TIDMAEC

RNS Number : 3541H

AEC Education plc

17 August 2016

AEC Education Plc

("AEC" or the "Company")

Final Results for the year ended 31 December 2015

AEC Education the provider of educational services in Europe and

the Far East announces its results for the year end 301 December

2015.

Key points

-- Revenues GBP7.7m (2014:GBP8.1m)

-- Operating loss of GBP1.4m (2014: loss of GBP1.5m)

-- Loss before tax of GBP 1.4m (2014: loss of GBP 1.5m)

-- Adjusted loss before tax and impairment charges GBP0.5m (2014: loss of GBP1.1m)

-- Loss per share of 2.42p (2014:2.18p)

Liam Swords, Chairman of AEC, commented:

"In summary, 2015 was another difficult year in Singapore as we

strived to regain revenue and profitability and the market in the

UK remained in turmoil. The restructuring of the operations in

Singapore and London is now complete and this combined with the

return to profit in Malaysia and the continuing investment enabled

by the sale of our operations in Ireland creates a platform from

which AEC can continue to rebuild group profitability.

"The report and accounts are expected to be posted to

shareholders shortly following which the Company will seek the

restoration of trading in its shares on AIM. The Notice of the AGM

of the Company to be held on 12 September 2016 will also be

despatched shortly."

This announcement contains inside information as defined in

Article 7 of the Market Abuse Regulation No. 596/2014 and is

disclosed in accordance with the Company's obligations under

Article 17 of those Regulations.

For further information, please contact:

AEC Education Plc

Liam Swords

Tel: 07725 836811

WH Ireland Limited (NOMAD & Broker)

Mike Coe

Liam Gribben

Tel: 0117 945 3470

CHAIRMAN'S STATEMENT

Overview

The year under review more or less mirrored the fortunes of the

previous year. This can be summarised as follows:

Europe

-- Trading in London continued to show a downturn and

consequently London suffered a significant loss.

-- Ireland again grew substantially and showed an operating

profit, albeit, as noted below, this entity has now been sold in

July 2016.

-- In Cyprus, where the group has a joint venture interest, the

market continued to be affected by the impact of the slowing

economy in Russia, its main market, but this entity showed a small

operating profit allowing our share of the joint venture to break

even.

South East Asia/Middle East

-- Singapore continued to recover and to gain some ground with

its new product initiatives but not sufficiently to avoid an

operating loss.

-- Malaysia continued to recover strongly through its new market

and new product initiatives and showed a good operating profit.

The market in the UK continued to be severely impacted by

attitudes towards immigration, the likely terror threat and looking

forward there will be increased uncertainty caused by the

referendum on the European Union. To offset the impact of this the

operation has been downsized and there is a strong focus on more

local products and a wider offering to overseas students. The

positive signs that begun to show in Malaysia last year continued

strongly during the year and lays a firm base for next year. A key

development since the year end was that in July 2016, Malvern House

Ireland has been sold to enable the revival of London and Singapore

to be supported.

During 2015, given the changes in the ongoing structure of the

Group, the Board has undertaken an impairment review of the

carrying value of its goodwill and intangible assets within the

consolidated financial statements and of the investments held

within the Plc entity.

Financial results and business review

Group revenues on continuing activities for the year to 31

December 2015 reduced by 5% to GBP7.7m (2014: GBP8.1m). The

reduction was mainly due to the difficult trading conditions in

certain jurisdictions including London. The Group continued with

its programme of reducing operating costs during the year by

continued focus on implementing effective cost control strategies

in all units. Because of this the Group's loss before tax from

continuing operations was GBP1.4m (2014: GBP1.5m). If the impact of

these impairment charges is excluded, the adjusted group loss

before tax and impairment charges is GBP0.5m (2014: GBP1.1m).

In evaluating our impairment assessment for goodwill and

intangibles across the group we have considered our future plans

and growth strategies for both Europe and South East Asia/Middle

East, and assumptions on the future opportunities in Singapore

regarding obtaining a new license for EduTrust which the group are

currently exploring. In addition, we have considered impact of the

disposal in July 2016 of Ireland and the future income streams

arising from the royalties for which a commitment for one year has

been obtained and an assumption has been made regarding renewal for

future years.

During 2015 there has been a restatement of the prior year

figures increasing the comparative loss by GBP0.4m from GBP1.1m

previously reported for 2014 to GBP1.5m. This adjustment relates to

an overstatement of income by GBP0.4m in 2014 in respect of the UK

and Irish entities within the group. The comparative figures

presented reflect this restatement.

A summary of performance across the two key operating segments,

defined by the two 'sub-groups' of Malvern House Group Limited

(Europe) and AEC Colleage Pte Limited (South East Asia/Middle

East), can be summarised as follows:

Europe

-- The London operation recorded an operating loss of GBP384k

which after finance charges resulted in a loss of GBP541k. As we

have previously reported, our operations in the UK have felt the

significant effects of the changing legislation and regulations

regarding visas and work permits for overseas students and the

negative perception of this overseas continued again during 2015.

Adding to this is the continuing threat from terrorism and looking

forward there will be increased uncertainty regarding the European

Market and the resulting reduced market is very challenging. This

has caused our London operation to drop significantly during the

year with the result that revenue in our Kings Cross school was

down year on year by 26% to GBP2.4m (2014: GBP3.3m). This resulted

in an operating loss of GBP384k (2014: profit of GBP89k). There has

been significant investment in restructuring the operation,

creating new products and new local market initiatives to find new

sources of revenue both from new products and new areas of

distribution which should begin to offset the negative effects in

the London market during 2016.

-- Ireland recorded turnover of GBP2.9m in 2015 (2014 - GBP2.1m)

and an operating profit of GBP252k.

-- Additionally, our share of the profit from our joint venture

in Cyprus was at GBP1k (2014: GBP54k), which after central charges,

would have resulted in a loss for 2015.

South East Asia/Middle East

-- The Singapore College recorded an operating loss of GBP559k

(2014: GBP761k) mainly due to special impairment of assets of

GBP495k (2014: GBP866k). Excluding impairment, the operating loss

was at GBP65k (2014: profit of GBP105k). In Asia, our operations in

Singapore have started to show small improvements but as yet have

been unable to return to profit. The revenue decreased by 77% to

GBP193k (2014: GBP858k). The loss before tax was at GBP578k mainly

due to impairment of investments of GBP495k . They have continued

to market the new courses for diplomas I advanced diplomas in civil

engineering I electrical engineering I mechanical engineering,

higher diplomas in accounting and finance and working towards their

recently acquired Approved Training Organization(ATO status)

through the Singapore Workforce Development Agency which are

tailored for the local market through government subsidies. Whilst

growth has been slower than expected there are signs that they can

return to profit in 2016.

-- Malaysia returned an operating profit of GBP123k (2014:

GBP47K). In Malaysia, revenue increased on the previous year by 19%

largely based on local currency due to new product and market

initiatives which commenced last year but the exchange rate decline

against the British Pound meant it only showed a 8% growth. Revenue

increased to GBP2.2m (2014: GBP2.0m) and profit before tax was

GBP118k (2014: GBP42k). The gains in this year have created a

strong platform and combined with initiatives that are being taken

to create new university partnerships should enable them to

continue the revenue and profit growth next year

The initiatives we have taken in Singapore to reduce costs and

to focus on the local market have been slower than expected but

should allow it to return to profit in 2016. Initiatives continue

to be developed to generate revenue from non-traditional sources to

improve the results in London.

The basic and diluted loss per share was 2.42p (2014: Loss of

2.18p).

Net cash at the end of the year stood at GBP0.42m (2014:

GBP0.36m). During the year there was a cash injection of GBP949K

from shareholders by means of an unguaranteed and zero interest

loan.

From an AEC Education Plc entity perspective an impairment

charge of GBP1.6m has been made in 2015 in respect of the carrying

value of investments.

Dividend

The Board does not propose the payment of a final dividend for

the year ended 31 December 2015 (2014: 0.00p per share).

Going concern

The Board has considered the preparation of the financial

statements on the basis that the Company and Group are going

concerns. The Group has good visibility on the various operations

and have identified those operations that have exposure to funding

requirements with those that are self-funding based on their

ability to generate positive operating cash.

The Group's main source of fund are internally generated fund

and shareholder loans which are unsecured and interest-free. Some

of these loans will be converted to Capital during 2016, subject to

shareholding limitations for conversions. These are further

explained in various disclosures within the Annual report.

In making this assessment to prepare the financial statements on

a going concern basis, the Board have additionally considered a

number of factors including:

-- Profit and cash flow projections for the group and its key

operating entities based upon their assessment and plans for the

operating entities in each of the key jurisdictions

-- Evaluation of the working capital requirements of the

business and its ability to meet liabilities as and when they fall

due

-- The proceeds arising from the disposal of Ireland in July 2016

-- The agreement reached in July 2016 with certain shareholders

to convert certain loans from them into ordinary shares in the

company

-- Plans for future raising of funds, probably through the issue

of equity, to fund the growth and strategic plans for the

business

The Directors recognise the need to raise further funding and

they believe and anticipate that this will be achieved within the

next 12 months. For this reason, they consider it appropriate to

prepare the financial statements on the going concern basis but

recognise that the reliance on future funding, which is not

guaranteed, represents a material uncertainty.

Staff

On behalf of the Board I would like to thank all staff for their

hard work and efforts during what has been a very difficult period.

Their support as we continue to implement the changes to ensure the

Group returns to sustainable profit is very much appreciated by the

Board.

Prospects

In summary, 2015 was another difficult year in Singapore as we

strived to regain revenue and profitability and the market in the

UK remained in turmoil. The Malvern brand is still a major strength

in international markets and we continue to pursue options to

support further expansion overseas under the Malvern brand. The

restructuring of the operations in Singapore and London is now

complete and this combined with the return to profit in Malaysia

and the continuing investment enabled by the sale of our operations

in Ireland creates a platform from which AEC can continue to

rebuild group profitability.

Liam Swords

Chairman

CONSOLIDATED INCOME STATEMENT

FOR THE YEARED 31 DECEMBER 2015

2015 2014

(Restated)

GBP GBP

Revenue

Sale of services 7,699,469 8,126,722

Other income 261,467 457,972

7,960,936 8,584,694

------------- --------------

Cost of services sold 3,864,736 5,136,220

Salaries and employees' benefits 1,831,125 2,059,555

Amortisation of brand, licences and

trademarks 165,166 166,050

Depreciation of plant and equipment 150,016 203,710

Other operating expenses 2,405,482 2,176,610

Impairment of goodwill 404,352 -

Impairment of intangible assets 495,648 350,000

Total operating costs and expenses 9,317,560 10,092,145

------------- --------------

Operating loss (1,356,588) (1,507,451)

------------- --------------

Share of results of associated companies

and

joint ventures (965) 53,829

Finance costs (43,747) (41,202)

Loss before income tax (1,400,336) (1,494,824)

Income tax charge (6,996) (28,986)

Loss for the year from continuing activities (1,407,332) (1,523,810)

Profit/(loss) for the year from discontinued

activities - 282,420

Loss for the year (1,407,332) (1,241,390)

------------- --------------

Attributable to:

Equity holders of the Company (1,525,426) (1,158,743)

Non-controlling interest 118,094 (82,647)

------------- --------------

(1,407,332) (1,241,390)

------------- --------------

2015 2014

(Restated)

Loss per share on continuing activities

(in pence)

Basic (2.42) (2.18)

-------- ---------------

Diluted (2.42) (2.18)

-------- ---------------

Profit /(loss) per share on discontinued

activities (in pence)

Basic 0.00 0.45

-------- ---------------

Diluted 0.00 0.45

-------- ---------------

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEARED 31 DECEMBER 2015

2015 2014

(Restated)

GBP GBP

Loss for the year (1,407,332) (1,241,390)

Foreign currency translation movements (311,466) 182,880

------------ ---------------

Other comprehensive (expense)/income

for the year (311,466) 182,880

------------ ---------------

Total comprehensive income for the year (1,718,798) (1,058,510)

------------ ---------------

Attributable to:

Equity holders of the parent (1,837,769) (985,686)

Non-controlling interest 138,971 (72,824)

------------ ---------------

Total comprehensive income for the year (1,718,798) (1,058,510)

------------ ---------------

STATEMENTS OF FINANCIAL POSITION

AS AT 31 DECEMBER 2015

Group Company

2015 2014 2015 2014

(Restated)

TOTAL ASSETS GBP GBP GBP GBP

Non-Current Assets

Property, plant and equipment 348,251 450,042 - -

Investment in subsidiary

companies - - 3,657,585 5,260,107

Investment in joint ventures 89,675 97,799 - -

Intangible assets 2,445,611 3,101,851 - -

Goodwill 1,312 422,520 - -

Deferred tax asset 17,120 - - -

----------

2,901,969 4,072,212 3,657,585 5,260,107

--- ------------ --- ---------------- --- -----------

Current Assets

Inventories 9,142 6,718 - -

Trade receivables 575,952 677,573 41,985 -

Other receivables and

prepayments 804,003 445,670 111,022 5,218

Tax recoverable 13,020 51,844 13,020 51,844

Amounts due from subsidiary

companies - - 622,442 692,752

Amounts due from joint

ventures 32,428 46,684 - 41,000

Amounts due from related - 456 - -

parties

Cash and cash equivalents 416,268 360,746 5,235 14,816

---------- ------------ -----------

1,850,813 1,589,691 793,704 805,630

---------- ------------ ---------------- -----------

Total Assets 4,752,782 5,661,903 4,451,289 6,065,737

---------- ------------ ---------------- -----------

Group Company

2015 2014 2015 2014

(Restated)

GBP GBP GBP GBP

EQUITY AND LIABILITIES

Non-Current Liabilities

Financial liabilities 7,492 38,185 - 23,000

Deferred taxation liability 3,323 12,674 - -

---------- ------------ ---------- ----------

10,815 50,859 - 23,000

---------- ------------ ---------- ----------

Current Liabilities

Trade payables 535,940 514,951 - 35,934

Deferred income 756,282 1,013,863 - -

Other payables and accruals 1,487,997 1,140,218 239,686 31,638

Amounts due to subsidiary

companies - - 60,039 1,243,545

Amounts due to joint ventures - 38,673 - -

Amounts due to related

parties 1,589,052 801,358 1,492,430 368,079

Financial liabilities 31,383 39,654 - 14,000

Provision for income tax 18,949 26,667 - -

---------- ------------ ----------

4,419,603 3,575,383 1,792,155 1,693,196

---------- ------------ ---------- ----------

Total liabilities 4,430,418 3,626,243 1,792,155 1,716,196

---------- ------------ ---------- ----------

Equity attributable to

equity

holders of the Company

Share capital 5,362,491 5,362,491 5,362,491 5,362,491

Share premium 896,111 896,111 896,111 896,111

Share based compensation - - - -

reserve

Retained earnings (6,964,400) (5,444,476) (3,599,468) (1,909,061)

Translation reserve 893,916 1,297,945 - -

Capital reserve 142,932 170,560 - -

327,177 2,282,631 2,659,134 4,349,541

Non-controlling interests (4,813) (246,971) - -

------------ ------------ ------------ ---------------

Total equity 322,364 2,035,660 2,659,134 4,349,541

------------ ------------ ------------ ---------------

Total Equity and Liabilities 4,752,782 5,661,903 4,451,289 6,065,737

------------ ------------ ------------ ---------------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 31 DECEMBER 2015

Share Share Share-Based Translation Capital Attributable Non-

Capital Premium Payment Retained Reserve Reserve To Equity controlling Total

Reserve Earnings Holders Interests

Of The

Company

GBP GBP GBP GBP GBP GBP GBP GBP GBP

Balance at 1

January

2014 5,362,491 896,111 239,044 (4,524,777) 1,124,888 170,560 3,268,317 (174,147) 3,094,170

Loss for the

year (as

restated) - - - (1,158,743) - - (1,158,743) (82,647) (1,241,390)

Total other

comprehensive

income - - - - 173,057 - 173,057 9,823 182,880

------------ ---------- ------------ -------------- ------------ ---------- -------------- ------------ --------------

Total

comprehensive

income for

the year - - - (1,158,743) 173,057 - (985,686) (72,824) (1,058,510)

------------ ---------- ------------ -------------- ------------ ---------- -------------- ------------ --------------

Share based

compensation

transfer - - (239,044) 239,044 - - - - -

------------ ---------- ------------ -------------- ------------ ---------- -------------- ------------ --------------

Balance at 31

December

2014/ 1

January 2015

(as restated 5,362,491 896,111 - (5,444,476) 1,297,945 170,560 2,282,631 (246,971) 2,035,660

Loss for the

year - - - (1,525,426) - - (1,525,426) 118,094 (1,407,332)

Total other

comprehensive

income - - - - (332,343) - (332,343) 20,877 (311,466)

------------ ---------- ------------ -------------- ------------ ---------- -------------- ------------ --------------

Total

comprehensive

income for the

year - - - (1,525,426) (332,343) - (1,857,769) 138,971 (1,718,798)

------------ ---------- ------------ -------------- ------------ ---------- -------------- ------------ --------------

Unclaimed

dividends

returned - - - 5,502 - - 5,502 - 5,502

------------ ---------- ------------ -------------- ------------ ---------- -------------- ------------ --------------

Balance at 31

December

2015 5,362,491 896,111 - (6,964,400) 965,602 170,560 430,364 (108,000) 322,364

------------ ---------- ------------ -------------- ------------ ---------- -------------- ------------ --------------

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE YEARED 31 DECEMBER 2015

2015 2014

GBP GBP

(Restated)

Cash Flows from Operating Activities

Loss before income tax from continuing

activities (1,400,336) (1,494,824)

Profit/(loss) before income tax from discontinued

activities - 282,419

Adjustments for:

Amortisation of intangible assets 165,166 166,050

Depreciation of property, plant and equipment 150,016 203,710

Impairment of goodwill 404,352 -

Impairment of intangible assets 495,648 350,000

Loss on disposal of plant and equipment 9,920 170,481

Non-cash elements of profit on discontinued

activities - (52,104)

Interest expense 43,747 41,201

Interest income -

Others 965 (244)

(130,522) (387,140)

Changes in working capital:

Receivables (137,221) 724,582

Payables (63,954) ( 1,693,920)

Inventories (2,424) 2,511

Related parties and associated companies 632,497 231,777

298,376 ( 735,050)

Taxation (7,718) ( 4,741)

Net cash used from operating activities 290,658 (739,791)

------------ -------------

Cash Flows from Investing Activities

Interest received - 244

Dividends received Purchases of property,

plant and equipment (90,649) 40,303

(68,254)

Purchase of trademarks and licences - (14,685)

Net cash used in investing activities (90,649) (42,392)

------------ -------------

Cash Flows from Financing Activities

Interest paid (43,747) (41,201)

Repayment of term loan (37,204) (62,378)

Finance leases (38,964) (34,939)

Dividends Refund 5,502

---------- ------------

Net cash generated by/(used in) financing

activities (114,413) (138,518)

---------- ------------

Effect of foreign exchange rate changes

on

consolidation (30,074) 193,236

Net decrease in cash and cash equivalents 55,522 (1,114,605)

Cash and cash equivalents at the beginning

of the Year 360,746 1,475,351

---------- ------------

Cash and cash equivalents at the end of

the year 416,268 360,746

---------- ------------

NOTES

1. General Information

AEC Education plc (the "Company") is a public limited liability

company incorporated in England and Wales on 8 July 2004. The

Company was admitted to AIM on 10 December 2004. Its registered

office is Witan Gate House, 500-600 Witan Gate West, Milton Keynes

MK9 1SH and its principal place of business is in Singapore. The

registration number of the Company is 05174452.

The principal activities of the Company are that of investment

holding and provision of educational consultancy services. The

principal activity of the group is to provide an educational

offering that is broad and geared principally towards preparing

students to meet the demands of business and management. The

specific principal activities of the subsidiary companies are set

out in note 12 to the financial statements. There have been no

significant changes in the nature of these activities during the

year.

2. Segmental Information

All revenue and profit before taxation arises from operations in

the education sector. Reportable segments are based on the

geographical area where operations are based comprising Europe (UK,

Ireland and Cyprus) and South East Asia/Middle East (Malaysia and

Singapore). These segments represent the respective sub-groups of

Malvern House Group Limited (Europe) and AEC Colleage Pte Limited

(South East Asia/Middle East).

The segmental analysis is as follows:

South East

Europe Asia/Middle Total

East

2015 GBP GBP GBP

Revenue from external customers 5,352,035 2,347,434 7,699,469

------------- ------------- -------------

Depreciation, write offs and amortisation (1,092,797) (122,384) (1,215,181)

------------- ------------- -------------

Loss before taxation (1,293,465) (106,871) (1,400,336)

------------- ------------- -------------

Taxation charge 16,050 (23,046) (6,996)

------------- ------------- -------------

Profit on discontinued activities - - -

Loss for the year (1,277,415) (129,917) (1,407,332)

Segmental assets 1,988,438 2,764,344 4,752,782

------------- ------------- -------------

Segmental liabilities (3,178,018) (1,252,400) (4,430,418)

------------- ------------- -------------

Additions to non-current assets 17,120 - 17,120

------------- ------------- -------------

2014 (Restated)

Revenue from external customers 5,267,983 3,313,711 8,584,693

------------- ------------- -------------

Depreciation, write offs and amortisation (182,036) (537,724) (719,760)

------------- ------------- -------------

Loss before taxation (444,326) (1,050,498) (1,494.824)

------------- ------------- -------------

Taxation charge (4,685) (24,301) (28,986)

------------- ------------- -------------

Profit on discontinued activities 76,313 206,106 282,419

------------- ------------- -------------

Loss for the year (372,697) (868,693) (1,241,391)

Segmental assets 3,706,133 1,955,770 5,661,903

------------- ------------- -------------

Segmental liabilities (4,906,914) 1,334,671 (3,626,242)

------------- ------------- -------------

Additions to non-current assets 38,970 43,969 82,939

------------- ------------- -------------

Note that the Segmental liabilities figure for South East Asia

and the Middle East is shown as a net asset due to the treatment of

the amount due from Europe to South East Asia for funding being

shown as a liability in the former and an asset in the latter.

3. Earnings/(Loss) Per Share

The basic and diluted earnings/(loss) per share on continuing

activities was based on the loss attributable to shareholders of

GBP1,525,426 (2014: restated loss of GBP1,241,391) and the weighted

average number of ordinary shares in issue during the year of

63,051,043 shares (2014: 63,051,043 shares).

The basic and diluted earnings/(loss) per share on discontinued

activities was based on the profit attributable to shareholders of

GBP0 (2014: GBP282,419) and the weighted average number of ordinary

shares in issue during the year of 63,051,043 shares (2014:

63,051,043 shares).

By 31 December 2014, all previously issued options had lapsed .

There were no outstanding options in 2015.

4. Annual Report

The Annual Report will be sent to shareholders by close of

business on or around 18 August 2016. Additional copies will be

available to the public, free of charge, from the Company's website

ww.aeceducationplc.co.uk.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR PFMATMBTBBFF

(END) Dow Jones Newswires

August 17, 2016 02:00 ET (06:00 GMT)

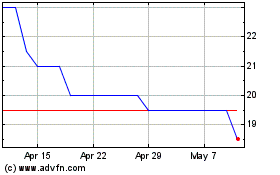

Malvern (LSE:MLVN)

Historical Stock Chart

From Mar 2024 to Apr 2024

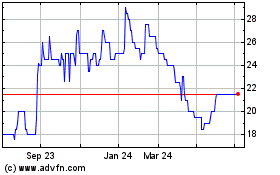

Malvern (LSE:MLVN)

Historical Stock Chart

From Apr 2023 to Apr 2024