3i Group PLC Q3 Performance update (2299N)

January 28 2016 - 2:00AM

UK Regulatory

TIDMIII

RNS Number : 2299N

3i Group PLC

28 January 2016

28 January 2016

3i Group plc

FY2016 Q3 performance update

3i Group plc ("the Group" or "3i") today issues its performance

update relating to the third quarter from 1 October 2015 to 31

December 2015 ("the quarter") of FY2016.

Another solid quarter with some important transactions

and strong earnings growth

* NAV per share of 413 pence and total return of 7.4%

* Realised GBP403 million in the 9 months to 31

December 2015, excluding the c.GBP188 million due

from the sale of Element Materials Technology

* Invested GBP364 million in Private Equity in the 9

months to 31 December 2015 with three new investments

* Launched two new CLOs in Debt Management in the

quarter, one in Europe and one in the US

* The portfolio companies in Private Equity continue to

perform well with a good increase in unrealised value

supported by value weighted earnings growth,

including acquisitions, of 18%

Simon Borrows, Chief Executive, commented:

"This was another steady quarter for 3i. We

delivered a solid result, supported by good

levels of investment and divestment activity,

despite the challenging market backdrop. Our

portfolio companies continue to perform well

with strong unrealised value growth from a

number of our key investments such as Action,

3i Infrastructure plc, Scandlines and GIF.

Investment activity was strong in the quarter,

with the highly profitable sale of Element

Materials Technology at 4.5x euro cost and

the purchase of Audley Travel, a business with

excellent growth potential. We have a good

level of planned realisations and an interesting

pipeline of potential new investments, but

we remain disciplined on price given the broader

macroeconomic and market uncertainties.

With earnings growth, including acquisitions,

of 18% and average gearing under 3x EBITDA

in Private Equity, we expect our investment

portfolio to continue to demonstrate its resilience

as we complete the important final quarter

of our financial year."

==============================================================

Private Equity

Investments

The team had a busy end to the 2015 calendar year. We completed

a GBP159 million investment in Audley Travel, a market leader in

tailor-made luxury travel based in the UK and with a growing

presence in the United States. On completion of the transaction, 3i

also underwrote an GBP87 million loan pending the refinancing of

Audley Travel's debt facilities. This amount was repaid in full on

27 January 2016.

Total Proprietary

Capital

investment investment

========================= =========== ============

Audley Travel(1) GBP159m GBP156m

H1 2016 investment GBP247m GBP208m

Total cash investment as GBP406m GBP364m

at 31 December 2015(1)

========================= =========== ============

1 Cash invested in Private Equity excludes the

GBP87 million (GBP85 million 3i Proprietary

Capital) loan underwritten on behalf of Audley

Travel which was repaid on 27 January 2016.

Realisations

We received total cash proceeds in the quarter of GBP43 million.

This included proceeds of GBP17 million from the refinancing of

Geka, as well as proceeds of GBP20 million from a partial sale of

our quoted holding in Refresco Gerber and the full sale of

Consultim.

On 17 December 2015, we announced the sale of our investment in

Element Materials Technology ("Element"), with estimated proceeds

of GBP188 million, representing a 12% uplift against the value at

30 September 2015 and a 30% uplift against the value at 31 March

2015. Inclusive of the proceeds from Element's refinancing

completed in August 2014,

the transaction will generate a 4.5x euro money multiple (3.9x

in sterling) and is expected

to complete before 31 March 2016. Element was valued on an

imminent sale basis at

31 December 2015.

3i realisation

proceeds

======================================== ===============

Full realisations

Consultim GBP10m

Vijai GBP4m

Other GBP1m

Partial realisations

Refresco Gerber GBP10m

Refinancings

Geka GBP17m

Deferred consideration

Other GBP1m

====================================== ===============

Total Q3 2016 cash proceeds GBP43m

======================================== ===============

H1 2016 cash proceeds GBP307m

Total cash proceeds as at 31 December GBP350m

2015

======================================== ===============

Element GBP188m

Total Private Equity realisation GBP538m

proceeds including Element

======================================== ===============

Portfolio performance

The underlying Private Equity portfolio performed well in the

quarter despite the challenging macroeconomic and market

conditions. The portfolio has limited direct exposure to regions or

sectors that have shown weakness over recent months, such as

emerging markets or oil and gas or commodities. Value weighted

earnings growth, including the effect of portfolio acquisitions,

over the last twelve months was 18% (September 2015: 19%) and 12%

excluding Action (September 2015: 14%).

Action, our largest investment, maintained its strong like for

like revenue and EBITDA growth, excellent cash flow generation and

good progress on store openings, resulting in strong unrealised

value growth for this asset. Action's momentum in trading and store

openings has continued through its final quarter. Together with the

good levels of unrealised value generated from assets such as

Scandlines and GIF, this more than offset the continued negative

effect of weak macroeconomic and market conditions on the valuation

of assets such as AES, Dynatect, Etanco and JMJ.

The value weighted average EBITDA multiple used to value the

Private Equity portfolio decreased by 1% to 11.3x before liquidity

discount and 10.7x after liquidity discount in the quarter.

Excluding Action, the multiple before liquidity discount decreased

by 3% to 9.8x (post discount: 9.2x).

Top 10 investments by value at 31 December 2015

Valuation(1) Valuation(1)

Valuation Valuation Sep-15 Dec-15

basis currency GBPm GBPm Activity in

the quarter

=================== ============= =========== ============= ============= =====================

Action Earnings Euro 712 797

=================== ============= =========== ============= ============= =====================

GBP10m interim

2016 dividend

3i Infrastructure accrued within

plc Quoted GBP 450 463 income

=================== ============= =========== ============= ============= =====================

Scandlines DCF Euro 257 271

=================== ============= =========== ============= ============= =====================

Sale signed

in December

2015 and completion

Imminent expected by

Element sale USD 168 182 March 2016

=================== ============= =========== ============= ============= =====================

Amor / Christ Earnings Euro 174 174

=================== ============= =========== ============= ============= =====================

Audley Travel Price GBP - 156 The GBP85m loan,

of recent repaid on 27

investment January 2016,

is accounted

for as a current

debtor

=================== ============= =========== ============= ============= =====================

Weener Plastic Earnings Euro 149 151

=================== ============= =========== ============= ============= =====================

Basic-Fit Earnings Euro 119 123

=================== ============= =========== ============= ============= =====================

GIF Earnings Euro 106 120

=================== ============= =========== ============= ============= =====================

(MORE TO FOLLOW) Dow Jones Newswires

January 28, 2016 02:00 ET (07:00 GMT)

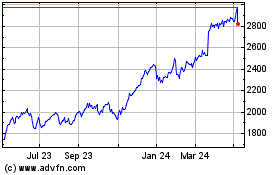

3i (LSE:III)

Historical Stock Chart

From Mar 2024 to Apr 2024

3i (LSE:III)

Historical Stock Chart

From Apr 2023 to Apr 2024