ADRs End Higher; BHP Billiton Rises

March 16 2016 - 6:05PM

Dow Jones News

International stocks trading in New York closed higher on

Wednesday.

BHP Billiton was among the companies with ADRs that traded

actively.

The BNY Mellon index of American depositary receipts rose 0.8%

to 122.37. The European index increased 0.4% to 120.59, the Asian

index improved 1.2% to 131.75, the Latin American index rose 1.8%

to 163.08 and the emerging markets index increased 2.1% to

223.75.

BHP Billiton Chief Executive Andrew Mackenzie said in an

interview with The Wall Street Journal that the Anglo-Australian

mining giant is sizing up deals for petroleum and copper assets

that could offer an immediate boost to profits amid what it now

expects to be a prolonged period of low commodity prices. ADRs of

BHP Billiton Ltd. (BHP, BHP.AU) rose 4% to $26 and BHP Billiton PLC

(BBL, BLT.LN) increased 3.6% to $22.69.

Anheuser-Busch InBev NV (BUD, ABI.BT) sold 13.25 billion euros

($14.8 billion) in debt in the largest sale ever of

euro-denominated corporate bonds. The world's largest brewer plans

to use the proceeds to finance a portion of its $108 billion

takeover of rival drinks firm SABMiller PLC (SBMRY, SAB.LN,

SAB.JO). The deal comes amid a flurry of bond sales from European

companies this week. The increased activity follows the European

Central Bank's announcement last week that it will start buying

corporate debt later this year. ADRs rose 72 cents to $117.23.

Baidu Inc. (BIDU, K3SD.SG) will soon start testing autonomous

cars in the U.S., part of the Chinese tech giant's effort to

introduce a commercially viable model by 2018. The move, disclosed

by Baidu's chief scientist Andrew Ng in an interview, is a

significant step for the company, which is trying to get ahead in

the race to build autonomous cars and is now calling on the

resources of its Silicon Valley tech center to advance the effort.

ADRs rose 1.6% to $183.05.

Cheetah Mobile Inc. (CMCM) issued first-quarter revenue guidance

that missed analysts expectations and signaled slower growth at the

Chinese mobile utility and security app company. ADRs rose 11 cents

to $15.96.

Low-cost airline GOL Linhas Aereas Inteligentes SA (GOL,

GOLL4.BR) continues to come under pressure from Brazil's economic

woes, with traffic down 4.1% in the first two months of the year

and the percentage of seats filled sliding to 79.2% from 80.1%.

Brazilians are delaying vacation plans as the country's economic

recession deepens. ADRs fell 1.8% to $7.08.

A U.S. jury declared valid two Amgen Inc. (AMGN) patents linked

to the company's recently approved cholesterol-lowering drug,

delivering a setback to Regeneron Pharmaceuticals Inc. (REGN) and

Sanofi (SNY), makers of a rival drug. Regeneron and Sanofi, in a

prepared statement, said they "strongly disagree" with the verdict

by the Delaware jury and that they plan to appeal. Amgen, in a

separate statement, said it was thankful for the verdict and that

proceedings will follow on damages and whether a permanent

injunction will be approved that would remove the rival drug from

the market. Sanofi's ADRs fell 1% to $40.76.

The U.S. consumer unit of Banco Santander SA (SAN, SAN.MC) said

it has again missed the deadline to file its annual report after

regulators raised questions about how it provisions for loans. The

second delay in the publishing of Santander Consumer's 2015 annual

accounts escalates the problems facing Santander Executive Chairman

Ana Botin in the U.S. Ms. Botin has appointed new executives in the

U.S. and stepped up meeting with regulators to try to shape up the

Spanish-lender's U.S. operations. ADRs fell 1.1% to $4.71.

Write to Tess Stynes at tess.stynes@wsj.com

(END) Dow Jones Newswires

March 16, 2016 17:50 ET (21:50 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

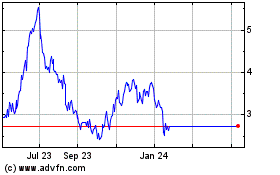

Gol Linhas Aereas Inteli... (NYSE:GOL)

Historical Stock Chart

From Mar 2024 to Apr 2024

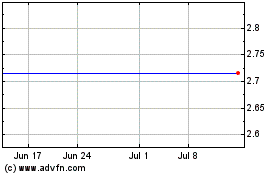

Gol Linhas Aereas Inteli... (NYSE:GOL)

Historical Stock Chart

From Apr 2023 to Apr 2024