A.M. Best Assigns Debt Rating to Aflac Incorporated’s Forthcoming Senior Unsecured Notes

November 05 2014 - 8:57AM

Business Wire

A.M. Best has assigned a debt rating of “a-” to the

forthcoming $750 million 3.625% senior unsecured notes due 2024 of

Aflac Incorporated (Aflac) (Columbus, GA) [NYSE: AFL]. The

assigned outlook is stable. Aflac’s existing issuer credit and debt

ratings are unchanged.

Proceeds from the issuance will be used for general corporate

purposes, which also could include capital contributions to Aflac’s

subsidiaries, if needed.

A.M. Best anticipates that Aflac’s adjusted financial leverage

ratio, which includes equity credit for a portion of its existing

subordinated debentures, will increase to approximately 24% as a

result of the current notes offering. Despite the increase in

leverage, A.M. Best notes that Aflac’s financial leverage and

interest coverage ratios remain well within A.M. Best’s guidelines

for its current rating level.

The ratings recognize Aflac’s growth in risk-adjusted

capitalization, strong operating earnings and the ongoing execution

of its long-term investment allocation strategy. In addition, the

ratings reflect the company’s status as a leading provider of

individual guaranteed-renewable health and accident insurance both

in Japan and the United States. While operating earnings have been

strong, Aflac continues to report net realized investment losses.

However, A.M. Best notes that the investment losses have been

significantly lower than in prior years. Furthermore, given Aflac’s

strong earnings and the substantial cash flow from its operating

activities, as well as its much improved risk-adjusted

capitalization, A.M. Best believes the organization has the

capacity to withstand a reasonably high level of additional

realized losses should they occur.

The methodology used in determining these ratings is Best’s

Credit Rating Methodology, which provides a comprehensive

explanation of A.M. Best’s rating process and contains the

different rating criteria employed in the rating process. Best’s

Credit Rating Methodology can be found at

www.ambest.com/ratings/methodology.

Key insurance criteria reports utilized:

- Equity Credit for Hybrid

Securities

- Insurance Holding Company and Debt

Ratings

A.M. Best Company is the world's oldest and most

authoritative insurance rating and information source. For more

information, visit www.ambest.com.

Copyright © 2014 by A.M. Best Company,

Inc. ALL RIGHTS RESERVED.

A.M. Best CompanyTom Zitelli, 908-439-2200,

ext. 5412Senior Financial

Analysttom.zitelli@ambest.comorTom Rosendale,

908-439-2200, ext. 5201Assistant Vice

Presidentthomas.rosendale@ambest.comorChristopher Sharkey,

908-439-2200, ext. 5159Manager, Public

Relationschristopher.sharkey@ambest.comorJim Peavy,

908-439-2200, ext. 5644Assistant Vice President, Public

Relationsjames.peavy@ambest.com

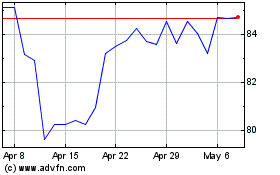

AFLAC (NYSE:AFL)

Historical Stock Chart

From Mar 2024 to Apr 2024

AFLAC (NYSE:AFL)

Historical Stock Chart

From Apr 2023 to Apr 2024