AB InBev Slams SABMiller's Rejection

October 08 2015 - 10:08AM

Dow Jones News

By Saabira Chaudhuri

LONDON--Anheuser-Busch InBev publicly slammed SABMiller PLC on

Thursday for rejecting its latest proposal to buy the world's

second-largest brewer in a complicated cash-and-stock deal that the

Belgian-based brewer insists is a good one for shareholders.

AB InBev made public its proposal to buy SABMiller for GBP42.15

($64.57) in cash on Wednesday and offered what it called a partial

share alternative for 41% of shares, which translates into a

combination of stock and cash that has a combined lower value of

GBP37.49. If SABMiller agrees to the proposal, AB InBev will end up

paying GBP65.14 billion for SABMiller. The proposal has the support

of SABMiller's largest shareholder, Altria Group Inc.

In response, SABMiller said the offer "still very substantially

undervalues SABMiller, its unique and unmatched footprint, and its

stand-alone prospects." Its board--excluding the directors

nominated by Altria--rejected the proposal, which AB InBev said was

the third it had made in recent days.

On Thursday, AB InBev Chief Executive Carlos Brito turned up the

heat on SABMiller by directly addressing shareholders in a

statement. "How long will it be before shareholders see a value of

over GBP42 in the absence of an offer from AB InBev?" he wrote. "If

shareholders agree that we should be in proper discussions, they

should voice their views and should not allow the Board of

SABMiller to frustrate this process and let this opportunity slip

away."

"We've noted their announcement, it contains nothing new," said

a SABMiller spokeswoman.

AB InBev said it is "surprised" that SAB's board, excluding the

three directors nominated by Altria, continues to say that the

proposal undervalued SAB significantly, adding that the claim

"lacks credibility."

The world's largest brewer noted that the cash part of the offer

represents a 44% premium to SABMiller's closing price on Sept. 14,

the day before media speculation about a possible deal

surfaced.

It added that it has the support of Altria, whose stake of more

than 25% makes it SABMiller's largest shareholder. AB InBev also

responded to the SABMiller board's Wednesday statement that the

proposals were "highly conditional" and that AB InBev hadn't yet

provided it with comfort about the regulatory hurdles in China and

the U.S.

"Together with its advisers, AB InBev has done significant work

on regulatory matters and has identified solutions that provide a

clear path to closing," said the brewer in a statement.

The biggest regulatory hurdle for a deal between the world's two

largest brewers is likely to be the U.S., where AB InBev already

has a roughly 45% market share and London-based SABMiller controls

a further 25% through its MillerCoors LLC joint venture with Molson

Coors Brewing Co.

Another potential regulatory headache is China, where AB InBev

had a 14% market share last year, according to Euromonitor. Chinese

authorities could require the brewer to exit SABMiller's joint

venture with China Resources Enterprise Ltd., which controls 23% of

the market and produces the top-selling Snow brand.

"AB InBev intends to work proactively with regulators to resolve

any concerns," said the company in its statement.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 08, 2015 09:53 ET (13:53 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

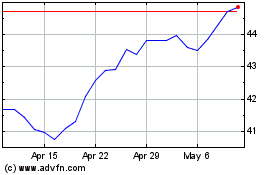

Altria (NYSE:MO)

Historical Stock Chart

From Mar 2024 to Apr 2024

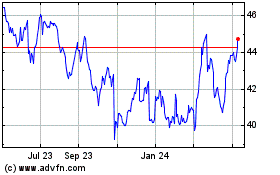

Altria (NYSE:MO)

Historical Stock Chart

From Apr 2023 to Apr 2024