AIM Schedule 1 update - Gresham House Plc (3153Y)

November 28 2014 - 6:09AM

UK Regulatory

TIDMGHE

RNS Number : 3153Y

AIM

28 November 2014

ANNOUNCEMENT TO BE MADE BY THE AIM APPLICANT

PRIOR TO ADMISSION IN ACCORDANCE WITH RULE 2

OF THE AIM RULES FOR COMPANIES ("AIM RULES")

------------------------------------------------------------------

COMPANY NAME:

------------------------------------------------------------------

Gresham House plc (the "Company")

------------------------------------------------------------------

COMPANY REGISTERED OFFICE ADDRESS AND IF DIFFERENT,

COMPANY TRADING ADDRESS (INCLUDING POSTCODES)

:

------------------------------------------------------------------

Registered Office (existing):

235 Hunts Pond Road

Fareham

Hampshire

PO14 4PJ

Registered Office (from Admission):

5 New Street Square

London EC4A 3TW

------------------------------------------------------------------

COUNTRY OF INCORPORATION:

------------------------------------------------------------------

England

------------------------------------------------------------------

COMPANY WEBSITE ADDRESS CONTAINING ALL INFORMATION

REQUIRED BY AIM RULE 26:

------------------------------------------------------------------

www.greshamhouse.com

------------------------------------------------------------------

COMPANY BUSINESS (INCLUDING MAIN COUNTRY OF

OPERATION) OR, IN THE CASE OF AN INVESTING COMPANY,

DETAILS OF ITS INVESTING POLICY). IF THE ADMISSION

IS SOUGHT AS A RESULT OF A REVERSE TAKE-OVER

UNDER RULE 14, THIS SHOULD BE STATED:

------------------------------------------------------------------

Upon admission to trading on AIM ("Admission")

and in the short to medium term the Company

will be an investing company under the AIM Rules

with an Investing Policy (details below).

The directors, following Admission, intend to

develop the Company as a quoted platform principally

for investment in, and the investment management

of, relatively differentiated, specialist or

illiquid assets. The directors intend to use

part of the proceeds of the placing to make

investments in line with the Company's Investing

Policy and to develop an asset management business,

either organically or through one or more acquisitions.

The development of such an asset management

business may lead to the Company ceasing to

be an investing company under the AIM Rules

and instead become a trading company. Furthermore,

in the event the Company makes an acquisition,

in the development of the asset management business,

which is classified as a reverse takeover under

the AIM Rules, the Company will be required

to publish an Admission Document.

The directors will review the group's existing

assets at Admission and develop an appropriate

strategy for each asset. As any of the existing

assets are realised, the directors will redeploy

the proceeds of realisation in accordance with

the Investment Policy and/or the development

of an asset management business.

Details of Investing Policy:

The Company will seek to use the expertise and

experience of its board of directors and members

of the Investment Committee to invest according

to a robust private equity-style investment

philosophy. The Company's investing policy is

to invest in assets that will typically have

a number of the following characteristics:

* an illiquidity discount;

* a minimum target internal rate of return (IRR) of 15

per cent;

* cash generative (or expected to generate cash within

a reasonable investment horizon);

* relatively differentiated, specialist or illiquid;

* attractive management track records;

* potential for superior risk adjusted returns;

* potential for liquidity or exit within an identified

time frame;

* potential for the Company to have a competitive

advantage; and/or

* potential for the Company to add incremental value to

an investment.

The board of directors will consider investment

in a number of business areas, particularly

those sectors in which the board of directors

collectively believes that it and/or members

of the Investment Committee has the necessary

expertise and experience to be able to manage

the opportunity. The board of directors and

members of the Investment Committee have a wide

network of contacts to assist in the identification,

evaluation and funding of suitable investment

opportunities.

The Company may, directly or indirectly invest

in publicly and/or privately held companies

(primarily in equity and also in debt instruments),

set up (and potentially co-invest in) funds,

and enter into derivative contracts.

Investments may be made in any country globally

and be either passive or active. The Company

will not invest more than 35 per cent. of the

group's gross assets, at the time when the investment

is made, in securities issued by any single

company other than, subject to certain restrictions,

in a single collective investment undertaking

or fund structure. The Company has no borrowing

limits. A typical direct investment will be

expected to have a holding period of between

three to five years, but may be shorter or longer.

The directors' initial intention is to re-invest

profits into the Company rather than paying

dividends and shareholder returns are likely

to be through capital appreciation.

Full details of the Company's Investing Policy

and strategy are published in the Admission

Document.

------------------------------------------------------------------

DETAILS OF SECURITIES TO BE ADMITTED INCLUDING

ANY RESTRICTIONS AS TO TRANSFER OF THE SECURITIES

(i.e. where known, number and type of shares,

nominal value and issue price to which it seeks

admission and the number and type to be held

as treasury shares):

------------------------------------------------------------------

5,369,880 existing ordinary shares of 25p each

("Ordinary Shares"), and

3,973,510 new Ordinary Shares at an issue price

of 286.9 pence per share to be issued at Admission;

and

Up to 1,073,976 shareholder warrants to subscribe

for Ordinary Shares (to be issued on 1 for 5

basis to existing shareholders immediately prior

to Admission).

There are no restrictions on the transfer of

the securities and there will be no ordinary

shares held in treasury on Admission.

------------------------------------------------------------------

CAPITAL TO BE RAISED ON ADMISSION (IF APPLICABLE)

AND ANTICIPATED MARKET CAPITALISATION ON ADMISSION:

------------------------------------------------------------------

Capital to be raised on Admission via a placing

for cash: GBP11.5 million (inclusive of subscriptions

for unquoted Supporter Warrants)

Anticipated Market Capitalisation on Admission:

GBP26.8 million

------------------------------------------------------------------

PERCENTAGE OF AIM SECURITIES NOT IN PUBLIC HANDS

AT ADMISSION:

------------------------------------------------------------------

17%

------------------------------------------------------------------

DETAILS OF ANY OTHER EXCHANGE OR TRADING PLATFORM

TO WHICH THE AIM COMPANY HAS APPLIED OR AGREED

TO HAVE ANY OF ITS SECURITIES (INCLUDING ITS

AIM SECURITIES) ADMITTED OR TRADED:

------------------------------------------------------------------

The Ordinary Shares are currently admitted to

trading on the Main Market of the London Stock

Exchange and listed on the Official List. Trading

on the Main Market and listing on the Official

List will cease upon Admission.

------------------------------------------------------------------

FULL NAMES AND FUNCTIONS OF DIRECTORS AND PROPOSED

DIRECTORS (underlining the first name by which

each is known or including any other name by

which each is known):

------------------------------------------------------------------

Directors:

Antony (Tony) Gerard Ebel, Non-Executive Chairman*

Brian James Hallett, Non-Executive Director*

John Anthony Crosbie Lorimer, Non-Executive

Director*

Richard Andrew Chadwick, Non-Executive Director

* Tony Ebel, Brian Hallett and John Lorimer

will cease to be directors with effect from

Admission

Proposed Directors (with effect from Admission):

John Anthony Victor Townsend, proposed Non-Executive

Chairman

Anthony (Tony) Lionel Dalwood, proposed Chief

Executive

Michael Charles Phillips, proposed Strategic

Development Director

Duncan James Langlands Abbot, proposed Finance

Director

Peter Geoffrey Moon, proposed senior Non-Executive

Director

------------------------------------------------------------------

FULL NAMES AND HOLDINGS OF SIGNIFICANT SHAREHOLDERS

EXPRESSED AS A PERCENTAGE OF THE ISSUED SHARE

CAPITAL, BEFORE AND AFTER ADMISSION (underlining

the first name by which each is known or including

any other name by which each is known):

------------------------------------------------------------------

Before Admission:

RevCap Estates 24 Limited: 21.80%

The Trustees of the Rowe Trust: 12.00%

A P (Fred) Stirling: 8.72%

Standard Life Investments 4.95%

Following Admission:

RevCap Estates 24 Ltd: 12.53% (and 21.80% of

the shareholder warrants)

River & Mercantile Asset Management: 7.46%

Majedie Asset Management: 7.46%

The Trustees of the Rowe Trust: 6.89%(and 12.00%

of the shareholder warrants)

Helium Rising Stars Fund: 6.74%

A P (Fred) Stirling: 5.01% (and 8.72% of the

shareholder warrants)

Rathbone Investment Management: 3.06%

Standard Life Investments: 2.85% (and 4.95%

of the shareholder warrants)

------------------------------------------------------------------

NAMES OF ALL PERSONS TO BE DISCLOSED IN ACCORDANCE

WITH SCHEDULE 2, PARAGRAPH (H) OF THE AIM RULES:

------------------------------------------------------------------

None

------------------------------------------------------------------

(i) ANTICIPATED ACCOUNTING REFERENCE DATE

(ii) DATE TO WHICH THE MAIN FINANCIAL INFORMATION

IN THE ADMISSION DOCUMENT HAS BEEN PREPARED

(this may be represented by unaudited interim

financial information)

(iii) DATES BY WHICH IT MUST PUBLISH ITS FIRST

THREE REPORTS PURSUANT TO AIM RULES 18 AND 19:

------------------------------------------------------------------

(i) 31 December

(ii) 30 June 2014 (unaudited interim statements)

(iii) 30 June 2015 (annual report for the twelve

months ending 31 December 2014)

30 September 2015 (interim report for the six

months ending 30 June 2015)

30 June 2016 (annual report for the twelve

months ending 31 December 2015)

------------------------------------------------------------------

EXPECTED ADMISSION DATE:

------------------------------------------------------------------

1 December 2014

------------------------------------------------------------------

NAME AND ADDRESS OF NOMINATED ADVISER:

------------------------------------------------------------------

Westhouse Securities Limited

110 Bishopsgate

London, EC2N 4AY

------------------------------------------------------------------

NAME AND ADDRESS OF BROKER:

------------------------------------------------------------------

Westhouse Securities Limited

110 Bishopsgate

London, EC2N 4AY

------------------------------------------------------------------

OTHER THAN IN THE CASE OF A QUOTED APPLICANT,

DETAILS OF WHERE (POSTAL OR INTERNET ADDRESS)

THE ADMISSION DOCUMENT WILL BE AVAILABLE FROM,

WITH A STATEMENT THAT THIS WILL CONTAIN FULL

DETAILS ABOUT THE APPLICANT AND THE ADMISSION

OF ITS SECURITIES:

------------------------------------------------------------------

The admission document, which contains full

details about the applicant and the admission

of its securities, is available on the Company's

website (www.greshamhouse.com) in accordance

with AIM Rule 26.

------------------------------------------------------------------

DATE OF NOTIFICATION:

------------------------------------------------------------------

28 November 2014

------------------------------------------------------------------

NEW/ UPDATE:

------------------------------------------------------------------

Update

------------------------------------------------------------------

This information is provided by RNS

The company news service from the London Stock Exchange

END

AIMBPBBTMBMTBRI

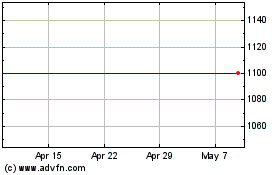

Gresham House (LSE:GHE)

Historical Stock Chart

From Mar 2024 to Apr 2024

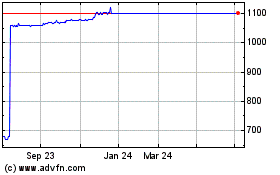

Gresham House (LSE:GHE)

Historical Stock Chart

From Apr 2023 to Apr 2024