3M's Profit Rises on Stronger Margins, Tax Benefit -- Update

April 26 2016 - 11:59AM

Dow Jones News

By Bob Tita

3M Co.'s first-quarter profit rose 6.3% with an

accounting-related tax gain, but sales dropped from continued lower

demand for 3M's materials used in cellphones, computers and other

consumer gadgets.

The St. Paul, Minn.-based manufacturer of Post-it Notes, Ace

bandages, Filtrete furnace filters and Scotch tape topped sales and

profit expectations for the quarter and backed its earlier profit

outlook for the year.

3M's electronics and energy business was the company's weakest

unit during the quarter, continuing a pattern seen in recent

quarters. First-quarter sales from the electronics unit dropped 14%

to $1.1 billion. Operating income from the business plunged 27% to

$208 million. Performance of the electronics unit has lagged behind

amid lower demand for 3M's films and other components used in

electronic products. Sales of 3M products to the renewable energy

market and the telecommunications industry were lower during the

quarter as well.

Chairman and Chief Executive Inge Thulin said the weakness in

electronics wasn't unexpected, adding the company remains committed

to the business and revealed the company intends to record a $20

million charge in the second quarter to restructure the unit.

"This is a very good business for us," Mr. Thulin told analysts

during a conference call Tuesday "We have worked on this business

for four years to be more relevant for us."

Mr. Thulin reiterated 3M's expectation that the electronics

business will improve as the year progresses. Even with a better

second half of 2016, the company predicted sales will be moderately

lower this year from 2015.

3M's other consumer-related businesses fared better during the

first quarter. Sales from the company's health care business rose

4% to $1.4 billion as the unit's income rose 12% to $455 million.

Sales from the consumer unit, which includes some of 3M's

best-known brands, were flat at $1 billion, while income edged up

1% to $238 million.

Fourth-quarter sales from 3M's industrial business -- the

company largest business unit -- fell 3% to $2.6 billion. But

income rose 3.6% to $617 million on an improved profit margin.

3M's ability to raise its margins has helped the company

increase income, despite sluggish sales growth lately. The

company's first-quarter operating margin grew to 24.1% from 22.8% a

year earlier. Meanwhile, changes in the way 3M accounts for

stock-based compensation for employees added 10 cents to per-share

income for the first quarter.

Overall for the quarter ended March 31, 3M reported a profit of

$1.28 billion, or $2.05 a share, up from $1.2 billion, or $1.85 a

share, a year earlier. Sales decreased 2.2% to $7.41 billion.

Organic sales -- which exclude revenue from acquisitions and the

effects of currency exchange rates -- edged down 0.8%. Analysts

expected per-share profit of $1.92 and sales of $7.33 billion. For

2016, 3M said it continues to expect to earn $8.10 to $8.45 per

share.

3M's stock was recently trading down at 1.2% at $166.40 a

share.

Write to Bob Tita at robert.tita@wsj.com

(END) Dow Jones Newswires

April 26, 2016 11:44 ET (15:44 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

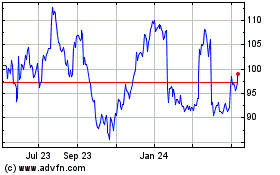

3M (NYSE:MMM)

Historical Stock Chart

From Mar 2024 to Apr 2024

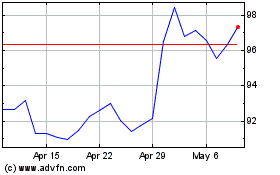

3M (NYSE:MMM)

Historical Stock Chart

From Apr 2023 to Apr 2024