ACM Research Announces Pricing of Initial Public Offering

November 03 2017 - 8:00AM

ACM Research, Inc. announced today the pricing of its initial

public offering of 2,000,000 shares of its Class A common stock at

a price to the public of $5.60 per share, before underwriting

discounts and commissions. The shares are expected to begin trading

on The Nasdaq Global Market Stock Exchange on November 3, 2017

under the symbol “ACMR.” In addition, ACM Research has granted the

underwriters a 30-day option to purchase up to 300,000 additional

shares of Class A common stock at the initial public offering

price, less underwriting discounts and commissions.

Roth Capital Partners is acting as sole book-running manager for

the offering. Craig-Hallum Capital Group and The Benchmark Company

are acting as co-managers for the offering.

A registration statement relating to and describing the terms of

the offering was declared effective by the U.S. Securities and

Exchange Commission on November 2, 2017. The offering is being made

only by means of a prospectus. Copies of the final prospectus

related to the offering, when available, may be obtained from Roth

Capital Partners, Attn: Prospectus Department, 888 San Clemente

Drive, Suite 400, Newport Beach, California 92660, telephone:

1-800-678-9147 or by accessing the SEC’s website, www.sec.gov.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy these securities, nor shall there

be any sale of these securities in any state or jurisdiction in

which such an offer, solicitation or sale would be unlawful prior

to registration or qualification under the securities laws of any

such state or jurisdiction.

About ACM Research, Inc.

ACM Research Inc. develops, manufactures and sells single-wafer

wet cleaning equipment, which semiconductor manufacturers can use

in numerous manufacturing steps to remove particles, contaminants

and other random defects, and thereby improve product yield, in

fabricating advanced integrated circuits.

Forward-Looking Statements

This press release includes certain disclosures which contain

“forward-looking statements,” including, without limitation,

statements regarding the anticipated timing of completion of the

offering. You can identify forward-looking statements because they

contain words such as “believes” and “expects.” Forward-looking

statements are based on ACM’s current expectations and assumptions.

Because forward-looking statements relate to the future, they are

subject to inherent uncertainties, risks and changes in

circumstances that may differ materially from those contemplated by

the forward-looking statements, which are neither statements of

historical fact nor guarantees or assurances of future performance.

Important factors that could cause actual results to differ

materially from those in the forward-looking statements are set

forth in ACM’s filings with the Securities and Exchange Commission,

including its registration statement on Form S-1, as amended from

time to time, under the caption “Risk Factors.”

For investor and media inquiries, please

contact:

In the United States:

The Blueshirt GroupMr. Ralph Fong+1 (415)

489-2195ralph@blueshirtgroup.com

In China:

The Blueshirt Group AsiaMr. Gary Dvorchak, CFA+86 (138)

1079-1480gary@blueshirtgroup.com

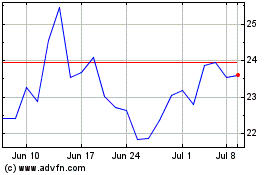

ACM Research (NASDAQ:ACMR)

Historical Stock Chart

From Mar 2024 to Apr 2024

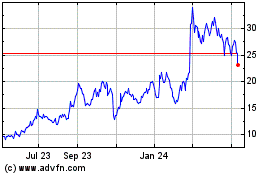

ACM Research (NASDAQ:ACMR)

Historical Stock Chart

From Apr 2023 to Apr 2024