ADTRAN, Inc. (NASDAQ:ADTN) reported results for the second

quarter 2017. For the quarter, sales were $184.7 million compared

to $162.7 million for the second quarter of 2016. Net income was

$12.4 million compared to $10.2 million for the second quarter of

2016. Earnings per share, assuming dilution, were $0.26 compared to

$0.21 for the second quarter of 2016. Non-GAAP earnings per share

were $0.30 compared to $0.25 for the second quarter of 2016. The

reconciliation between GAAP earnings per share, diluted, and

non-GAAP earnings per share, diluted, is in the table provided.

ADTRAN Chairman and Chief Executive Officer Tom Stanton stated,

“The company’s performance continues on pace with record sales for

the second quarter and the first half of 2017. Our record revenue

was driven by increasing momentum with our ultra-broadband

solutions, where we saw significant year-over-year growth both in

the US and Europe. We continue to be at the forefront of several

inflection points of innovation in the market, including next

generation optical access, services transformation and Software

Defined Access (SD-Access). Our services combined with market

leading access and software solutions have enabled us to expand our

range and reach into new opportunities that show promise for both

short and long-term growth. We are pleased with our progress and

the market reception to ADTRAN Mosaic and our SD-Access portfolio

as Tier 1 operators around the world prepare for the transition to

SDN. With our focus on software innovation and domain expertise,

ADTRAN is uniquely positioned to enable internet service providers

of all types to meet increasing customer demand and decrease their

time to market for next generation services.”

The Company also announced that its Board of Directors declared

a cash dividend for the second quarter of 2017. The quarterly cash

dividend is $0.09 per common share to be paid to holders of record

at the close of business on August 3, 2017. The ex-dividend date is

August 1, 2017, and the payment date is August 17, 2017.

The Company confirmed that its second quarter conference call

will be held Wednesday, July 19, 2017, at 9:30 a.m. Central Time.

This conference call will be web cast live through the Q4 Inc.

webcasting service. To listen, simply visit the Investor Relations

site at www.adtran.com/investor approximately 10 minutes

prior to the start of the call and click on the conference call

link provided.

An online replay of the conference call, as well as the text of

the Company's earnings release, will be available on the Investor

Relations site for at least 12 months following the call.

ADTRAN, Inc. is a leading global provider of networking and

communications equipment. ADTRAN’s products enable voice, data,

video and Internet communications across a variety of network

infrastructures. ADTRAN solutions are currently in use by

service providers, private enterprises, government organizations,

and millions of individual users worldwide. For more information,

please visit www.adtran.com.

For more information, contact the company at 800 9ADTRAN (800

923-8726) or via email at info@adtran.com. On the Web,

visit www.adtran.com.

This press release contains forward-looking statements which

reflect management’s best judgment based on factors currently

known. However, these statements involve risks and uncertainties,

including the successful development and market acceptance of new

products, the degree of competition in the market for such

products, the product and channel mix, component costs,

manufacturing efficiencies, and other risks detailed in our annual

report on Form 10-K for the year ended December 31, 2016.

These risks and uncertainties could cause actual results to differ

materially from those in the forward-looking statements included in

this press release.

Condensed Consolidated Balance Sheet

(Unaudited) (In thousands) June 30,

December 31, 2017 2016 Assets

Cash and cash equivalents $ 88,798 $ 79,895 Short-term investments

47,331 43,188 Accounts receivable, net 79,891 92,346 Other

receivables 14,561 15,137 Income tax receivable, net — 760

Inventory, net 113,995 105,117 Prepaid expenses and other current

assets 23,556 16,459

Total Current Assets

368,132 352,902 Property, plant and equipment,

net 84,122 84,469 Deferred tax assets, net 40,296 38,036 Goodwill

3,492 3,492 Other assets 13,305 12,234 Long-term investments

159,634 176,102

Total Assets $ 668,981

$ 667,235 Liabilities and Stockholders'

Equity Accounts payable $ 66,161 $ 77,342 Unearned revenue

15,449 16,326 Accrued expenses 13,433 12,434 Accrued wages and

benefits 16,303 20,433 Income tax payable, net 9,594

—

Total Current Liabilities 120,940 126,535

Non-current unearned revenue 5,351 6,333 Other non-current

liabilities 32,527 28,050 Bonds payable 26,800 26,800

Total Liabilities 185,618 187,718

Stockholders' Equity 483,363

479,517 Total Liabilities and Stockholders'

Equity $ 668,981 $ 667,235

Consolidated Statements of Income

(Unaudited) (In thousands, except per share data)

Three Months Ended Six Months Ended June

30, June 30, 2017 2016 2017

2016 Sales Products $ 155,543 $ 138,549 $

299,140 $ 262,432 Services 29,130 24,152

55,812 42,473

Total Sales 184,673

162,701 354,952 304,905 Cost of

Sales Products 79,658 67,844 156,317 131,917 Services

20,383 15,902 40,288 28,239

Total Cost of

Sales 100,041 83,746 196,605

160,156 Gross Profit 84,632

78,955 158,347 144,749 Selling, general

and administrative expenses 34,683 32,866 69,450 63,651 Research

and development expenses 33,501 31,277 65,417

60,765

Operating Income 16,448

14,812 23,480 20,333 Interest and

dividend income 972 927 1,905 1,782 Interest expense (137 ) (142 )

(278 ) (287 ) Net realized investment gain 1,390 1,110 1,860 2,838

Other expense, net (804 ) (251 ) (753 )

(132 )

Income before provision for income taxes

17,869 16,456 26,214 24,534

Provision for income taxes (5,468 ) (6,228 )

(7,162 ) (9,292 )

Net Income $

12,401 $ 10,228 $ 19,052

$ 15,242 Weighted average shares outstanding -

basic 48,036 48,831 48,232 49,026 Weighted average shares

outstanding - diluted (1) 48,413 49,048 48,675 49,218

Earnings per common share - basic $ 0.26 $ 0.21 $ 0.40 $ 0.31

Earnings per common share - diluted (1) $ 0.26 $ 0.21 $ 0.39 $ 0.31

(1) Assumes exercise of dilutive stock

options calculated under the treasury stock method.

Consolidated Statements of Comprehensive

Income (Unaudited) (In thousands) Three

Months Ended Six Months Ended June 30, June

30, 2017 2016 2017

2016 Net Income $ 12,401 $ 10,228 $ 19,052 $ 15,242

Other

Comprehensive Income (Loss), net of tax: Net unrealized gains

(losses) on available-for-sale securities 373 (165 ) 1,708 (420 )

Net unrealized losses on cash flow hedges (417 ) — (338 ) — Defined

benefit plan adjustments 86 22 141 67 Foreign currency translation

2,619 (601 ) 3,861 627

Other

Comprehensive Income (Loss), net of tax 2,661

(744 ) 5,372 274

Comprehensive Income, net of tax $ 15,062

$ 9,484 $ 24,424 $ 15,516

Consolidated Statements of Cash Flows

(Unaudited) (In thousands) Six Months

Ended June 30, 2017 2016 Cash

flows from operating activities: Net income $ 19,052 $ 15,242

Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization 5,156 6,689

Amortization of net premium on available-for-sale investments 238

376 Net realized gain on long-term investments (1,860 ) (2,838 )

Net (gain) loss on disposal of property, plant and equipment (11 )

5 Stock-based compensation expense 3,739 3,109 Deferred income

taxes (2,772 ) (354 ) Changes in operating assets and liabilities:

Accounts receivable, net 13,911 (17,192 ) Other receivables 571

7,876 Inventory (7,547 ) 4,938 Prepaid expenses and other assets

(6,632 ) (4,263 ) Accounts payable (10,910 ) 10,354 Accrued

expenses and other liabilities (2,629 ) 1,474 Income tax

payable/receivable, net 10,273 (4,799 )

Net cash

provided by operating activities 20,579 20,617

Cash flows from investing activities: Purchases of

property, plant and equipment (7,509 ) (6,679 ) Proceeds from

disposals of property, plant and equipment 16 — Proceeds from sales

and maturities of available-for-sale investments 81,891 109,993

Purchases of available-for-sale investments (65,140 )

(112,903 )

Net cash provided by (used in) investing

activities 9,258 (9,589 ) Cash

flows from financing activities: Proceeds from stock option

exercises 1,722 541 Purchases of treasury stock (17,311 ) (16,579 )

Dividend payments (8,719 ) (8,860 )

Net cash used

in financing activities (24,308 ) (24,898

) Net increase (decrease) in cash and cash

equivalents 5,529 (13,870 ) Effect of

exchange rate changes 3,374 234

Cash and cash equivalents,

beginning of period 79,895 84,550

Cash and cash equivalents, end of period $

88,798 $ 70,914 Supplemental disclosure

of non-cash investing activities: Purchases of property, plant and

equipment included in accounts payable $ 454 $ 554

Supplemental InformationAcquisition

Related Expenses, Amortizations and

Adjustments(Unaudited)(In thousands)

On August 4, 2011, we closed on the acquisition of Bluesocket,

Inc., on May 4, 2012, we closed on the acquisition of the Nokia

Siemens Networks Broadband Access business (NSN BBA), and on

September 13, 2016, we closed on the acquisition of CommScope’s

active fiber business (CommScope). Acquisition related expenses,

amortizations and adjustments for the three and six months ended

June 30, 2017 and 2016 for all three transactions are as

follows:

Three Months Ended Six Months Ended June

30, June 30, 2017 2016 2017

2016 Bluesocket, Inc. acquisition Amortization of acquired

intangible assets $ 158 $ 173 $ 316 $ 346 NSN BBA

acquisition Amortization of acquired intangible assets 129 228 337

455

Amortization of other purchase accounting

adjustments

10 44 38 80

Subtotal - NSN BBA

acquisition 139 272 375 535

CommScope acquisition Amortization of acquired intangible assets

608 — 1,294 —

Amortization of other purchase accounting

adjustments

31 — 81 —

Acquisition related professional fees,

travel and other expenses

— — 8 —

Subtotal - CommScope

acquisition

639 —

1,383 —

Total acquisition related expenses,

amortizations and adjustments

936 445 2,074 881 Provision for income

taxes (354 ) (152 ) (779 ) (301 )

Total acquisition related expenses,

amortizations and adjustments, net of tax

$ 582 $ 293 $ 1,295

$ 580

The acquisition related expenses,

amortizations and adjustments above were recorded in the following

Consolidated Statements of Income categories for the three and six

months ended June 30, 2017 and 2016:

Three Months Ended Six Months Ended June

30, June 30, 2017 2016 2017

2016 Cost of goods sold $ 31 $

13

$

81

$

20 Selling, general and administrative expenses 52 4

114 7 Research and development expenses 853 428

1,879 854

Total acquisition related expenses,

amortizations and adjustments included in operating

expenses

905 432 1,993 861

Total acquisition related expenses,

amortizations and adjustments

936 445 2,074 881 Provision for income

taxes (354 ) (152

)

(779 ) (301 )

Total acquisition related expenses,

amortizations and adjustments, net of tax

$ 582 $ 293

$

1,295

$

580 Supplemental Information

Stock-based Compensation Expense (Unaudited) (In

thousands) Three Months Ended Six Months

Ended June 30, June 30, 2017

2016 2017 2016 Stock-based

compensation expense included in cost of sales $

93 $ 95 $ 184 $

194 Selling, general and administrative expense 1,008

788 2,024 1,557 Research and development expense 755

668 1,531 1,358

Stock-based compensation expense

included in operating expenses 1,763

1,456 3,555 2,915

Total stock-based compensation expense 1,856

1,551 3,739 3,109

Tax benefit for expense associated with

non-qualified options, PSUs, RSUs and restricted stock

(433 ) (213 ) (813 ) (425 )

Total stock-based compensation expense, net of tax $

1,423 $ 1,338 $ 2,926 $

2,684 Reconciliation of GAAP

net income per share, diluted, to Non-GAAP net income per

share, diluted (Unaudited) Three Months

Ended Six Months Ended June 30, June 30,

2017 2016 2017

2016 GAAP earnings per common share - diluted

$ 0.26 $ 0.21 $

0.39 $ 0.31 Acquisition related

expenses, amortizations and adjustments 0.01 0.01 0.03 0.01

Stock-based compensation expense 0.03 0.03

0.06 0.05

Non-GAAP earnings per common share -

diluted $ 0.30 $ 0.25 $

0.48 $ 0.37

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170718006486/en/

ADTRAN, Inc.Investor Services/Assistance:Gloria Brown,

256-963-8220investor@adtran.com

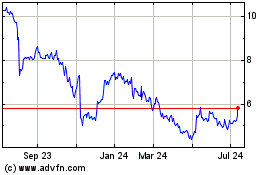

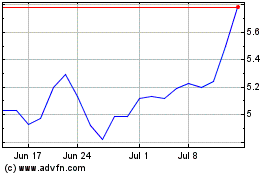

ADTRAN (NASDAQ:ADTN)

Historical Stock Chart

From Mar 2024 to Apr 2024

ADTRAN (NASDAQ:ADTN)

Historical Stock Chart

From Apr 2023 to Apr 2024