AB InBev Struggles to Put Fizz Back Into Bud Light -- 3rd Update

May 04 2017 - 10:33AM

Dow Jones News

By Nick Kostov

The King of Beers hasn't found a fix yet for Bud Light.

Anheuser-Busch InBev NV reported surging profit thanks to last

year's integration of rival beer giant SABMiller, but its

best-selling Bud Light continues to hemorrhage market share in the

U.S., underscoring the challenge the company faces turning the

brand around.

The company is in the middle of a high-stakes revamp of Bud

Light, including a U.S. marketing campaign, "Famous Among Friends,"

which it launched earlier this year. The move is aimed at putting

some fizz back in the brand. It continues to outsell every other

beer by a wide margin in the U.S., but has suffered years of

falling market share at the hands of Mexican lagers and the craft

beer craze.

Elsewhere, the world's largest brewer reported Thursday a

rebound in its second biggest market, Brazil, cheering investors.

Shares in Belgium-based AB InBev were up almost 4% in early

afternoon trading in Europe.

Apart from the integration of SAB, the company's biggest focus

remains improving the fortunes of Bud Light. AB InBev said Thursday

that the brand's U.S. market share for the quarter ended March 31

fell almost two-thirds of a percentage point.

It remains America's favorite beer by sales, but the drop

continues years of declines. In 2010, Bud Light commanded a 19%

share, according to Beer Marketer's Insights, an industry trade

publication. That fell to 16% at the end of last year.

Chief Executive Carlos Brito said that he saw positive signs

from the new marketing campaign but that it hadn't yet translated

to an increase in sales.

The Budweiser brand, meanwhile, lost over a third of a

percentage point of market share in the quarter. Beer Marketer's

Insights estimates Budweiser had 6.3% of the U.S. market at the end

of last year, making it the number three seller behind Coors

Light.

Overall sales volume in North America fell 4.4% in the quarter

from a year ago, sharply lower than analysts' consensus forecast of

a 2.2% fall. Margins in the U.S. increased, however, as the

company's portfolio of more-expensive beers, including Michelob

Ultra and Stella Artois, performed well. AB InBev has also rolled

out a handful of beers it markets as "craft," to compete with the

hundreds of smaller brewers that have popped up across the country

in recent years. It said this portfolio performed well in the U.S.

and Canada.

"There is no end in sight to the weakness" of Budweiser and Bud

Light, said Trevor Stirling, European beverage analyst at Sanford

C. Bernstein. "The success of Michelob Ultra and the craft

portfolio is not enough to compensate."

AB InBev said Thursday that net profit surged to $1.41 billion

in the quarter from $132 million a year earlier. The figure was

boosted by the integration of rival SAB, following AB InBev's $100

billion-plus acquisition. The deal's funding costs hit AB InBev's

year-earlier profit.

Revenue in the quarter rose 35% to $12.92 billion, but organic

growth--stripping out acquisitions, including the effect of the SAB

purchase--rose just 3.7%.

AB InBev said the integration of SAB was "progressing well,"

with savings of $252 million from the combination in the period.

That was higher than expected by analysts, with some suggesting the

company could wring out more than the overall $2.8 billion in cost

savings AB InBev has targeted in the deal.

But that isn't a long-term fix for flagging sales at its biggest

brands in the U.S. and Western Europe. AB InBev's acquisition of

SAB was a big bet that it could tap new growth in Africa and other

emerging markets such as Colombia and Peru.

In the short term, that has been a mixed bag. In Colombia,

revenue fell 5.1% because of a tax hike there. Peru sales rose 3%.

Sales in South Africa were up mid-single digits, AB InBev said,

thanks to price hikes pushed through at SAB just before AB InBev

took control.

A surprising bright spot was Brazil. Despite what the company

described as a challenging political and macroeconomic environment

there, beer volume rose in the quarter but revenue per hectoliter

dropped because large state tax increases last year haven't yet

been fully passed on to customers. The company said it remains

optimistic about Brazil in the long run and expects the rise in the

cost of sales to slow in the second half of the year.

U.K. sales rose by a double-digit percentage, meanwhile, lifted

by the launch of Bud Light. The company also posted a strong start

to the year in China. AB InBev said its full-year expectations

remained unchanged, including an acceleration of revenue

growth.

Write to Nick Kostov at Nick.Kostov@wsj.com

(END) Dow Jones Newswires

May 04, 2017 10:18 ET (14:18 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

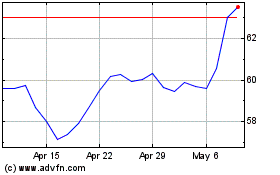

Anheuser Busch Inbev SA NV (NYSE:BUD)

Historical Stock Chart

From Mar 2024 to Apr 2024

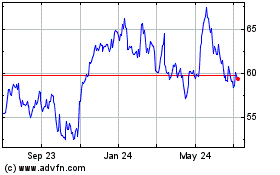

Anheuser Busch Inbev SA NV (NYSE:BUD)

Historical Stock Chart

From Apr 2023 to Apr 2024