3M Pares Full-Year View, Says 2017 to Remain Weak -- WSJ

October 26 2016 - 3:03AM

Dow Jones News

By Bob Tita

3M Co. trimmed sales and earnings outlooks for 2016 and sees

lackluster economic growth continuing into next year, curbing

demand across its broad portfolio of consumer and industrial

products.

"We cannot predict when a turnaround is coming in the economy,"

Chief Executive Inge Thulin said Tuesday. "When it comes, we are

ready to capitalize on that."

The maker of Post-it Notes, Scotch tape and Ace bandages said it

expects sales outside of acquisitions or currency gains to be flat

this year. 3M previously forecast sales rising 1% in 2016. The

company trimmed a dime off its profit per share forecast for the

year, to $8.15 to $8.20.

Mr. Thulin said demand for many 3M products "tempered" in the

third quarter, particularly in the U.S. and key developing markets

such as Brazil and Turkey,

The St. Paul, Minn.-company continued to counter sluggish sales

growth with stellar profit margins. 3M's overall operating margin

for the quarter rose slightly from last year to 24.7%. Three of the

company's five business units reported higher operating

margins.

In 3M's weakest unit, electronics and energy, operating margin

slipped just slightly from last year to 24.2%, despite a 9% drop in

income and a 7.5% drop in sales. The business supplies components

for cellphones, computers and other consumer electronics.

Electronics-related sales slipped 8% during the quarter, the

company said. Mr., Thurlin credited the company's revamped business

strategies for maintaining margins in a tough consumer electronics

market.

3M's other business units fared better. Sales from the consumer

unit rose 4% as operating income rose 8.3%. The company said growth

was propelled by strong back-to-school demand for consumer

products. 3M's industrial unit, including automotive products,

recorded a 1% sales increase and a 2% increase in operating profit.

The safety and graphics unit, which supplies materials for products

like roofing shingles, reported a 12.3% operating profit increase

on a 2.2% bump in sales.

Over all for the latest quarter, 3M earned $1.33 billion, or

$2.15 a share, compared with $1.30 billion, or $2.05 a share, a

year earlier. Analysts polled by Thomson Reuters expected $2.14 a

share. Sales were essentially flat at $7.71 billion, meeting

analysts' expectations.

3M stock was recently down nearly 3% at $166.16.

Ezequiel Minaya contributed to this article.

Write to Bob Tita at robert.tita@wsj.com

(END) Dow Jones Newswires

October 26, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

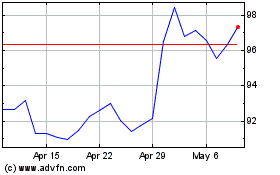

3M (NYSE:MMM)

Historical Stock Chart

From Mar 2024 to Apr 2024

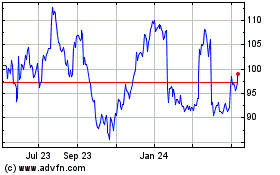

3M (NYSE:MMM)

Historical Stock Chart

From Apr 2023 to Apr 2024