TIDMAFN

RNS Number : 2286N

ADVFN PLC

21 October 2016

ADVFN PLC

Audited Results for the Year Ended 30 June 2016

ADVFN, the global stocks and shares website, announces its

audited results for the year ended 30 June 2016

The annual report and accounts will shortly be sent to

shareholders and will be available on the Company's website,

http://www.advfn.com.

For further information, please contact:

Clem Chambers,

ADVFN PLC CEO

0207 0700 909

Salmaan Khawaja/ Jamie Barklem

Grant Thornton UK LLP (Nominated Adviser)

0207 383 5100

CHIEF EXECUTIVE'S STATEMENT

2016 was a transformational year for ADVFN with a change in the

long term strategy of the company from international growth to

consolidation of the existing business.

Having had our plans derailed last year by the attempt to take

control of the ADVFN board, we have made the decision to enter a

period of retrenchment.

Cash burn and losses are almost unavoidable with the sort of

investment programs we have undertaken in the past. Currently the

UK stock market has no stomach to support this kind of strategy so

we have changed course to avoid needing to raise further funding

and to instead produce profits and cash flow.

Curtailing investment drops quickly through to the bottom line

but also feeds through to reductions in sales. The net result is

equilibrium at a lower level of activity, which we hope will

provide a solid basis for future growth. This is what we are

working towards and, so far, we have made good progress.

The operating losses dropped from GBP1,905,000 to GBP650,000 an

improvement of 65.8%. Sales are down 10.7% from GBP9,297,000 in

2015 to GBP8,303,000. However, costs of sales and expenses were

down 20.1% per cent from GBP11,202,000 in 2015 to GBP8,953,000.

The after tax loss for the year was GBP478,000 down from

GBP1,560,000 in the same period last year represents an improvement

of 69.4%.

As announced on 24 March 2016, the loss after tax for the 6

months to 31 December 2015 was GBP442,000, so it can be seen that

the company made a significantly reduced loss of GBP36,000 in the

final six months in the financial year. This is an improvement of

GBP406,000 on the previous half.

The market for our services is fast changing, with mobile

becoming the dominant platform for communication and information.

We have positioned ourselves for this development with our mobile

app which has enabled us to buffer these changes as our traffic

transitions to mobile.

However the mobile platforms are a weaker environment for

monetisation which means, from a business perspective, we have to

progress just to remain stationary.

This shift of usage from the desktop to mobile adds uncertainty

but change is always an opportunity. We are well used to adapting

to changing circumstances. In line with this we are adding new

products to ADVFN which provide new advertising opportunities, new

subscription products and new investor relations services.

We believe these offerings will help keep ADVFN relevant to its

users as the online landscape continues to shift.

Clement Chambers

CEO

21 October 2016

STRATEGIC REPORT

Financial Overview

These consolidated and company accounts have been prepared under

International Financial Reporting Standards (IFRS) as adopted by

the European Union.

There has been a continued environment of rising costs in data

licenses and we continue to prune content where its costs outweigh

its benefits.

We are comfortable with our new cost base and believe it has the

capacity for business growth.

Business Review

ADVFN has restructured. We have cut costs, repriced product,

closed international offices and created new offerings. The bulk of

this process completed early this year. It would seem that our

decision to do so was the correct one, with a general rise of

fragility on many fronts. AIM, on which we are quoted, has been

through a poor period with many companies delisting. Important

foreign markets like Brazil and the US suffered from a deep malaise

for most of the year. Even the dreaded Brexit was a drag on our

business up until the aftermath of the vote.

These situations remain unresolved but we have in the meantime

put our business onto a different footing. We made a significantly

reduced loss of GBP36,000 in the final six months in the financial

year. This signals the end of a restructuring process that we

undertook in this financial year and places us with a focus on our

key US and UK territories. Business is stable and we are working on

a series of initiatives to underpin that and with a little good

fortune provide growth.

Operating Costs

We have significantly cut operating costs. We have slimmed down

our offerings, international operations, marketing and cut

headcount.

Closure of ADVFN Japan LLP and disposal of Investor Events

Ltd

During the year the office in Japan was closed, however the

on-line presence in Japan continues operating as normal with UK

hosted websites.

On 19(th) May 2016 an agreement was reached to dispose of the

business Investor Events Limited and was completed 30 September

2016. The proceeds of the disposal amounted to GBP40,000 and

exceeded the book value of other related net assets and accordingly

no impairment losses have been recognised.

Both of these strategic changes have been designed to bring the

Group's focus back to the central, core offering. It also allows us

the financial flexibility to react to the changing technology in

our market place.

Research and Development

We are highly focused on new developments including improvements

to our website and researching and developing other methods of

accessing our offering. The web and mobile environment is going

through a seismic shift on many levels and we are struggling to

stay ahead of changes that threaten to make us obsolete. We have a

road map for the shifting trends in platform, offering, exchange

landscape and advertising infrastructure. We have managed to adapt

over the last 16 years so we remain in good shape to cope with what

is a very fast changing environment.

Environmental policy

The Group as a whole continues to look for ways to develop its

environmental policy. It remains our objective to improve our

performance in this area.

Future outlook for the business

ADVFN has had a successful period of consolidation as you will

note from the transformation in our results. We have turned this

necessity into an opportunity to refocus our business away from

international growth onto consolidation and redevelopment of the

business.

Early outcomes from new product initiatives are promising and

our goal is to return to growth in the next twelve to eighteen

months whilst controlling costs. The whole market place we are

operating in is changing dramatically. However we are confident

that we can adapt to these changes by using our market knowledge,

years of experience and strong technical platform to keep abreast

of these developments.

Summary of key performance indicators

The Directors monitor the Key Performance Indicators on an

ongoing basis. The chart below shows the level of performance

achieved in the financial year. The individual items are as

follows:

Turnover - is of vital importance as it gives the sales

department a goal and measures the financial success of the Group's

service.

Head count - is a very significant part of the costs of the

company and is fixed as an overhead. It provides a good indicator

when taken against the revenue figure for the efficiency of the

business. Talented people are a vital part of the business.

Registered users - give us an accurate indication of our

audience pool and the potential available for marketing our

service.

2016 2016 2015 2015

Actual Target Actual Target

-------------------- -------- -------- -------- --------

GBP9 -

Turnover GBP8.3M GBP8.0M GBP9.3M GBP10M

-------- -------- --------

Average head count 37 37 53 53

-------------------- -------- -------- -------- --------

ADVFN registered

users 3.5M 3.3M 3.2M 3.1M

-------------------- -------- -------- -------- --------

Principal risks and uncertainties

Economic downturn

There are signs of global economic recovery and these have shown

up as bursts of traffic on ADVFN.

However there can be no certainty in a return to economic

normality in the near future but as previously stated the Company

has bridged both the dotcom crash the credit crunch and now Brexit,

so we feel that we have shown we are robust enough to withstand the

financial conditions of economic emergencies.

High proportion of fixed overheads coupled with variable

revenues

A large proportion of the company's overheads are fixed. There

is the risk that any significant changes in revenue may lead to the

inability to cover such costs. Management closely monitor fixed

overheads against budget on a monthly basis and cost saving

exercises are implemented on a constant review basis. We have had a

strong period of cost optimisations that are updated on a regular

basis.

Product obsolescence

The technology that we use is always in development and

constantly changing. All our products are subject to technological

change and advance and resultant obsolescence.

We have no choice but to keep innovating to keep up with growing

technical challenges that are changing all the time.

The Directors are committed to the Research and Development

strategy in place, and are confident that the company is able to

react effectively to the developments within the market.

Fluctuations in currency exchange rates

A growing proportion of our turnover relates to overseas

operations. As a company, we are therefore exposed to foreign

currency fluctuations. The Company manages its foreign exchange

exposure on a net basis, and if required uses forward foreign

exchange contracts and other derivatives/financial instruments to

reduce the exposure. Currently hedging is not employed and no

forward contracts are in place. If currency volatility was extreme

and hedging activity did not mitigate the exposure, then the

results and the financial condition of the company might be

adversely impacted by foreign currency fluctuations.

Following the volatility post Brexit, management will continue

to monitor the impact of currency fluctuation. The exchange rate of

the US Dollar has been a recent focus.

People

I would like to thank everyone at ADVFN who tirelessly provide a

global service for private investors that never sleeps.

ON BEHALF OF THE BOARD

Clement Chambers

CEO

21 October 2016

Consolidated income statement

30 June 30 June

2016 2015

Notes GBP'000 GBP'000

Revenue 1 8,303 9,297

Cost of sales (1,077) (1,628)

-------- --------

Gross profit 7,226 7,669

Share based payment (275) (189)

Amortisation of intangible assets (425) (647)

Other administrative expenses (7,176) (8,738)

-------- --------

Total administrative expenses (7,876) (9,574)

Operating loss (650) (1,905)

Finance income and expense 126 114

Loss before tax (524) (1,791)

Taxation 46 231

-------- --------

Total loss for the period attributable

to shareholders of the parent 2 (478) (1,560)

Loss per share

Total loss per share - basic

and diluted 2 (1.89)p (6.19)p

Consolidated statement of comprehensive

income

30 June 30 June

2016 2015

GBP'000 GBP'000

Loss for the period (478) (1,560)

Other comprehensive income:

Items that will be reclassified

subsequently to profit or loss:

Exchange differences on translation

of foreign operations 233 185

Deferred tax on translation

of foreign held assets (47) (21)

-------- ----------

Total other comprehensive income 186 164

Total comprehensive income for

the year attributable to shareholders

of the parent (292) (1,396)

======== ==========

Consolidated balance sheet

30 June 30 June

2016 2015

GBP'000 GBP'000

Assets

Non-current assets

Property, plant and equipment 68 99

Goodwill 918 784

Intangible assets 1,321 1,216

Trade and other receivables 155 103

Investments - 6

-------- --------

2,462 2,208

Current assets

Trade and other receivables 1,025 1,095

Current tax recoverable - 181

Cash and cash equivalents 843 986

-------- --------

1,868 2,262

Assets in disposal group classified

as held for sale 3 142 -

-------- --------

2,010 2,262

Total assets 4,472 4,470

Equity and liabilities

Equity

Issued capital 51 50

Share premium 119 -

Share based payment reserve 344 189

Foreign exchange reserve 467 281

Retained earnings 640 1,118

-------- --------

1,621 1,638

Non-current liabilities

Deferred tax 100 97

100 97

Current liabilities

Trade and other payables 2,583 2,731

Current tax 10 4

2,593 2,735

Liabilities directly associated

with assets in disposal groups

classified as held for sale 3 158 -

-------- --------

2,751 2,735

-------- --------

Total liabilities 2,851 2,832

-------- --------

Total equity and liabilities 4,472 4,470

======== ========

Consolidated statement of changes in equity

Share Share Merger Share Foreign Retained Total

capital premium reserve based exchange earnings equity

payment reserve

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 July 2014 6,305 8,102 221 617 117 (12,517) 2,845

Equity settled

share options - - - 189 - - 189

--------- --------- --------- --------- ---------- ---------- --------

Total transactions

with owners - - - 189 - - 189

Loss for the period

after tax - - - - - (1,560) (1,560)

Other comprehensive

income

Exchange differences

on translation

of foreign operations - - - - 185 - 185

Deferred tax on

translation of

foreign held assets - - - (21) - (21)

Total other comprehensive

income - - - - 164 - 164

--------- --------- --------- --------- ---------- ---------- --------

Total comprehensive

income - - - - 164 (1,560) (1,396)

Share consolidation (6,255) (8,102) (221) (617) - 15,195 -

At 30 June 2015 50 - - 189 281 1,118 1,638

Equity settled

share options - - - 155 - - 155

Share issues 1 119 - - - - 120

--------- --------- --------- --------- ---------- ---------- --------

Total transactions

with owners 1 119 - 155 - - 275

Loss for the period

after tax - - - - - (478) (478)

Other comprehensive

income

Exchange differences

on translation

of foreign operations - - - - 233 - 233

Deferred tax on

translation of

foreign held assets - - - - (47) - (47)

--------- --------- --------- --------- ---------- ---------- --------

Total other comprehensive

income - - - - 186 - 186

--------- --------- --------- --------- ---------- ---------- --------

Total comprehensive

income - - - - 186 (478) (292)

At 30 June 2016 51 119 - 344 467 640 1,621

========= ========= ========= ========= ========== ========== ========

Consolidated cash flow statement

12 months 12 months

to to

30 June 30 June

2016 2015

GBP'000 GBP'000

Cash flows from operating activities

Loss for the year (478) (1,560)

Taxation (46) (231)

Net finance income in the income

statement (126) (114)

Depreciation of property, plant

& equipment 83 61

Amortisation 425 647

Adjustment to fair value of

embedded derivative 225 200

Share based payments - options 155 189

Issue of share capital 120 -

Increase in trade and other

receivables (80) 133

(Decrease)/increase in trade

and other payables (148) 463

Net cash generated /(used) by

continuing operations 130 (212)

Income tax receivable 236 46

---------- ----------

Net cash generated/(used) by

operating activities 366 (166)

Cash flows from financing activities

Interest paid (1) -

Net cash generated by financing (1) -

activities

Cash flows from investing activities

Payments for property plant

and equipment (52) (89)

Purchase of intangibles (399) (472)

Sale/(purchase) of investments 6 (6)

Net cash used by investing activities (445) (567)

Net decrease in cash and cash

equivalents (80) (733)

Exchange differences (79) 44

---------- ----------

Decrease in cash and cash equivalents

continuing operations (159) (689)

Cash generated by disposal group 16 -

---------- ----------

Net decrease in cash and cash

equivalents (143) (689)

Cash and cash equivalents at

the start of the period 986 1,675

---------- ----------

Cash and cash equivalents at

the end of the period 843 986

========== ==========

1. Segmental analysis

The directors identify operating segments based upon the

information which is regularly reviewed by the chief operating

decision maker. The Group considers that the chief operating

decision makers are the executive members of the Board of

Directors. The Group has identified two reportable operating

segments, being that of the provision of financial information and

that of other services. The provision of financial information is

made via the Group's various website platforms.

The parent entities operations are entirely of the provision of

financial information.

Two minor operating segments, for which IFRS 8's quantitative

thresholds have not been met, are currently combined below under

'other'. The main sources of revenue for these operating segments

is the provision of financial broking services and other internet

services not related to financial information. The Disposal Group

segment comprises Investor Events Limited which is held for sale

with completion on 30 September 2016. Segment information can be

analysed as follows for the reporting period under review:

2016 Provision Other Total Disposal Total

of financial Group

information

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue from external

customers 7,558 745 8,303 - 8,303

Depreciation and

amortisation (604) 117 (487) - (487)

Other operating

expenses (7,710) (756) (8,466) - (8,466)

-------------- -------- -------- --------- --------

Segment operating

loss (756) 106 (650) - (650)

Interest income 126 - 126 - 126

Interest expense - - - - -

============== ======== ======== ========= ========

Segment assets 4,348 (18) 4,330 142 4,472

Segment liabilities (2,620) (73) (2,693) (158) (2,851)

Purchases of non-current

assets 316 86 402 - 402

============== ======== ======== ========= ========

2015 Provision Other Total Disposal Total

of financial group

information

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue from external

customers 8,695 228 9,297 - 9,297

Depreciation and

amortisation (612) (78) (690) - (690)

Other operating

expenses (9,876) (262) (10,512) - (10,512)

-------------- -------- --------- --------- ---------

Segment operating

loss (1,793) (112) (1,905) - (1,905)

Interest income 114 - 114 - 114

Interest expense - - - - -

============== ======== ========= ========= =========

Segment assets 4,595 (276) 4,319 151 4,470

Segment liabilities (2,586) (164) (2,750) (82) (2,832)

Purchases of non-current

assets 380 92 472 - 472

============== ======== ========= ========= =========

The Group's revenues, which wholly relate to the sale of

services, from external customers and its non-current assets, are

divided into the following geographical areas:

Revenue Non-current Revenue Non-current

assets assets

2016 2016 2015 2015

GBP'000 GBP'000 GBP'000 GBP'000

UK (domicile) 3,807 1,209 3,587 1,070

USA 3,731 1,253 4,919 1,138

Other 765 - 791 -

8,303 2,462 9,297 2,208

======== ============ ======== ============

Revenues are allocated to the country in which the customer

resides. During both 2016 and 2015 no single customer accounted for

more than 10% of the Group's total revenues.

2. Loss per share

12 months 12 months

to to

30 June 30 June

2016 2015

GBP'000 GBP'000

Loss for the year attributable to

equity shareholders (478) (1,560)

Total loss per share - basic and

diluted (1.89)p (6.19)p

Shares Shares

Weighted average number of shares

in issue for the year 25,237,597 25,220,210

Dilutive effect of options - -

----------- -----------

Weighted average shares for diluted

earnings per share 25,237,597 25,220,210

=========== ===========

Where a loss has been recorded for the year the diluted loss per

share does not differ from the basic loss per share as the exercise

of share options would have the effect of reducing the loss per

share and is therefore not dilutive under the terms of IAS 33.

3. Disposal of Investor Events Limited

On 19(th) May 2016 an agreement was reached to dispose of the

business Investor Events Limited. The disposal was effected in

order to generate cash flow to benefit the other Group businesses.

The disposal was completed 30 September 2016. The proceeds of the

disposal amounted to GBP40,000 and exceeded the book value of other

related net assets and accordingly no impairment losses have been

recognised. The major classes of assets and liabilities comprising

the operation are as below:

Net assets of the disposal group 2016

GBP'000

Current assets

Trade receivables 18

Other receivables 120

Cash and cash equivalents 4

Total assets classified as held for sale 142

========

Current liabilities

Accrued expenses (158)

Total liabilities associated with assets

classified as held for sale (158)

--------

Net assets of disposal group (16)

========

The result for the company was a profit of GBP11,000 (2015:

GBPnil)

4. Events after the balance sheet date

The sale of the subsidiary company Investor Events Limited was

completed on 30 September 2016 (see note 3). The amount of the

consideration exceeded the carrying value of the net assets and

therefore no impairment was required.

There are no other events of significance occurring after the

balance sheet date to report.

5. Publication of non-statutory accounts

The financial information set out in this preliminary

announcement does not constitute statutory accounts as defined in

section 435 of the Companies Act 2006.

The consolidated balance sheet at 30 June 2016 and the

consolidated income statement, consolidated statement of

comprehensive income, consolidated statement of changes in equity,

consolidated cash flow statement and associated notes for the year

then ended have been extracted from the Company's 2016 statutory

financial statements upon which the auditors' opinion is

unqualified and does not include any statement under Section 498(2)

or (3) of the Companies Act 2006.

The annual report and accounts will shortly be sent to

shareholders and will be available on the Company's website,

http://www.advfn.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR BLBDGISDBGLB

(END) Dow Jones Newswires

October 21, 2016 12:56 ET (16:56 GMT)

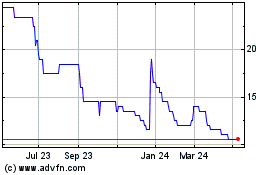

Advfn (LSE:AFN)

Historical Stock Chart

From Mar 2024 to Apr 2024

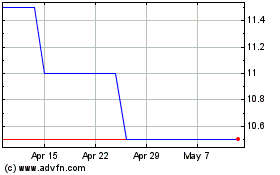

Advfn (LSE:AFN)

Historical Stock Chart

From Apr 2023 to Apr 2024