3i Group PLC Agreement to sell Debt Management business (3650N)

October 25 2016 - 2:00AM

UK Regulatory

TIDMIII

RNS Number : 3650N

3i Group PLC

25 October 2016

25 October 2016

3i agrees sale of its Debt Management business to Investcorp

Highlights

* 3i Group plc ("3i" or "the Group") has agreed the

sale of its Debt Management business ("3iDM") to

Investcorp

* The transaction will generate cash proceeds to 3i of

GBP222 million and an exceptional profit on disposal

of GBP36 million, subject to closing adjustments

which are dependent on the transaction's completion

date. The proceeds will be reinvested in 3i's Private

Equity and Infrastructure divisions

* The transaction is expected to close by the end of

March 2017, subject to satisfaction of closing

conditions including the required regulatory

approvals

Simon Borrows, 3i's Chief Executive, commented: "Our

Debt Management business has produced strong cash

income for the Group since our strategic review in

2012. However, the division fits less well with the

3i of today as we focus on our growing Infrastructure

business and a proprietary capital approach in Private

Equity. We are proud to have built 3iDM into an industry

leader in its markets and are delighted with our

agreement with Investcorp, which we believe has the

strategic commitment, capital and distribution capabilities

to support 3iDM in its next phase of growth."

==============================================================

Strategic rationale for the transaction

3i's Debt Management business was formed in February 2011

following the acquisition of Mizuho Investment Management, then one

of Europe's leading debt management businesses, from Mizuho

Corporate Bank. 3i built on that platform through the acquisition,

in 2012, of WCAS Fraser Sullivan Investment Management, a leading

specialist US debt manager, and of five European CLO management

contracts from Invesco. Today, 3iDM is a global leader in its

markets, with strong investment teams based in London and New York

and assets under management of approximately $12 billion.

3iDM has played an important role since our 2012 strategic

review. Predominantly a third-party asset management business, it

has provided us with cash income, contributing to achieving and

maintaining a group operating cash profit, as well as good cash

returns from our investments in the underlying CLOs. However, today

the cash income from our Debt Management activities is less

important as we focus on building our Private Equity and

Infrastructure portfolios from a robust position, with a strong

balance sheet and a lean cost base.

Information on the transaction

As part of the transaction, 3i will be selling its 3iDM fund

management business and CLO equity investments required to meet

risk retention requirements, valued at GBP182 million at 30

September 2016. Investcorp has also agreed to take over 3i's debt

warehouse commitments in Europe and the US. 3i will continue to

hold certain CLO investments valued at GBP56 million at 30

September 2016, together with the benefit of certain incentive fees

and will maintain its commitments to the Global Income Fund and the

Senior Loan Fund.

The transaction will generate cash proceeds to 3i of GBP222

million and an exceptional profit on disposal of GBP36 million,

subject to closing adjustments which are dependent on the

transaction's completion date.

The sale is expected to close by 31 March 2017, subject to

satisfaction of closing conditions including the required

regulatory approvals. 3iDM's employees are expected to remain with

the 3iDM business that transfers to Investcorp. The leadership of

3iDM will remain unchanged, with Jeremy Ghose continuing as CEO of

the overall division and John Fraser continuing to oversee the US

operations.

Note: the audited gross assets of the two entities being sold

totalled GBP225 million at 31 March 2016. The entities' total

comprehensive income for the year ended 31 March 2016 totalled

GBP20 million.

- Ends -

For further information, please contact:

Silvia Santoro

Investor Relations Director Tel: 020 7975 3258

Toby Bates

Interim Communications Director Tel: 020 7975 3032

Notes to editors

About 3i and 3i Debt Management

3i is a leading international investment manager focused on

mid-market Private Equity, Infrastructure and Debt Management. Our

core investment markets are northern Europe and North America. For

further information, please visit: www.3i.com.

3i Debt Management is a leading global credit management

business. It manages funds which invest primarily in senior secured

corporate debt issued by mid and large-cap corporates in the UK,

Europe and the US. Assets under management as of 30 September 2016

totalled c. $12 billion. The business employs c. 50 people based in

London, New York and Singapore.

About Investcorp

Investcorp is a leading provider and manager of alternative

investment products and is publicly traded on the Bahrain Bourse

(INVCORP). The Investcorp Group has offices in London, Bahrain, New

York, Saudi Arabia, Abu Dhabi and Doha. Investcorp has three

business areas: corporate investment, real estate investment and

alternative investment solutions (formerly known as hedge funds).

As at June 30, 2016, the Investcorp Group had $10.8 billion in

total assets under management, including assets managed by third

party managers and assets subject to a non-discretionary advisory

mandate where Investcorp receives fees calculated on the basis of

assets under management.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCLIFSEIFLEFIR

(END) Dow Jones Newswires

October 25, 2016 02:00 ET (06:00 GMT)

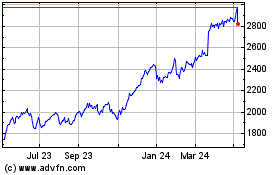

3i (LSE:III)

Historical Stock Chart

From Mar 2024 to Apr 2024

3i (LSE:III)

Historical Stock Chart

From Apr 2023 to Apr 2024