A.C. Moore Continues to Struggle - Analyst Blog

August 11 2011 - 7:30AM

Zacks

Berlin, New Jersey-based

A.C. Moore Arts & Crafts, Inc (ACMR) reported

a loss of 32 cents in the second quarter of 2011, below the Zacks

Consensus Estimate of a loss of 28 cents, but above the year-ago

quarter's loss of 40 cents. The company continues to report a

deficit due to poor sales.

Total revenue of the specialty

retailer of arts, crafts and floral merchandise fell 0.8% year over

year to $99.0 million in the reported quarter attributable to a

0.7% plunge in same-store sales. Same-store sales remained soft due

to a 1.1% dip in transactions, and 0.4% decrease in average

ticket.

The gross profit for the quarter

inched up 0.4% year over year to $43.3 million and gross margin

inched up 60 basis points (bps) to 43.8%. The upside in gross

margin was driven by supply chain efficiencies and improvements in

inventory control and security, partially offset by the plunge in

merchandise margin.

Selling, general and administrative

expenses dropped 0.2% year over year to $51.0 million in the second

quarter due to reduced advertising expenses, partially offset by an

upside in payroll during the quarter. However, selling,

general and administrative expenses, as a percentage of revenue,

were up 30 bps to 51.5%.

Stores Update

During the quarter, A.C. Moore

opened no new stores but remodeled 3 stores. The company currently

operates 135 stores and plans to open no more stores in 2011. A.C.

Moore expects to close one store in the third quarter of 2011.

Financial

Position

A.C. Moore ended the quarter with

cash and cash equivalents of $16.2 million and shareholders’ equity

of $117.1 million.

The company expects cash and cash

equivalents of approximately $30 million for fiscal 2011.

Outlook

For 2011, the company anticipates a

lower net loss compared to 2010.

Our Take

The company continues to undertake

various initiatives to drive traffic and improve profitability

but A.C. Moore has a long way to go. Hence, we expect a

downward movement in estimates over the coming days. The Zacks

Consensus Estimates for 2011 and 2012 are pegged at a loss of 66

cents and 36 cents, respectively.

On February 15, A.C. Moore reported

that the board of directors is exploring strategic alternatives.

This process is still in progress and the company does not plan to

comment unless an option is approved.

A.C. Moore competes mainly with

Cash America International, Inc (CSH) and

Hot Topic Inc. (HOTT). A.C. Moore currently

retains a Zacks #3 Rank, which translates into a short-term ‘Hold’

rating. We are also maintaining our long-term “Neutral”

recommendation on the stock.

AC MOORE ARTS (ACMR): Free Stock Analysis Report

CASH AM INTL (CSH): Free Stock Analysis Report

HOT TOPIC INC (HOTT): Free Stock Analysis Report

Zacks Investment Research

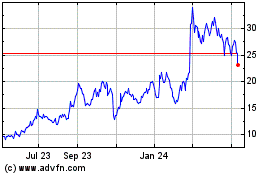

ACM Research (NASDAQ:ACMR)

Historical Stock Chart

From Mar 2024 to Apr 2024

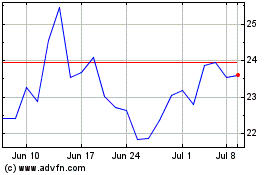

ACM Research (NASDAQ:ACMR)

Historical Stock Chart

From Apr 2023 to Apr 2024