New Study Offers Insight Into the Motivations,

Expectations and Behaviors of Various Demographic Segments of

Wealthy Donors

Most wealthy individuals believe charitable giving (45 percent)

and volunteering (31 percent) have the greatest potential for

positive impact on society –far more so than voting for (13

percent) or contributing to (1 percent) a political candidate who

shares their ideals on topics important to them – according to the

2016 U.S. Trust® Study of High Net Worth Philanthropy. Through an

ongoing partnership with the Indiana University Lilly Family School

of Philanthropy, the sixth in this series of biennial studies

reveals a strong commitment to charitable causes among high net

worth (HNW) households, and giving and volunteering levels poised

to increase in future years:

- Last year, the vast majority (91

percent) of HNW households donated to charity. This high rate of

giving among the wealthy compares with 59 percent of the U.S.

general population who donate to charity.1

- Fifty percent of wealthy individuals

volunteered their time and talents last year to charitable

organizations they care about – twice the rate of the general

population (25 percent).2

- The study offers an optimistic view of

future giving levels, with 83 percent of wealthy individuals

planning to give as much (55 percent) or more (28 percent) in the

next three years (through 2018) than they have in the past. Women,

African Americans, and younger individuals (age 50 and under) are

even more likely to increase their giving in the next three

years.

- Future levels of volunteerism are also

promising. Among wealthy individuals who currently volunteer, 90

percent say they plan to do so as much (60 percent) or more (30

percent) over the next three years. Even among those who did not

volunteer last year, 39 percent plan to do so during the coming

years.

“Wealthy donors continue to be incredibly generous with their

time and money in support of social change in their communities and

in the world,” said Claire Costello, national philanthropic

practice executive for U.S. Trust. “And while their charitable

activity is driven to a large extent by their personal values and

convictions, donors are also listening closely to the needs of

nonprofits as they make their giving and volunteering

decisions.”

This research series is the most comprehensive and

longest-running of its kind, and an important barometer for wealthy

donors’ charitable engagement and perspectives. Key findings from

this latest research offer valuable insights that help inform the

strategies of nonprofit professionals, wealthy donors and

charitable advisors alike. The study is based on a nationally

representative random sample of wealthy individuals, including, for

the first time, deeper analysis based on age, gender, sexual

orientation and race. This expanded methodology enables further

exploration of the philanthropic trends, strategies, and behaviors

among the HNW population.

And the recipients are…

On average, wealthy donors gave to eight different nonprofit

organizations last year. However, this number varied based on a

donor’s age – for instance, donors over the age of 70 gave to an

average of 11 organizations and baby boomers gave to seven, whereas

younger donors (age 50 and under) gave to five.

Sixty-three percent of wealthy donors gave to basic needs

organizations last year – making it the charitable subsector

supported by the largest percentage of HNW households. Additional

causes supported by the greatest percentages of wealthy donors

included religion (50 percent), education (45 percent), the

environment (42 percent) and health (40 percent). With respect to

giving to education, 31 percent of respondents gave to higher

education and 33 percent gave to K–12 education.

Volunteers give more

Among the wealthy, volunteering with a nonprofit organization

has a strong correlation with giving to that organization. A large

majority of HNW individuals (84 percent) give financially to at

least some of the organizations with which they volunteer, while 49

percent give to most, if not all, of the organizations where they

volunteer.

The study found that volunteerism also has an influence on

giving levels. Wealthy individuals who volunteered in 2015 gave 56

percent more on average than those who did not volunteer.3

While many wealthy individuals experience a high degree of

personal fulfillment from their charitable giving (42 percent),

even more experience it through their volunteerism (63 percent).

Women reported deriving greater levels of fulfillment from

volunteering than men, as did younger individuals when compared to

those over the age of 50.

Motivations, expectations and challenges

A variety of motivations drive HNW philanthropy. In 2015,

wealthy households cited the following among the primary reasons

they give: believing in the mission of the organization (54

percent); believing that their gift can make a difference (44

percent); experiencing personal satisfaction, enjoyment or

fulfillment (39 percent); supporting the same causes annually (36

percent); giving back to the community (27 percent); and adhering

to religious beliefs (23 percent). Just 18 percent of wealthy

donors said they gave largely because of tax benefits in 2015.

Wealthy donors have strong feelings about how the nonprofits

they support should use their contributions and conduct themselves.

After making a charitable gift, 89 percent of wealthy donors said

it is important that the organization spend only a reasonable

amount of their donation on general administrative and fundraising

expenses. Wealthy donors also indicated that it is important that

the organization demonstrate sound business and operational

practices (89 percent), acknowledge donations by providing a

receipt for tax purposes (88 percent), not distribute their names

to others (84 percent), and honor their requests for anonymity (83

percent) and for how their gift is to be used (83 percent).

Nearly one out of five wealthy individuals stopped giving to at

least one nonprofit organization last year. When individuals

stopped giving to a particular charity they previously supported,

among the reasons cited were because they received too frequent

solicitation from the organization (41 percent), circumstances in

their household changed (40 percent), the organization was not

effective or did not sufficiently communicate its effectiveness (18

percent), or the organization asked for an amount the donor felt

was inappropriate (14 percent).

Wealthy individuals reported their greatest challenge when it

comes to charitable giving is identifying what causes they care

about and deciding where to donate (67 percent). Other charitable

giving challenges include understanding how much they can afford to

give (50 percent), allocating time to volunteer with the

organizations they care about (45 percent), and monitoring giving

to ensure it has its intended impact (37 percent).

This study also found that, among the 33 percent of wealthy

donors who participate in impact investing, 61 percent approach it

as something they do in addition to their existing charitable

giving, whereas 34 percent do so in place of at least some of their

charitable giving. And just 5 percent of wealthy donors participate

in impact investing in place of all of their charitable giving.

Higher levels of charitable giving knowledge improve the

giving experience

The study found notable relationships between wealthy

individuals’ level of knowledge about giving and their giving

behaviors and characteristics. When comparing individuals by levels

of charitable giving knowledge (i.e., expert, knowledgeable,

novice), higher levels of knowledge directly correlate with whether

individuals monitor the impact of their giving, believe their

giving is having its intended impact, consult with advisors, and

utilize giving vehicles (e.g., private foundation, donor-advised

fund), as well as with greater personal fulfillment from giving and

higher average giving amounts.

Overall, 44 percent of wealthy donors believe their giving is

having the impact they intended, while 54 percent are not sure

whether their gifts are achieving the impact they desire. This may

be partly due to the fact that 78 percent of wealthy donors do not

monitor or evaluate the impact of their charitable giving.

Nearly all wealthy individuals (94 percent) would like to be

more knowledgeable about at least one aspect of charitable giving,

with the highest percentages of these individuals interested in

learning how to identify the right volunteer opportunities (42

percent), becoming more familiar with nonprofits and how they serve

their constituents’ needs (29 percent), and how to engage the next

generation in philanthropic giving (20 percent).

“Nonprofits that understand the priorities and expectations of

their wealthy donors, engage them in meaningful and fulfilling

ways, and communicate the organization’s impact can effectively

partner with donors to achieve their mutual goals for a better

world,” said Una Osili, Ph.D., professor of economics and

philanthropic studies and director of research for the Indiana

University Lilly Family School of Philanthropy.

Making giving a family affair

Among the 79 percent of HNW households surveyed who indicated

having children, grandchildren or other younger relatives, just 21

percent have family traditions around giving, such as volunteering

as a family or giving together to charity during the holidays.

African Americans, Asian Americans, Hispanics and women were

significantly more likely to indicate that their household has

family traditions around giving. Younger individuals were twice as

likely to have family traditions around giving as those over the

age of 50.

Similarly, far more individuals reported not involving their

younger relatives in their giving (72 percent) than those who do

(28 percent). Once again, African Americans, Hispanics, women and

younger individuals were significantly more likely to indicate that

they have involved younger relatives in their giving. Among wealthy

individuals who involve younger relatives in their giving, the

majority found the experience personally rewarding (77

percent).

When asked how they would like to ultimately distribute their

wealth, HNW individuals reported that they intend to leave the

majority to their children and grandchildren (75 percent), with

other heirs receiving the second-highest percentage (14 percent).

Respondents intend to leave 12 percent of their wealth to charities

(8 percent to secular charities, and 4 percent to religious

charities).

Electing to give, and giving to elect

Twenty-four percent of wealthy individuals contributed to a

political candidate, campaign or committee last year or plan to do

so during the 2016 election season. Among this group, donors over

the age of 70 (40 percent) and LGBT individuals (38 percent) were

more likely to make such political contributions.

Among those who contributed to a political candidate or

campaign, wealthy individuals reported doing so because they:

- View it as an opportunity to exercise

their voice (56 percent).

- Hope to influence the outcome of

elections (49 percent).

- Believe their contribution can make a

difference (46 percent).

The main reasons why 76 percent of wealthy individuals have not

and do not plan to make political contributions during this

election season include:

- Feeling such contributions would have

little to no impact when compared to corporate contributions (47

percent) and contributions from political action committees (PACs)

(26 percent).

- Believing such contributions won’t make

a difference (31 percent).

- Not having a particular candidate they

would endorse (26 percent).

Results of this study are based on a survey of 1,435 U.S.

households with a net worth of $1 million or more (excluding the

value of their primary home) and/or an annual household income of

$200,000 or more. To view a detailed summary of key findings and to

access the full report, visit www.ustrust.com/philanthropy.

1 2013 Philanthropy Panel Study on giving in 2012, the latest

year data is available on average giving by American households

2 2013 U.S. Volunteering and Civic Engagement Study

3 Average giving amounts are calculated excluding ultra high net

worth households (those with a wealth level greater than $20

million) because our data is only able to provide an aggregate

value for giving by these households, not individual giving values.

We cannot use an aggregate value when looking at individual

characteristics.

The Indiana University Lilly Family School of PhilanthropyThe

Indiana University Lilly Family School of Philanthropy is dedicated

to improving philanthropy to improve the world by training and

empowering students and professionals to be innovators and leaders

who create positive and lasting change. The school offers a

comprehensive approach to philanthropy through its academic,

research and international programs and through The Fund Raising

School, Lake Institute on Faith & Giving, and the Women’s

Philanthropy Institute. For more information, visit

www.philanthropy.iupui.edu.

U.S. Trust’s Philanthropic Solutions GroupU.S. Trust’s

Philanthropic Solutions Group serves the needs of nonprofit

institutions, philanthropic individuals and families across the

investment businesses with Bank of America. Philanthropic Solutions

distributes more than $300 million in grants to charitable

organizations annually on behalf of clients where U.S. Trust serves

as trustee, co-trustee or grant-making agent. The investment

businesses within Bank of America, including U.S. Trust, Merrill

Lynch Wealth Management and the Merrill Lynch Private Banking and

Investment Group are among the nation's leading providers of

investment and philanthropic services to individuals, families,

foundations, endowments and other nonprofit organizations.

Bank of AmericaBank of America is one of the world's leading

financial institutions, serving individual consumers, small and

middle-market businesses and large corporations with a full range

of banking, investing, asset management and other financial and

risk management products and services. The company provides

unmatched convenience in the United States, serving approximately

47 million consumer and small business relationships with

approximately 4,600 retail financial centers, approximately 16,000

ATMs, and award-winning online banking with approximately 34

million active accounts and more than 21 million mobile active

users. Bank of America is a global leader in wealth management,

corporate and investment banking and trading across a broad range

of asset classes, serving corporations, governments, institutions

and individuals around the world. Bank of America offers

industry-leading support to approximately 3 million small business

owners through a suite of innovative, easy-to-use online products

and services. The company serves clients through operations in all

50 states, the District of Columbia, the U.S. Virgin Islands,

Puerto Rico and more than 35 countries. Bank of America Corporation

stock (NYSE: BAC) is listed on the New York Stock Exchange.

Institutional Investments & Philanthropic Solutions

(“Philanthropic Solutions”) is part of U.S. Trust, Bank of America

Corporation (“U.S. Trust”). U.S. Trust operates through Bank of

America, N.A. and other subsidiaries of Bank of America Corporation

(“BofA Corp.”). Bank of America, N.A., Member FDIC. Banking and

fiduciary activities are performed by wholly owned banking

affiliates of BofA Corp., including Bank of America, N.A.

Investment products:

Are Not FDIC Insured Are Not Bank

Guaranteed May Lose Value

Visit the Bank of America newsroom for more Bank of America

news, and click here to register for news email alerts.

www.bankofamerica.com

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161025005251/en/

Reporters May Contact:Matt Card, Bank of America,

1.617.434.1388matthew.card@bankofamerica.comJulia Ehrenfeld, Bank

of America, 1.646.855.3267julia.ehrenfeld@bankofamerica.com

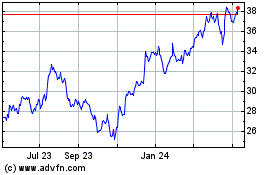

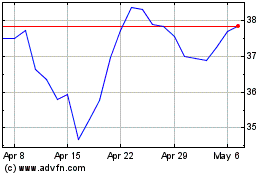

Bank of America (NYSE:BAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bank of America (NYSE:BAC)

Historical Stock Chart

From Apr 2023 to Apr 2024