ADRs End Mixed; BP Falls

April 14 2016 - 6:51PM

Dow Jones News

International stocks trading in New York were mixed on

Thursday.

BP PLC (BP, BP.LN) was among the companies with ADRs that traded

actively.

The BNY Mellon index of American depositary receipts edged up

0.09% to 126.14. The European index rose 0.18% to 123.37, the Asian

index increased 0.21% to 135.68, the Latin American index fell 1.2%

to 184.10 and the emerging markets index edged down 0.5% to

239.12.

ADRs of oil giant BP fell 1.5% to $30.92 after a majority of its

shareholders voted against its executive pay policy, including a

hefty increase in Chief Executive Bob Dudley's compensation. This

vote, although non-binding, comes after a year when BP lost more

than $5 billion. Also weighing on investors' minds are comments

that BP's dividend may not be sacrosanct if oil prices remain

lower.

Carnival boosted its quarterly dividend by 17%, the second

increase in less than a year, as the cruise line operator has

benefited from lower fuel costs as well as higher booking volumes

and prices. The company is dual listed in the U.S. and Britain.

ADRs of Carnival PLC (CUK, CCL.LN) fell 19 cents to $53.46.

Robert Shafir, Credit Suisse Group AG's (CS, CSGN.EB) chairman

of the Americas region who stepped down from the executive board

late last year, is planning to leave the Swiss bank. Credit

Suisse's ADRs fell seven cents to $15.01.

The Canadian unit of one of China's largest oil and gas

companies is on track to start operations at a new

35,000-barrel-per-day oil-sands plant later this year despite crude

prices being below break-even levels for the project, a senior

executive said. PetroChina Co.'s (PTR, 0857.HK, 601857.SH, K3OD.SG)

Brion Energy unit plans to begin steaming operations at its MacKay

River oil-sands site in northern Alberta later this year and

produce first oil in early in 2017. PetroChina's ADRs fell 11 cents

to $68.98.

Royal Bank of Scotland Group PLC (RBS, RBS.LN) is cutting 600

jobs across its retail division, according to a a trade union. The

bank, which is 73% owned by the U.K. government, is cutting back

its branch network as its customers move online and it looks to

save on costs. Of the 600 jobs, 200 are in London and the south

east of England, The Wall Street Journal reported, citing a person

familiar with the matter. ADRs rose 38 cents to $51.70.

A majority of Smith & Nephew PLC's (SNN, SN.LN) shareholders

voted down the company's pay decisions for its top executives, over

a rift on how it awarded bonuses. The medical-device maker said 53%

of investors opposed its remuneration report for 2015, though the

nonbinding vote won't affect last year's management pay packages.

ADRs rose 1.2% to $34.41.

Unilever reported a rise in underlying sales for the first

quarter as the consumer-goods giant sold more products at higher

prices. However currency fluctuations weighed on the Anglo-Dutch

company's overall revenue. ADRs of Unilever PLC (UL, ULVR.LN) fell

seven cents to $46.17 and Unilever NV (UN, UNA.AE) decreased 18

cents to $45.30.

Write to Tess Stynes at tess.stynes@wsj.com

(END) Dow Jones Newswires

April 14, 2016 18:36 ET (22:36 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

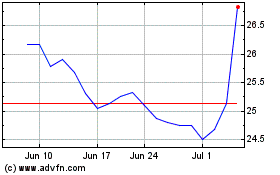

Smith and Nephew (NYSE:SNN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Smith and Nephew (NYSE:SNN)

Historical Stock Chart

From Apr 2023 to Apr 2024