AIG: The Value Of Togetherness

February 11 2016 - 3:02AM

Dow Jones News

(FROM THE WALL STREET JOURNAL 2/11/16)

By Steven Russolillo

American International Group Inc. has repeatedly resisted

overtures from investors Carl Icahn and John Paulson to break up

the business. The more that interest rates fall, the better that

AIG's argument looks.

More than a month after the Federal Reserve raised its benchmark

rate from zero, both short- and long-term rates have fallen. Now,

many investors anticipate low rates won't go away anytime soon amid

economic risks and broad market turmoil.

While those conditions tend to hurt large insurers, AIG, for now

at least, has the benefit of diversification on its side. That

should help when it reports fourth-quarter results Thursday.

Analysts expect a loss of 92 cents a share, although that is mainly

due to an announced $3.6 billion reserve charge.

For years, AIG traded at a steeper discount to book value than

many of its peers. That bolstered Mr. Icahn's case for a breakup,

as it suggested AIG isn't reflective of its full value.

But things have changed. AIG shares are down about 15% this

year, which isn't as bad as some other insurance or bank stocks.

And trading at about 10 times projected earnings, AIG commands a

more expensive price/earnings multiple than life-insurance rivals

such as MetLife Inc., Prudential Financial Inc. and Lincoln

National Corp.

In essence, the market is giving AIG a pass that many other

insurers aren't getting. Low rates hurt the profitability of life

insurers, which hold long-term assets to pay future claims. That is

because falling rates inflate the present-value terms of those

claims.

But AIG has a buffer: It also has a property-casualty business

that is less afflicted by low interest rates. And the market is

suggesting that the more-lucrative property-casualty insurance

business is, in effect, subsidizing the life business.

In a strategy update last month, AIG laid out plans to

reorganize its core operations into nine units, part of an effort

to increase transparency. AIG also committed to returning at least

$25 billion to shareholders over the next two years through

buybacks and dividends.

In this tough market for financials, an undivided AIG offers a

bit of hope.

(END) Dow Jones Newswires

February 11, 2016 02:47 ET (07:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

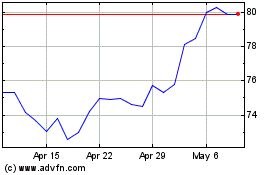

American (NYSE:AIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

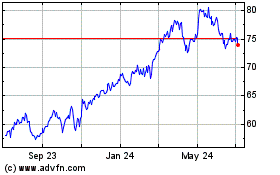

American (NYSE:AIG)

Historical Stock Chart

From Apr 2023 to Apr 2024