AB Foods Profit Falls; To Invest More in Primark

November 03 2015 - 3:14AM

Dow Jones News

By Razak Musah Baba

LONDON--Associated British Foods PLC (ABF.LN), the agricultural

products supplier which owns the Primark fast-fashion brand, has

turned in lower profit in its latest fiscal year, with its

performance hurt by the strength of sterling against other

currencies and a tough year at its sugar business.

ABF said pretax profit fell around 30% to 717 million pounds

($1.11 billion) in the 52 weeks to Sept. 12 from GBP1.02 billion in

the previous fiscal year on a 1.1% decline in revenue to GBP12.80

billion.

ABF said its underlying performance was less weak. Stripping out

exceptional items and other costs, pretax profit fell 7.2% to

GBP1.03 billion compared with GBP1.11 billion.

"The good underlying trading achieved by our businesses in 2015

is expected to continue," Chairman Charles Sinclair said. "We

intend to maintain investment in expansion opportunities, most

notably for Primark."

The group is forecasting a turnaround at its sugar unit. "After

three years of large profit declines for AB Sugar, we expect

greater stability in profit next year ahead of the EU quota removal

in 2017," Mr. Sinclair said.

But volatile currency markets could still weigh down on the

group's earnings, notably at Primark and British Sugar, he said.

"At this early stage we expect the currency pressures to lead to a

modest decline in adjusted operating profit and adjusted earnings

for the group for the coming year," he said.

-Write to Razak Musah Baba at razak.baba@wsj.com; Twitter:

@Raztweet

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 03, 2015 02:59 ET (07:59 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

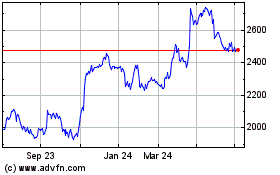

Associated British Foods (LSE:ABF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Associated British Foods (LSE:ABF)

Historical Stock Chart

From Apr 2023 to Apr 2024