015 and

602,411 shares outstanding at September 2014

6,811 6,677 Additional paid-in capital 14,743,839 13,571,909

Retained earnings 49,814,791 47,829,201 Treasury stock at cost

(5,965,503 )

(5,965,503 ) Total shareholders’ equity

58,599,938

55,442,284 $

125,585,645 $

108,679,952 AMCON Distributing

Company and Subsidiaries Condensed Consolidated Unaudited

Statements of Operations for the three and six months ended

March 31, 2015 and 2014 For the

three months For the six months ended March

ended March 2015

2014 2015

2014

Sales (including excise taxes of $87.4

million and $85.7 million, and $184.4 million and $183.1 million,

respectively)

$ 287,443,864 $ 272,421,788 $ 602,877,340 $ 578,047,345 Cost of

sales

269,710,529

254,801,826 565,617,473

540,786,320 Gross profit

17,733,335 17,619,962

37,259,867

37,261,025

Selling, general and administrative

expenses

15,485,757 15,812,174 31,666,879 32,304,437 Depreciation and

amortization

590,857

628,834 1,167,162

1,252,874 16,076,614

16,441,008

32,834,041 33,557,311

Operating income

1,656,721

1,178,954 4,425,826

3,703,714 Other expense (income):

Interest expense 194,375 222,624 431,517 524,619 Other (income),

net

(35,987 )

(38,955 )

(43,054 )

(69,186 )

158,388 183,669

388,463 455,433

Income from operations before income tax expense 1,498,333

995,285 4,037,363 3,248,281 Income tax expense

729,000 464,000

1,722,000 1,429,000

Net income 769,333 531,285 2,315,363 1,819,281 Preferred

stock dividend requirements

(48,108 )

(48,108 )

(97,285 )

(97,285 ) Net income available to common shareholders

$ 721,225 $

483,177 $ 2,218,078

$ 1,721,996

Basic earnings per share available to common shareholders $ 1.17 $

0.79 $ 3.61 $ 2.79 Diluted earnings per share available to common

shareholders $ 1.04 $ 0.72 $ 3.15 $ 2.46 Basic weighted

average shares outstanding 615,822 611,432 614,173 616,888 Diluted

weighted average shares outstanding 737,180 737,461 735,599 739,223

AMCON Distributing Company and Subsidiaries

Condensed Consolidated Unaudited Statements of Cash Flows

for the six months ended March 31, 2015 and 2014

2015

2014 CASH FLOWS FROM OPERATING

ACTIVITIES: Net income $ 2,315,363 $ 1,819,281

Adjustments to reconcile net income from

operations to net cash flows from operating activities:

Depreciation 984,662 1,070,374 Amortization 182,500 182,500 (Gain)

loss on sale of property and equipment 7,036 (24,746 ) Equity-based

compensation 607,661 717,821 Deferred income taxes 238,555 462,447

Provision for losses on doubtful accounts 159,999 132,000 Provision

for losses (recoveries) on inventory obsolescence (34,189 ) (1,121

) Other (4,023 ) (4,023 ) Changes in assets and liabilities:

Accounts receivable 2,279,407 1,356,409 Inventories (21,852,218 )

(2,474,084 ) Prepaid and other current assets 1,708,944 5,700 Other

assets 111,792 13,054 Accounts payable 200,996 (34,071 ) Accrued

expenses and accrued wages, salaries and bonuses (862,235 )

(1,565,640 ) Income tax payable

(1,577,138 )

(1,618,592 ) Net cash flows from operating

activities (15,532,888 ) 37,309 CASH FLOWS FROM INVESTING

ACTIVITIES: Purchases of property and equipment (611,106 )

(1,362,832 ) Proceeds from sales of property and equipment 7,800

29,969 Acquisition

—

(513,938 ) Net cash flows from investing

activities (603,306 ) (1,846,801 ) CASH FLOWS FROM FINANCING

ACTIVITIES: Net borrowings on bank credit agreements 16,881,883

4,926,619 Principal payments on long-term debt (169,782 ) (607,923

) Repurchase of Series B Convertible Preferred Stock and common

stock — (1,941,918 ) Dividends paid on convertible preferred stock

(97,285 ) (97,285 ) Dividends on common stock (232,488 ) (239,362 )

Withholdings on the exercise of equity-based awards

(156,497 )

(109,115 ) Net cash

flows from financing activities

16,225,831

1,931,016 Net change in

cash 89,637 121,524

Cash, beginning of period

99,922 275,036

Cash, end of period

$ 189,559

$ 396,560

2015 2014 Supplemental

disclosure of cash flow information: Cash paid during the period

for interest $ 403,758 $ 523,081 Cash paid during the period for

income taxes 3,060,584 2,585,145 Supplemental disclosure of

non-cash information: Equipment acquisitions classified as accounts

payable 48,754 152,311

Issuance of common stock in connection

with the vesting and exercise of equity-based awards

1,240,842 1,154,869

AMCON Distributing CompanyChristopher H. Atayan,

402-331-3727

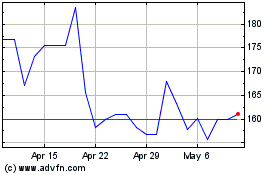

AMCON Distributing (AMEX:DIT)

Historical Stock Chart

From Mar 2024 to Apr 2024

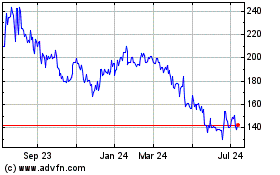

AMCON Distributing (AMEX:DIT)

Historical Stock Chart

From Apr 2023 to Apr 2024