By Jon Sindreu and Laurence Fletcher

In the wake of the global financial crisis, fear of such "black

swan" events drove some investors into hedge funds that offered

extreme insurance policies. But the swans have yet to return, and

such strategies have fallen out of favor.

The patience of many investors has run out after losing money

during the intervening years of mainly benign market conditions.

According to data by CBOE Eurekahedge, those who invested in

tail-risk funds when their performance peaked in September 2011

would have by now lost 55% of their money.

Some big names in asset management have been hit, leaving only a

handful of funds that promise outsize returns should markets go

into a tailspin.

Those left say that a decade after the financial crisis began,

people have forgotten its lessons just as market risks are

building. Market volatility is near record lows and equity markets

remain resilient, but entering September, typically the weakest

month of the year for the U.S. stock market, many investors and

traders are looking over their shoulders. Historically high equity

valuations, increased consumer leverage and unprecedented

central-bank stimulus are among the factors that tail-risk managers

believe make a black swan event more likely than at any time since

the financial crisis sent equity, credit and commodity markets

plummeting.

However, critics point to evidence suggesting that buying

insurance is always a losing strategy in financial markets.

As the crisis peaked in 2008, Universa Investments LP made

returns of above 100% for its clients.

Nine years later, "I don't see anyone out there doing what I

do," said founder Mark Spitznagel, who defined what he does as

"sort of like gold on steroids."

There is no set definition for how far markets must fall before

the drop can be labeled as a black swan event. The term was

popularized by writer and academic Nassim Nicholas Taleb to

describe extreme events that are difficult to predict and more

likely to happen than forecast.

Funds like Mr. Spitznagel's, which Mr. Taleb advises, mainly use

put options to protect against dramatic moves lower. These

derivatives offer an option to sell an underlying security at a

particular price, so they benefit when the security's price drops

below that "strike." Investors can buy cheap out-of-the-money

options with a strike price way below where the security currently

trades.

Tail-risk funds also invest in gold and other safe-haven assets

that usually rally when other markets collapse.

But recently, markets have mainly climbed as central banks

continue to flood them with liquidity and the global economy grows.

The CBOE Volatility Index, known as Wall Street's "fear gauge,"

fell to its lowest intraday level ever in July and remains near

historic lows. The S&P 500 has been on a smooth road higher

since early 2009, while the bull run in bonds continues

unabated.

Those results have hit these investors hard. Tail-risk funds are

down 6.3% this year through July, according to data group

eVestment, and have lost money in four of the five preceding

years.

London hedge fund giant Man Group launched the AHL Tail Protect

Fund in 2009 and has lost 45% since then, according to Man Group.

Capula Investment Management's Tail Risk Fund, one of the biggest

in the sector with $3.7 billion under management, is down 6.7% this

year, according to an investor letter reviewed by The Wall Street

Journal. The fund made 11% in 2011 but lost 14% the following year

and ran up further losses in three of the four years following.

Representatives of Man Group and Capula declined to comment.

Many others have given up. AXA Investment Managers wound its

tail-risk fund down several years ago.

While there are still inflows into these funds, according to

eVestment, many of those left in the game have changed the meaning

of what they consider a "tail risk." Rather than focusing on

extreme black swan events, they now offer cheaper insurance against

less dramatic -- but more common -- stock selloffs.

Swiss wealth manager Unigestion SA shut down a tail-risk focused

fund in 2010 but now runs a strategy to protect against bumpy days

in the market. Recently, Unigestion bought the safe-haven Japanese

yen and sold the Korean won, a currency pair that would move apart

in dramatic fashion if the market becomes more fearful.

"The protection will be less significant," Unigestion's head of

cross asset solutions, Jérôme Teiletche, said. "But the cost will

be less significant as well."

It costs money to roll over put options, and if they aren't

being triggered, they aren't earning anything back.

Protecting against volatility can provide returns if timed

properly, but over the long term it is a losing strategy, according

to a raft of academic papers and market analysis. It is similar to

taking an insurance policy on your car or home. On average, it is

the insured, rather than the insurer, that loses money.

A U.S.-listed volatility product called VXX, which bets on

surges in volatility, is down 98% over five years.

AQR Capital Management LLC calculates that black swan events

need to happen, on average, at least once every decade for

tail-risk strategies to break even. The fund defines such an event

as a 20% drop in the S&P 500 in one day.

But the last time the stock market suffered such a plunge was 27

years ago, on Black Monday, Oct. 19, 1987.

Mr. Spitznagel said the problem is that most funds just aren't

bold enough to lose a lot of money when markets are calm, which is

the price to pay for these strategies to offer gigantic returns

when another Black Monday happens. The point of black swans, he

said, is that they are more likely to happen than calculations

suggest.

Some of these fund managers say investors are dropping their

guard when they are at their most vulnerable.

"You are kind of balanced on the tip of a mountain or a hill,"

said Vineer Bhansali, founder of LongTail Alpha LLC. "It's not very

scary to me, but it's very scary."

Write to Jon Sindreu at jon.sindreu@wsj.com and Laurence

Fletcher at laurence.fletcher@wsj.com

(END) Dow Jones Newswires

September 05, 2017 05:44 ET (09:44 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

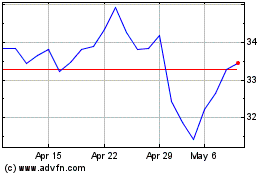

Axa (EU:CS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Axa (EU:CS)

Historical Stock Chart

From Apr 2023 to Apr 2024