A.M. Best Affirms Ratings of Seaworthy Insurance Company

May 19 2015 - 2:14PM

Business Wire

A.M. Best has affirmed the financial strength rating of

A+ (Superior) and the issuer credit rating of “aa” of Seaworthy

Insurance Company (Seaworthy) (Annapolis, MD). The outlook for

both ratings is stable.

The ratings reflect Seaworthy’s strong risk-adjusted capital,

historical favorable experience within the ocean and inland marine

specialty niche and the implicit and explicit support provided by

the ultimate parent, Berkshire Hathaway Inc. (Berkshire)

[NYSE:BRK.A and BRK.B], and members of the Berkshire

organization.

The ratings take into account significant reinsurance protection

provided by National Indemnity Company (NICO) (Omaha, NE)

through a 75% quota share agreement, along with an additional

reinsurance agreement providing 100% coverage for named windstorms.

In addition to these programs, GEICO Corporation now serves

as an agent for Seaworthy’s inland marine (boat) business.

These positive rating factors are partially offset by

Seaworthy’s product concentration and the execution risk with the

expansion of business outside its historical business distribution

model.

Negative rating action could occur if capitalization and/or

operating performance fall markedly short of A.M. Best’s

expectations as a result of a significant deterioration in loss

trends or premium volume growth exceeding Seaworthy’s risk-adjusted

capital position. Given the company’s limited business profile, the

rating is subject to sudden shifts in the market or an unforeseen

disruption in distribution. Because of the breadth of the

relationship between Seaworthy and other Berkshire companies,

change in the ratings or outlooks of any of the associated

insurance companies may impact the rating of Seaworthy.

The methodology used in determining these ratings is Best’s

Credit Rating Methodology, which provides a comprehensive

explanation of A.M. Best’s rating process and contains the

different rating criteria employed in the rating process. Best’s

Credit Rating Methodology can be found at

www.ambest.com/ratings/methodology.

Key insurance criteria reports utilized:

- Rating Members of Insurance Groups

- Risk Management and the Rating Process

for Insurance Companies

- Understanding BCAR for

Property/Casualty Insurers

This press release relates to rating(s) that have been

published on A.M. Best's website. For all rating information

relating to the release and pertinent disclosures, including

details of the office responsible for issuing each of the

individual ratings referenced in this release, please visit A.M.

Best’s Ratings & Criteria Center.

A.M. Best Company is the world's oldest and most

authoritative insurance rating and information source. For more

information, visit www.ambest.com.

Copyright © 2015 by A.M. Best Company,

Inc. ALL RIGHTS RESERVED.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150519006912/en/

A.M. Best CompanyRobert Raber, 908-439-2200, ext.

5696Senior Financial

Analystrobert.raber@ambest.comorHenry Witmer , CPCU,

ARM-E, 908-439-2200, ext. 5097Assistant Vice

Presidenthenry.witmer@ambest.comorChristopher

Sharkey, 908-439-2200, ext. 5159Manager, Public

Relationschristopher.sharkey@ambest.comorJim Peavy,

908-439-2200, ext. 5644Assistant Vice President, Public

Relationsjames.peavy@ambest.com

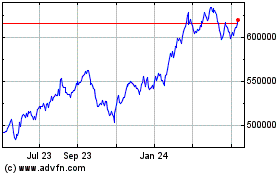

Berkshire Hathaway (NYSE:BRK.A)

Historical Stock Chart

From Mar 2024 to Apr 2024

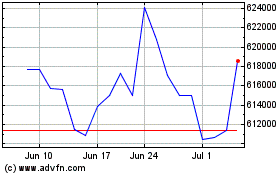

Berkshire Hathaway (NYSE:BRK.A)

Historical Stock Chart

From Apr 2023 to Apr 2024