A.M. Best Places Ratings of Continental General Insurance Company & United Teacher Associates Insurance Company Under Review ...

April 15 2015 - 2:39PM

Business Wire

A.M. Best has placed under review with negative

implications the financial strength ratings of B++ (Good) and the

issuer credit ratings of “bbb” of Continental General Insurance

Company (Continental) and United Teacher Associates

Insurance Company (UTA). Both companies are headquartered in

Austin, TX.

The rating actions follow the announcement by parent company,

American Financial Group, Inc. (AFG) [NYSE/Nasdaq: AFG],

that it has reached a definitive agreement to sell Continental and

UTA, which contain all of AFG’s run-off long-term care insurance

business, to HC2 Holdings, Inc. (HCHC) for an initial payment of $7

million in cash and HCHC securities, subject to adjustment based on

certain items, including operating results through the closing

date. In addition, AFG may also receive up to $13 million of

additional proceeds in the future based on the release of certain

statutory liabilities. Continental and UTA contain all of AFG’s

$800 million in net GAAP long-term care insurance reserves, as well

as nearly $300 million of net GAAP annuity and life insurance

reserves. The transaction had no ratings impact on AFG’s other life

and annuity companies.

The ratings of Continental and UTA reflect A.M. Best’s current

view of each company’s current credit profile, while the under

review status with negative implications reflects the uncertainty

over the future financial and strategic direction of the companies

under its prospective new ownership, as well as the relatively weak

credit profile of HCHC based upon its current leverage position and

debt ratings issued by other Nationally Recognized Statistical

Rating Organizations (NRSROs).

The transaction is expected to close in the third quarter of

2015, subject to customary conditions, including receipt of

required regulatory approvals. The ratings will be removed from

under review following the close of the transaction and A.M. Best’s

discussions with the management of HCHC. Negative rating actions

could occur if there is a deterioration of A.M. Best’s view of the

stand alone credit profiles of the companies between now and the

time the transaction closes, or if A.M. Best believes that the

credit profile of HCHC is weak enough to warrant rating drag.

The methodology used in determining these ratings is Best’s

Credit Rating Methodology, which provides a comprehensive

explanation of A.M. Best’s rating process and contains the

different rating criteria employed in the rating process. Best’s

Credit Rating Methodology can be found at

www.ambest.com/ratings/methodology.

Key insurance criteria reports utilized:

- Rating Members of Insurance Groups

- Evaluating Non-Insurance Ultimate

Parents

This press release relates to rating(s) that have been

published on A.M. Best's website. For all rating information

relating to the release and pertinent disclosures, including

details of the office responsible for issuing each of the

individual ratings referenced in this release, please visit A.M.

Best’s Ratings & Criteria Center.

A.M. Best Company is the world's oldest and most

authoritative insurance rating and information source. For more

information, visit www.ambest.com.

Copyright © 2015 by A.M. Best Company,

Inc. ALL RIGHTS RESERVED.

A.M. BestTom Zitelli, 908-439-2200, ext.

5412Senior Financial

Analysttom.zitelli@ambest.comorTom Rosendale, 908-439-2200,

ext. 5201Assistant Vice

Presidentthomas.rosendale@ambest.comorChristopher Sharkey,

908-439-2200, ext. 5159Manager, Public

Relationschristopher.sharkey@ambest.comorJim Peavy,

908-439-2200, ext. 5644Assistant Vice President, Public

Relationsjames.peavy@ambest.com

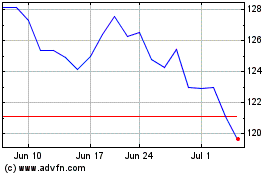

American Financial (NYSE:AFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

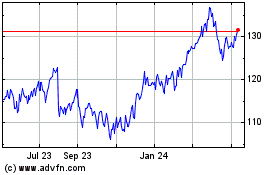

American Financial (NYSE:AFG)

Historical Stock Chart

From Apr 2023 to Apr 2024