TIDMAFN

RNS Number : 0613V

ADVFN PLC

23 October 2014

ADVFN PLC

Audited Results for the Year Ended 30 June 2014

ADVFN, the global stocks and shares website, announces its

audited results for the year ended 30 June 2014

-- EBITDA* profit increases to GBP298,000 (2013: profit of GBP108,000 )

-- Loss for the period down to GBP454,000 (2013: loss of GBP539,000)

-- ADVFN's registered user base continues to grow and is in

excess of 3,000,000 (2013: 2,800,000)

For further information, please contact:

Clem Chambers,

ADVFN PLC CEO

0207 0700 909

Salmaan Khawaja/Edward Thomas

Grant Thornton UK LLP (Nominated Adviser)

0207 383 5100

*EBITDA is calculated as the operating result for the year

before depreciation and amortisation charges.

CHIEF EXECUTIVE'S STATEMENT

2014 was a good year. Our EBITDA was GBP298,000 up 176%. This

was on top of a significant improvement in the year before.

Sales were GBP9,702,000 up GBP1,625,000 from GBP8,077,000, an

increase of 20% from 2013 levels.

The operating loss improved again in 2014 by GBP208,000 from a

loss of GBP871,000 in 2013 to GBP663,000 this year.

Our cash rose by GBP214,000 to GBP1,675,000 from GBP1,461,000 in

2014.

These solid gains have been against a background of further

investment, apparently depressed market activity as far as market

participants are concerned and a rampant pound which suppressed the

results of our very strong US performance.

Our US business has continued to perform very satisfactorily

with particularly strong growth in the winter and spring of 2014.

The US market has been far and away the highlight of the year.

ADVFN's growth has come from increased advertising sales, which

has coincided with our total subscriber numbers rising.

Our focus remains the same with particular concentration on the

US which continues to deliver on its promise.

Last year I mentioned that ADVFN has over the years grown and

plateaued only to grow again when changes in the market or product

breakthrough trigger a period of growth. As I write it appears we

continue to be in a growth phase.

We continue to look out for acquisitions and joint ventures and

one of these developments has been the joint venture with

Topstocks.com in Australia. This has begun to be a

revenue-generator for us and has given us another model to apply to

opportunities where a JV is more appropriate with a website than

the acquisition of all or part of it.

It is a positive sign that while 2014 has not been a bull year

for world markets we have still been making good progress. It is of

our opinion that if the market was to crash ADVFN would do very

well as ultimately the thing traders hate most is inactivity in the

market. Previous corrections and crashes have resulted in traffic

increases for us, and this outcome would present an opportunity to

showcase the site to a whole new generation.

We have been working extremely hard in 2014. That is not to say

we do not every year, but 2013-2014 has been a period of

significant change and reorganisation. This should have been

invisible to our customers and shareholders; if it hasn't been then

we have not done it smoothly enough.

We have been building out our sales force, re-engineering our

infrastructure and working on new products and features.

This is the core process that will drive future growth.

We felt 2013-2014 would be another solid year and it has come in

a little ahead of our expectations. We believe that 2014-2015 also

looks positive.

Key to this year has been our US OTC QX listing in the US and

our capital reorganization and American Depository Receipts (ADR)

program. Picking our Google analytic stats at random, in April 2014

we had 5.4 million US visitors in that month according to Comscore

we are the ninth biggest finance site in the US by page

impressions. The eight bigger were: Yahoo Finance, MSN Money, Dow

Jones & Company, CNBC, Bloomberg, AOL Money & Finance, CNN

Money and Forbes Digital. Anyone else you have ever heard of in our

field is smaller than us in the US, that's staggering.

We, of course, know the numbers inside out but no matter how

often we review ADVFN's website stats, our scale in America is

significant and we are thrilled by it. In a nutshell it means we

have an opportunity to add significant shareholder value in the

medium to long term if we can gain a US internet valuation for our

business.

We do have a natural advantage in this effort, as we have three

million active, high risk small cap investors as a loyal and

engaged user base within the US.

During 2015 we hope to continue to show how well we can present

ourselves to this audience which, if we are successful in reaching

them, will drive a flow of our UK shares into the US ADR.

It's an exciting prospect.

Clem Chambers

CEO

22 October 2014

STRATEGIC REPORT

Financial Overview

These accounts have been prepared under International Financial

Reporting Standards (IFRS) as adopted by the European Union.

This year's Group results show a significant improvement with

EBITDA improving by GBP190,000 from GBP108,000 to GBP298,000.

The result after tax, which includes GBP1,178,000 of non-cash

items, was a loss of GBP454,000, an improvement of GBP85,000

against a loss in 2013 of GBP539,000.

We continue to be robust on costs, which has given us the

resources to continue to invest heavily in R&D and

international markets. We have also increased our marketing with

online brand building.

Business Review

I normally find myself trying to say the long term plan for the

business is exactly the same one as we had last year and the year

before. We try to stick with our long term strategy and we have

ploughed the same strategic furrow for more than a decade. Our

strategy has not made us a billion dollar company but it has left

us as one of only a smattering of surviving dotcom boom internet

companies on AIM.

We aren't however complacent about our progress. We are trying

to become an internet colossus and we are working hard towards that

goal, even if we are still not galloping towards that destination

at great speed.

While we are not going to throw our strategy away we are however

thinking a new thought.

Whilst the UK is a great place for technical and sales talent

and sits in the heart of the global financial system, it is not

necessarily, from a financial markets perspective, the most benign

environment for small internet and technology companies.

This is why we have gone to the considerable trouble of listing

on the OTC Markets QX tier. Our huge user base in the US loves

small cap companies as much as US investors in general love tech

companies. As such with our new US listing we plan to try to become

a highly regarded listed small cap internet company in the US. With

this in mind we have put the technical equity mechanisms in place

to make it possible to operate a dual listing, which allows our

shares to flow freely from the UK to the significantly larger

market place of our US customers.

It's been hard work setting it all up, but the potential is very

exciting as anyone calculating the sales to market cap of US

internet companies will note.

We think a lot can go right in 2015.

Operating Costs

We have been very focused on costs over the last three years and

we have taken the decision to grow our head count again especially

in sales to monetize our increased inventory. While it takes time

for new hires to skill up at ADVFN we expect to begin feeling the

benefits of this investment in the latter half of the next

financial year.

Research and Development

R&D at ADVFN never stops and this year was no different.

As an aggregator of a myriad of feeds, we are always fixing what

gets broken upstream from us.

In the old days we would have said one of our core values was we

have a platform that pulls an ocean of financial information

together and then disseminates it to a huge audience. We are one of

a few vendors that can or do this for world markets. These days you

don't hear that this kind of platform is worth beyond gold. It is

however a big barrier of entry to competition.

We also must keep our infrastructure up to the latest standards

and ahead of demand, which might spike to giant levels should the

market, for example, crash.

Additionally this year we won patent pending status for new

market technology that we will apply to new product which we feel

could be breakthrough for us. If it isn't we will still have made

another step along the way.

As I said last year, R&D will always be the heart of

ADVFN.

Environmental policy

The company as a whole continues to look for ways to develop our

environmental policy. It remains our objective to improve our

performance in this area.

Summary of key performance indicators

2014 2014 2013 2013

Actual Target Actual Target

-------------------- -------- -------- -------- -------

EBITDA GBP298k GBP200k GBP108k GBP50k

-------- -------- --------

Average head count 43 44 37 40

-------------------- -------- -------- -------- -------

ADVFN registered

users 3.0M 2.9M 2.8M 2.7M

-------------------- -------- -------- -------- -------

Future outlook for the business.

You may have noticed from the tone of this year's report, I am

very positive about the road ahead.

While it's good to have strong top line growth and solid all

round performance improvements there is nothing like the prospect

of a shot of a breakthrough to raise spirits.

The opportunity of being able to present the company to millions

of new investors is a bracing prospect.

Meanwhile we are expecting to continue along the same path as

the last two years.

Principle risks and uncertainties

Economic downturn

There are signs of global economic recovery and these have shown

up as bursts of traffic on ADVFN, for example in Japan. However

there can be no certainty in a return to economic normality in the

near future but as previously stated the company has bridged both

the dotcom crash and the credit crunch, so we feel that we have

shown we are robust enough to withstand the financial conditions of

economic emergencies.

High proportion of fixed overheads and variable revenues

A large proportion of the company's overheads are fixed. There

is the risk that any significant changes in revenue may lead to the

inability to cover such costs. Management closely monitor fixed

overheads against budget on a monthly basis and cost saving

exercises are implemented on a constant review basis. We have had a

strong period of cost optimisations that are updated on a regular

basis.

Product obsolescence

The technology that we use is always in development and

constantly changing. All our products are subject to technological

change and advance and resultant obsolescence.

We have no choice but to keep innovating to keep up with growing

technical challenges that are changing all the time.

The directors are committed to the Research and Development

strategy in place, and are confident that the company is able to

react effectively to the developments within the market.

Fluctuations in currency exchange rates

A growing proportion of our turnover relates to overseas

operations. As a company, we are therefore exposed to foreign

currency fluctuations. The company manages its foreign exchange

exposure on a net basis, and if required uses forward foreign

exchange contracts and other derivatives/financial instruments to

reduce the exposure. Currently hedging is not employed. If currency

volatility was extreme and hedging activity did not mitigate the

exposure, then the results and the financial condition of the

company might be adversely impacted by foreign currency

fluctuations.

Consideration of the principle risks associated with financial

instruments is contained in note 22.

People

We are a dedicated, highly skilled and loyal team. I would like

to thank everyone for enabling ADVFN to provide a superb 24/7/365

service to millions of users around the globe; the private

investors of the world.

ON BEHALF OF THE BOARD

Clem Chambers

CEO

22 October 2014

Consolidated income statement

12 months 12 months

to to

30 June 30 June

2014 2013

GBP'000 GBP'000

Revenue 9,702 8,077

Cost of sales (1,165) (339)

---------- ----------

Gross profit 8,537 7,738

Share based payment (54) (93)

Amortisation of intangible assets (914) (917)

Other administrative expenses (8,232) (7,599)

---------- ----------

Total administrative expenses (9,200) (8,609)

Operating loss (663) (871)

Finance income 108 95

Loss before tax (555) (776)

Taxation 101 242

---------- ----------

Total loss after taxation for

continuing operations (454) (534)

Total (loss)/profit after taxation

from discontinued operations - (5)

Loss for the period attributable

to shareholders of the parent (454) (539)

Loss per share - basic and diluted

based on consolidated shares (1.80)p (2.14)p

Consolidated statement of comprehensive

income

12 months 12 months

to to

30 June 30 June

2014 2013

GBP'000 GBP'000

Loss for the period (454) (539)

Other comprehensive income:

Items that will be reclassified

subsequently to profit or loss:

Exchange differences on translation

of foreign operations (190) 69

Deferred tax on translation

of foreign held assets 29 (6)

---------- ----------

Total other comprehensive income (161) 63

Total comprehensive income for

the year attributable to shareholders

of the parent (615) (476)

========== ==========

Consolidated balance sheet

30 June 30 June

2014 2013

GBP'000 GBP'000

Assets

Non-current assets

Property, plant and equipment 71 61

Goodwill 724 806

Intangible assets 1,331 1,777

Trade and other receivables 295 485

--------- ---------

2,421 3,129

Current assets

Trade and other receivables 1,122 925

Current tax recoverable 60 46

Cash and cash equivalents 1,675 1,461

--------- ---------

2,857 2,432

--------- ---------

Total assets 5,278 5,561

Equity and liabilities

Equity

Issued capital 6,305 6,291

Share premium 8,102 8,062

Merger reserve 221 221

Share based payment reserve 617 563

Foreign exchange reserve 117 278

Retained earnings (12,517) (12,063)

--------- ---------

2,845 3,352

Non-current liabilities

Deferred tax 134 249

134 249

Current liabilities

Trade and other payables 2,269 1,954

Current tax 31 6

2,299 1,960

Total liabilities 2,433 2,209

--------- ---------

Total equity and liabilities 5,278 5,561

========= =========

Consolidated statement of changes in equity

Share Share Merger Share Foreign Retained Total

capital premium reserve based exchange earnings equity

payment reserve

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 July 2012 6,289 8,057 221 474 215 (11,528) 3,728

Issue of shares 2 5 - - - - 7

Exercise of share

options - - - (4) - 4 -

Equity settled

share options - - - 93 - - 93

--------- --------- --------- --------- ---------- ---------- --------

Transactions with

owners 2 5 - 89 - 4 100

Loss for the period

after tax - - - - - (539) (539)

Other comprehensive

income

Exchange differences

on translation

of foreign operations - - - - 69 - 69

Deferred tax on

translation of

foreign held assets - - - - (6) - (6)

--------- --------- --------- --------- ---------- ---------- --------

Total comprehensive

income for the

year - - - - 63 (539) (476)

At 30 June 2013 6,291 8,062 221 563 278 (12,063) 3,352

Issue of shares 14 40 - - - - 54

Equity settled

share options - - - 54 - - 54

--------- --------- --------- --------- ---------- ---------- --------

Transactions with

owners 14 40 - 54 - - 108

Loss for the period

after tax - - - - - (454) (454)

Other comprehensive

income

Exchange differences

on translation

of foreign operations - - - - (190) - (190)

Deferred tax on

translation of

foreign held assets - - - - 29 - 29

Total comprehensive

income for the

year - - - - (161) (454) (615)

At 30 June 2014 6,305 8,102 221 617 117 (12,517) 2,845

========= ========= ========= ========= ========== ========== ========

Consolidated cash flow statement

12 months 12 months

to to

30 June 30 June

2014 2013

GBP'000 GBP'000

Cash flows from operating activities

Loss for the period before tax (555) (776)

Net finance income in the income

statement (unwinding receivable) (108) (95)

Depreciation of property, plant

& equipment 47 62

Amortisation 914 917

Adjustment to fair value of

embedded derivative 250 300

Share based payments 54 93

(Increase)/decrease in trade

and other receivables (149) 149

Increase/(decrease) in trade

and other payables 314 (199)

Net cash generated by continuing

operations 767 451

Net cash used by discontinued

operations - (5)

---------- ----------

767 446

Income tax (payable)/receivable (3) 77

---------- ----------

Net cash generated by operating

activities 764 523

Cash flows from investing activities

Payments for property plant

and equipment (57) (40)

Purchase of intangibles (495) (499)

Net cash used by investing activities (552) (539)

Cash flows from financing activities

Proceeds from issue of equity

shares - 7

Net cash generated by financing

activities - 7

---------- ----------

Net increase /(decrease) in

cash and cash equivalents 212 (9)

Exchange differences 2 30

---------- ----------

Total increase in cash and cash

equivalents 214 21

Cash and cash equivalents at

the start of the period 1,461 1,440

---------- ----------

Cash and cash equivalents at

the end of the period 1,675 1,461

========== ==========

1. Segmental analysis

The directors identify operating segments based upon the

information which is regularly reviewed by the chief operating

decision maker. The Group considers that the chief operating

decision makers are the executive members of the Board of

Directors. The Group has identified two reportable operating

segments, being that of the provision of financial information and

that of research services. The provision of financial information

is made via the Group's various website platforms.

Two minor operating segments, for which IFRS 8's quantitative

thresholds have not been met, are currently combined below under

'other'. The main sources of revenue for these operating segments

is the provision of financial broking services and other internet

services not related to financial information. Segment information

can be analysed as follows for the reporting period under

review:

2014 Provision Other Total

of financial

information

GBP'000 GBP'000 GBP'000

Revenue from

external customers 9,354 357 9,711

Depreciation

and amortisation (793) - (793)

Other operating

expenses (9,101) (325) (9,426)

-------------- -------- --------

Segment operating

profit/(loss) (540) 32 (508)

Interest income 108 - 108

Interest expense - - -

Segment assets 7,169 245 7,414

Segment liabilities (2,451) (10) (2,461)

Purchases of

non-current assets 549 - 549

============== ======== ========

2013 Provision Other Total Research Total

of financial continuing services

information operations (Disposal

group)

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue from

external customers 7,835 252 8,087 16 8,103

Depreciation

and amortisation (804) (3) (807) - (807)

Other operating

expenses (7,754) (182) (7,936) (21) (7,957)

Segment operating

(loss)/profit (723) 67 (656) (5) (661)

Interest income 95 - 95 - 95

Interest expense - - - - -

Segment assets 7,407 254 7,661 - 7,661

Segment liabilities (2,080) (57) (2,137) - (2,137)

Purchases of

non-current assets (554) - (554) - (554)

============== ======== ============ =========== ========

The Group's revenues, which wholly relate to the sale of

services, from external customers and its non-current assets, are

divided into the following geographical areas:

Revenue Non-current Revenue Non-current

assets assets

2014 2014 2013 2013

GBP'000 GBP'000 GBP'000 GBP'000

UK (domicile) 3,800 3,140 3,594 3,134

USA 5,039 1,225 3,639 1,409

Other 872 1 854 -

Discontinued operations - - 16 -

-------- ------------ -------- ------------

9,711 4,366 8,103 4,543

======== ============ ======== ============

Revenues are allocated to the country in which the customer

resides. During both 2014 and 2013 no single customer accounted for

more than 10% of the Group's total revenues.

The segmental information regularly reviewed by the Board is

presented under UK GAAP and, as a result, a key reconciling item

between the segmental and the Group financial information relates

to IFRS conversion.

The totals presented for the Group's operating segments

reconcile to the entity's key financial figures as presented in its

financial statements as follows:

2014 2013

GBP'000 GBP'000

Revenue

Total segment revenue 9,711 8,103

Consolidation adjustment (9) (10)

-------- --------

Group revenue 9,702 8,093

Disposal group revenue - (16)

-------- --------

Group revenue net of discontinued

operations 9,702 8,077

======== ========

Segment profit or loss

Total segment operating (loss) (508) (661)

Consolidation adjustments (393) (396)

IFRS conversion adjustments 238 186

-------- --------

Group operating loss (663) (871)

Finance income 108 95

Group loss before tax (555) (776)

======== ========

2014 2013

GBP'000 GBP'000

Segment assets

Total segment assets 7,414 7,661

Consolidation adjustments (2,933) (2,669)

IFRS conversion adjustments 797 569

-------- --------

Total Group assets 5,278 5,561

======== ========

Segment liabilities

Total segment liabilities (2,461) (2,137)

Consolidation adjustments (860) (848)

IFRS conversion adjustments 923 665

-------- --------

Total Group liabilities (2,398) (2,320)

======== ========

Consolidation adjustments primarily relate to the elimination of

investments and the calculation of goodwill. IFRS conversion

adjustments primarily relate to the different accounting bases for

the Group's intangible and tangible assets under IFRS and UK GAAP.

Significant items adjusting for both consolidation and IFRS

conversion items were amortisation of intangible assets and

depreciation of property plant and equipment.

2. Loss per share

12 months 12 months

to to

30 June 30 June

2014 2013

GBP'000 GBP'000

Re-stated

(Loss) for the year from continuing

operations attributable to equity

shareholders (454) (534)

(Loss)/profit for the year from discontinued

operations - (5)

----------- -----------

Total (loss) for the year (454) (539)

=========== ===========

Total (loss) per share- basic and

diluted - following share consolidation (1.80)p (2.14)p

=========== ===========

Loss per share based on pre-consolidation

shares in issue (0.07)p (0.09)p

Weighted average number of shares

in issue for the year - consolidated 25,219,905 25,163,136

Dilutive effect of options - -

----------- -----------

Weighted average shares for diluted

earnings per share - consolidated 25,219,905 25,163,136

=========== ===========

Where a loss has been recorded for the year the diluted loss per

share does not differ from the basic loss per share as the exercise

of share options would have the effect of reducing the loss per

share and is therefore not dilutive under the terms of IAS 33.

Share consolidation

At the company's General Meeting held on 20 August 2014, the

resolution to approve the share consolidation of existing issued

Ordinary shares of GBP0.01 each in the capital of the company shall

be consolidated into Ordinary shares of GBP0.25 each, was duly

passed. The number of post consolidation Ordinary shares is

disclosed above.

3. Events after the balance sheet date

At the company's General Meeting held on 20 August 2014, the

resolution to approve the share consolidation of existing issued

Ordinary shares of GBP0.01 each in the capital of the company shall

be consolidated into Ordinary shares of GBP0.25 each, was duly

passed. In addition, approval was also sought for the cancellation

of the share premium account and the capitalisation of the share

based payment account and the merger reserve.

4. Publication of Non Statutory Accounts

The financial information set out in this preliminary

announcement does not constitute statutory accounts as defined in

section 435 of the Companies Act 2006.

The consolidated balance sheet at 30 June 2014 and the

consolidated income statement, consolidated statement of

comprehensive income, consolidated statement of changes in equity,

consolidated cash flow statement and associated notes for the year

then ended have been extracted from the Company's 2014 statutory

financial statements upon which the auditors' opinion is

unqualified and does not include any statement under Section 498(2)

or (3) of the Companies Act 2006.

The annual report and accounts will shortly be sent to

shareholders and will be available on the Company's website,

http://www.advfn.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR QKBDNFBDDAKB

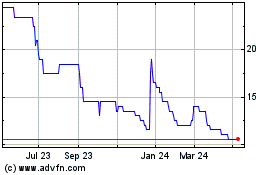

Advfn (LSE:AFN)

Historical Stock Chart

From Mar 2024 to Apr 2024

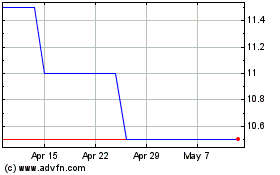

Advfn (LSE:AFN)

Historical Stock Chart

From Apr 2023 to Apr 2024