New Albany, Ohio,

November 20, 2015: Abercrombie & Fitch Co.

(NYSE: ANF) today reported GAAP net income per diluted share of

$0.60 for the thirteen weeks ended October 31, 2015, compared to

GAAP net income per diluted share of $0.25 for the thirteen weeks

ended November 1, 2014.

Excluding certain items, the

company reported adjusted non-GAAP net income per diluted share of

$0.48 for the third quarter, compared to adjusted non-GAAP net

income per diluted share of $0.42 for the third quarter last

year. Adjusted non-GAAP net income per diluted share included

year-over-year adverse effects from changes in foreign currency

exchange rates of approximately $0.13.

Both GAAP and non-GAAP net income

per diluted share for the quarter reflect benefits related to a

change in the estimated annual effective tax rate. In

addition, GAAP and non-GAAP net income per diluted share for the

quarter include discrete tax benefits of approximately $0.14 and

$0.11, respectively.

A reconciliation of GAAP financial

measures to non-GAAP financial measures is included in a schedule

accompanying the consolidated financial statements with this

release.

Arthur Martinez, Executive

Chairman, said:

"Our third quarter results

exceeded our expectations coming into the quarter and provide the

strongest validation yet that our initiatives are working. We

have seen positive customer response to the actions we have been

taking on a number of fronts. We saw continued sequential

improvement in comparable sales, led by positive comparable sales

for our Hollister brand and across our international

business. Our gross margin rate increased substantially

year-over-year, as promotional frequency and intensity were

moderated. Expense management remains aggressive. As a

result, adjusted operating income improved meaningfully on a

constant currency basis. Inventories remain well

controlled.

We recognize that we still have

much to achieve. We remain intensely focused on our strategic

initiatives and evolving our brands' positioning and assortments,

as well as improving our customer's experience.

As we look ahead in the fourth

quarter, there are mixed signals in the sector and we remain

cautious; however, we are confident that the work we are doing is

laying the foundation for long-term profitability and growth."

Third Quarter Sales

Results

Net sales for the third quarter,

at $878.6 million, were approximately flat on a constant currency

basis, but down 4% on a reported basis over the same period a year

ago.

Comparable sales for the third

quarter decreased 1%. On a sequential basis, comparable sales

trends improved across all brands and geographies.

| Fiscal 2015 Comparable

Sales Summary (1) |

| Brand |

|

Geography |

|

|

|

First Quarter |

|

Second Quarter |

|

Third Quarter |

|

Year-to-Date |

|

|

|

First Quarter |

|

Second Quarter |

|

Third Quarter |

|

Year-to-Date |

|

Abercrombie(2) |

|

(9)% |

|

(7)% |

|

(5)% |

|

(7)% |

|

United

States |

|

(7)% |

|

(4)% |

|

(3)% |

|

(5)% |

|

Hollister |

|

(6)% |

|

(1)% |

|

3% |

|

(2)% |

|

International |

|

(9)% |

|

(4)% |

|

1% |

|

(4)% |

| Total

Company |

|

(8)% |

|

(4)% |

|

(1)% |

|

(4)% |

|

Total

Company |

|

(8)% |

|

(4)% |

|

(1)% |

|

(4)% |

(1) Comparable

sales are calculated on a constant currency basis.

(2) Abercrombie

includes the Abercrombie & Fitch and abercrombie kids

brands.

By brand, net sales for the third

quarter decreased 6% to $411.3 million for Abercrombie and were

approximately flat at $467.3 million for Hollister.

By geography, net sales for the

third quarter decreased 4% to $572.7 million in the U.S. and

decreased 3% to $305.8 million internationally.

Direct-to-consumer and omnichannel

sales comprised approximately 21% of total company net sales for

the quarter and grew in both the U.S. and internationally on a

constant currency basis over last year.

Additional Third

Quarter Results Commentary

The gross profit rate for the

third quarter was 63.7%. Excluding certain items, the

adjusted gross profit rate for the third quarter was 63.4%,

reflecting an improvement of 120 basis points on a reported basis

and 210 basis points on a constant currency basis over last year,

primarily due to higher average unit retails coupled with lower

average unit cost. Adjusted gross profit for the quarter

excluded a benefit of $2.6 million related to higher than expected

recoveries on the first quarter inventory write-down.

Stores and distribution expense

for the third quarter was $392.9 million, down from $413.6 million

last year. Excluding certain items, adjusted stores and

distribution expense decreased $18.8 million, primarily due to

benefits from changes in foreign currency exchange rates, as well

as expense reduction efforts, partially offset by higher

direct-to-consumer expense. Adjusted stores and distribution

expense for the quarter excluded $0.6 million of charges related to

accelerated depreciation and disposal costs from the discontinued

use of certain store fixtures, compared to $2.4 million of excluded

charges last year related to lease termination, store closure costs

and the company's profit improvement initiative.

Marketing, general and

administrative expense for the third quarter was $117.7 million, up

from $105.0 million last year, primarily due to higher compensation

related expense.

The company incurred asset

impairment charges in the third quarter of $12.1 million, compared

to $16.7 million last year, which were excluded from adjusted

results.

Net other operating income for the

third quarter was $3.9 million, which included $2.1 million of

insurance reimbursements, compared to $1.5 million last year.

The effective tax rate for the

third quarter was a benefit of 16%. Excluding certain items,

the adjusted effective tax rate for the quarter was an expense of

28%. Both the effective tax rate and the adjusted effective

tax rate reflect benefits related to a change in the estimated

annual effective tax rate. In addition, the effective tax

rate and the adjusted effective tax rate reflect discrete benefits

of $9.7 million and $7.7 million, respectively, related to a

release of a valuation allowance and other discrete tax items.

On a full year basis, the company expects the

adjusted effective tax rate to be in the mid-to-upper 30s,

including the discrete benefits noted above.

During the third quarter, the

company repurchased approximately 2.5 million shares of its common

stock at an aggregate cost of $50 million. As of October 31,

2015, the company had approximately 6.5 million shares remaining

available for purchase under its publicly announced stock

repurchase authorizations.

The company ended the quarter with

$405.6 million in cash and cash equivalents, and gross borrowings

under the company's term loan agreement of $297.0 million, compared

to $320.6 million in cash and cash equivalents and $300.0 million

in borrowings last year.

The company ended the quarter with

$601.5 million in inventory, a decrease of 3% versus last year,

which included a significant increase in inventory in-transit due

to a floorset shift. Excluding in-transit, inventory was down

10%.

During the quarter, the company

opened 13 new stores and closed two stores.

Other

Developments

On November 18, 2015, the Board of

Directors declared a quarterly cash dividend of $0.20 per share on

the Class A Common Stock of Abercrombie & Fitch Co., payable on

December 9, 2015 to stockholders of record at the close of business

on December 1, 2015.

Outlook

For the fourth quarter of fiscal

2015, the company expects:

-

Comparable sales to be approximately

flat.

-

Continued adverse effects from foreign currency

exchange rates.

-

Gross margin rate to be approximately flat to

last year on a constant currency basis.

-

Operating expense to be approximately flat to

last year after absorbing a provision for the restoration of

incentive compensation.

-

A weighted average diluted share count of

approximately 68 million shares, excluding effects of potential

share buybacks.

On a full year basis, the company

expects the adjusted effective tax rate to be in the mid-to-upper

30s, including discrete benefits relating to the release of a

valuation allowance and other discrete tax items recognized through

the third quarter. On a go-forward basis, the company expects

the annual effective tax rate to be in the upper 30s.

The company expects capital

expenditures of approximately $150 million for the full year.

In addition to the 23 new stores

opened year-to-date, the company expects to open eight new stores

in the fourth quarter, including six international stores and two

North American stores. In addition, the company anticipates

closing approximately 60 stores in the U.S. during the fiscal year

through natural lease expirations.

Excluded from the company's

outlook for the remainder of fiscal year 2015 are potential charges

related to impairments and store closings and other potential

charges related to its restructuring efforts and related tax

effects.

An investor presentation of third

quarter results will be available in the "Investors" section of the

company's website at www.abercrombie.com at approximately 8:00 AM,

Eastern Daylight Time, today.

About Abercrombie

& Fitch Co.

Abercrombie &

Fitch Co. is a leading global specialty retailer of high-quality,

casual apparel for Men, Women and kids with an active, youthful

lifestyle under its Abercrombie & Fitch, abercrombie kids and

Hollister Co. brands. At the end of the third quarter, the

company operated 790 stores in the United States and 175 stores

across Canada, Europe, Asia and the Middle East. The company also

operates e-commerce websites at www.abercrombie.com,

www.abercrombiekids.com and www.hollisterco.com.

Today at 8:30 AM,

Eastern Standard Time, the company will conduct a conference

call. Management will discuss the company's performance and

its plans for the future and will accept questions from

participants. To listen to the conference call, dial (877) 856-1968

and ask for the Abercrombie & Fitch Quarterly Call or go to

www.abercrombie.com. The international call-in number is

(719) 325-4826. This call will be recorded and made available

by dialing the replay number (888) 203-1112 or the international

number (719) 457-0820 followed by the conference ID number 8013718

or through www.abercrombie.com.

|

Investor Contact: |

|

Media

Contact: |

|

|

|

|

| Brian

Logan |

|

Michael Scheiner |

|

Abercrombie & Fitch |

|

Abercrombie & Fitch |

| (614)

283-6877 |

|

(614)

283-6192 |

|

Investor_Relations@abercrombie.com |

|

Public_Relations@abercrombie.com |

SAFE HARBOR STATEMENT UNDER THE

PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

A&F cautions that any

forward-looking statements (as such term is defined in the Private

Securities Litigation Reform Act of 1995) contained in this Press

Release or made by management or spokespeople of A&F involve

risks and uncertainties and are subject to change based on various

important factors, many of which may be beyond the company's

control. Words such as "estimate," "project," "plan," "believe,"

"expect," "anticipate," "intend," and similar expressions may

identify forward-looking statements. Except as may be required by

applicable law, we assume no obligation to publicly update or

revise our forward-looking statements. The following factors, in

addition to those included in the disclosure under the heading

"FORWARD-LOOKING STATEMENTS AND RISK FACTORS" in "ITEM 1A. RISK

FACTORS" of A&F's Annual Report on Form 10-K for the fiscal

year ended January 31, 2015, in some cases have affected, and in

the future could affect, the company's financial performance and

could cause actual results for fiscal 2015 and beyond to differ

materially from those expressed or implied in any of the

forward-looking statements included in this Press Release or

otherwise made by management: changes in global economic and

financial conditions, and the resulting impact on consumer

confidence and consumer spending, as well as other changes in

consumer discretionary spending habits, could have a material

adverse effect on our business, results of operations and

liquidity; the inability to manage our inventory commensurate with

customer demand and changing fashion trends could adversely impact

our sales levels and profitability; fluctuations in the cost,

availability and quality of raw materials, labor and

transportation, could cause manufacturing delays and increase our

costs; we are currently involved in a selection process for a new

Chief Executive Officer and if this selection process is delayed

our business could be negatively impacted; failure to realize the

anticipated benefits of our recent transition to a brand-based

organizational model could have a negative impact on our business;

a significant component of our growth strategy is international

expansion, which requires significant capital investment, the

success of which is dependent on a number of factors that could

delay or prevent the profitability of our international operations;

direct-to-consumer sales channels are a focus of our growth

strategy, and the failure to successfully develop our position in

these channels could have an adverse impact on our results of

operations; our inability to successfully implement our strategic

plans, including our restructuring efforts, could have a negative

impact on our growth and profitability; fluctuations in foreign

currency exchange rates could adversely impact our financial

condition and results of operations; our business could suffer if

our information technology systems are disrupted or cease to

operate effectively; we may be exposed to risks and costs

associated with cyber-attacks, credit card fraud and identity theft

that would cause us to incur unexpected expenses and loss of

revenues; our market share may be negatively impacted by increasing

competition and pricing pressures from companies with brands or

merchandise competitive with ours; our ability to attract customers

to our stores depends, in part, on the success of the shopping

malls or area attractions in which most of our stores are located;

our failure to protect our reputation could have a material adverse

effect on our brands; we rely on the experience and skills of our

senior executive officers, the loss of whom could have a material

adverse effect on our business; we depend upon independent third

parties for the manufacture and delivery of all our merchandise, a

disruption of which could result in lost sales and could increase

our costs; our reliance on two distribution centers domestically

and third-party distribution centers internationally makes us

susceptible to disruptions or adverse conditions affecting our

distribution centers; we may be exposed to liabilities under the

Foreign Corrupt Practices Act, and any determination that we

violated the Foreign Corrupt Practices Act could have a material

adverse effect on our business; in a number of our European stores,

associates are represented by workers' councils and unions, whose

demands could adversely affect our profitability or operating

standards for our brands; our facilities, systems and stores, as

well as the facilities and systems of our vendors and

manufacturers, are vulnerable to natural disasters, pandemic

disease and other unexpected events, any of which could result in

an interruption to our business and adversely affect our operating

results; our litigation and regulatory compliance exposure could

have a material adverse effect on our financial condition and

results of operations; our inability or failure to adequately

protect our trademarks could have a negative impact on our brand

image and limit our ability to penetrate new markets; fluctuations

in our tax obligations and effective tax rate may result in

volatility in our operating results; extreme weather conditions and

the seasonal nature of our business may cause net sales to

fluctuate and negatively impact our results of operations; the

impact of war or acts of terrorism could have a material adverse

effect on our operating results and financial condition; changes in

and compliance with the regulatory or compliance landscape could

adversely affect our business and results of operations; our

Asset-Based Revolving Credit Agreement and our Term Loan Agreement

include restrictive covenants that limit our flexibility in

operating our business; and, compliance with changing regulations

and standards for accounting, corporate governance and public

disclosure could adversely affect our business, results of

operations and reported financial results.

Q3 2015 ER Financial Statements

FINAL

This

announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Abercrombie & Fitch Co via Globenewswire

HUG#1968230

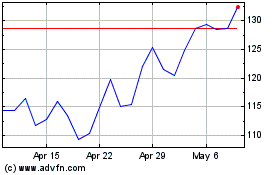

Abercrombie and Fitch (NYSE:ANF)

Historical Stock Chart

From Mar 2024 to Apr 2024

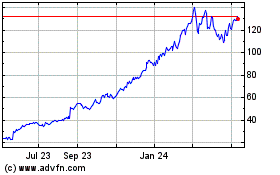

Abercrombie and Fitch (NYSE:ANF)

Historical Stock Chart

From Apr 2023 to Apr 2024