3M Sales Hurt by Electronics and Energy Segment

July 26 2016 - 8:50AM

Dow Jones News

3M Co. cut its sales outlook for the year as the manufacturing

giant's struggling electronics and energy business continued to

crimp growth in other segments in its latest period.

Shares slipped 1.5% premarket to $176.91.

The St. Paul, Minn.-based company has posted weaker sales

results recently amid slowing demand in some markets, including

materials used in consumer electronics, such as adhesives and films

that go into screens for computers, tablets and phones.

The company narrowed its earnings outlook for the year to a

range of $8.15 to $8.30 from a prior range of $8.10 and $8.45 a

share. It also reduced its organic sales growth forecast to a range

of flat to 1% growth amid weakening market conditions, particularly

overseas. The company previously guided for organic sales growth of

1% to 3%.

In the latest quarter, sales in the electronics and energy

segment fell 10% to $1.2 billion, with foreign currency translation

cut sales by 0.9%. Electronics-related sales fell 14%, hurt by

declines in both electronics materials solutions and display

materials and systems. Energy-related sales slipped 2%, hurt by

declines in electrical markets and renewable energy.

Industrial segment sales edged down 0.1% to $2.6 billion, with

foreign currency translation reducing sales by 1.3%.

Over all, 3M reported a profit of $1.29 billion, or $2.08 a

share, compared with $1.3 billion, or $2.02 a share, a year

earlier. Analysts polled by Thomson Reuters expected $2.02 a

share.

Sales edged down 0.3% to $7.66 billion, below the $7.71 billion

expected by analysts. The company said foreign-currency translation

reduced total sales by 1.5%.

Write to Joshua Jamerson at joshua.jamerson@wsj.com

(END) Dow Jones Newswires

July 26, 2016 08:35 ET (12:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

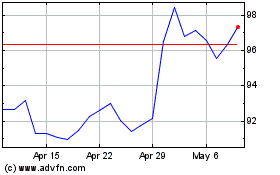

3M (NYSE:MMM)

Historical Stock Chart

From Mar 2024 to Apr 2024

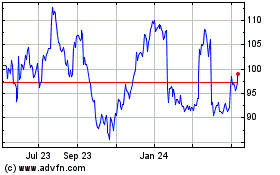

3M (NYSE:MMM)

Historical Stock Chart

From Apr 2023 to Apr 2024