ADTRAN, Inc. (NASDAQ:ADTN) reported results for the fourth

quarter 2014. For the quarter, sales were $143,982,000 compared to

$159,094,000 for the fourth quarter of 2013. Net income was

$9,292,000 compared to $11,840,000 for the fourth quarter of 2013.

Earnings per share, assuming dilution, were $0.17 compared to $0.20

for the fourth quarter of 2013. Non-GAAP earnings per share were

$0.19 compared to $0.25 for the fourth quarter of 2013. The

reconciliation between GAAP earnings per share, diluted, and

non-GAAP earnings per share, diluted, is in the table provided.

ADTRAN Chief Executive Officer Tom Stanton stated, “Our Company

had a solid performance this quarter with most segments meeting or

slightly exceeding our expectations. We continue to see positive

trends as we enter 2015 and believe our geographic presence, market

share gains and new product introductions position us well for the

future.”

The Company also announced that its Board of Directors declared

a cash dividend for the fourth quarter of 2014. The quarterly cash

dividend is $0.09 per common share to be paid to holders of record

at the close of business on February 5, 2015. The ex-dividend date

is February 3, 2015 and the payment date is February 19, 2015.

The Company confirmed that its fourth quarter conference call

will be held Wednesday, January 21, 2015 at 9:30 a.m. Central Time.

This conference call will be web cast live through

StreetEvents.com. To listen, simply visit the Investor Relations

site at www.adtran.com or www.streetevents.com approximately 10

minutes prior to the start of the call and click on the conference

call link provided.

An online replay of the conference call will be available for

seven days at www.streetevents.com. In addition, an online replay

of the conference call, as well as the text of the Company's

earnings release, will be available on the Investor Relations site

at www.adtran.com for at least 12 months following the call.

ADTRAN, Inc. is a leading global provider of networking and

communications equipment. ADTRAN’s products enable voice, data,

video and Internet communications across a variety of network

infrastructures. ADTRAN solutions are currently in use by service

providers, private enterprises, government organizations, and

millions of individual users worldwide. For more information,

please visit www.adtran.com.

For more information, contact the company at 800 9ADTRAN (800

923-8726) or via email at info@adtran.com. On the Web, visit

www.adtran.com.

This press release contains forward-looking statements which

reflect management’s best judgment based on factors currently

known. However, these statements involve risks and uncertainties,

including the successful development and market acceptance of new

products, the degree of competition in the market for such

products, the product and channel mix, component costs,

manufacturing efficiencies, and other risks detailed in our annual

report on Form 10-K for the year ended December 31, 2013 and on

Form 10-Q for the quarter ended September 30, 2014. These risks and

uncertainties could cause actual results to differ materially from

those in the forward-looking statements included in this press

release.

Condensed Consolidated Balance Sheet

(Unaudited) (In thousands) December 31,

2014

December 31,

2013

Assets Cash and cash equivalents $ 73,439 $ 58,298

Short-term investments 46,919 105,760 Accounts receivable, net

86,158 85,814 Other receivables 35,639 18,249 Inventory 86,710

90,111 Prepaid expenses 5,129 4,325 Deferred tax assets, net

17,095 17,083

Total Current Assets 351,089

379,640 Property, plant and equipment, net 74,828

76,739 Deferred tax assets, net 17,694 9,622 Goodwill 3,492 3,492

Other assets 10,942 11,180 Long-term investments 280,649

309,225

Total Assets $ 738,694

$ 789,898 Liabilities and Stockholders'

Equity Accounts payable $ 56,414 $ 48,282 Unearned revenue

22,762 22,205 Accrued expenses 11,077 12,776 Accrued wages and

benefits 13,855 14,040 Income tax payable, net 14,901

5,002

Total Current Liabilities 119,009

102,305 Non-current unearned revenue 10,948 14,643

Other non-current liabilities 30,924 22,144 Bonds payable

28,800 46,200

Total Liabilities 189,681

185,292 Stockholders' Equity

549,013 604,606 Total Liabilities

and Stockholders' Equity $ 738,694 $

789,898 Consolidated Statements of

Income (Unaudited) (In thousands, except per share

data) Three Months Ended Twelve Months

Ended December 31, December 31, 2014

2013 2014 2013 Sales $

143,982 $ 159,094 $ 630,007 $ 641,744 Cost of sales 75,499

82,230 318,680 332,858

Gross Profit 68,483 76,864

311,327 308,886 Selling, general and

administrative expenses 31,793 33,284 131,958 129,366 Research and

development expenses 32,711 32,941

132,258 131,055

Operating

Income 3,979 10,639 47,111 48,465

Interest and dividend income 1,679 1,991 5,019 7,012

Interest expense (152 ) (588 ) (677 ) (2,325 ) Net realized

investment gain 59 1,665 7,278 8,614

Other income (expense), net (1)

2,790 610 1,175

(911 )

Income before provision for income taxes

8,355 14,317 59,906 60,855

Provision for income taxes 937 (2,477 )

(15,286 ) (15,061 )

Net Income $

9,292 $ 11,840 $

44,620 $ 45,794 Weighted

average shares outstanding - basic 53,835 57,178 55,120 59,001

Weighted average shares outstanding -

diluted (2)

54,085 57,777 55,482 59,424 Earnings per common share -

basic $ 0.17 $ 0.21 $ 0.81 $ 0.78

Earnings per common share - diluted

(2)

$ 0.17 $ 0.20 $ 0.80 $ 0.77

(1)

Results for the three and twelve months

ended December 31, 2014 include a $2.4 million gain related to the

settlement of working capital items from an acquisition transaction

that closed in 2012.

(2)

Assumes exercise of dilutive stock options

calculated under the treasury stock method.

Consolidated Statements of Comprehensive

Income (Unaudited) (In thousands) Three

Months Ended Twelve Months Ended December 31,

December 31, 2014 2013 2014

2013 Net Income $ 9,292 $ 11,840

$ 44,620 $ 45,794

Other Comprehensive

Income (Loss), net of tax: Unrealized gains (losses) on

available-for-sale securities 1,077 1,409 (1,773 ) 629 Defined

benefit plan adjustments (4,866 ) 1,061 (4,866 ) 1,061 Foreign

currency translation (2,007 ) (707 ) (4,189 )

(2,205 )

Other Comprehensive Income (Loss), net of

tax (5,796 ) 1,763

(10,828 ) (515 )

Comprehensive Income, net of tax $ 3,496

$ 13,603 $ 33,792

$ 45,279 Consolidated

Statements of Cash Flows (Unaudited) (In

thousands) Twelve Months Ended December

31, 2014 2013 Cash flows from operating

activities: Net income

$ 44,620 $

45,794 Adjustments to reconcile net income to net cash

provided by operating activities: Depreciation and amortization

14,845 14,628 Amortization of net premium on available-for-sale

investments 4,360 5,956 Net realized gain on long-term investments

(7,278 ) (8,614 ) Net loss on disposal of property, plant and

equipment 142 3 Stock-based compensation expense 8,563 9,073

Deferred income taxes (5,526 ) (4,058 ) Tax benefit from stock

option exercises 81 169 Excess tax benefits from stock-based

compensation arrangements (63 ) (158 ) Change in operating assets

and liabilities: Accounts receivable, net (2,769 ) (5,541 ) Other

receivables (20,439 ) (1,549 ) Inventory 1,953 10,265 Prepaid

expenses and other assets (3,627 ) (11 ) Accounts payable 9,973

5,206 Accrued expenses and other liabilities (166 ) (15,146 )

Income tax payable, net 11,168 3,747

Net cash provided by operating activities

55,837 59,764 Cash

flows from investing activities: Purchases of property, plant

and equipment (11,256 ) (8,173 ) Proceeds from disposals of

property, plant and equipment 1 - Proceeds from sales and

maturities of available-for-sale investments 230,019 343,567

Purchases of available-for-sale investments (142,695 )

(261,625 )

Net cash provided by investing activities

76,069 73,769

Cash flows from financing activities: Proceeds from stock

option exercises 2,839 3,629 Purchases of treasury stock (80,576 )

(124,267 ) Dividend payments (19,947 ) (21,412 ) Payments on

long-term debt (16,500 ) - Excess tax benefits from stock-based

compensation arrangements 63 158

Net

cash used in financing activities (114,121

) (141,892 ) Net increase

(decrease) in cash and cash equivalents 17,785 (8,359 ) Effect of

exchange rate changes (2,644 ) (1,800 )

Cash and cash

equivalents, beginning of period 58,298

68,457 Cash and cash equivalents,

end of period $ 73,439 $

58,298 Supplemental disclosure of non-cash

investing activities Purchases of property, plant and equipment

included in accounts payable $ 467 $ 444

Supplemental Information Acquisition Related Expenses,

Amortizations and Adjustments (Unaudited) (In

thousands)

On August 4, 2011, we closed on the

acquisition of Bluesocket, Inc. and on May 4, 2012, we closed on

the acquisition of the Nokia Siemens Networks Broadband Access

business (NSN BBA). Acquisition related expenses, amortizations and

adjustments for the three and twelve months ended December 31, 2014

and 2013 for both transactions are as follows:

Three Months Ended Twelve Months Ended

December 31, December 31, 2014

2013 2014 2013 Bluesocket, Inc.

acquisition Amortization of acquired intangible assets and other

purchase accounting adjustments $ 226 $ 279 $ 925

$ 1,142 NSN BBA acquisition Amortization of

acquired intangible assets 269 301 1,153 1,174 Amortization of

other purchase accounting adjustments 222 391 1,117 1,378

Acquisition related professional fees, travel and other expenses

193 16 282 345

Subtotal 684

708 2,552 2,897

Total acquisition related expenses, amortizations

and adjustments 910 987 3,477 4,039

Provision for income taxes (300 ) (328 )

(1,151 ) (1,343 )

Total acquisition related

expenses, amortizations and adjustments, net of tax $

610 $ 659 $ 2,326

$ 2,696

The acquisition related expenses,

amortizations and adjustments above were recorded in the following

Consolidated Statements of Income categories for the three and

twelve months ended December 31, 2014 and 2013:

Three Months Ended Twelve Months Ended

December 31, December 31, 2014

2013 2014 2013 Revenue

(adjustments to deferred revenue recognized in the period) $ 73 $

211 $ 601 $ 929 Cost of goods sold 67 102

171 196

Subtotal

140 313 772

1,125 Selling, general and

administrative expenses 200 24 310 399 Research and development

expenses 570 650 2,395

2,515

Subtotal 770

674 2,705

2,914 Total acquisition related expenses,

amortizations and adjustments 910 987

3,477 4,039 Provision for income taxes (300 )

(328 ) (1,151 ) (1,343 )

Total

acquisition related expenses, amortizations and adjustments, net of

tax $ 610 $ 659

$ 2,326 $ 2,696

Supplemental Information Stock-based

Compensation Expense (Unaudited) (In thousands)

Three Months Ended Twelve Months Ended

December 31, December 31, 2014

2013 2014 2013 Stock-based

compensation expense included in cost of sales $

120 $ 131 $ 479

$ 465 Selling, general and

administrative expense 1,096 1,314 4,185 4,443 Research and

development expense 1,051 1,112

3,899 4,165

Stock-based compensation

expense included in operating expenses 2,147

2,426 8,084

8,608 Total stock-based compensation

expense 2,267 2,557 8,563 9,073 Tax

benefit for expense associated with non-qualified options

(279 ) (374 ) (1,157 ) (1,298 )

Total stock-based compensation expense, net of tax $

1,988 $ 2,183 $

7,406 $ 7,775

Reconciliation of GAAP net income per share, diluted,

to Non-GAAP net income per share, diluted

(Unaudited) Three Months Ended Twelve

Months Ended December 31, December 31,

2014 2013 2014 2013

GAAP earnings per common share – diluted $

0.17 $ 0.20 $ 0.80 $

0.77 Acquisition related expenses, amortizations and

adjustments 0.01 0.01 0.04 0.05 Settlement of acquisition related

working capital items (0.03 ) - (0.03 ) - Stock-based compensation

expense 0.04 0.04 0.13

0.13

Non-GAAP earnings per common share – diluted

$ 0.19 $ 0.25 $

0.94 $ 0.95

ADTRAN, Inc.Jim Matthews, 256-963-8775Senior Vice

President/CFOorInvestor Services/Assistance:Gayle Ellis,

256-963-8220

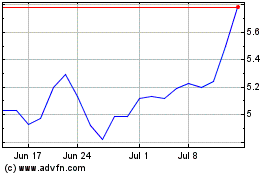

ADTRAN (NASDAQ:ADTN)

Historical Stock Chart

From Mar 2024 to Apr 2024

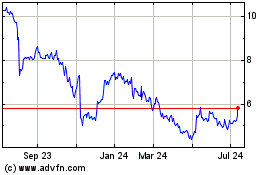

ADTRAN (NASDAQ:ADTN)

Historical Stock Chart

From Apr 2023 to Apr 2024