A.M. Best Assigns Issue Credit Ratings to Aflac Incorporated’s Senior Unsecured Notes

September 15 2016 - 11:36AM

Business Wire

A.M. Best has assigned a Long-Term Issue Credit Rating

(Long-Term IR) of “a-” to the $300 million 2.875% 10-year senior

unsecured notes and $400 million 4.00% 30-year senior unsecured

notes recently issued by Aflac Incorporated (Aflac)

(Columbus, GA)(NYSE:AFL). The outlook assigned to these Credit

Ratings (ratings) is stable. Aflac’s existing Long-Term Issuer

Credit Ratings remain unchanged.

A.M. Best expects the proceeds from the sale of the notes to be

utilized to repay in full, at maturity, Aflac’s $650 million 2.65%

senior notes due February 2017. Additional funds will be used for

general corporate purposes.

A.M. Best notes that Aflac’s financial leverage will be

minimally impacted, and is expected to remain in the 25% range

until the repayment of the February maturity occurs. Additionally,

Aflac’s financial flexibility remains strong and interest coverage

is expected to remain above 12 times.

All of Aflac’s ratings, which were affirmed on June 22, 2016,

recognize its position as the world’s leading underwriter of

individually issued policies marketed at worksites. The company’s

insurance subsidiaries offer a diverse portfolio of supplemental

health products in both Japan and the United States, which generate

strong earnings and steady cash flows to the holding company. A.M.

Best believes that Aflac will remain challenged to achieve

considerable growth in its domestic operations given the intense

competition in the voluntary supplemental insurance market.

Additionally, Aflac’s earnings will be impacted due to the weaker

Japanese yen relative to the U.S. dollar, and the potential exists

for noteworthy realized investment losses as the company continues

to execute its long-term asset allocation strategy.

This press release relates to Credit Ratings that have been

published on A.M. Best’s website. For all rating information

relating to the release and pertinent disclosures, including

details of the office responsible for issuing each of the

individual ratings referenced in this release, please see A.M.

Best’s Recent Rating Activity web page. For

additional information regarding the use and limitations of Credit

Rating opinions, please view Understanding Best’s Credit

Ratings.

A.M. Best is the world’s oldest and most authoritative

insurance rating and information source. For more information,

visit www.ambest.com.

Copyright © 2016 by A.M. Best Rating

Services, Inc. and/or its subsidiaries. ALL RIGHTS

RESERVED.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160915006003/en/

A.M. BestKate Steffanelli, +1-908-439-2200, ext.

5063Senior Financial

Analystkate.steffanelli@ambest.comorJoseph Zazzera, MBA,

+1-908-439-2200, ext. 5797Assistant Vice

Presidentjoseph.zazzera@ambest.comorChristopher Sharkey,

+1-908-439-2200, ext. 5159Manager, Public

Relationschristopher.sharkey@ambest.comorJim Peavy,

+1-908-439-2200, ext. 5644Assistant Vice President, Public

Relationsjames.peavy@ambest.com

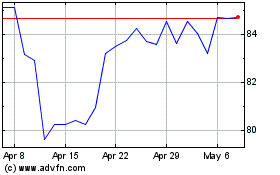

AFLAC (NYSE:AFL)

Historical Stock Chart

From Mar 2024 to Apr 2024

AFLAC (NYSE:AFL)

Historical Stock Chart

From Apr 2023 to Apr 2024