ADRs End Mostly Lower; Alibaba, Baidu Trade Actively

May 27 2016 - 5:26PM

Dow Jones News

By Maria Armental

International stocks trading in New York closed mostly lower on

Friday.

The BNY Mellon index of American depositary receipts eased 0.08%

to 124.88. The European index edged down 0.12% to 124.13. The Asian

index improved 0.24% to 131.88. The Latin American index fell 1% to

168.39. And the emerging-markets index increased 0.43% to 227.65.

Alibaba Group Holding (BABA) and Baidu Inc. (BIDU) were among the

companies with ADRs that traded actively.

Moody's Investors Services said Friday that while it is too

early to determine any consequences of the Securities and Exchange

Commission's investigation into Alibaba's accounting practices, the

company has plenty of cash to weather a storm. On Wednesday,

Alibaba disclosed the SEC investigation and described three areas

of query: 1) Alibaba's business unit consolidation practices

including its 47%-owned Cainiao logistics network 2) Alibaba's

related-party transactions and 3) Alibaba's reporting on China's

biggest online shopping day, Singles' Day. Shares closed up 3% at

$80.97.

U.S. health regulators on Friday raised concerns about

AstraZeneca PLC's (AZN, AZN.LN) potassium-lowering drug ZS-9.

AstraZeneca acquired ZS-9 with its $2.7 billion purchase of

California biotechnology company ZS Pharma Inc. last year.

AstraZeneca said the Food and Drug Administration's complete

response letter is about manufacturing issues, not the drug. Shares

eased 0.2% to $29.88.

ADRs of Baidu rose 4% to $185.01 on Friday, a day after the

company said it had changed its search algorithm, after the Chinese

government ordered it to revamp the way it handled advertising

results in online searches to cap ads at 30% of results displayed

on the page and attach "eye catching markers" to all paid results

so search users can distinguish promotions from other results.

Separately, Baidu said this week it would shut down discussion

forums on literature that are suspected of piracy.

European regulators on Friday approved GlaxoSmithKline PLC's

(GSK, GSK.LN) treatment for a rare disease called ADA-SCID,

commonly referred to as "bubble boy" disease. Children born with

the genetic disorder have faulty immune systems that fail to

protect them from bacteria and viruses. The treatment, Strimvelis,

will be one of the few gene therapies to hit the market. ADRs

closed down 0.8% at $42.75.

JinkoSolar Holding Co. Ltd.'s (JKS) first-quarter results easily

beat analysts' estimates as shipments were well above what the

Chinese company projected in early March. Still, the company

affirmed shipment projections for the year. ADRs fell 3% to

$22.71.

Shareholders of Dublin-based pharmaceutical company Shire PLC

(SHPG, SHP.LN) and U.S.-based Baxalta Inc. on Friday approved the

companies' proposed $32 billion merger. The deal, subject to

customary closing conditions, is expected to close on June 3. Shire

ADRs closed down 2% at $186.96.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

May 27, 2016 17:11 ET (21:11 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

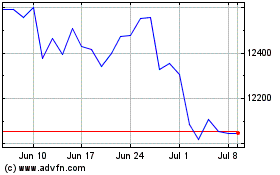

Astrazeneca (LSE:AZN)

Historical Stock Chart

From Mar 2024 to Apr 2024

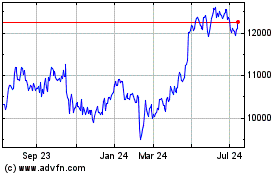

Astrazeneca (LSE:AZN)

Historical Stock Chart

From Apr 2023 to Apr 2024