ADP Lowers 2017 Outlook as Bookings Fall

February 01 2017 - 10:44AM

Dow Jones News

By Imani Moise

Automatic Data Processing Inc.'s earnings rose in the most

recent quarter despite a slowdown in new bookings.

The payroll company lowered its 2017 outlook, forecasting

revenue growth of about 6% compared with prior guidance of 7% to 8%

growth.

Additionally, the company expects new bookings to be about flat

compared with its previous forecast of 4% to 6% growth.

New business bookings declined 5% year-over-year amid customer

uncertainty over U.S. elections, the company said. Chief Financial

Officer Jan Siegmund said the booking pressure should subside as

the year progresses.

Employer services revenue increased 4% and the number of

employees on client's payrolls increased 2.3% on a comparable

basis.

In all for the fiscal second quarter, ADP reported a profit of

$510.9 million, or $1.13 a share, up from $341.4 million, or 74

cents, a year earlier. Excluding certain items, earnings rose to 87

cents a share from 72 cents a share.

Revenue grew 6.4% to $2.99 billion.

Analysts polled by Thomson Reuters had forecast earnings of 81

cents on $3.02 billion in revenue.

Last month, ADP completed the acquisition of human relations

company The Marcus Buckingham Co. for approximately $70

million.

Shares fell 5.2% to $95.70 during early trading Wednesday but

are up 10% over the past three months.

Write to Imani Moise at imani.moise@wsj.com

(END) Dow Jones Newswires

February 01, 2017 10:29 ET (15:29 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

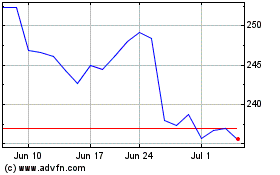

Automatic Data Processing (NASDAQ:ADP)

Historical Stock Chart

From Mar 2024 to Apr 2024

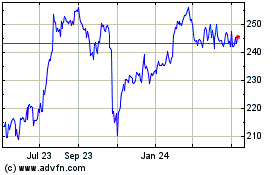

Automatic Data Processing (NASDAQ:ADP)

Historical Stock Chart

From Apr 2023 to Apr 2024