TIDMAEC

RNS Number : 1593R

AEC Education plc

25 June 2015

AEC Education Plc

("AEC" or the "Company")

Final Results for the year ended 31 December 2014

Highlights:

-- Ireland demonstrated significant growth in sales and achieved

a small operating profit but results in London and Singapore offset

this success

-- Group revenue fell by 20% to GBP9.0 million (2013: GBP11.3

million) due largely to the reduction in business in Singapore

-- Losses before tax from continuing operations of GBP1.1

million (2013 (restated): loss before tax of GBP1.66 million)

-- Loss per share on continuing activities is 1.85p (2013 (restated): loss per share of 4.01p)

-- Net cash of GBP0.36 million (2013: GBP1.48 million)

-- Malaysia continued to recover lost ground following the

Middle East crisis and returned a profit before brand

amortisation

-- Cyprus returned a small loss driven by a slowdown in revenue from Russia

-- The Company exited operations in Oman in the year which had

returned losses up to the sale of shares to a local company

-- 2014 has been a difficult year, though the success in Ireland

demonstrates the strength of the Malvern brand internationally.

Liam Swords, Chairman of AEC, commented,

"The London and Singaporean markets continue to be challenging

but the Group implemented its strategy to centralise the European

operations and to focus Singapore on the local market. This creates

a new platform in Singapore from which we can build and helps to

reduce costs in London. It is satisfying to see the continued

growth in Ireland and the steady turnaround in Malaysia reflected

in these accounts".

ENDS

For further information, please contact:

AEC Education Plc

Liam Swords

Tel: 07725 836811

WH Ireland Limited (NOMAD & Broker)

Andrew Kitchingman

Liam Gribben

Tel: 0113 394 6600

CHAIRMAN'S STATEMENT

Overview

The year under review continued to show mixed fortunes. Trading

in London showed another downturn but by judicious cost reduction

London returned a small operating loss. Cyprus was also affected by

a slowing down in revenue from Russia, its largest summer school

market and, whilst showing a reasonable operating result, the

increased marketing costs to maintain revenue resulted in a small

operating loss on our share of the joint venture. Oman declined

further during the year to the point where the Board decided to

transfer the operation to a local company for a price that will

recover about one quarter of our original investment and advance.

The residual impact from the loss of EduTrust meant that Singapore

suffered a large operating loss but during the year made ground

towards restructuring a new business targeting the local market.

Ireland again grew substantially and showed an operating profit.

Malaysia continued to recover the ground lost following the Middle

East crisis and was again profitable before Malvern brand

amortisation.

The market in the UK continued to be severely impacted by

attitudes towards immigration and the withdrawal of the students'

ability to support their costs by temporary work. However, the

strategy to invest in Ireland to offset this has proven to be very

successful. Additionally the positive signs in Malaysia continued

during the year with strong gains in new markets and Singapore

began to see some traction in the local market.

Financial results

Group revenues on continuing activities for the year to 31

December 2014 reduced by 20% to GBP9.0m (2013: GBP11.3m). The

reduction was mainly due to the difficult trading conditions in

London and the substantially reduced capacity in Singapore.

Singapore's revenue decreased by 68% to GBP1.2m (2013: GBP3.8m) and

London's revenue reduced by 11% to GBP3.3m (2013 GBP3.7m). The

Group achieved significant reductions in operating costs during the

year by implementing effective cost control strategies in all

units. Because of this the Group's loss before tax from continuing

operations was reduced to GBP1.10m (2013: GBP1.66m).

The London operation recorded an operating loss of GBP245k after

brand impairment and amortisation of GBP395k which, after finance

charges, resulted in a loss of GBP414k before tax. Ireland recorded

turnover of GBP2.34m in 2014 (2013 - GBP1.41m), an operating profit

of GBP49k. In Asia, the Singapore College recorded an operating

loss of GBP420k and Malaysia returned an a profit of GBP23k before

brand amortisation and an operating loss of GBP2k after brand

amortisation. Additionally our share of the profit from our joint

venture in Cyprus was GBP54k, which after central charges, was

breakeven. Oman showed a loss of GBP81k (AEC's share GBP28k) until

31st July 2014, when the Group decided to exit the operations in

Oman by selling the shares to an interested party. We expect that

the initiatives we have taken in Singapore to reduce costs and to

focus on the local market should return it to profit in 2015. Steps

are also being taken to further reduce costs and to generate

revenue from non-traditional sources to improve the results in

London.

The loss per share was 1.40p (2013: Loss of 6.19p).

The net cash outflow from operating activities was GBP1.13m

(2013: outflow of GBP1.51m). Net cash at the end of the year stood

at GBP0.36m (2013: GBP1.48m).

Dividend

The Board does not propose the payment of a final dividend for

the year ended 31 December 2014 (2013: 0.00p per share).

Business Review

In Asia, our operations in Singapore continued to be impacted by

the withdrawal of EduTrust status. The revenue declined by 68% to

GBP1.2m (2013: GBP3.8m) and a loss of GBP0.3m before tax. They have

registered courses for diplomas / advanced diplomas in civil

engineering / electrical engineering / mechanical engineering,

higher diplomas in accounting and finance and Singapore Workforce

Development Agency related safety short courses that are tailored

and repositioned for the local market in 2015 and we expect will

help to return it to profitability.

In Malaysia, revenue was lower than the previous year by 10%

largely due to the fact that the contract with the University of

Wales to recruit students expired in September 2014. Because of

this decrease in revenue to GBP2.15m (2013: GBP2.40m), a small

operating loss of GBP2k was returned (2013: loss GBP1k). However, a

new contract with Leeds Beckett University will allow us to resume

the recruitment of students for both undergraduate and post

graduate programmes in the latter part of 2015. The introduction of

new programmes ranging from post graduate to vocational studies

combined with the focus on new markets should open up opportunities

for growth next year.

As we have previously reported, our English language teaching

operations in the UK have felt the significant effects of the

changing legislation and regulations regarding visas and work

permits for overseas students and the negative perception of this

overseas continued during 2014. This has caused the market in the

UK to drop significantly during the year with the result that

revenue in our Kings Cross school was down year on year by 11% to

GBP3.3m (2013: GBP3.7m). This and the consequent additional brand

impairment charge of GBP350k resulted in an operating loss of

GBP245k (2013: profit GBP45k). Steps have been taken to find new

sources of revenue both from new products and areas of distribution

which should stabilise London during 2015.

Ireland achieved revenue of GBP2.3m, a 66% increase on 2013 in

its second full year of trading and produced an operating profit of

GBP49k (2013: loss GBP48k). The strength of the summer school

market combined with continuing strong growth in the core EFL

business in Ireland leaves it with potential to show significantly

improved results in 2015.

Our joint venture in Cyprus showed a reduction in revenue in the

summer school mainly from Russia, its largest market. Operating

profits were affected such that our share of the joint venture

recorded a profit before tax of GBP54k and was breakeven before

brand amortisation. The market in Russia continues to be depressed

because of its political stance in Europe and the reduced value of

the Rouble and we expect these conditions to remain during

2015.

Oman declined further during the year and impacted the Group

results with a loss of GBP81k (AEC's share GBP28k). Due to earlier

losses including the loss until 31 July 2014, we see no future for

our investment in Oman. Consequently, the Board has decided to exit

the operation and sold the investment to a local company for GBP41k

which recovers approximately one quarter of our investment and

advance given.

Staff

On behalf of the Board I would like to thank all staff for their

hard work and efforts during what has been a very difficult period.

Their support as we continue to implement the necessary changes to

ensure the Group returns to sustainable profit is very much

appreciated by the Board.

Prospects

2014 was another very difficult year in Singapore and the market

in the UK remains constrained by visa restrictions and the negative

perception by overseas students of UK Government policy. Our

success in Ireland has demonstrated that the Malvern brand is still

a major strength in international markets and we continue to pursue

options to support further expansion overseas under the Malvern

brand. The restructuring of the operations in Singapore and London

is now almost complete and this combined with the return to profit

in Malaysia and the withdrawal from Oman creates a platform from

which AEC can begin to rebuild group profitability.

Liam Swords

Chairman

24 June 2015

AEC EDUCATION PLC

CONSOLIDATED INCOME STATEMENT

FOR THE YEAR ENDED 31 DECEMBER 2014

2014 2013

(Restated)

GBP GBP

Revenue

Sale of services 8,520,196 10,989,755

Other income 457,972 314,123

8,978,168 11,303,878

------------- ---------------

Cost of services sold 5,136,220 6,906,791

Salaries and employees' benefits 2,059,555 2,770,010

Amortisation of brand, licences

and

trademarks 166,050 144,957

Depreciation of plant and equipment 203,710 437,778

Impairment or write-down of property,

plant and equipment - 287,390

Other operating expenses 2,176,610 2,213,560

Brand impairment 350,000 150,000

Total operating costs and expenses 10,092,145 12,910,486

------------- ---------------

Operating loss (1,113,977) (1,606,608)

------------- ---------------

Share of results of associated

companies and

joint ventures 53,829 (4,320)

Finance costs (41,201) (45,875)

Loss before income tax (1,101,349) (1,656,803)

Income tax charge (28,986) (235,459)

Loss for the year from continuing

activities (1,130,335) (1,892,262)

Profit/(loss) for the year from

discontinued activities 282,419 (998,323)

Loss for the year (847,916) (2,890,585)

------------- ---------------

Attributable to:

Equity holders of the Company (881,956) (2,832,688)

Non-controlling interest 34,040 (57,897)

------------- ---------------

(847,916) (2,890,585)

------------- ---------------

Loss per share on continuing

activities

(in pence)

------------- ---------------

Basic (1.85) (4.01)

------------- ---------------

Diluted (1.85) (4.01)

------------- ---------------

Profit /(loss) per share on discontinued

activities

(in pence)

------------- ---------------

Basic 0.45 (2.18)

------------- ---------------

Diluted 0.45 (2.18)

------------- ---------------

AEC EDUCATION PLC

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEAR ENDED 31 DECEMBER 2014

2014 2013

(Restated)

GBP GBP

Loss for the year (847,916) (2,890,585)

Foreign currency translation

movements 182,880 (19,465)

---------- ---------------

Other comprehensive (expense)/income

for the year 182,880 (19,465)

---------- ---------------

Total comprehensive income for

the year (665,036) (2,910,050)

---------- ---------------

Attributable to:

Equity holders of the parent (708,899) (2,845,515)

Non-controlling interest 43,863 (64,535)

---------- ---------------

Total comprehensive income for

the year (665,036) (2,910,050)

---------- ---------------

AEC EDUCATION PLC

STATEMENTS OF FINANCIAL POSITION

AS AT 31 DECEMBER 2014

Group Company

2014 2013 2014 2013

(Restated)

TOTAL ASSETS GBP GBP GBP GBP

Non-Current Assets

Property, plant and

equipment 450,042 763,033 - -

Investment in subsidiary

companies - - 5,260,107 5,760,107

Investment in associated - 16,668 - -

companies

Investment in joint

ventures 97,799 26,074 - 122,039

Intangible assets 3,101,851 3,603,250 - -

Goodwill 422,520 420,324 - -

Deferred tax asset - - - -

4,072,212 4,829,349 5,260,107 5,882,146

---------- -------------- ---------------- -----------

Current Assets

Inventories 6,718 9,229 - -

Trade receivables 677,573 908,710 - -

Other receivables

and

prepayments 445,670 990,959 5,218 131,010

Tax recoverable 51,844 9,806 51,844 -

Due from subsidiary

companies - - 692,752 442,304

Due from joint ventures 46,684 95,897 41,000 94,427

Due from related

parties 456 3,798 - -

Cash and cash equivalents 360,746 1,475,351 14,816 1,153,035

---------- -------------- -----------

1,589,691 3,493,750 805,630 1,820,776

---------- -------------- ---------------- -----------

Total Assets 5,661,903 8,323,099 6,065,737 7,702,922

---------- -------------- ---------------- -----------

EQUITY AND LIABILITIES

Non-Current Liabilities

Financial liabilities 38,185 63,048 23,000 23,000

Deferred taxation

liability 12,674 22,275 - -

---------- ------------ ------------ ------------

50,859 85,323 23,000 23,000

---------- ------------ ------------ ------------

Current Liabilities

Trade payables 514,951 263,303 35,934 -

Deferred income 620,389 2,160,688 - -

Other payables and

accruals 1,140,218 1,938,962 31,638 88,009

Due to subsidiary

companies - - 1,243,545 2,090,328

Due to joint ventures 38,673 - - -

Due to related parties 801,358 660,810 368,079 23,323

Financial liabilities 39,654 112,107 14,000 14,000

Provision for income

tax 26,667 7,736 - -

---------- ------------ ------------

3,181,910 5,143,606 1,693,196 2,215,660

---------- ------------ ------------ ------------

Total liabilities 3,232,769 5,228,929 1,716,196 2,238,660

---------- ------------ ------------ ------------

Equity attributable

to equity

holders of the Company

Share capital 5,362,491 5,362,491 5,362,491 5,362,491

Share premium 896,111 896,111 896,111 896,111

Reserves (3,699,184) (2,990,285) (1,909,061) (794,340)

-------------- ------------ ------------ ----------

2,559,418 3,268,317 4,349,541 5,464,262

Non-controlling interests (130,284) (174,147) - -

-------------- ------------ ------------ ----------

Total equity 2,429,134 3,094,170 4,349,541 5,464,262

-------------- ------------ ------------ ----------

Total Equity and

Liabilities 5,661,903 8,323,099 6,065,737 7,702,922

-------------- ------------ ------------ ----------

AEC EDUCATION PLC

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEAR ENDED 31 DECEMBER 2014

Share Share Other Other Other Other Attributable Non-

Capital Prem-ium Reserves Reserves Reserves Reserves Total To Equity controlling Total

Share-Based Retained Trans- Capital Of Holders Interests

Payment Earnings lation Reserve Other Of The

Reserve Reserve Reserves Company

GBP GBP GBP GBP GBP GBP GBP GBP GBP GBP

Balance

at 1 January

2013 as

previously

reported 4,419,878 707,588 328,744 (2,018,789) 1,137,715 170,560 (381,770) 4,745,696 (43,415) 4,702,281

Prior

year adjustment - - - 237,000 - - 237,000 237,000 - 237,000

Balance

at 1 January

2013 as

restated 4,419,878 707,588 328,744 (1,781,789) 1,137,715 170,560 (144,700) 4,982,696 (43,415) 4,939,281

Loss for

the year - - - (2,832,688) - - (2,832,688) (2,832,688) (57,897) (2,890,585)

Total

other

comprehensive

income - - - - (12,827) - (12,827) (12,827) (6,638) (19,465)

------------ ---------- ------------ ------------------- ------------ ---------- -------------- -------------- ------------ --------------

Total

comprehensive

income

for the

year - - - (2,832,688) (12,827) - (2,845,515) (2,845,515) (64,535) (2,910,050)

------------ ---------- ------------ ------------------- ------------ ---------- -------------- -------------- ------------ --------------

Issue

of new

shares 942,613 188,523 - - - - - 1,131,136 - 1,131,136

Share

based

compensation

transfer - - (89,700) 89,700 - - - - - -

------------ ---------- ------------ ------------------- ------------ ---------- -------------- -------------- ------------ --------------

Total

transactions

with owners 942,613 188,523 (89,700) 89,700 - - - 1,131,136 - 1,131,136

------------ ---------- ------------ ------------------- ------------ ---------- -------------- -------------- ------------ --------------

Non-controlling

interest

acquired - - - - - - - - (125,489) (125,489)

Impairment

of carrying

value - - - - - - - - 59,292 59,292

Balance

at 31

December

2013 as

restated 5,362,491 896,111 239,044 (4,524,777) 1,124,888 170,560 (2,990,285) 3,268,317 (174,147) 3,094,170

------------ ---------- ------------ ------------------- ------------ ---------- -------------- -------------- ------------ --------------

Balance

at 1 January

2014 as

restated 5,362,491 896,111 239,044 (4,524,777) 1,124,888 170,560 (2,990,285) 3,268,317 (174,147) 3,094,170

------------ ---------- ------------ ------------------- ------------ ---------- -------------- -------------- ------------ --------------

Loss for

the year - - - (881,956) - - (881,956) (881,956) 34,040 (847,916)

Total

other

comprehensive

income - - - - 173,057 - 173,057 173,057 9,823 182,880

------------ ---------- ------------ ------------------- ------------ ---------- -------------- -------------- ------------ --------------

Total

comprehensive

income

for the

year - - - (881,956) 173,057 - (708,899) (708,899) 43,863 (665,036)

------------ ---------- ------------ ------------------- ------------ ---------- -------------- -------------- ------------ --------------

Share

based

compensation

transfer - - (239,044) 239,044 - - - - - -

------------ ---------- ------------ ------------------- ------------ ---------- -------------- -------------- ------------ --------------

Total

transactions

with owners - - (239,044) 239,044 - - - - - -

------------ ---------- ------------ ------------------- ------------ ---------- -------------- -------------- ------------ --------------

Balance

at 31

December

2014 5,362,491 896,111 - (5,167,689) 1,297,945 170,560 (3,699,184) 2,559,418 (130,284) 2,429,134

AEC EDUCATION PLC

CONSOLIDATED STATEMENT OF CASH

FLOWS

FOR THE YEAR ENDED 31 DECEMBER

2014

2014 2013

GBP GBP

(Restated)

Cash Flows from Operating Activities

Loss before income tax from continuing

activities (1,101,349) (1,656,803)

Profit/(loss) before income tax from

discontinued activities 282,419 (998,323)

Adjustments for:

Amortisation of intangible assets 166,050 169,957

Depreciation of property, plant and

equipment 203,710 437,778

Impairment and write down of property

plant and

equipment - 299,099

Impairment of intangible assets 350,000 600,000

Loss on disposal of plant and equipment 170,481 88,909

Profit on disposal of subsidiary - (215,308)

Non-cash elements of profit on discontinued (52,104) -

activities

Interest expense 41,201 45,875

Interest income (244) (375)

Impairment of goodwill and minority

interest - 59,292

Share of results of associated and joint

venture companies (53,829) 4,320

6,335 (1,165,579)

Changes in working capital:

Receivables 724,582 1,567,976

Payables (2,087,395) ( 2,551,785)

Inventories 2,511 12,629

Related parties and associated companies 231,777 668,427

(1,122,190) ( 1,468,332)

Taxation (4,741) ( 39,638)

Net cash used from operating activities (1,126,931) (1,507,970)

------------ ---------------

Cash Flows from Investing Activities

Interest received 244 375

Profit distribution received from associated 40,303 -

and joint

venture companies

Purchases of property, plant and equipment (68,254) (528,009)

Purchase of trademarks and licences (14,685) (16,099)

Disposal of subsidiary - (11,606)

Acquisition of subsidiary - (99,541)

Net cash used in investing activities (42,392) (654,880)

------------ ---------------

Cash Flows from Financing Activities

Share issue - 1,131,136

Interest paid (41,201) (45,875)

Repayment of term loan (62,378) (267,376)

Finance leases (34,939) 63,577

------------ -------------

Net cash generated by/(used in) financing

activities (138,518) 881,462

------------ -------------

Effect of foreign exchange rate changes

on consolidation 193,236 50,048

Net decrease in cash and cash equivalents (1,114,605) (1,231,340)

Cash and cash equivalents at the beginning

of the

Year 1,475,351 2,706,691

------------ -------------

Cash and cash equivalents at the end

of the year 360,746 1,475,351

------------ -------------

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2014

1 General

AEC Education plc is a public limited liability company

incorporated in England and Wales on 8 July 2004. The Company was

admitted to AIM on 10 December 2004. Its registered office is Witan

Gate House, 500-600 Witan Gate West, Milton Keynes MK9 1SH and its

principal place of business is in Singapore. The registration

number of the Company is 05174452.

The principal activities of the Company are that of investment

holding and provision of educational consultancy services. There

have been no significant changes in the nature of these activities

during the year.

The Board of Directors has authorised the issue of these

financial statements on 24 June 2015.

2 Segmental Information

Segmental analysis is as follows:

Europe South East Total

Asia/Middle

East

2014 GBP GBP GBP

Revenue from external customers 5,661,457 3,316,711 8,978,168

------------- ------------- --------------

Depreciation, write offs and amortisation (182,036) (537,724) (719,760)

------------- ------------- --------------

Loss before taxation (50,851) (1,050,498) (1,101,349)

------------- ------------- --------------

Taxation charge (4,685) (24,301) (28,986)

------------- ------------- --------------

Profit on discontinued activities 76,313 206,106 282,419

Loss for the year 20,777 (868,693) (847,916)

Segmental assets 3,706,133 1,955,770 5,661,903

------------- ------------- --------------

Segmental liabilities (4,567,440) 1,334,671 (3,232,769)

------------- ------------- --------------

Additions to non-current assets 38,970 43,969 82,939

------------- ------------- --------------

2013 (Restated)

Revenue from external customers 5,080,994 6,222,884 11,303,878

------------- ------------- --------------

Depreciation, write offs and amortisation (415,496) (604,629) (1,020,125)

------------- ------------- --------------

Loss before taxation (198,939) (1,457,864) (1,656,803)

------------- ------------- --------------

Taxation charge (6,460) (228,999) (235,459)

------------- ------------- --------------

Loss on discontinued activities (380,629) (617,694) (998,323)

------------- ------------- --------------

Loss for the year (586,028) (2,304,557) (2,890,585)

Segmental assets 4,194,708 4,128,391 8,323,099

------------- ------------- --------------

Segmental liabilities (4,655,567) (573,362) (5,228,929)

------------- ------------- --------------

Additions to non-current assets 170,478 347,682 518,160

------------- ------------- --------------

Note that the Segmental liabilities figure for South East Asia

and the Middle East is shown as a net asset due to the treatment of

the amount due from Europe to South East Asia for funding being

shown as a liability in the former and an asset in the latter.

3 Earnings/(Loss) Per Share

The basic earnings/(loss) per share on continuing activities was

based on the loss attributable to shareholders of GBP1,164,375

(2013: restated loss of GBP1,834,365) and the weighted average

number of ordinary shares in issue during the year of 63,051,043

shares (2013: 45,753,464 shares).

The basic earnings/(loss) per share on discontinued activities

was based on the profit attributable to shareholders of GBP282,419

(2013: loss of GBP998,323) and the weighted average number of

ordinary shares in issue during the year of 63,051,043 shares

(2013: 45,753,464 shares).

The diluted earnings/(loss) per ordinary share on continuing

activities and the diluted earnings/(loss) per share on

discontinued activities are based respectively on the loss

attributable to shareholders of GBP1,164,375 (2013 (restated): loss

of GBP1,834,365) and profit attributable to shareholders of

GBP282,419 (2013: loss of GBP998,323) and the weighted average

number of ordinary shares in issue at during the year of 63,051,043

shares (2013: 45,753,464 shares) diluted for the effect of share

options and warrants.

By 31 December 2014 all previously issued options had lapsed

(2013: 1,950,000 options were outstanding). At 31 December 2013 all

1,950,000 options were excluded from the diluted weighted average

number of ordinary shares calculation as their effect would have

been anti-dilutive.

9 Annual Report

The Annual Report will be sent to shareholders by close of

business on or around 25 June 2015. Additional copies will be

available to the public, free of charge, from the Company's website

ww.aeceducationplc.co.uk.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR FIMMTMBITTIA

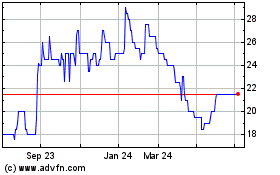

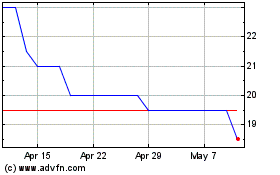

Malvern (LSE:MLVN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Malvern (LSE:MLVN)

Historical Stock Chart

From Apr 2023 to Apr 2024