Transformative acquisitions and innovative

strategic initiatives drive growth

AMC Entertainment Holdings, Inc. (NYSE: AMC) (“AMC” or “the

Company”), the largest theatrical exhibition company in the U.S.,

Europe and the world, and an industry leader in innovation and

operational excellence, today reported results for the first

quarter ended March 31, 2017.

Highlights for the first quarter ended March 31, 2017,

include the following:

- AMC set first quarter records for the

three months ended March 31 period for all revenue categories:

admissions, food and beverage and other.

- Total revenues increased 67.5% to

$1,283.4 million compared to total revenues of $766.0 million for

the three months ended March 31, 2016.

- Admissions revenues increased 69.4% to

$817.3 million compared to $482.6 million for the same period a

year ago.

- Food and beverage revenues increased

63.0% to $397.9 million, compared to $244.1 million for the quarter

ended March 31, 2016.

- Net earnings decreased 70.3% to $8.4

million compared to $28.3 million for the three months ended March

31, 2016. Included in net earnings for the first quarter of 2017

and 2016 were approximately $26.2 million and $3.9 million,

respectively, of after-tax merger and acquisition expenses

associated with prior acquisitions. Excluding merger and

acquisition expenses in both years, net earnings increased 7.5% to

$34.6 million.

- Diluted earnings per share (“diluted

EPS”) decreased 75.9% to $0.07 compared to $0.29 for the same

period a year ago. Average diluted shares outstanding in the first

quarter of 2017 increased approximately 23.6% compared to the first

quarter last year as a result of equity consideration for the Odeon

Cinemas Group (“Odeon”) and Carmike Cinemas (“Carmike”)

acquisitions completed in 2016 and the successful completion of an

equity offering in February 2017.

- Adjusted EBITDA1 increased 71.5% to

$251.3 million compared to $146.5 million for the three months

ended March 31, 2016.

- Results for the 2017 first quarter

include the contribution from two acquisitions completed during the

fourth quarter of 2016 and one acquisition completed in the last

week of the first quarter of 2017. The acquisition of Odeon and

Carmike were completed on November 30, 2016, and December 21, 2016,

respectively, and AMC completed the acquisition of Nordic Cinema

Group Holding AB on March 28, 2017.

“AMC is off to a tremendous and record start in 2017. AMC’s

ability to purposefully act on the opportunities and innovations

that drive growth continues to set us apart and further solidifies

our leadership position among movie-theatre operators in the U.S.

and Europe,” said Adam Aron, AMC Chief Executive Officer and

President. “Achieving record first quarter 2017 Adjusted EBITDA of

$251.3 million is tangible evidence of what we have been saying for

the better part of a year, that the earnings power of this new

incarnation of a larger and more influential AMC is enormous

compared to other operators and even to our own recent past."

Aron said, "We would particularly point out three important

developments at AMC so far this year. First, at the legacy

pre-acquisition AMC theatres, we grew revenues at a meaningfully

faster pace than the industry at large, due in part to our

commitment to renovating theatres and the strength of our impactful

marketing programs. Second, with our domestic acquisition, our

rapid move to achieve cost synergies and efficiencies brought

immediate bottom line benefit, offsetting revenue weakness that had

been prevalent at Carmike for eight of the twelve months and three

of the last four months of 2016. We are directly focused on

improving revenues at the acquired domestic theatres, as well as

furthering the cost reduction efforts that already are well in

hand. And third, we are thrilled both by our brisk start in driving

immediate revenue and earnings growth in constant currency in

Europe, and the likelihood that our plans to drive even more

earnings through renovation of European theatres will come to

initial fruition in quantity as early as the end of 2018."

Aron added, "We are only just beginning to unlock the growth

potential of our recent acquisitions. The initial integration

efforts of creating a transformed AMC have been done quickly and

have been very smooth. As we now move to make what we expect will

be highly lucrative investments in guest-facing initiatives like

powered recliner seats, enhanced food and beverage offerings and

the expansion of premium large format experiences, we are as

confident as we could be in the future earnings potential of AMC.

We remain optimistic about the opportunity to continue to deliver

meaningful value to our shareholders both in the balance of 2017

and in the years ahead.”

CFO Commentary

Commentary on the quarter by Craig Ramsey, AMC's Executive Vice

President and Chief Financial Officer, is available at

http://investor.amctheatres.com.

Additional information detailing select unaudited pro forma

financial data for the three-month period ended March 31, 2016 is

included in the first quarter 2017 CFO Commentary. The select

unaudited pro forma data for the three-month period ended March 31,

2016 combines the historical financial data of operations of AMC,

Odeon and Carmike, giving effect to the acquisitions, financings

and theatre divestitures as if they had been completed on January

1, 2016. The historical consolidated financial information for

Odeon has been adjusted to comply with U.S. GAAP. The

classification of certain items presented by Odeon under U.K. GAAP

has been modified in order to align with the presentation used by

AMC under U.S. GAAP. In addition to the U.S. GAAP adjustments and

the reclassifications, amounts have also been translated to U.S.

Dollars. The unaudited pro forma financial information is provided

for informational purposes only and is not necessarily indicative

of what our results of operations would actually have been had the

acquisitions occurred on the date indicated. Please refer to the

March 13, 2017 Form 8-K/A for additional information on pro forma

financial statement adjustments.

Dividend

On February 14, 2017, the Company declared a regular quarterly

dividend of $0.20 per share for the quarter ended December 31,

2016, which was paid on March 27, 2017, to shareholders of record

as of March 13, 2017. The total dividends paid in the first quarter

of 2017 were approximately $26.2 million.

On April 27, 2017, the Company declared a regular quarterly

dividend of $0.20 per share for the quarter ended March 31, 2017,

which is payable on June 19, 2017, to shareholders of record on

June 5, 2017.

Recent Acquisition

Nordic Cinema Group: As previously

announced, AMC completed the acquisition of Stockholm-based Nordic

Cinema Group Holding AB (“Nordic”), the largest theatre exhibitor

in seven countries in Scandinavia, and the Nordic and Baltic

regions on March 28, 2017. Nordic operates 71 theatres and has a

substantial minority interest (approximately a 50% ownership) in

another 51 associated theatres to which Nordic provides a variety

of shared services. Nordic's theatres hold the #1 market share in

Sweden, Finland, Estonia, Latvia and Lithuania. Nordic currently is

number two in market share in Norway, and with a new theatre

currently under construction in Norway and scheduled to open next

year, is expected to increase market share in Norway to number one

as well. Nordic also has theatres in Denmark. AMC purchased Nordic

from European private equity firm Bridgepoint and Swedish media

group Bonnier Holding in an all-cash transaction valued at

approximately $968.8 million, which includes the repayment of

debt.

Conference Call / Webcast

Information

The Company will host a conference call via webcast for

investors and other interested parties beginning at 4:00 p.m.

CT/5:00 p.m. ET on Monday, May 8, 2017. To listen to the conference

call via the internet, please visit the investor relations section

of the AMC website at www.investor.amctheatres.com for a link to

the webcast. Investors and interested parties should go to the

website at least 15 minutes prior to the call to register, and/or

download and install any necessary audio software.

Participants may also listen to the call by dialing (877)

407-3982, or (201) 493-6780 for international participants.

An archive of the webcast will be available on the Company’s

website after the call for a limited time.

About AMC Entertainment Holdings, Inc.

AMC (NYSE: AMC) is the largest movie exhibition company in the

U.S., in Europe and throughout the world with 1,027 theatres and

11,247 screens across the globe. AMC has propelled innovation in

the exhibition industry by: deploying more plush power-recliner

seats; delivering enhanced food and beverage choices; generating

greater guest engagement through its loyalty program, web site and

smart phone apps; offering premium large format experiences and

playing a wide variety of content including the latest Hollywood

releases and independent programming. AMC operates among the most

productive theatres in the United States’ top markets, having the

#1 or #2 market share positions in 22 of the 25 largest

metropolitan areas of the United States, including the top three

markets (NY, LA, Chicago). Through its Odeon subsidiary AMC

operates in 14 European countries and is the #1 theatre chain in

Estonia, Finland, Italy, Latvia, Lithuania, Spain, Sweden and UK

& Ireland. amctheatres.com

Website Information

This press release, along with other news about AMC, is

available at www.amctheatres.com. We routinely post information

that may be important to investors in the Investor Relations

section of our website, www.investor.amctheatres.com. We use this

website as a means of disclosing material, non-public information

and for complying with our disclosure obligations under Regulation

FD, and we encourage investors to consult that section of our

website regularly for important information about AMC. The

information contained on, or that may be accessed through, our

website is not incorporated by reference into, and is not a part

of, this document. Investors interested in automatically receiving

news and information when posted to our website can also visit

www.investor.amctheatres.com to sign up for email alerts.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of the “safe harbor” provisions of the United States

Private Securities Litigation Reform Act of 1995. Forward-looking

statements may be identified by the use of words such as

“forecast,” “plan,” “estimate,” “will,” “would,” “project,”

“maintain,” “intend,” “expect,” “anticipate,” “prospect,”

“strategy,” “future,” “likely,” “may,” “should,” “believe,”

“continue,” “opportunity,” “potential,” and other similar

expressions that predict or indicate future events or trends or

that are not statements of historical matters. These

forward-looking statements are based on information available at

the time the statements are made and/or management’s good faith

belief as of that time with respect to future events, and are

subject to risks, trends, uncertainties and other facts that could

cause actual performance or results to differ materially from those

expressed in or suggested by the forward-looking statements. These

risks, trends, uncertainties and facts include, but are not limited

to, risks related to: motion picture production and performance;

AMC’s lack of control over distributors of films; intense

competition in the geographic areas in which AMC operates;

increased use of alternative film delivery methods or other forms

of entertainment; shrinking exclusive theatrical release windows;

international economic, political and other risks; risks and

uncertainties relating to AMC’s significant indebtedness;

limitations on the availability of capital; risks relating to AMC’s

inability to achieve the expected benefits and performance from its

recent acquisitions; AMC’s ability to comply with a settlement it

entered into with the U.S. Department of Justice pursuant to which

it agreed to divest theatres and divest holdings in National

CineMedia, LLC; AMC’s ability to refinance its indebtedness on

favorable terms; optimizing AMC’s theatre circuit through

construction and the transformation of its existing theatres may be

subject to delay and unanticipated costs; failures, unavailability

or security breaches of AMC’s information systems; risks relating

to impairment losses and theatre and other closure charges; AMC’s

ability to utilize net operating loss carryforwards to reduce its

future tax liability; review by antitrust authorities in connection

with acquisition opportunities; risks relating to unexpected costs

or unknown liabilities relating to recently completed acquisitions;

risks relating to the incurrence of legal liability; general

political, social and economic conditions and risks, trends,

uncertainties and other factors discussed in the reports AMC has

filed with the SEC. Should one or more of these risks, trends,

uncertainties or facts materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those indicated or anticipated by the forward-looking

statements contained herein. Accordingly, you are cautioned not to

place undue reliance on these forward-looking statements, which

speak only as of the date they are made. Forward-looking statements

should not be read as a guarantee of future performance or results,

and will not necessarily be accurate indications of the times at,

or by, which such performance or results will be achieved. For a

detailed discussion of risks, trends and uncertainties facing AMC,

see the section entitled “Risk Factors” in AMC’s Annual Report on

Form 10-K, filed with the SEC on March 10, 2017, and the risks,

trends and uncertainties identified in its other public filings.

AMC does not intend, and undertakes no duty, to update any

information contained herein to reflect future events or

circumstances, except as required by applicable law.

AMC Entertainment Holdings, Inc. Consolidated

Statements of Operations For the Fiscal Periods Ended

3/31/17 and 3/31/16

(dollars in millions, except share and per

share data)

(unaudited)

Quarter Ended March

31, 2017 2016 Revenues Admissions $

817.3 $ 482.6 Food and beverage 397.9 244.1 Other theatre

68.2 39.3 Total revenues 1,283.4

766.0 Operating costs and expenses Film

exhibition costs 420.7 262.3 Food and beverage costs 60.6 34.0

Operating expense 363.9 202.3 Rent 182.6 124.6 General and

administrative: Merger, acquisition and transaction costs 40.4 4.6

Other 34.5 18.5 Depreciation and amortization 125.3

60.4 Operating costs and expenses 1,228.0

706.7 Operating income 55.4 59.3 Other

expense (income): Other income (2.7 ) — Interest expense: Corporate

borrowings 51.1 24.9 Capital and financing lease obligations 10.8

2.2 Equity in (earnings) losses of non-consolidated entities 2.3

(4.2 ) Investment income (5.3 ) (10.0 ) Total other

expense 56.2 12.9 Earnings

(loss) before income taxes (0.8 ) 46.4 Income tax provision

(benefit) (9.2 ) 18.1 Net Earnings $ 8.4

$ 28.3 Diluted earnings

per share $ 0.07 $ 0.29

Average shares outstanding diluted (in thousands) 121,401

98,207

Consolidated Balance

Sheet Data (at period end):

(dollars in millions)

(unaudited)

As of As

of March 31, December 31, 2017 2016

Cash and equivalents $ 313.1 $ 207.1 Corporate borrowings 4,195.2

3,760.9 Other long-term liabilities 726.5 706.5 Capital and

financing lease obligations 701.1 675.4 Stockholders' equity

2,600.6 2,009.6 Total assets 9,940.0 8,641.8

Consolidated Other Data:

(in millions, except operating data)

(unaudited)

Quarter Ended March

31, Consolidated

2017 2016 Net cash

provided by operating activities $ 166.0 $ 22.9 Capital

expenditures $ (161.3 ) $ (57.7 ) Screen additions 19 12 Screen

acquisitions 683 — Screen dispositions 17 38 Construction openings

(closures), net 4 (20 ) Average screens 10,434 5,313 Number of

screens operated 11,247 5,380 Number of theatres operated 1,027 385

Screens per theatre 11.0 14.0 Attendance (in thousands) 93,354

51,245

Segment Other Data:

(unaudited)

Quarter Ended March

31, 2017 2016 Other

operating data: Attendance (patrons, in thousands): U.S.

markets 66,822 51,096 International markets 26,532

149 Consolidated 93,354 51,245

Average

ticket price (in dollars): U.S. markets $ 9.27 $ 9.42

International markets $ 7.46 $ 7.38 Consolidated $ 8.75 $ 9.42

Food and beverage revenues per patron (in dollars):

U.S. markets $ 4.88 $ 4.77 International markets $ 2.72 $ 3.36

Consolidated $ 4.26 $ 4.76

Average Screen Count (month

end average): U.S. markets 8,163 5,297 International markets

2,271 16 Consolidated 10,434 5,313

Segment Information

(unaudited, in millions)

Quarter Ended March

31, 2017 2016

Revenues U.S. markets $ 992.2 $ 764.2 International markets

291.2 1.8 Consolidated $ 1,283.4 $ 766.0

Adjusted EBITDA U.S. markets $ 198.0 $ 146.4 International

markets 53.3 0.1 Consolidated $ 251.3 $ 146.5

Capital Expenditures U.S. markets $ 150.3 $ 57.7

International markets 11.0 — Consolidated $ 161.3 $

57.7

Reconciliation of Adjusted EBITDA:

(dollars in millions)

(unaudited)

Quarter Ended

March 31, 2017 March 31, 2016 Net

earnings $ 8.4 $ 28.3 Plus: Income tax provision (benefit) (9.2 )

18.1 Interest expense 61.9 27.1 Depreciation and amortization 125.3

60.4 Certain operating expenses (2) 5.3 3.4 Equity in (earnings)

losses of non-consolidated entities 2.3 (4.2 ) Cash distributions

from non-consolidated entities 24.4 17.7 Investment expense

(income) (5.3 ) (10.0 ) Other income (3) (2.3 ) — General and

administrative expense—unallocated: Merger, acquisition and

transaction costs (4) 40.4 4.6 Stock-based compensation expense (5)

0.1 1.1 Adjusted EBITDA (1) $ 251.3

$ 146.5 (1) We present Adjusted EBITDA as a

supplemental measure of our performance. We define Adjusted EBITDA

as net earnings plus (i) income tax provision, (ii) interest

expense and (iii) depreciation and amortization, as further

adjusted to eliminate the impact of certain items that we do not

consider indicative of our ongoing operating performance and to

include any cash distributions of earnings from our equity method

investees. These further adjustments are itemized above. You are

encouraged to evaluate these adjustments and the reasons we

consider them appropriate for supplemental analysis. In evaluating

Adjusted EBITDA, you should be aware that in the future we may

incur expenses that are the same as or similar to some of the

adjustments in this presentation. Our presentation of Adjusted

EBITDA should not be construed as an inference that our future

results will be unaffected by unusual or non-recurring items.

Adjusted EBITDA is a non-GAAP financial measure and should not be

construed as an alternative to net earnings as an indicator of

operating performance or as an alternative to cash flow provided by

operating activities as a measure of liquidity (as determined in

accordance with U.S. GAAP). Adjusted EBITDA may not be comparable

to similarly titled measures reported by other companies. We have

included Adjusted EBITDA because we believe it provides management

and investors with additional information to measure our

performance and estimate our value. Adjusted EBITDA has

important limitations as an analytical tool, and you should not

consider it in isolation, or as a substitute for analysis of our

results as reported under U.S. GAAP. For example, Adjusted

EBITDA:

• does not reflect our capital

expenditures, future requirements for capital expenditures or

contractual commitments;

• does not reflect changes in, or cash

requirements for, our working capital needs;

• does not reflect the significant

interest expenses, or the cash requirements necessary to service

interest or principal payments, on our debt;

• excludes income tax payments that

represent a reduction in cash available to us; and

• does not reflect any cash requirements

for the assets being depreciated and amortized that may have to be

replaced in the future.

(2) Amounts represent preopening expense related to

temporarily closed screens under renovation, theatre and other

closure expense for the permanent closure of screens including the

related accretion of interest, non-cash deferred digital equipment

rent expense, and disposition of assets and other non-operating

gains or losses included in operating expenses. We have excluded

these items as they are non-cash in nature, include components of

interest cost for the time value of money or are non-operating in

nature. (3) Other income for the current year includes $2.7

million of foreign currency transaction gains and a $0.4 million

loss on redemption of the Bridge Loan Facility. (4) Merger,

acquisition and transaction costs are excluded as it is

non-operating in nature. (5) Non-cash or non-recurring

expense included in General and Administrative: Other

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170508006298/en/

AMC Entertainment Holdings, Inc.Investor

Relations:John Merriwether,

866-248-3872InvestorRelations@amctheatres.comorMedia

Contact:Ryan Noonan, 913-213-2183rnoonan@amctheatres.com

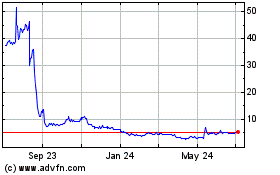

AMC Entertainment (NYSE:AMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

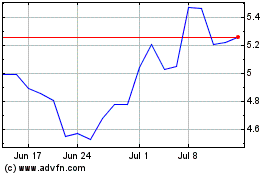

AMC Entertainment (NYSE:AMC)

Historical Stock Chart

From Apr 2023 to Apr 2024