AMC to Buy Odeon & UCI, Says Carmike Deal in Jeopardy

July 12 2016 - 8:40AM

Dow Jones News

AMC Entertainment Holdings Inc. said Tuesday that it agreed to

acquire European movie theater operator Odeon & UCI Cinemas

Group in a roughly £ 500 million ($650 million) deal even as the

U.S. theater chain works to close its delayed deal for Carmike

Cinemas Inc.

At the same time, the company warned that its $1.1 billion deal

to buy Carmike Cinemas Inc. remains at "considerable risk" because

some shareholders have an "unrealistic view" of Carmike's value to

AMC.

AMC said the deal to buy Odeon & UCI would make it the

world's largest movie theater operator. Odeon & UCI operates

2,236 screens in 242 theaters across seven European countries,

including in the U.K., Spain and Italy. AMC has 385 locations and

5,380 screens located primarily in the U.S.

AMC is buying the European theater operator from private-equity

firm Terra Firma in a deal valued at about £ 921 million, including

£ 407 million in debt. The equity part of the deal comprises 75%

stock and 25% cash.

The deal is expected to close in the fourth quarter of the year

and is subject to antitrust clearance by the European Commission

and to consultation with the European Works Council.

The transaction is subject to antitrust clearance by the

European Commission and to consultation with the European Works

Council.

"This is a once-in-a-generation opportunity to acquire Europe's

leading cinema chain," AMC Chief Executive Adam Aron said.

AMC said there are "some uncertainties" related to the U.K.'s

vote to leave the European Union but that the decades-low exchange

rate between the U.S. Dollar and British Pound made the deal highly

favorable to AMC. London-based Odeon will continue to be based

there and will retain its brand names.

AMC also is working to acquire U.S.-based Carmike. Last month, a

shareholder vote to approve that deal was postponed following

concerns among some Carmike shareholders that the sale price was

too low.

AMC said Tuesday it remains committed to the Carmike deal.

"We intend to continue to work this week with Carmike to see if

the AMC/Carmike transaction can be saved, but we again note that

the economics of a transaction get marginal very quickly for AMC

above the $30 deal price," the company said.

Shares of Carmike fell 2.5% to $27.77 in premarket trading. AMC

shares were inactive.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

July 12, 2016 08:25 ET (12:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

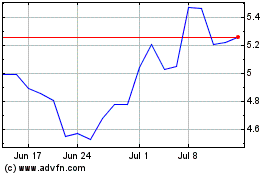

AMC Entertainment (NYSE:AMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

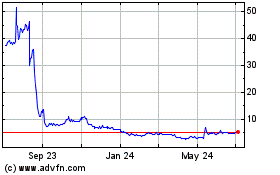

AMC Entertainment (NYSE:AMC)

Historical Stock Chart

From Apr 2023 to Apr 2024