ADP Private Payrolls Rise a More-than-Expected 172,000 in June -- 2nd Update

July 07 2016 - 10:19AM

Dow Jones News

By Lisa Beilfuss

Private payrolls in June rose at the best clip in three months,

suggesting many U.S. firms continue to create jobs at a healthy

pace and alleviating some concerns over May's marked slowdown.

Private firms across the U.S. added 172,000 workers to their

ranks last month, according to payroll processor Automatic Data

Processing Inc. and forecasting firm Moody's Analytics. Economists

surveyed by The Wall Street Journal expected an increase of

151,000.

May's gain, initially reported at 173,000, was revised down

slightly to 168,000.

"Job growth revived last month from its spring slump," said Mark

Zandi, chief economist of Moody's Analytics. The employment market

remains healthy outside of the struggling energy and manufacturing

sectors, "and Brexit won't help," but small- and mid-sized

companies are hiring at a solid pace, he said.

U.S. job growth has slowed in recent months, with the

government's May employment report showing considerably weaker

growth in payrolls than had been expected and previous months'

gains revised down, the Federal Reserve said in its June meeting

minutes released Wednesday. While a strike at Verizon

Communications Inc. dragged down May's payroll figure, weakness was

broad-based with construction companies, manufacturers and miners

together cutting 36,000 jobs, temporary head counts dropping by

21,000 and service providers significantly slowing hiring.

ADP's May report didn't similarly reflect significantly softer

hiring, partly because of its methodology. The report is based on

data collected from ADP clients in addition to lagged government

figures -- it doesn't aim to replicate the nonfarm payrolls survey

-- and it didn't include the Verizon strike or adjust for it. Some

other job market indicators, such as the number of Americans filing

for unemployment benefits and those quitting their jobs, have

continued to suggest a healthy labor market. Separately Thursday

morning, the Labor Department said jobless claims dropped last

week.

Service providers and small businesses continued to drive the

June payroll gains, according to ADP, offsetting intensifying job

losses across the manufacturing sector.

Service-sector firms, home to most U.S. jobs and reflective of

domestic demand, grew payrolls by 208,000 last month, up 35,000

from May. Meanwhile, factory head counts fell 21,000 -- marking the

fifth straight month of declining jobs in the sector and the

biggest monthly decline since early 2010. While manufacturing

conditions have stabilized in recent months, headwinds remain and

factory owners remain reluctant to hire. Construction jobs,

meanwhile, fell in June for the first time in 5 1/2 years.

America's smallest companies -- those with fewer than 50

employees -- picked up their pace of hiring last month to 95,000

workers, up from 84,000 in May and far outpacing payroll gains at

bigger businesses that continue to grapple with weaker

international demand, uncertainty over the Brexit fallout and a

strong U.S. dollar that hurts exports.

The June ADP report comes a day before the Bureau of Labor

Statistic's employment situation report. Economists polled by The

Wall Street Journal expect nonfarm payrolls to have risen 165,000

last month, up from 38,000 in May. The unemployment rate is

expected to tick up to 4.8% from 4.7%, where it unexpectedly fell

because of sharp labor market shrinkage.

Many economists say the better-than-expected ADP result doesn't

affect their nonfarm payroll forecasts for tomorrow's report,

pointing to frequent divergence between the two numbers. "We've

seen recent ADP overshoots of 148,000 in May, 26,000 in April and

33,000 in March, after undershoots of as much as 122,000 in four of

the prior five months," said Michael Englund, chief economist at

Action Economics.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

(END) Dow Jones Newswires

July 07, 2016 10:04 ET (14:04 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

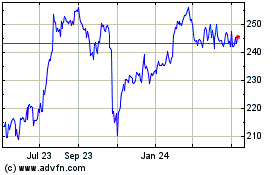

Automatic Data Processing (NASDAQ:ADP)

Historical Stock Chart

From Mar 2024 to Apr 2024

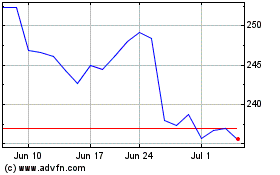

Automatic Data Processing (NASDAQ:ADP)

Historical Stock Chart

From Apr 2023 to Apr 2024