AB InBev Responds to SABMiller Rejection of Takeover Offer

October 08 2015 - 6:28AM

Dow Jones News

By Saabira Chaudhuri

LONDON--Anheuser-Busch InBev has responded to SABMiller PLC's

rejection of its Wednesday offer to buy the world's second-largest

brewer in a complicated cash-and-stock deal that the Belgian-based

brewer insists is a good one for shareholders.

AB InBev said it is "surprised" that SAB's board, excluding the

three directors nominated by Altria Group Inc., continues to say

that the proposal "still very substantially undervalues SABMiller"

adding that the claim "lacks credibility."

AB InBev, the world's largest brewer, noted that the cash part

of the offer represents a 44% premium to SABMiller's closing price

on Sept. 14, the day before media speculation about a possible deal

surfaced. AB InBev on Wednesday offered to buy SABMiller for

GBP42.15 ($64.57) in cash and offered what it called a partial

share alternative for 41% of shares, which translates into a

combination of stock and cash that has a combined lower value.

It added that it has the support of Altria, whose stake of more

than 25% makes it SABMiller's largest shareholder. AB InBev also

responded to the SABMiller board's Wednesday statement that the

proposals were "highly conditional" and that AB InBev hadn't yet

provided it with comfort about the regulatory hurdles in China and

the U.S.

"Together with its advisers, AB InBev has done significant work

on regulatory matters and has identified solutions that provide a

clear path to closing," said the brewer in a statement. "AB InBev

intends to work proactively with regulators to resolve any

concerns."

SABMiller didn't immediately respond to a request for

comment.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 08, 2015 06:13 ET (10:13 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

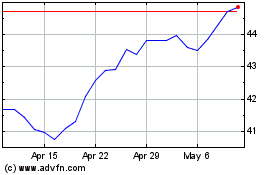

Altria (NYSE:MO)

Historical Stock Chart

From Mar 2024 to Apr 2024

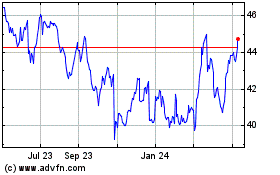

Altria (NYSE:MO)

Historical Stock Chart

From Apr 2023 to Apr 2024