TIDMAEC

RNS Number : 2897I

AEC Education plc

29 May 2014

29 May 2014

AIM: AEC

AEC EDUCATION PLC

("AEC" or "the Group")

Full Year Results

for the 12 months ended 31 December 2013

Key Points

-- London returned to profitably and Ireland produced a small

operating profit in this its first full year of trading but results

in Singapore and residual costs from the funded operation closed

last year impacted severely

-- Revenues on continuing activities of GBP11.3m (2012:

GBP15.1m) showed a reduction of 25% due largely to the reduction in

business in Singapore

-- Losses before tax and discontinued activities of GBP1.73m

(2012: loss before tax of GBP3.58m)

-- Statutory loss before tax of GBP2.73m (2012: loss before tax of GBP3.84m)

-- Loss per share on continuing activities is 4.17p (2012: loss per share of 6.59p)

-- Statutory loss per share of 6.35p (2012: loss per share of 7.18.p)

-- Net cash of GBP1.48m (2012: GBP2.71m)

-- Malaysian revenue held up despite the troubles in Northern

Africa - one of its major markets and it was profitable

-- Cyprus returned reduced profits reflecting the impact of the

banking crisis in the early part of the year

-- Oman failed to gain traction.

-- Cinnovation involvement and the wide range of developments

now being pursued leads the Board to conclude that these will

enable AEC to grow profitably in the immediate future.

Liam Swords, Chairman of AEC, commented,

"The year under review again proved to be very challenging with

visa policies continuing to affect the market for London and the

impact of the loss of EduTrust status impacting greatly on the

results. The fact that London has returned to profitably and our

new operation in Dublin returned an operating profit in its first

full year of trading augurs well for 2014. Additionally, action

taken to enable Singapore to target breakeven in 2014 and the

opportunity for growth in profits in Malaysia and Cyprus are

encouraging signs for a return to profit."

Enquiries

AEC Education Plc

Liam Swords tel: 07725 836 811

W H Ireland

Andrew Kitchingman / James Bavister tel: 0207 220 1666

AEC EDUCATION PLC

ANNUAL REPORT

YEAR ENDED 31 DECEMBER 2013

CHAIRMAN'S STATEMENT

Overview

The year under review proved to be one of very mixed fortunes.

Trading in our London operation continued to be very challenging

but did return a marginal operating profit. Cyprus was affected by

the banking crisis in the first and second quarters which reduced

its usual level of performance but it did provide a small operating

profit. Ireland grew substantially and showed a small operating

profit in this its first full year of trading and Malaysia fully

regained the ground lost following the Middle East crisis and was

profitable. Unfortunately these hard won successes were negated by

Oman which continued to lack traction and recorded an Operating

Loss. Also our Singaporean operation was severely affected by the

withdrawal of its EduTrust status at the beginning of August

resulting in very material provisions having to be made for

teaching out its international student population.

The withdrawal of EduTrust in Singapore meant that it could no

longer recruit overseas students and cost levels could not be

reduced whilst we applied for reinstatement. The impact was severe

in both profit and cash terms and is more fully quantified below.

With London, Ireland, Malaysia and Cyprus now in a position to

trade profitably and other initiatives taken to stabilize Singapore

we should see a return to profitably this year. Additionally the

introduction of Cinnovation as a major investor and their interest

in assisting growth has meant we have planned some significant new

initiatives in Europe in 2014.

Financial results

Group revenues on continuing activities for the year to 31

December reduced by 25% to GBP11.3m (2012: GBP15.1m). The reduction

was partly due to the continuing impact of the closure of two

schools in London the previous year and the continuing negative

impact of the current visa policies on student recruitment in the

UK. Also the cessation of student recruitment in Singapore caused

their revenue to reduce by 36% year on year. The Group's loss

before tax from continuing operations was GBP1.73m (2012: loss

before tax GBP3.58m).

The London operation recorded an operating profit of GBP45k

which after finance charges was a loss of GBP141k. Ireland also

recorded an operating profit of GBP16k which after interest and

central charges was a loss of GBP49k. In Asia, the Singapore

college recorded a pre-tax loss of GBP1.19m and Malaysia returned a

profit of GBP27k. Additionally our share of the profit from our

joint venture in Cyprus was GBP8k which after finance and group

charges was a loss of GBP20k and Oman showed an operating loss of

GBP91k (GBP241k after charging GBP150k for the impairment of the

Malvern House brand). The initiatives we have taken in Singapore to

reduce costs and to focus on the local market, following an

unsuccessful application to regain EduTrust, should return it to

breakeven or at worst a marginal loss in 2014.

The loss per share was 6.35p (2012: 7.18p). The net cash outflow

from operating activities was GBP1.51m (2012: outflow of

GBP2.42m).

Net cash at the end of the year stood at GBP1.48m (2012:

GBP2.71m).

Dividend

Given the Group's trading results, the Board does not intend to

propose the payment of a final dividend for the year ended 31

December 2013 (2012: 0.00p per share).

Business Review

In Asia, our operations in Singapore suffered a severe setback

resulting from the withdrawal of EduTrust status. The impact was

reduced revenue of 25% and a loss before tax of GBP1.19m - GBP1.42m

after tax. We have reduced the operation down to a level consistent

with servicing the local market with a range of vocational

programmes with the expectation of breaking even in 2014.

Our operations in Malaysia maintained the level of student

numbers and revenue generated last year despite the continuing

troubles in its markets in Northern Africa. This was achieved by an

increase in the revenue from the undergraduate and professional

programmes in the local market. Revenue in Malaysia was about the

same as the previous year but profits before tax were reduced to

GBP27k (2012 GBP70k) because of the need to compete more strongly

in the local market. In 2014 we are introducing new Islamic

Diplomas as well as a new range of undergraduate business degrees

and two new post graduate degrees. All the Asian financial

operations are now centred in Malaysia. We are continuing to invest

in Malaysia and an ambitious growth programme is expected to show a

significant increase in profits in 2014 and to take a further step

towards achieving the ultimate objective of becoming a "deemed

university" with its own campus.

As we have previously reported, our English language teaching

operations in the UK have felt the significant effects of the

changing legislation and regulations regarding visas and work

permits for overseas students and the negative views portrayed by

this overseas continued during 2013. This made the market for our

remaining UK school in Kings Cross difficult, and this, combined

with the reduction in capacity implemented last year, reduced

revenue year on year by 36%. The remaining operation produced a

small operating profit of GBP45k (2012 loss GBP1.38m). The return

to profit at operational level was a significant milestone and

there is confidence that this success can be built on in 2014. We

recorded a loss on discontinued activities of GBP0.38m due to

writing off the residual costs relating to the funded training

operation closed last year.

Ireland achieved revenue of GBP1.41m in this its first full year

of trading and produced an operating profit of GBP16k. Finance and

central charges created a loss before tax of GBP49k. Ireland

trialled a Summer School last year which mirrored the strong

results traditionally achieved in Cyprus so it will add a full

Summer School during 2014. This combined with continuing strong

growth in the core EFL business leaves it in a position to show

significantly improved results in 2014.

Our joint venture in Cyprus was severely affected by the banking

crisis in the first and second quarters but still achieved about

the same revenue as the previous year. Operating profits were

affected such that our share of the Joint Venture was GBP8k and we

recorded a loss before tax of GBP20k after allocating a share of

central costs. The agreement signed with UCLan (University of

Central Lancashire) in 2014 to deliver pre-sessional English and a

University Taster Programme combined with a return to growth

provides a strong opportunity for Cyprus to return to its normal

level of profit during 2014.

Oman has not lived up to expectation. Student interest is low

and it has not yet proved possible to expand into the surrounding

regions. The result was an operating loss of GBP91k (GBP241k after

charging GBP150k for the impairment of the Malvern House brand).

Steps are being taken with our partners to improve the

situation.

Staff

On behalf of the Board I would like to thank all staff for their

hard work and efforts during what has been a very difficult period.

The level of support as we implemented the necessary changes to

ensure the Group returns to sustainable profit growth is very much

appreciated by the Board.

Prospects

2013 was a very difficult year in Singapore and the market in

the UK remains constrained by visa restrictions and the negative

attitude perceived by overseas students of Government policy. Our

investment in the expansion of the Malvern brand internationally as

well as London and Malaysia returning to profit leads the Board to

expect the Group to show a significantly improved performance in

2014. The recent shareholding taken up by Cinnovation and their

strong interest in supporting AEC to achieve its full potential

leads the Board to conclude that the wide range of developments now

being pursued will enable AEC to grow profitably in the immediate

future.

Liam Swords

Chairman

28 May 2014

AEC EDUCATION PLC

CONSOLIDATED INCOME STATEMENT

FOR THE YEAR ENDED 31 DECEMBER 2013

2013 2012

GBP GBP

Revenue

Sale of services 10,989,755 14,776,108

Other income 314,123 317,086

11,303,878 15,093,194

----------- -----------

Cost of services sold 6,978,791 7,573,112

Salaries and employees' benefits 2,770,010 4,212,032

Amortisation of brand, licences and trademarks 144,957 172,593

Depreciation of plant and equipment 437,778 631,754

Other operating expenses 2,213,560 4,192,137

Restructuring of activities - 729,937

Impairment or write-down of property, plant

and equipment 287,390 220,217

Brand impairment 150,000 -

Goodwill impairment - 882,163

Total operating costs and expenses 12,982,486 18,613,945

----------- -----------

Operating loss -1,678,608 -3,520,751

----------- -----------

Share of results of associated companies

and joint ventures -4,320 15,398

Finance costs -45,875 -70,804

Loss before income tax -1,728,803 -3,576,157

Income tax (charge)/credit -235,459 287,382

Loss for the year from continuing activities -1,964,262 -3,288,775

Loss for the year from discontinued activities -998,323 -262,007

Loss for the year -2,962,585 -3,550,782

----------- -----------

Attributable to:

Equity holders of the Company -2,904,688 -3,174,361

Non-controlling interest -57,897 -376,421

----------- -----------

-2,962,585 -3,550,782

----------- -----------

Loss per share on continuing activities

(in pence)

Basic -4.17 -6.59

----------- -----------

Diluted -4.17 -6.59

----------- -----------

Loss per share on discontinued activities

(in pence)

Basic -2.18 -0.59

----------- -----------

Diluted -2.18 -0.59

----------- -----------

AEC EDUCATION PLC

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEAR ENDED 31 DECEMBER 2013

2013 2012

GBP GBP

Loss for the year -2,962,585 -3,550,782

Foreign currency translation movements -19,465 185,517

----------- -----------

Other comprehensive (expense)/income for

the year -19,465 185,517

----------- -----------

Total comprehensive income for the year -2,982,050 -3,365,265

----------- -----------

Attributable to:

Equity holders of the parent -2,917,515 -3,020,171

Non-controlling interest -64,535 -345,094

----------- -----------

Total comprehensive income for the year -2,982,050 -3,365,265

----------- -----------

AEC EDUCATION PLC

STATEMENTS OF FINANCIAL POSITION

AS AT 31 DECEMBER 2013

2013 2012

TOTAL ASSETS GBP GBP

Non-Current Assets

Property, plant and equipment 763,033 1,090,213

Investment in associated companies 16,668 29,395

Investment in joint ventures 26,074 66,653

Intangible assets 3,603,250 4,357,956

Goodwill 420,324 446,558

Deferred tax asset - 233,031

4,829,349 6,223,806

----------- -----------

Current Assets

Inventories 9,229 21,858

Trade receivables 908,710 1,948,591

Other receivables and prepayments 990,959 1,575,099

Tax recoverable 9,806 8,581

Due from joint ventures 95,897 105,438

Due from related parties 3,798 26,165

Cash and cash equivalents 1,475,351 2,706,691

----------- -----------

3,493,750 6,392,423

----------- -----------

Total Assets 8,323,099 12,616,229

----------- -----------

EQUITY AND LIABILITIES

Non-Current Liabilities

Financial liabilities 63,048 94,390

Deferred taxation liability 22,275 24,249

----------- -----------

85,323 118,639

----------- -----------

Current Liabilities

Trade payables 263,303 652,045

Deferred income 2,160,688 3,813,401

Other payables and accruals 2,247,962 2,969,251

Due to related parties 660,810 24,291

Financial liabilities 112,107 284,564

Provision for income tax 7,736 51,757

----------- -----------

5,452,606 7,795,309

----------- -----------

Total liabilities 5,537,929 7,913,948

----------- -----------

Equity attributable to equity holders of

the Company

Share capital 5,362,491 4,419,878

Share premium 896,111 707,588

Reserves -3,299,285 -381,770

----------- -----------

2,959,317 4,745,696

Non-controlling interests -174,147 -43,415

----------- -----------

Total equity 2,785,170 4,702,281

----------- -----------

Total Equity and Liabilities 8,323,099 12,616,229

----------- -----------

AEC EDUCATION PLC

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEAR ENDED 31 DECEMBER 2013

Share Share Other Other Other Other Attribut- Non-

controlling

Capital Premium Reserves Reserves Reserves Reserves Total able Interests Total

Of to

Share-Based Retained Trans- Capital Other Equity

Payment Earnings lation Reserve Reserves Holders

of

Reserve Reserve The

Company

GBP GBP GBP GBP GBP GBP GBP GBP GBP GBP

Balance at 1

January 2012 4,419,878 707,588 433,443 1,139,270 983,525 170,560 2,726,798 7,854,264 196,018 8,050,282

Loss for the

year - - - -3,174,361 - - -3,174,361 -3,174,361 -376,421 -3,550,782

Total other

comprehensive

income - - - - 154,190 - 154,190 154,190 31,327 185,517

---------- -------- ------------ ----------- ---------- --------- ----------- ----------- ------------ -----------

Total

comprehensive

income for the

year - - - -3,174,361 154,190 - -3,020,171 -3,020,171 -345,094 -3,365,265

---------- -------- ------------ ----------- ---------- --------- ----------- ----------- ------------ -----------

Dividends - - - -88,397 - - -88,397 -88,397 - -88,397

Share based

compensation

transfer - - -104,699 104,699 - - - - - -

---------- -------- ------------ ----------- ---------- --------- ----------- ----------- ------------ -----------

Total

transactions

with owners - - -104,699 16,302 - - -88,397 -88,397 - -88,397

---------- -------- ------------ ----------- ---------- --------- ----------- ----------- ------------ -----------

Non-controlling

interest

arising

on business

acquisition - - - - - - - - -160,997 -160,997

Dividend paid

to

non-controlling

interest - - - - - - - - -23,768 -23,768

Impairment of

carrying value - - - - - - - - 290,426 290,426

----------------- ---------- -------- ------------ ----------- ---------- --------- ----------- ----------- ------------ -----------

Balance at 31

December 2012 4,419,878 707,588 328,744 -2,018,789 1,137,715 170,560 -381,770 4,745,696 -43,415 4,702,281

Share Share Other Other Other Other Attribut- Non-

Capital Premium Reserves Reserves Reserves Reserves Total able controlling Total

Of to

Share-Based Retained Trans- Capital Other Equity Interests

Payment Earnings lation Reserve Reserves Holders

of

Reserve Reserve The

Company

GBP GBP GBP GBP GBP GBP GBP GBP GBP GBP

Balance at 1

January 2013 4,419,878 707,588 328,744 -2,018,789 1,137,715 170,560 -381,770 4,745,696 -43,415 4,702,281

Loss for the

year - - - -2,904,688 - - -2,904,688 -2,904,688 -57,897 -2,962,585

Total other

comprehensive

income - - - - -12,827 - -12,827 -12,827 -6,638 -19,465

----------------- ---------- -------- ------------ ----------- ---------- --------- ----------- ----------- ------------ -----------

Total

comprehensive

income for the

year - - - -2,904,688 -12,827 - -2,917,515 -2,917,515 -64,535 -2,982,050

----------------- ---------- -------- ------------ ----------- ---------- --------- ----------- ----------- ------------ -----------

Issue of new

shares 942,613 188,523 - - - - - 1,131,136 - 1,131,136

Share based

compensation

transfer - - -89,700 89,700 - - - - - -

----------------- ---------- -------- ------------ ----------- ---------- --------- ----------- ----------- ------------ -----------

Total

transactions

with owners 942,613 188,523 -89,700 -89,700 - - - 1,131,136 - 1,131,136

----------------- ---------- -------- ------------ ----------- ---------- --------- ----------- ----------- ------------ -----------

Non-controlling

interest

acquired - - - - - - - - -125,489 -125,489

Impairment of

carrying value - - - - - - - - 59,292 59,292

----------------- ---------- -------- ------------ ----------- ---------- --------- ----------- ----------- ------------ -----------

Balance at 31

December 2013 5,362,491 896,111 239,044 -4,833,777 1,124,888 170,560 -3,299,285 2,959,317 -174,147 2,785,170

----------------- ---------- -------- ------------ ----------- ---------- --------- ----------- ----------- ------------ -----------

AEC EDUCATION PLC

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE YEAR ENDED 31 DECEMBER 2013

2013 2012

GBP GBP

Cash Flows from Operating Activities

Loss before income tax from continuing activities -1,728,803 -3,576,157

Loss before income tax from discontinued

activities -998,323 -262,007

Adjustments for:

Amortisation of intangible assets 169,957 172,593

Depreciation of property, plant and equipment 437,778 648,096

Impairment and write down of property plant

and equipment 299,099 220,217

Impairment of intangible assets 600,000 -

Loss on disposal of plant and equipment 88,909 24,334

(Profit)/loss on disposal of subsidiary -215,308 190,609

Interest expense 45,875 70,804

Interest income -375 -7,012

Impairment of goodwill and minority interest 59,292 882,163

Share of results of associated companies

and joint ventures 4,320 -15,398

-1,237,579 -1,651,758

Changes in working capital:

Receivables 1,567,976 -690,420

Payables -2,479,785 -47,085

Inventories 12,629 12,404

Related parties and associated companies 668,427 -80,026

-1,468,332 -2,456,885

Taxation -39,638 40,510

Net cash used from operating activities -1,507,970 -2,416,375

----------- -----------

Cash Flows from Investing Activities

Interest received 375 7,012

Dividend income received from associated

and joint venture companies - 154,736

Purchases of property, plant and equipment -528,009 -510,083

Purchase of trademarks and licences -16,099 -9,594

Disposal of subsidiary -11,606 2,260,270

Acquisition of subsidiary -99,541 -133,630

Net cash (used in) /generated by investing

activities -654,880 1,768,711

----------- -----------

Cash Flows from Financing Activities

Share issue 1,131,136 -

Interest paid -45,875 -70,804

Repayment of term loan -267,376 -255,608

Dividend paid to shareholders - -88,397

Dividends paid to non-controlling interests - -23,768

Finance leases 63,577 -86,039

----------- -----------

Net cash generated by/(used in) financing

activities 881,462 -524,616

----------- -----------

Effect of foreign exchange rate changes

on consolidation 50,048 68,596

Net decrease in cash and cash equivalents -1,231,340 -1,103,684

Cash and cash equivalents at the beginning

of the year 2,706,691 3,810,375

----------- -----------

Cash and cash equivalents at the end of

the year 1,475,351 2,706,691

----------- -----------

Cash and cash equivalents consist of the

following:

2013 2012

GBP GBP

Cash and bank balances 1,475,351 2,700,140

Fixed deposits - 6,551

1,475,351 2,706,691

----------- -----------

AEC EDUCATION PLC

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2013

1 General

AEC Education plc (the "Company") is a public limited liability

company incorporated in England and Wales on 8 July 2004.

The Company was admitted to AIM on 10 December 2004. Its registered

office is Witan Gate House, 500-600 Witan Gate West, Milton

Keynes MK9 1SH and its principal place of business is in Singapore.

The registration number of the Company is 05174452.

The principal activities of the Company are that of investment

holding and provision of educational consultancy services..

There have been no significant changes in the nature of these

activities during the year.

The Board of Directors has authorised the issue of these financial

statements on 28 May 2014.

2 Significant Accounting Policies

Basis of Preparation

The consolidated financial statements of the Group and Company

financial statements have been prepared in accordance with

International Financial Reporting Standards (IFRS) as endorsed

and adopted for use in the European Union (EU).

The financial statements have been prepared on a going concern

basis under the historical cost convention, except that certain

financial instruments are accounted for at fair values

3 Segmental Information

All revenue and profit before taxation arises from operations

in the education sector. Reportable segments are based on

the geographical area where operations are based.

Europe South East Total

Asia/Middle

East

2013 GBP GBP GBP

Revenue from external customers 5,080,994 6,222,884 11,303,878

----------- ------------- -----------

Depreciation, write offs and amortisation -415,496 -604,629 -1,020,125

----------- ------------- -----------

Loss before taxation -270,939 -1,457,864 -1,728,803

----------- ------------- -----------

Taxation (charge)/credit -6,460 -228,999 -235,459

----------- ------------- -----------

Loss on discontinued activities -380,629 -617,694 -998,323

Loss for the year -658,028 -2,304,557 -2,962,585

Segmental assets 4,194,708 4,128,391 8,323,099

----------- ------------- -----------

Segmental liabilities -4,964,567 -573,362 -5,537,929

----------- ------------- -----------

Additions to non-current assets 170,478 347,682 518,160

----------- ------------- -----------

2012

Revenue from external customers 6,639,932 8,453,262 15,093,194

----------- ------------- -----------

Depreciation, write offs and amortisation -703,589 -320,975 -1,024,564

----------- ------------- -----------

Restructuring costs -729,937 - -729,937

----------- ------------- -----------

Impairment loss -882,163 - -882,163

----------- ------------- -----------

Loss before taxation -3,401,769 -174,388 -3,576,157

----------- ------------- -----------

Taxation (charge)/credit 47,933 239,449 287,382

----------- ------------- -----------

Loss on discontinued activities - -262,007 -262,007

----------- ------------- -----------

Loss for the year -3,353,836 -196,946 -3,550,782

Segmental assets 5,548,024 7,068,205 12,616,229

----------- ------------- -----------

Segmental liabilities -5,323,606 -2,590,342 -7,913,948

----------- ------------- -----------

Additions to non-current assets 892,948 218,466 1,111,414

----------- ------------- -----------

4 Earnings/(Loss) Per Share

The basic earnings/(loss) per share on continuing activities

was based on the loss attributable to shareholders of GBP1,906,365

(2012: loss of GBP2,912,354) and the weighted average number

of ordinary shares in issue during the year of 45,753,464 shares

(2012: 44,198,781 shares).

The basic earnings/(loss) per share on discontinued activities

was based on the loss attributable to shareholders of GBP998,323

(2012: loss of GBP262,007) and the weighted average number

of ordinary shares in issue during the year of 45,753,464 shares

(2012: 44,198,781 shares).

The diluted earnings/(loss) per ordinary share on continuing

activities and the diluted earnings/(loss) per share on discontinued

activities are based respectively on the loss attributable

to shareholders of GBP1,906,365 (2012: loss of GBP2,912,354)

and loss attributable to shareholders of GBP998,323 (2012:

loss of GBP262,007) and the weighted average number of ordinary

shares in issue at during the year of 45,753,464 shares (2012:

44,198,781 shares) diluted for the effect of share options

and warrants.

At 31 December 2013 there were 1,950,000 options (2012: 2,840,000

options) outstanding. Of these all 1,950,000 options (2012:

2,840,000 options) were excluded from the diluted weighted

average number of ordinary shares calculation as their effect

would have been anti-dilutive.

5 Property, Plant and Equipment

Leasehold Classroom Motor Total

property and office vehicle

and improvements equipment

GBP GBP GBP GBP

Group 2013

Cost

As at 1 January 2013 1,205,755 1,979,193 35,602 3,220,550

Additions 111,182 416,827 - 528,009

Disposals -348,506 -21,594 -36,248 -406,348

Disposals of subsidiary -8,999 -17,576 - -26,575

Currency realignment -42,044 -77,312 646 -118,710

-------------------- -------------- ----------- ------------

As at 31 December 2013 917,388 2,279,538 - 3,196,926

-------------------- -------------- ----------- ------------

Accumulated depreciation

As at 1 January 2013 817,861 1,289,727 22,749 2,130,337

Charge for the year 15,698 417,914 4,166 437,778

Impairment in the year - continuing

activities 104,705 182,685 - 287,390

Impairment in the year - discontinued

activities 11,709 - - 11,709

Disposals -278,369 -11,749 -27,321 -317,439

Disposal of subsidiary -8,999 -17,576 - -26,575

Currency realignment -33,907 -55,806 406 -89,307

-------------------- -------------- ----------- ------------

As at 31 December 2013 628,698 1,805,195 - 2,433,893

-------------------- -------------- ----------- ------------

Net book value

At 31 December 2013 288,690 474,343 - 763,033

-------------------- -------------- ----------- ------------

An impairment charge of GBP100,325 during the year ended 31 December

2013 arose as a result of the decision made in London to cease

using the student database during the ensuing year. The balance

of GBP187,065 was a direct consequence of the decision to downsize

the operation in Singapore following the loss of EduTrust status

as was the GBP11,709 included within the loss on discontinued

activities.

Leasehold Classroom Motor Total

property and office vehicle

and improvements equipment

GBP GBP GBP GBP

Group 2012

Cost

As at 1 January 2012 1,090,106 1,949,260 36,575 3,075,941

Additions 196,615 313,468 - 510,083

Additions on acquisition of

subsidiary - 9,998 - 9,998

Disposals -7,650 -169,640 - -177,290

Disposals on sale of subsidiary -77,105 -114,848 - -191,953

Currency realignment 3,789 -9,045 -973 -6,229

-------------------- -------------- ----------- ------------

As at 31 December 2012 1,205,755 1,979,193 35,602 3,220,550

-------------------- -------------- ----------- ------------

Accumulated depreciation

As at 1 January 2012 574,745 999,322 16,168 1,590,235

Charge for the year - continuing

activities 234,071 390,523 7,160 631,754

Charge for the year - discontinued

activities 6,564 9,778 - 16,342

Charge for impairment 68,621 151,596 - 220,217

Disposals -7,650 -145,306 - -152,956

Disposals on sale of subsidiary -60,452 -108,445 - -168,897

Currency realignment 1,962 -7,741 -579 -6,358

-------------------- -------------- ----------- ------------

As at 31 December 2012 817,861 1,289,727 22,749 2,130,337

-------------------- -------------- ----------- ------------

Net book value

At 31 December 2012 387,894 689,466 12,853 1,090,213

-------------------- -------------- ----------- ------------

The impairment charge during the year ended 31 December 2012 arose

as a result of the closure of two schools and separate offices

in London as part of the restructuring.

6 Intangible Assets

Intangible assets are summarised

as follows:

Licences Brands Trademarks Total

GBP GBP GBP GBP

Group 2013

Cost

As at 1 January 2013 847,494 3,750,000 20,797 4,618,291

Additions 14,317 - 1,782 16,099

Currency alignment -8,238 - - -8,238

As at 31 December 2013 853,573 3,750,000 22,579 4,626,152

=========== ========== =========== ===========

Accumulated amortisation

As at 1 January 2013 100,460 150,000 9,875 260,335

Charge for the year - continuing

activities 15,589 125,000 4,368 144,957

Charge for the year - discontinued

activities - 25,000 - 25,000

Charge for impairment - continuing

activities - 150,000 - 150,000

Charge for impairment - discontinued

activities - 450,000 - 450,000

Currency alignment -7,390 - - -7,390

As at 31 December 2013 108,659 900,000 14,243 1,022,902

=========== ========== =========== ===========

Net book value

At 31 December 2013 744,914 2,850,000 8,336 3,603,250

=========== ========== =========== ===========

Analysed as follows:

Indefinite life 734,046 - - 734,046

Definite life 10,868 2,850,000 8,336 2,869,204

744,914 2,850,000 8,336 3,603,250

=========== ========== =========== ===========

There is an annual amortisation charge for the Malvern House brand

made in accordance with the stated accounting policy. In addition,

following the loss of EduTrust status by AEC College Pte Ltd and

the consequent inability to recruit foreign students, teaching

of English language in Singapore which was branded as Malvern

House, has now ceased. As a direct consequence the Board has reassessed

the carrying value of the Brand attributable to that cash generating

unit and concluded that a permanent impairment took place on the

cessation of that activity. Accordingly a charge of GBP450,000

has been made for that permanent impairment of the Malvern House

brand within the loss on the discontinued activities in the current

year.

In addition, the Board has reviewed all ongoing cash generating

units in accordance using the detailed procedures adopted by th

Board and concluded that one, the school in Oman, can also no

longer support the carrying value of the Malvern House brand with

which it was previously attributed. Therefore, as shown in the

table above, a further provision of GBP150,000 was made during

the year ended 31 December 2013 to reflect this change. This impairment

charge is set out on the face of the Consolidated Income Statement

as the entity concerned is a continuing activity.

Licences Brands Trademarks Total

GBP GBP GBP GBP

Group 2012

Cost

As at 1 January 2012 2,845,940 3,750,000 15,017 6,610,957

Additions 3,814 - 5,780 9,594

Disposal of subsidiary -2,013,855 - - -2,013,855

Currency alignment 11,595 - - 11,595

As at 31 December 2012 847,494 3,750,000 20,797 4,618,291

=========== ========== =========== ===========

Accumulated amortisation

As at 1 January 2012 84,133 - 5,424 89,557

Charge 18,142 150,000 4,451 172,593

Currency alignment -1,815 - - -1,815

As at 31 December 2012 100,460 150,000 9,875 260,335

=========== ========== =========== ===========

Net book value

At 31 December 2012 747,034 3,600,000 10,922 4,357,956

=========== ========== =========== ===========

Analysed as follows:

Indefinite life 734,046 - - 734,046

Definite life 12,988 3,600,000 10,922 3,623,910

747,034 3,600,000 10,922 4,357,956

=========== ========== =========== ===========

7 Goodwill

2013 2012

GBP GBP

Cost

Balance as at the beginning

of the year 446,558 1,141,242

Acquisition of subsidiary -25,948 591,737

Disposal of subsidiary - -678,040

Impairment loss - -591,737

Currency alignment -286 -16,644

------------ --------------

Balance as at the end of the

year 420,324 446,558

------------ --------------

Goodwill has arisen on acquisitions by the Group.

During the year ended 31 December 2013, the Group acquired the

non-controlling interest in AEC Bilingual Pte Limited with negative

goodwill of GBP25,948.

During the prior year, the Group acquired Malvern House Training

Solutions Limited with goodwill on consolidation calculated as

GBP591,737.

The goodwill relating to Malvern House Training Solutions Limited

was reassessed and a provision to write this down to GBPnil was

created at 31 December 2012.

In the prior year, in addition to the impairment loss of GBP591,737

a further GBP290,426 has been charged in the Consolidated Income

Statement in respect of the non-controlling interest in Malvern

House Training Solutions Limited which gives a total impairment

of GBP882,163.

8 Share Capital

Allotted, called up and

fully paid

Nominal Nominal Nominal

No of value No of value value

ordinary ordinary deferred deferred All

shares shares shares shares shares

At 1 January 2012 10p ordinary

shares 44,198,781 4,419,878 - - 4,419,878

----------- ----------- ----------- ---------- ----------

At 1 January 2013 10p ordinary

shares 44,198,781 4,419,878 - - 4,419,878

Division of shares to 5p

ordinary shares - -2,209,939 44,198,781 2,209,939 -

Shares issue on 23 December

2013 18,852,262 942,613 - - 942,613

----------- ----------- ----------- ---------- ----------

At 31 December 2013 5p ordinary

shares 63,051,043 3,152,552 44,198,781 2,209,939 5,362,491

=========== =========== =========== ========== ==========

Until the division of the Company's shares on 20 December 2013

the par value of each existing ordinary share in the capital

of the Company was 10p, which was the minimum price at which

the Company's ordinary shares could be issued.

At that date the Company's existing ordinary shares had been

trading at below the par value of 10p for quite some time,

and in order to proceed with the planned subscription, the

Company proposed to undertake a capital reorganisation so that

the par value of its ordinary shares was reduced to 5p per

ordinary share.

At the Extraordinary General Meeting held on 20 December 2013

the Shareholders approved splitting each issued existing ordinary

share into one new ordinary share of 5p and one deferred share

of 5p. As all rights remain with the new ordinary shares of

5p each these deferred shares are effectively valueless but

remain part of the share capital of the Company.

9 Annual Report

The Annual Report will be sent to shareholders by close of

business on or around 4 June 2014. Additional copies will be

available to the public, free of charge, from the Company's

website www.aeceducationplc.co.uk.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR APMRTMBBTBFI

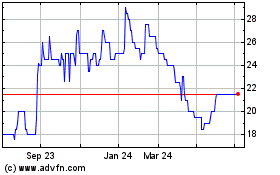

Malvern (LSE:MLVN)

Historical Stock Chart

From Mar 2024 to Apr 2024

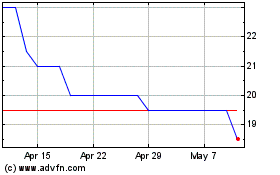

Malvern (LSE:MLVN)

Historical Stock Chart

From Apr 2023 to Apr 2024