A Raise at Morgan Stanley -- WSJ

January 23 2017 - 3:02AM

Dow Jones News

By Liz Hoffman

Morgan Stanley gave its chairman and CEO, James Gorman, a 7%

raise for 2016, while Goldman Sachs Group Inc. cut stock awards for

several executives but didn't disclose compensation for its top

executive Lloyd Blankfein.

Mr. Gorman received a pay package valued at $22.5 million for

his work in 2016, up from $21 million the previous year, according

to a spokesman for the New York firm. The 2016 haul included a $5

million stock award disclosed in a filing Friday afternoon and a

salary of $1.5 million. The details of the remainder of Mr.

Gorman's incentive-based compensation are expected to be disclosed

in coming months.

Goldman shareholders won't get a picture Friday of whether Mr.

Blankfein beat his $23 million haul from 2015 until later this

spring. A person familiar with the matter said the bank wouldn't be

making year-end equity disclosures on Friday for Mr. Blankfein or

Chief Financial Officer Harvey Schwartz, who made $20.5 million in

2015.

Morgan Stanley reported a $6 billion profit on $34.6 billion in

revenue for the year, both down about 1% from 2015. But its shares

rose 33% in 2016, with most of the gains coming since the November

presidential election. Bank stocks have soared as investors bet on

lower taxes and faster economic growth under President Donald

Trump.

Mr. Gorman has set more public targets than other Wall Street

CEOs and made some progress toward meeting them in 2016.

The firm strung together three quarters of $1 billion revenues

in its debt-trading business, a longtime trouble spot that Mr.

Gorman's top deputy, former trading chief Colm Kelleher, has sought

to overhaul.

Wealth-management assets and loans continued to grow.

But Morgan Stanley still hasn't hit a 10% return on equity, a

key profitability goal. It ended the year with an ROE of 8%.

Mr. Kelleher received a $2.4 million grant, down from 2015.

Overall compensation for Mr. Kelleher, who became Mr. Gorman's sole

No. 2 a year ago, will be higher than in 2015, a person familiar

with the matter said.

Mr. Gorman's restricted shares valued at $5 million represent an

increase from his $4.6 million stock bonus a year ago. His cash

bonus and other long-term incentives will be disclosed in the

bank's proxy statement this spring.

At Goldman, the entire stock piece of the top executives' 2016

pay may be tied to how the company does over the next few years.

Such performance-based compensation doesn't have to be disclosed

until company's annual proxy statement.

Goldman in 2015 began tying a portion of top executives' pay to

ROE targets, saying it had heard from shareholders that they wanted

officials' fortunes more closely tied to that of investors.

In order for Mr. Blankfein and other top executives to receive

all of their stock awards, they will need to keep the firm's

average ROE above 11% in coming years. The firm didn't clear that

bar in 2015 or 2016.

Also missing from Friday's disclosures was Gary Cohn, who left

as president and chief operating officer at year-end for a senior

economic-policy job in the Trump White House.

Stock bonuses fell for several executives for whom Goldman did

make disclosures, including general counsel Greg Palm,

human-resources head Edith Cooper and accounting chief Sarah Smith,

who will soon become the firm's head of compliance. Stock awards,

which typically make up about half of compensation among Goldman's

top brass, were down about 6% on average.

Goldman's 2016 revenue fell 9% from a year earlier, though

profits rose over 2015, when the bank set aside billions of dollars

to pay a mortgage settlement with the government.

David Solomon, the senior investment banker who was recently

named co-president and co-COO, received $9.8 million worth of

shares, using Thursday's closing price. His pay last year wasn't

disclosed.

His co-president and co-COO, Mr. Schwartz, also disclosed in a

filing that he sold $5.8 million worth of stock Thursday as part of

a prescheduled plan.

Pay at the upper echelons of Goldman has been fairly flat in

recent years, with Mr. Blankfein out-earning his top lieutenants by

relatively small margins.

Write to Liz Hoffman at liz.hoffman@wsj.com

(END) Dow Jones Newswires

January 23, 2017 02:47 ET (07:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

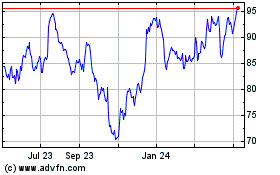

Morgan Stanley (NYSE:MS)

Historical Stock Chart

From Mar 2024 to Apr 2024

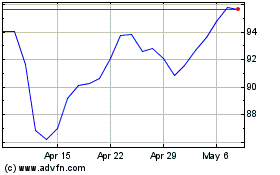

Morgan Stanley (NYSE:MS)

Historical Stock Chart

From Apr 2023 to Apr 2024