– Third Quarter Net Sales Grew to $35.6

Million

– Company Raises Annual 2017 Net Sales Guidance

to Between $124 Million and $127 Million

ACADIA Pharmaceuticals Inc. (NASDAQ: ACAD), a biopharmaceutical

company focused on the development and commercialization of

innovative medicines to address unmet medical needs in central

nervous system (CNS) disorders, today announced its unaudited

financial results for the third quarter ended September 30,

2017.

“Our results this quarter reflect strong growth for NUPLAZID for

Parkinson’s disease psychosis,” said Steve Davis, ACADIA’s

President and Chief Executive Officer. “We also recently advanced

our clinical portfolio with the initiation of our Phase III study

of pimavanserin for dementia-related psychosis and were pleased to

receive FDA Breakthrough Therapy Designation for this program. If

this study is successful, we believe pimavanserin will provide an

important benefit to patients with dementia-related psychosis who

currently have no FDA-approved treatments available to them.”

Recent Highlights

- Initiated pivotal Phase III HARMONY

Study with pimavanserin in dementia-related psychosis in October

2017.

- FDA granted Breakthrough Therapy

Designation to pimavanserin for the treatment of dementia-related

psychosis in October 2017. This is the second Breakthrough Therapy

Designation for pimavanserin.

- Presented Phase II data with

pimavanserin in Alzheimer’s disease psychosis at the Symposium,

“The Importance of Serotonin in Alzheimer’s Disease Psychosis and

the Role of Pimavanserin,” at the Clinical Trials on Alzheimer’s

Disease (CTAD) meeting in Boston in November 2017.

- In addition to dementia-related

psychosis, ACADIA continues to advance its broad clinical

development program with ongoing studies in schizophrenia

inadequate response, schizophrenia negative symptoms, and major

depressive disorder.

Financial Results

Revenue

Net product sales of NUPLAZID, which was first made available

for prescription starting in May 2016, were $35.6 million for the

three months ended September 30, 2017 compared to $5.3 million for

the three months ended September 30, 2016. For the nine months

ended September 30, 2017 and 2016, ACADIA reported NUPLAZID net

product sales of $81.3 million and $5.4 million, respectively.

Research and Development

Research and development expenses for the three months ended

September 30, 2017 were $36.4 million, compared to $25.8 million

for the same period of 2016. For the nine months ended September

30, 2017 and 2016, research and development expenses were $106.0

million and $69.1 million, respectively. The increase in research

and development expenses during the 2017 periods as compared to

2016 was primarily due to increased clinical costs related to the

clinical studies initiated in the fourth quarter of each of 2016

and 2017. The company also incurred additional personnel and

related costs associated with its expanded research and development

organization during 2017 as compared to 2016.

Selling, General and Administrative

Selling, general and administrative expenses for the three

months ended September 30, 2017 were $62.3 million, compared to

$50.5 million for the same period of 2016. For the nine months

ended September 30, 2017 and 2016, selling, general and

administrative expenses were $189.5 million and $128.8 million,

respectively. The increase in selling, general and administrative

expenses during the 2017 periods as compared to 2016 was primarily

due to costs incurred to support ACADIA’s commercial activities for

NUPLAZID, including additional personnel and related costs and due

to increased charitable contributions.

Net Loss

For the three months ended September 30, 2017, ACADIA reported a

net loss of $65.2 million, or $0.53 per common share, compared to a

net loss of $71.6 million, or $0.61 per common share, for the same

period in 2016. The net losses for the three months ended September

30, 2017 and 2016 included $19.7 million and $14.0

million, respectively, of non-cash stock-based compensation

expense. For the nine months ended September 30, 2017, ACADIA

reported a net loss of $220.5 million, or $1.81 per common share,

compared to a net loss of $192.7 million, or $1.69 per common

share, for the same period in 2016. The net losses for the nine

months ended September 30, 2017 and 2016 included $53.5

million and $39.8 million, respectively, of non-cash

stock-based compensation expense.

Cash and Investments

At September 30, 2017, ACADIA’s cash, cash equivalents and

investment securities totaled $366.6 million, compared to $529.0

million at December 31, 2016.

2017 Financial Guidance

ACADIA is increasing its revenue guidance and now expects that

full-year NUPLAZID net sales for 2017 will be between $124 million

and $127 million.

Pro Forma Reconciliation of Sell-Through to Sell-In

Method

In the second quarter of 2017 the company began to recognize

revenue at the point of sale to its specialty pharmacy and

specialty distributor partners, commonly referred to as the

“sell-in” revenue recognition method. Previously, ACADIA had

deferred the recognition of revenue until it obtained evidence that

its specialty partners had dispensed the product to a patient or

had sold the product to a government facility, long-term care

pharmacy or in-patient hospital pharmacy, commonly referred to as

the “sell-through” revenue recognition method. As a result of this

change, ACADIA recorded a one-time adjustment of $3.6 million in

the second quarter of 2017 to record revenue that had previously

been deferred as of March 31, 2017. For comparison purposes, the

following table presents NUPLAZID’s pro forma quarterly net product

sales under the sell-in method for the three months ended March 31

and June 30, 2017, respectively, if ACADIA had been able to

reasonably estimate its allowances for rebates and chargebacks from

the time of launch in May 2016. Net sales for the three months

ended September 30, 2017, as recorded under the sell-in method, are

also presented.

(in millions) March 31,

June 30, September 30,

2017 2017 2017 NUPLAZID net sales, as

reported1 $ 15.3 $ 30.5 $ 35.6 Difference2 1.5 (3.6 )

- NUPLAZID net sales, sell-in method3 $ 16.8 $ 26.9 $ 35.6

1 Represents the net sales, as reported, for the periods

presented, including the three months ended March 31, 2017

utilizing the sell-through revenue recognition method and the three

months ended June 30, 2017 utilizing the sell-in revenue

recognition method together with one-time recognition of previously

deferred revenue as a result of the impact of the transition to the

sell-in method during the three months ended June 30, 2017.

2 Represents the impact of recognizing the deferred revenue at

period-end, net of allowances for rebates and chargebacks, had the

sales been recognized in the quarter which the product was

delivered to the specialty pharmacies and distributors.

3 Represents pro forma results for the

three months ended March 31 and June 30, 2017. Results for the

three months ended September 30, 2017 are as reported.

Conference Call and Webcast Information

ACADIA management will review its third quarter financial

results and operations via conference call and webcast later today

at 5:00 p.m. Eastern Time. The conference call may be accessed by

dialing 844-821-1109 for participants in the U.S. or Canada and

830-865-2550 for international callers (reference passcode

8898709). A telephone replay of the conference call may be accessed

through November 21, 2017 by dialing 855-859-2056 for callers in

the U.S. or Canada and 404-537-3406 for international callers

(reference passcode 8898709). The conference call also will be

webcast live on ACADIA’s website, www.acadia-pharm.com, under the

investors section and will be archived there through November 21,

2017.

About NUPLAZID® (pimavanserin)

NUPLAZID is the first and only FDA-approved treatment for

hallucinations and delusions associated with Parkinson's disease

(PD) Psychosis. NUPLAZID is a non-dopaminergic, selective serotonin

inverse agonist preferentially targeting 5-HT2A receptors that are

thought to play an important role in PD Psychosis. NUPLAZID is an

oral medicine taken once a day with a recommended dose of 34 mg

(two 17-mg tablets). ACADIA discovered this new chemical entity and

holds worldwide rights to develop and commercialize NUPLAZID.

About ACADIA Pharmaceuticals

ACADIA is a biopharmaceutical company focused on the development

and commercialization of innovative medicines to address unmet

medical needs in central nervous system disorders. ACADIA maintains

a website at www.acadia-pharm.com to which we regularly post copies

of our press releases as well as additional information and through

which interested parties can subscribe to receive e-mail

alerts.

Forward-Looking Statements

Statements in this press release that are not strictly

historical in nature are forward-looking statements. These

statements include but are not limited to statements related to

guidance for full-year 2017 NUPLAZID net sales; the benefits to be

derived from NUPLAZID (pimavanserin); and whether NUPLAZID will

provide an important benefit to patients with dementia-related

psychosis. These statements are only predictions based on current

information and expectations and involve a number of risks and

uncertainties. Actual events or results may differ materially from

those projected in any of such statements due to various factors,

including the uncertainty of future commercial sales and related

items that would impact net sales for 2017, the risks and

uncertainties inherent in drug discovery, development, approval and

commercialization, and the fact that past results of clinical

trials may not be indicative of future trial results. For a

discussion of these and other factors, please refer to ACADIA’s

annual report on Form 10-K for the year ended December 31, 2016 as

well as ACADIA’s subsequent filings with the Securities and

Exchange Commission. You are cautioned not to place undue reliance

on these forward-looking statements, which speak only as of the

date hereof. This caution is made under the safe harbor provisions

of the Private Securities Litigation Reform Act of 1995. All

forward-looking statements are qualified in their entirety by this

cautionary statement and ACADIA undertakes no obligation to revise

or update this press release to reflect events or circumstances

after the date hereof, except as required by law.

ACADIA PHARMACEUTICALS INC.

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

(in thousands, except per share

amounts)

(Unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2017 2016 2017

2016 Revenues Product sales, net $ 35,578 $ 5,268 $

81,339 $ 5,365 Collaborative revenue — — —

4 Total revenues 35,578 5,268 81,339 5,369

Operating

expenses Cost of product sales 2,135 845 6,622 1,371 License

fees and royalties 1,078 475 2,735 723 Research and development

36,421 25,813 106,010 69,066 Selling, general and administrative

62,255 50,534 189,523 128,793 Total

operating expenses 101,889 77,667 304,890

199,953 Loss from operations (66,311 ) (72,399 ) (223,551 )

(194,584 ) Interest income, net 1,063 786

3,019 1,887 Net loss $ (65,248 ) $ (71,613 ) $ (220,532 ) $

(192,697 ) Net loss per common share, basic and diluted $ (0.53 ) $

(0.61 ) $ (1.81 ) $ (1.69 ) Weighted average common shares

outstanding, basic and diluted 122,484 117,497

122,089 114,063

ACADIA PHARMACEUTICALS INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands)

September 30,

2017

December 31,

2016

(unaudited)

Assets Cash, cash equivalents and investment

securities $ 366,625 $ 529,036 Accounts receivable, net 14,221

5,903 Interest and other receivables 1,033 1,237 Inventory 5,536

4,175 Prepaid expenses 14,557 7,546 Total current assets 401,972

547,897 Property and equipment, net 2,991 3,081 Intangible assets,

net 5,907 7,015 Restricted cash 2,475 2,375 Other assets

369 785 Total assets $ 413,714 $ 561,153

Liabilities and stockholders’ equity Accounts payable $

2,962 $ 3,912 Accrued liabilities 33,181 36,029 Deferred revenue —

2,644 Total current liabilities 36,143 42,585 Long-term liabilities

245 157 Total liabilities 36,388 42,742 Total stockholders’ equity

377,326 518,411 Total liabilities and

stockholders’ equity $ 413,714 $ 561,153

Important Safety Information and

Indication for NUPLAZID (pimavanserin) tablets

WARNING: INCREASED MORTALITY IN ELDERLY PATIENTS WITH

DEMENTIA-RELATED PSYCHOSIS

Elderly patients with dementia-related psychosis treated with

antipsychotic drugs are at an increased risk of death. NUPLAZID is

not approved for the treatment of patients with dementia-related

psychosis unrelated to the hallucinations and delusions associated

with Parkinson’s disease psychosis.

NUPLAZID is an atypical antipsychotic indicated for the

treatment of hallucinations and delusions associated with

Parkinson’s disease psychosis.

Contraindication: NUPLAZID is contraindicated in patients with a

history of a hypersensitivity reaction to pimavanserin or any of

its components. Rash, urticaria, and reactions consistent with

angioedema (e.g., tongue swelling, circumoral edema, throat

tightness, and dyspnea) have been reported.

QT Interval Prolongation: NUPLAZID prolongs the QT interval. The

use of NUPLAZID should be avoided in patients with known QT

prolongation or in combination with other drugs known to prolong QT

interval including Class 1A antiarrhythmics or Class 3

antiarrhythmics, certain antipsychotic medications, and certain

antibiotics. NUPLAZID should also be avoided in patients with a

history of cardiac arrhythmias, as well as other circumstances that

may increase the risk of the occurrence of torsade de pointes

and/or sudden death, including symptomatic bradycardia, hypokalemia

or hypomagnesemia, and presence of congenital prolongation of the

QT interval.

Adverse Reactions: The most common adverse reactions (≥2% for

NUPLAZID and greater than placebo) were peripheral edema (7% vs

2%), nausea (7% vs 4%), confusional state (6% vs 3%), hallucination

(5% vs 3%), constipation (4% vs 3%), and gait disturbance (2% vs

<1%).

Drug Interactions: Strong CYP3A4 inhibitors (eg, ketoconazole)

increase NUPLAZID concentrations. Reduce the NUPLAZID dose by

one-half. Strong CYP3A4 inducers may reduce NUPLAZID exposure,

monitor for reduced efficacy. Increase in NUPLAZID dosage may be

needed.

Renal Impairment: No dosage adjustment for NUPLAZID is needed in

patients with mild to moderate renal impairment. Use of NUPLAZID is

not recommended in patients with severe renal impairment.

Hepatic Impairment: Use of NUPLAZID is not recommended in

patients with hepatic impairment. NUPLAZID has not been evaluated

in this patient population.

Pregnancy: Use of NUPLAZID in pregnant women has not been

evaluated and should therefore be used in pregnancy only if the

potential benefit justifies the potential risk to the mother and

fetus.

Pediatric Use: Safety and efficacy have not been established in

pediatric patients.

Dosage and Administration: Recommended dose: 34 mg per day,

taken orally as two 17-mg tablets once daily, without

titration.

For additional Important Safety Information, including boxed

warning, please see the full Prescribing Information for NUPLAZID

at

https://www.nuplazid.com/pdf/NUPLAZID_Prescribing_Information.pdf.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171107006591/en/

Investor Contact:ACADIA Pharmaceuticals Inc.Lisa Barthelemy(858)

558-2871ir@acadia-pharm.comorMedia Contact:Taft CommunicationsBob

Laverty(609) 558-5570bob@taftcommunications.com

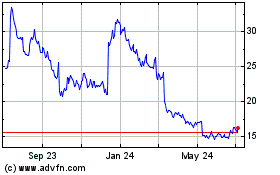

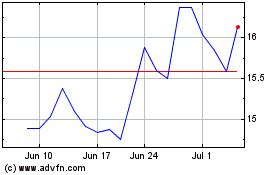

Acadia Pharmaceuticals (NASDAQ:ACAD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Acadia Pharmaceuticals (NASDAQ:ACAD)

Historical Stock Chart

From Apr 2023 to Apr 2024