3i Group PLC FY2016 Q1 performance update (3637U)

July 29 2015 - 2:01AM

UK Regulatory

TIDMIII

RNS Number : 3637U

3i Group PLC

29 July 2015

29 July 2015

3i Group plc - FY2016 Q1 performance update

3i Group plc ("the Group" or "3i") today issues its performance

update relating to the first quarter from 1 April 2015 to 30 June

2015 ("the quarter") of FY2016.

3i makes a positive start to the year with good portfolio performance

and realisations

* NAV per share of 400 pence after a 9 pence deduction

for foreign exchange translation

* Realised GBP229 million from Private Equity assets

* Announced two new investments in Private Equity

* Continued progress in new product development in Debt

Management

* The portfolio continues to perform well with Action

and 3i Infrastructure plc in particular supporting

good unrealised value growth

Simon Borrows, Chief Executive, commented:

"This was a productive first quarter for 3i with good levels

of activity across all three business lines. Our Private Equity

portfolio continued to perform well and saw good earnings growth

and realisations. Our Debt Management team made good progress

on fundraising and new product development and Infrastructure

continued to develop its investment pipeline.

While our portfolio valuations continue to be affected by the

strength of sterling and we cannot be immune to wider political

and economic conditions, the favourable transaction market enabled

us to realise a number of smaller assets at attractive valuations

and we leveraged our sector expertise to announce two new Private

Equity investments at sensible prices."

Private Equity

The Private Equity team had a busy quarter and we announced the

investment of c.GBP225 million of proprietary capital in two new

companies within the Northern European industrials sector. Both

investments were brought at sensible prices and are expected to

complete in the second quarter.

Market conditions continued to create opportunities to realise a

number of smaller investments at attractive valuations and 3i

generated total cash proceeds in the quarter of GBP229 million.

This represents an uplift of 5% to the 31 March 2015 valuation and

an average money multiple of 1.7x. Notable cash realisations in the

quarter included the full divestment of Azelis, a return of capital

from Scandlines following the sale of the route between Helsingor

and Helsingborg and the IPO of UFO Moviez.

3i realised proceeds

Full realisations

=====================

Azelis GBP62m

=====================

Touchtunes GBP38m

=====================

Soyaconcept GBP17m

=====================

Boomerang GBP11m

=====================

Inspecta GBP6m

=====================

Partial realisations

=====================

Scandlines GBP38m

=====================

Quintiles GBP27m

=====================

UFO Moviez GBP17m

=====================

Other GBP13m

=====================

Total GBP229m

=====================

The Private Equity portfolio continued to perform well and

weighted average earnings growth remained stable at 19%. Excluding

Action, this measure was 17% and it benefited from further

portfolio acquisitions largely funded from the portfolio's own

resources. The value weighted average multiple used to value the

portfolio also increased slightly to 10.7x post discount (March

2015: 10.5x), despite the volatility seen in the financial markets,

due to the contribution from our larger, more highly rated assets

and the disposal of a number of smaller lower rated assets.

Excluding Action the post discount value weighted average was 9.5x

(March 2015: 9.3x).

The portfolio valuation continued to be impacted by the strength

of sterling against the euro and US dollar which offset the value

growth seen in the quarter.

Infrastructure

The 3i Infrastructure plc ("3iN") share price increased by 5% to

168 pence at 30 June 2015 following its strong set of full year

2015 results. The Infrastructure team continued to develop its

pipeline of new investment opportunities, targeting investments in

mid-market economic infrastructure, primary PPP and low-risk energy

projects. In early July 2015 it was announced that 3iN would buy

50% of Esvagt for approximately GBP109 million.

Debt Management

Fee income remained strong in the quarter, with the majority of

the funds continuing to pay both senior and subordinated fees and

the FY2015 fund launches adding to total fee income.

The team announced the launch of its new Global Floating Rate

Income Fund with US$75 million of seed capital from 3i. The fund,

an open ended senior debt fund that invests across the US and

Europe, launched with a total of US$150 million under management

and marks a further step to diversify into complementary products.

In addition 3i invested GBP45 million into two CLO warehouses both

of which are expected to close in August 2015.

Top 10 investments by value at 30 June 2015

Valuation(1) Valuation(1)

Valuation Valuation Mar-15 Jun-15

basis currency GBPm GBPm Activity in the quarter

=========== =========== ============= ============= ============================

Action Earnings Euro 592 618

=========== =========== ============= ============= ============================

3i Infrastructure

plc Quoted GBP 481 503

=========== =========== ============= ============= ============================

GBP47m proceeds and

income, net of transaction

fees, following the

Scandlines DCF Euro 262 215 route sale

=========== =========== ============= ============= ============================

Amor / Christ Earnings Euro 165 166

=========== =========== ============= ============= ============================

Element Earnings USD 145 154

=========== =========== ============= ============= ============================

Mayborn Earnings GBP 133 135

=========== =========== ============= ============= ============================

Sold 20% and generated

Quintiles Quoted USD 144 117 proceeds of GBP27m

=========== =========== ============= ============= ============================

ACR Other USD 120 115

=========== =========== ============= ============= ============================

Q Holdings Earnings USD 109 109

=========== =========== ============= ============= ============================

Basic-Fit Earnings Euro 102 102

=========== =========== ============= ============= ============================

(1) Balance sheet values are stated after foreign exchange

translation.

The top 10 investments comprise 59% (31 March 2015: 58%) of the

total Proprietary Capital portfolio by value.

Total return and NAV position

Value growth from the Private Equity portfolio and 3iN resulted

in an increase in diluted NAV per share to 400 pence (31 March

2015: 396 pence), after recording a foreign exchange translation

loss of GBP84 million in the quarter due to sterling strengthening

relative to both the euro and the US dollar. As at 30 June 2015, a

1% movement in the euro and US dollar would result in a total

return movement of GBP17 million and GBP8 million respectively.

Balance sheet and dividend

The Group's balance sheet remains strong. The continued

realisation activity means that the net cash position increased to

GBP214 million at the quarter end before the payment of the FY2015

final dividend of 14 pence per share on 24 July 2015. Gross debt

and liquidity are stable and were GBP812 million and GBP1,376

million respectively at 30 June 2015.

- Ends -

For further information, please contact:

Silvia Santoro

Investor Relations Director

Tel: 020 7975 3258

Kathryn van der Kroft

Communications Director

Tel: 020 7975 3021

About 3i Group

3i is a leading international investment manager focused on

mid-market Private Equity, Infrastructure and Debt Management. Our

core investment markets are northern Europe and North America. For

further information, please visit: www.3i.com.

All statements in this performance update relate to the three

month period ended 30 June 2015 unless otherwise stated. The

financial information is unaudited and is presented on 3i's

non-GAAP Investment basis in order to provide users with the most

appropriate description of the drivers of 3i's performance. Net

asset value ("NAV") and total return are the same on the Investment

basis and on an IFRS basis. Details of the differences between 3i's

consolidated financial statements prepared on an IFRS basis and

under the Investment basis are provided in the 2015 Annual Report

and Accounts. There have been no material changes to the financial

position of 3i from the end of this quarter to the date of this

announcement.

Notes

1. Uplift on opening value represents the cash proceeds in the

quarter over opening value realised.

2. Money multiple over cost represents the cash proceeds

(including income) over cash invested. For partial divestments, the

valuation of the remaining investment is included in the

multiple.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCRPMRTMBTTBTA

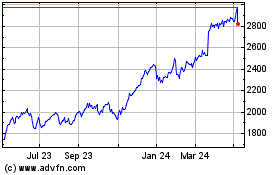

3i (LSE:III)

Historical Stock Chart

From Mar 2024 to Apr 2024

3i (LSE:III)

Historical Stock Chart

From Apr 2023 to Apr 2024