AES Announces Settlement of Outstanding Receivables at Maritza in Bulgaria; Reaffirms its Full Year 2016 Guidance

April 27 2016 - 6:00AM

Business Wire

The AES Corporation (NYSE: AES) announced that one of its

subsidiaries, AES 3C Maritza East I (Maritza) in Bulgaria, has

received €309 million ($350 million) in outstanding receivables

from NEK, the state-owned wholesale power company. This payment was

related to the amendment to Maritza’s Power Purchase Agreement

(PPA) signed in August 2015. Maritza will use the majority of the

proceeds to pay the local coal mine that supplies the plant, as

well as repay the lenders of the plant’s non-recourse debt.

“As a direct result of the steps taken by the Government of

Bulgaria to strengthen the financial position of NEK, Maritza has

received full payment of its outstanding receivables,” said Andrés

Gluski, AES President and Chief Executive Officer. “Maritza is one

of the most reliable and cleanest coal-fired plants in Europe,

using only domestically sourced fuel. By meeting all of its

contractual obligations, Bulgaria is sending a very positive sign

to all foreign investors in the country.”

Under the amendment, both parties agreed to make certain changes

to the PPA, including reducing the capacity payment to Maritza by

14 percent through 2026, the PPA term. In exchange, NEK agreed to

pay Maritza its full outstanding receivables. These terms were

previously incorporated in the Company’s 2016 guidance and

2017-2018 expectations.

“The resolution at Maritza is another step in our efforts to

improve the stability of our financial results,” said Tom O’Flynn,

AES Executive Vice President and Chief Financial Officer. “With our

progress to-date and our outlook for the remainder of 2016, we

remain on track to deliver on our financial and strategic

objectives.”

The Company also announced that it is reaffirming its 2016

guidance for all metrics. However, the Company expects its first

quarter 2016 Adjusted EPS results to be significantly below first

quarter 2015 Adjusted EPS of $0.25, which was 20% of full year 2015

Adjusted EPS. First quarter 2016 Adjusted EPS was impacted by a

higher adjusted effective tax rate, primarily as a result of the

enactment of income tax reforms in Chile, as anticipated and

previously included in its guidance. The Company continues to

expect its full year 2016 tax rate to be 31% to 33%. First quarter

2016 results were also impacted by the devaluation of foreign

currencies in Latin America and Europe. The Company is therefore

reaffirming its full year 2016 Adjusted EPS guidance range of $0.95

to $1.05.

The Company expects its first quarter 2016 Proportional Free

Cash Flow results to be largely in line with its first quarter 2015

Proportional Free Cash Flow of $265 million, which was 21% of full

year 2015 Proportional Free Cash Flow. The Company is reaffirming

its full year 2016 Proportional Free Cash Flow guidance range of

$1,000 to $1,350 million. The Company is continuing to review its

first quarter 2016 results and will provide an update on its

earnings call scheduled for Monday, May 9, 2016.

About AES

The AES Corporation (NYSE: AES) is a Fortune 200

global power company. We provide affordable, sustainable energy to

17 countries through our diverse portfolio of distribution

businesses as well as thermal and renewable generation facilities.

Our workforce of 21,000 people is committed to operational

excellence and meeting the world’s changing power needs. Our

2015 revenues were $15 billion and we own and

manage $37 billion in total assets. To learn more,

please visit www.aes.com. Follow AES on Twitter

@TheAESCorp.

Safe Harbor Disclosure

This news release contains forward-looking statements within the

meaning of the Securities Act of 1933 and of the Securities

Exchange Act of 1934. Such forward-looking statements include, but

are not limited to, those related to future earnings, growth and

financial and operating performance. Forward-looking statements are

not intended to be a guarantee of future results, but instead

constitute AES’ current expectations based on reasonable

assumptions. Forecasted financial information is based on certain

material assumptions. These assumptions include, but are not

limited to, our accurate projections of future interest rates,

commodity price and foreign currency pricing, continued normal

levels of operating performance and electricity volume at our

distribution companies and operational performance at our

generation businesses consistent with historical levels, as well as

achievements of planned productivity improvements and incremental

growth investments at normalized investment levels and rates of

return consistent with prior experience.

Actual results could differ materially from those projected in

our forward-looking statements due to risks, uncertainties and

other factors. Important factors that could affect actual results

are discussed in AES’ filings with the Securities and Exchange

Commission (the “SEC”), including, but not limited to, the risks

discussed under Item 1A “Risk Factors” and Item 7:

Management’s Discussion & Analysis in AES’ 2015 Annual

Report on Form 10-K and in subsequent reports filed with the SEC.

Readers are encouraged to read AES’ filings to learn more about the

risk factors associated with AES’ business. AES undertakes no

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or

otherwise.

Any Stockholder who desires a copy of the Company’s 2015 Annual

Report on Form 10-K dated on or about February 23, 2016 with

the SEC may obtain a copy (excluding Exhibits) without charge by

addressing a request to the Office of the Corporate Secretary, The

AES Corporation, 4300 Wilson Boulevard, Arlington, Virginia 22203.

Exhibits also may be requested, but a charge equal to the

reproduction cost thereof will be made. A copy of the Form 10-K may

be obtained by visiting the Company’s website

at www.aes.com.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160427005431/en/

The AES CorporationInvestor Contact:Ahmed Pasha

703-682-6451orMedia Contact:Amy Ackerman 703-682-6399

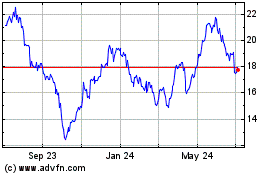

AES (NYSE:AES)

Historical Stock Chart

From Mar 2024 to Apr 2024

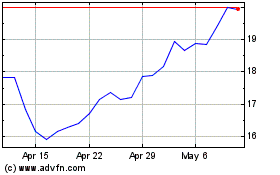

AES (NYSE:AES)

Historical Stock Chart

From Apr 2023 to Apr 2024