QUARTERLY HIGHLIGHTS

- Net income improved to $15.23 million

and diluted net income per common share improved to $0.58 from the

prior year's quarter.

- Return on average assets of 1.11% and

return on average common shareholders' equity of 8.96%.

- Net charge-offs of $1.10 million and

nonperforming assets to loans and leases of 0.70%.

- Average loans and leases grew $190.45

million or 4.81% from the fourth quarter of 2015.

- Average deposits grew $301.31 million

or 7.35% from the fourth quarter of 2015.

- Net interest income increased slightly

from the fourth quarter of 2015.

- Noninterest income increased $1.45

million or 6.96% from the fourth quarter of 2015 (increased 5.19%

excluding leased equipment depreciation).

- Noninterest expenses were comparable to

the fourth quarter of 2015 (decreased 1.65% excluding leased

equipment depreciation).

1st Source Corporation (NASDAQ: SRCE), parent company of 1st

Source Bank, today reported net income of $57.79 million for the

year of 2016, compared to $57.49 million in 2015. Fourth quarter

net income was $15.23 million, an increase of 5.60% compared to

$14.42 million in the fourth quarter of 2015. The year-to-date net

income comparison was positively impacted by net gains of $1.80

million on investment securities available-for-sale and gains of

$1.86 million on a partnership investment liquidation required by

the Volcker Rule. These positives were offset by a reduction in net

interest recoveries of $3.16 million and a higher provision for

loan and lease losses of $3.67 million.

Diluted net income per common share for the year improved to

$2.22 compared to $2.17 a year earlier. Diluted net income per

common share for the fourth quarter was $0.58, compared to $0.55

per common share reported in the fourth quarter of the previous

year.

At its January 2017 meeting, the 1st Source Board of Directors

approved a cash dividend of $0.18 per common share. The cash

dividend is payable to shareholders of record on February 6, 2017

and will be paid on February 15, 2017. Cash dividends for 2016

increased 7.30% over the previous year.

According to Christopher J. Murphy III, Chairman, “1st Source

Corporation had a steady fourth quarter and 2016 was our 29th year

of consecutive annual dividend growth. Credit quality remains

stable and we have seen average deposits increase 7.35% from a year

ago. Average loan and lease growth of 4.81% for the same quarterly

period was a strong increase considering the acquisitions of a

number of our clients. As an example, the consolidation occurring

in the recreational vehicle industry and the auto rental industry

has resulted in the sale of a number of our clients to

substantially larger companies. These sales and mergers have

resulted in loan payoffs as have the sale of local business

customers with aging owners who took advantage of the improved

economy to sell their businesses. For the year, average loans and

leases grew by 7.20%.”

“This past quarter we launched a new mobile responsive website

and smart watch apps for Android™ and Apple® watches. We also

opened a new expanded banking center in Warsaw, Indiana, replacing

our former downtown location and financed our first tax advantaged

renewable energy solar projects.”

“We were once again identified for providing the best banking

experience in the Midwest by The MSR Group, a top research firm

specializing in the customer experience in retail banking. To

determine this they interviewed thousands of customers of banks

including the top 50 banks in the country. We are proud to have

received this award for two consecutive years as it shows our

commitment to delivering outstanding client service. We are

committed to providing outstanding service to our clients whether

they prefer to bank in person, online or with their mobile device.”

Mr. Murphy concluded.

FOURTH QUARTER 2016 FINANCIAL

RESULTS

Loans

Average loans and leases of $4.15 billion increased $190.45

million, or 4.81% in the fourth quarter of 2016 from the year ago

quarter and have decreased slightly from the third quarter. Annual

average loans and leases of $4.11 billion increased $276.36

million, or 7.20% from the same period in 2015.

Deposits

Average deposits of $4.40 billion grew $301.31 million, or 7.35%

for the quarter ended December 31, 2016 from the year ago quarter

and have increased $48.97 million, or 1.12% compared to the third

quarter. Annual average deposits for 2016 were $4.30 billion an

increase of $341.64 million or 8.62% from 2015.

Net Interest Income and Net Interest Margin

Fourth quarter 2016 net interest income of $43.38 million

increased slightly from the fourth quarter a year ago and increased

$0.69 million, or 1.61% from the third quarter. Net interest

recoveries during the quarter were down $1.70 million from 2015,

resulting in a 14 basis point reduction to the net interest

margin.

Fourth quarter 2016 net interest margin was 3.39%, a decrease of

19 basis points from the 3.58% for the same period in 2015 and an

increase of 4 basis points from the 3.35% in the third quarter.

Fourth quarter 2016 net interest margin on a fully tax-equivalent

basis was 3.42%, a decrease of 19 basis points from the 3.61% for

the same period in 2015 and an increase of 3 basis points from the

3.39% in the third quarter.

For the twelve months of 2016, net interest income was $169.66

million, an increase of $3.14 million, or 1.88% compared to the

same period a year ago. Net interest recoveries for 2016 were down

$3.16 million from 2015, resulting in a 6 basis point reduction to

the net interest margin.

Net interest margin for the year ending December 31, 2016 was

3.39%, a decrease of 18 basis points from the 3.57% for the year

ending December 31, 2015. Net interest margin on a fully

tax-equivalent basis for the year ending December 31, 2016 was

3.43%, a decrease of 17 basis points from the 3.60% for the year

ending December 31, 2015.

Noninterest Income

Noninterest income increased $1.45 million or 6.96% and $5.63

million or 6.76% in the three and twelve month periods ended

December 31, 2016, respectively over the same periods a year ago.

The increase in noninterest income during the fourth quarter was

mainly due to higher equipment rental income related to an increase

in the average equipment rental portfolio and gains on the sale of

available-for-sale equity securities, which was offset by lower

monogram fund income. The increase in noninterest income during the

twelve months of 2016 was primarily due to higher equipment rental

income related to an increase in the average equipment rental

portfolio, improved debit card income due to growth in those

transactions, gains on the liquidation of a partnership investment

required by the Volcker Rule and gains on the sale of

available-for-sale equity securities, which was offset by lower

monogram fund income and decreased customer swap fees.

Noninterest Expense

Noninterest expense was flat for the quarter ended December 31,

2016 and increased $4.53 million or 2.85% for the twelve months of

2016, respectively over the comparable periods a year ago.

Excluding depreciation on leased equipment, annual noninterest

expenses were up $1.13 million or 0.80%. The 2016 increase in

noninterest expense was primarily due to higher depreciation on

leased equipment, furniture and equipment expense and increased

loan and lease collection and repossession expenses offset by

reduced residential mortgage foreclosure expenses, losses on the

sale of fixed assets and lower supplies and communication.

Depreciation on leased equipment was higher as a result of an

increase in the average equipment rental portfolio. Furniture and

equipment expense was higher due to increased software maintenance

costs, depreciation on new equipment with banking center remodels

and computer processing charges. Loan and lease collection and

repossession expenses increased mainly due to lower recoveries on

repurchased mortgage loans, fewer gains on the sale of other real

estate owned and repossessions and an increase in general

collection and repossession expenses. Supplies and communication

expense was lower primarily due to costs associated with replacing

debit cards with embedded EMV chip cards in 2015 and a reduction in

telephone charges. In addition, during the fourth quarter of 2016,

business development and marketing expenses included $0.53 million

of charitable contributions related to the gains on the sale of

available-for-sale securities.

Credit

The reserve for loan and lease losses as of December 31, 2016

was 2.11% of total loans and leases compared to 2.13% at September

30, 2016 and 2.21% at December 31, 2015. Net charge-offs of $1.10

million were recorded for the fourth quarter of 2016 compared with

net recoveries of $0.50 million in the same quarter a year ago. Net

charge-offs for the full year were $5.40 million in 2016, compared

to net recoveries of $0.88 in 2015.

The provision for loan and lease losses for the fourth quarter

and full year of 2016 increased $0.74 million and $3.67 million,

respectively compared with the same periods in 2015.

The ratio of nonperforming assets to net loans and leases was

0.70% as of December 31, 2016, up from the 0.50% on December 31,

2015 and comparable to the 0.68% on September 30, 2016.

Capital

As of December 31, 2016, the common equity-to-assets ratio was

12.26% compared to 12.30% at September 30, 2016 and 12.41% a year

ago. The tangible common equity-to-tangible assets ratio was 10.89%

at December 31, 2016 and 10.93% at September 30, 2016 compared to

10.96% a year earlier. The Common Equity Tier 1 ratio, calculated

under banking regulatory guidelines, was 12.59% at December 31,

2016 compared to 12.35% at September 30, 2016 and 12.39% a year

ago. During 2016, the Company repurchased $8.03 million of common

stock in several open market transactions. During the fourth

quarter of 2016, accumulated other comprehensive income decreased

$8.03 million as a result of the decrease in the market value of

our investment securities available-for-sale given current market

conditions. At December 31, 2016 approximately 53% of our

investment securities portfolio will reprice in the next three

years.

ABOUT 1ST SOURCE CORPORATION

1st Source common stock is traded on the NASDAQ Global Select

Market under “SRCE” and appears in the National Market System

tables in many daily newspapers under the code name “1st Src.”

Since 1863, 1st Source has been committed to the success of the

communities it serves. For more information, visit

www.1stsource.com.

1st Source serves the northern half of Indiana and southwest

Michigan and is the largest locally controlled financial

institution headquartered in the area. While delivering a

comprehensive range of consumer and commercial banking services

through its community bank offices, 1st Source has distinguished

itself with highly personalized services. 1st Source Bank also

competes for business nationally by offering specialized financing

services for new and used private and cargo aircraft, automobiles

for leasing and rental agencies, medium and heavy duty trucks, and

construction equipment. The Corporation includes 81 banking

centers, 22 1st Source Bank Specialty Finance Group locations

nationwide, eight Wealth Advisory Services locations and ten 1st

Source Insurance offices.

FORWARD LOOKING STATEMENTS

Except for historical information contained herein, the matters

discussed in this document express “forward-looking statements.”

Generally, the words “believe,” “contemplate,” “seek,” “plan,”

“possible,” “assume,” “expect,” “intend,” “targeted,” “continue,”

“remain,” “estimate,” “anticipate,” “project,” “will,” “should,”

“indicate,” “would,” “may” and similar expressions indicate

forward-looking statements. Those statements, including statements,

projections, estimates or assumptions concerning future events or

performance, and other statements that are other than statements of

historical fact, are subject to material risks and uncertainties.

1st Source cautions readers not to place undue reliance on any

forward-looking statements, which speak only as of the date

made.

1st Source may make other written or oral forward-looking

statements from time to time. Readers are advised that various

important factors could cause 1st Source’s actual results or

circumstances for future periods to differ materially from those

anticipated or projected in such forward-looking statements. Such

factors, among others, include changes in laws, regulations or

accounting principles generally accepted in the United States; 1st

Source’s competitive position within its markets served; increasing

consolidation within the banking industry; unforeseen changes in

interest rates; unforeseen downturns in the local, regional or

national economies or in the industries in which 1st Source has

credit concentrations; and other risks discussed in 1st Source’s

filings with the Securities and Exchange Commission, including its

Annual Report on Form 10-K, which filings are available from the

SEC. 1st Source undertakes no obligation to publicly update or

revise any forward-looking statements.

NON-GAAP FINANCIAL MEASURES

The accounting and reporting policies of 1st Source conform to

generally accepted accounting principles (“GAAP”) in the United

States and prevailing practices in the banking industry. However,

certain non-GAAP performance measures are used by management to

evaluate and measure the Company’s performance. Although these

non-GAAP financial measures are frequently used by investors to

evaluate a financial institution, they have limitations as

analytical tools, and should not be considered in isolation, or as

a substitute for analyses of results as reported under GAAP. These

include taxable-equivalent net interest income (including its

individual components), net interest margin (including its

individual components), the efficiency ratio, tangible common

equity-to-tangible assets ratio and tangible book value per common

share. Management believes that these measures provide users of the

Company’s financial information a more meaningful view of the

performance of the interest-earning assets and interest-bearing

liabilities and of the Company’s operating efficiency. Other

financial holding companies may define or calculate these measures

differently.

Management reviews yields on certain asset categories and the

net interest margin of the Company and its banking subsidiaries on

a fully taxable-equivalent (“FTE”) basis. In this non-GAAP

presentation, net interest income is adjusted to reflect tax-exempt

interest income on an equivalent before-tax basis. This measure

ensures comparability of net interest income arising from both

taxable and tax-exempt sources. Net interest income on a FTE basis

is also used in the calculation of the Company’s efficiency ratio.

The efficiency ratio, which is calculated by dividing non-interest

expense by total taxable-equivalent net revenue (less securities

gains or losses and lease depreciation), measures how much it costs

to produce one dollar of revenue. Securities gains or losses and

lease depreciation are excluded from this calculation to better

match revenue from daily operations to operational expenses.

Management considers the tangible common equity-to-tangible assets

ratio and tangible book value per common share as useful

measurements of the Company’s equity.

See the table marked “Reconciliation of Non-GAAP Financial

Measures” for a reconciliation of certain non-GAAP financial

measures used by the Company with their most closely related GAAP

measures.

(charts attached)

1st SOURCE CORPORATION

4th QUARTER 2016 FINANCIAL HIGHLIGHTS (Unaudited - Dollars

in thousands, except per share data)

Three Months

Ended Twelve Months Ended December 31,

September 30, December 31, December 31,

December 31, 2016 2016

2015 2016 2015 AVERAGE

BALANCES Assets $ 5,461,990 $ 5,425,530 $ 5,134,594 $ 5,360,685

$ 4,994,208 Earning assets 5,097,192 5,066,375 4,792,553 5,003,922

4,668,811 Investments 828,955 821,068 785,903 812,501 786,980 Loans

and leases 4,149,913 4,189,340 3,959,468 4,113,508 3,837,149

Deposits 4,402,225 4,353,253 4,100,913 4,302,701 3,961,060 Interest

bearing liabilities 3,729,397 3,734,322 3,532,627 3,695,309

3,459,939 Common shareholders’ equity 675,915 670,006 647,027

663,703 635,497

INCOME STATEMENT DATA Net interest

income $ 43,383 $ 42.694 $ 43,211 $ 169,659 $ 166,521 Net interest

income - FTE(1) 43,837 43,144 43,668 171,484 168,219 Provision for

loan and lease losses 742 2,067 — 5,833 2,160 Noninterest income

22,356 22,665 20,902 88,945 83,316 Noninterest expense 41,761

41,145 41,744 163,645 159,114 Net income 15,225 14,264 14,417

57,786 57,486

PER SHARE DATA Basic net income per

common share $ 0.58 $ 0.55 $ 0.55 $ 2.22 $ 2.17 Diluted net income

per common share 0.58 0.55 0.55 2.22 2.17 Common cash dividends

declared 0.180 0.180 0.180 0.720 0.671 Book value per common share

26.00 25.91 24.75 26.00 24.75 Tangible book value per common

share(1) 22.75 22.65 21.49 22.75 21.49 Market value - High 45.61

35.99 34.35 45.61 34.35 Market value - Low 33.27 31.50 29.35 27.01

26.95 Basic weighted average common shares outstanding 25,873,552

25,867,169 26,059,762 25,879,397 26,173,351 Diluted weighted

average common shares outstanding 25,873,552 25,867,169 26,059,762

25,879,397 26,173,351

KEY RATIOS Return on average

assets 1.11 % 1.05 % 1.11 % 1.08 % 1.15 % Return on average common

shareholders’ equity 8.96 8.47 8.84 8.71 9.05 Average common

shareholders’ equity to average assets 12.37 12.35 12.60 12.38

12.72 End of period tangible common equity to tangible assets(1)

10.89 10.93 10.96 10.89 10.96 Risk-based capital - Common Equity

Tier 1(2) 12.59 12.35 12.39 12.59 12.39 Risk-based capital - Tier

1(2) 13.80 13.56 13.65 13.80 13.65 Risk-based capital - Total(2)

15.12 14.87 14.97 15.12 14.97 Net interest margin 3.39 3.35 3.58

3.39 3.57 Net interest margin - FTE(1) 3.42 3.39 3.61 3.43 3.60

Efficiency ratio: expense to revenue 63.53 62.95 65.11 63.28 63.69

Efficiency ratio: expense to revenue - adjusted(1) 59.87 60.10

61.98 60.24 60.93 Net charge offs to average loans and leases 0.11

0.44 (0.05 ) 0.13 (0.02 ) Loan and lease loss reserve to loans and

leases 2.11 2.13 2.21 2.11 2.21 Nonperforming assets to loans and

leases 0.70 0.68 0.50 0.70 0.50

December 31,

September 30, June 30, March 31, December

31, 2016 2016

2016 2016 2015 END OF PERIOD

BALANCES Assets $ 5,486,268 $ 5,447,911 $ 5,379,938 $ 5,245,610

$ 5,187,916 Loans and leases 4,188,071 4,179,417 4,152,763

4,031,975 3,994,692 Deposits 4,333,760 4,377,038 4,325,084

4,225,148 4,139,186 Reserve for loan and lease losses 88,543 88,897

91,458 89,296 88,112 Goodwill and intangible assets 84,102 84,244

84,386 84,530 84,676 Common shareholders’ equity 672,650 670,259

661,756 649,973 644,053

ASSET QUALITY Loans and

leases past due 90 days or more $ 416 $ 611 $ 275 $ 728 $ 122

Nonaccrual loans and leases 19,907 19,922 12,579 12,982 12,718

Other real estate 704 551 452 330 736 Repossessions 9,373 8,089

7,619 7,201 6,927 Equipment owned under operating leases 34

43 107 113

121 Total nonperforming assets $ 30,434

$ 29,216 $ 21,032 $ 21,354

$ 20,624

(1) See “Reconciliation of Non-GAAP

Financial Measures” for more information on this performance

measure/ratio.

(2) Calculated under banking regulatory

guidelines.

1st SOURCE CORPORATION

CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION (Unaudited -

Dollars in thousands)

December 31, September

30, June 30, December 31,

2016 2016 2016

2015

ASSETS

Cash and due from banks $ 58,578 $ 65,724 $ 58,944 $ 65,171 Federal

funds sold and interest bearing deposits with other banks 49,726

30,100 14,297 14,550 Investment securities available-for-sale

850,467 828,615 814,258 791,727 Other investments 22,458 22,458

21,973 21,973 Mortgages held for sale 15,849 19,986 15,924 9,825

Loans and leases, net of unearned discount: Commercial and

agricultural 812,264 786,167 759,175 744,749 Auto and light truck

411,764 400,809 457,586 425,236 Medium and heavy duty truck 294,790

271,478 273,674 278,254 Aircraft 802,414 836,977 822,842 778,012

Construction equipment 495,925 498,086 484,354 455,565 Commercial

real estate 719,170 744,972 715,932 700,268 Residential real estate

and home equity 521,931 512,597 506,369 490,468 Consumer

129,813 128,331 132,831

122,140

Total loans and leases 4,188,071 4,179,417

4,152,763 3,994,692 Reserve for loan and lease losses

(88,543 ) (88,897 ) (91,458 ) (88,112 )

Net

loans and leases 4,099,528 4,090,520 4,061,305 3,906,580

Equipment owned under operating leases, net 118,793 117,883 119,312

110,371 Net premises and equipment 56,708 54,654 54,506 53,191

Goodwill and intangible assets 84,102 84,244 84,386 84,676 Accrued

income and other assets 130,059 133,727

135,033 129,852

Total assets

$ 5,486,268 $ 5,447,911 $

5,379,938 $ 5,187,916

LIABILITIES

Deposits: Noninterest bearing $ 991,256 $ 992,776 $ 944,626 $

902,364 Interest-bearing deposits: Interest-bearing demand

1,471,526 1,417,692 1,391,823 1,350,417 Savings 814,326 799,891

779,899 745,661 Time 1,056,652 1,166,679

1,208,736 1,140,744

Total

interest-bearing deposits 3,342,504

3,384,262 3,380,458 3,236,822

Total deposits 4,333,760 4,377,038

4,325,084 4,139,186 Short-term

borrowings: Federal funds purchased and securities sold under

agreements to repurchase 162,913 167,029 161,826 130,662 Other

short-term borrowings 129,030 48,978

44,150 102,567

Total short-term

borrowings 291,943 216,007

205,976 233,229 Long-term debt and mandatorily

redeemable securities 74,308 64,760 64,738 57,379 Subordinated

notes 58,764 58,764 58,764 58,764 Accrued expenses and other

liabilities 54,843 61,083 63,620

55,305

Total liabilities

4,813,618 4,777,652 4,718,182

4,543,863

SHAREHOLDERS’

EQUITY

Preferred stock; no par value

Authorized 10,000,000 shares; none issued

or outstanding

— — — —

Common stock; no par value

Authorized 40,000,000 shares; issued

28,205,674 shares at December 31, 2016, September 30, 2016, June

30, 2016, and December 31, 2015, respectively

436,538 436,538 436,538 436,538 Retained earnings 290,824 280,335

270,744 251,812 Cost of common stock in treasury (2,329,909,

2,338,581, 2,342,904, and 2,178,090 shares at December 31, 2016,

September 30, 2016, June 30, 2016, and December 31, 2015,

respectively) (56,056 ) (56,262 ) (56,357 ) (50,852 ) Accumulated

other comprehensive income 1,344 9,648

10,831 6,555

Total shareholders’

equity 672,650 670,259

661,756 644,053

Total liabilities and

shareholders’ equity $ 5,486,268 $

5,447,911 $ 5,379,938 $ 5,187,916

1st SOURCE

CORPORATION CONSOLIDATED STATEMENTS OF INCOME (Unaudited

- Dollars in thousands, except per share amounts)

Three

Months Ended Twelve Months Ended December 31,

September 30, December 31, December 31,

December 31, 2016 2016

2015 2016 2015 Interest

income: Loans and leases $ 44,407 $ 44,965 $ 44,019 $ 175,999 $

168,766 Investment securities, taxable 3,273 2,384 3,000 11,777

11,929 Investment securities, tax-exempt 679 672 731 2,740 2,992

Other 365 279 267

1,244 997

Total interest income 48,724

48,300 48,017 191,760

184,684 Interest expense: Deposits 3,827 3,879 3,218

15,267 11,489 Short-term borrowings 95 150 103 525 484 Subordinated

notes 1,055 1,055 1,055 4,220 4,220 Long-term debt and mandatorily

redeemable securities 364 522

430 2,089 1,970

Total interest

expense 5,341 5,606 4,806

22,101 18,163

Net interest

income 43,383 42,694 43,211 169,659 166,521 Provision for loan

and lease losses 742 2,067 —

5,833 2,160

Net interest income

after provision for loan and lease losses 42,641

40,627 43,211 163,826

164,361 Noninterest income: Trust and wealth advisory 4,834

4,691 4,688 19,256 19,126 Service charges on deposit accounts 2,304

2,366 2,336 9,053 9,313 Debit card 2,727 2,745 2,607 10,887 10,217

Mortgage banking 1,001 1,334 1,111 4,496 4,570 Insurance

commissions 1,367 1,350 1,318 5,513 5,465 Equipment rental 6,616

6,657 6,000 25,863 22,302 Gains on investment securities

available-for-sale 1,006 989 — 1,796 4 Other 2,501

2,533 2,842 12,081

12,319

Total noninterest income 22,356

22,665 20,902 88,945

83,316 Noninterest expense: Salaries and employee benefits 22,156

22,136 22,579 86,837 86,133 Net occupancy 2,443 2,435 2,466 9,686

9,768 Furniture and equipment 5,001 4,898 4,877 19,500 18,348

Depreciation — leased equipment 5,563 5,570 4,938 21,678 18,280

Professional fees 1,508 1,244 1,467 5,161 4,682 Supplies and

communication 1,106 1,256 1,889 5,244 6,011 FDIC and other

insurance 710 647 868 3,147 3,412 Business development and

marketing 1,668 1,263 1,330 4,936 4,837 Loan and lease collection

and repossession 464 324 182 1,600 667 Other 1,142

1,372 1,148 5,856

6,976

Total noninterest expense 41,761

41,145 41,744 163,645

159,114 Income before income taxes 23,236 22,147 22,369 89,126

88,563 Income tax expense 8,011 7,883

7,952 31,340 31,077

Net

income $ 15,225 $ 14,264 $

14,417 $ 57,786 $ 57,486 Per common

share: Basic net income per common share $ 0.58

$ 0.55 $ 0.55 $ 2.22

$ 2.17 Diluted net income per common share $ 0.58

$ 0.55 $ 0.55 $ 2.22

$ 2.17 Cash dividends $ 0.180 $

0.180 $ 0.18 $ 0.720 $

0.671 Basic weighted average common shares outstanding

25,873,552 25,867,169 26,059,762

25,879,397 26,173,351 Diluted weighted average

common shares outstanding 25,873,552

25,867,169 26,059,762 25,879,397

26,173,351

1st SOURCE CORPORATION DISTRIBUTION

OF ASSETS, LIABILITIES AND SHAREHOLDERS’ EQUITY INTEREST

RATES AND INTEREST DIFFERENTIAL (Unaudited - Dollars in

thousands)

Three Months Ended December 31,

2016 September 30, 2016 December 31, 2015

Interest Interest Interest Average

Income/ Yield/ Average Income/

Yield/ Average Income/ Yield/

Balance Expense Rate

Balance Expense Rate

Balance Expense Rate

ASSETS

Investment securities available-for-sale: Taxable $ 696,110 $ 3,273

1.87 % $ 690,867 $ 2,384 1.37 % $ 663,569 $ 3,000 1.79 %

Tax-exempt(1) 132,845 983 2.94 % 130,201 973 2.97 % 122,334 1,074

3.48 % Mortgages held for sale 14,615 128 3.48 % 14,681 134 3.63 %

8,392 88 4.16 % Loans and leases, net of unearned discount(1)

4,149,913 44,429 4.26 % 4,189,340 44,980 4.27 % 3,959,468 44,045

4.41 % Other investments 103,709 365

1.40 % 41,286 279 2.69 %

38,790 267 2.73 % Total earning

assets(1) 5,097,192 49,178 3.84 % 5,066,375 48,750 3.83 % 4,792,553

48,474 4.01 % Cash and due from banks 62,689 60,665 62,446 Reserve

for loan and lease losses (89,618 ) (92,237 ) (89,841 ) Other

assets 391,727

390,727 369,436

Total assets $ 5,461,990

$ 5,425,530

$ 5,134,594

LIABILITIES AND

SHAREHOLDERS’ EQUITY

Interest-bearing deposits $ 3,406,478 $ 3,827 0.45 % $ 3,393,457 $

3,879 0.45 % $ 3,193,247 $ 3,218 0.40 % Short-term borrowings

189,895

95

0.20 % 217,460 150 0.27 % 223,202 103 0.18 % Subordinated notes

58,764 1,055 7.14 % 58,764 1,055 7.14 % 58,764 1,055 7.12 %

Long-term debt and mandatorily redeemable securities 74,260

364 1.95 % 64,641

522 3.21 % 57,414 430

2.97 % Total interest-bearing liabilities 3,729,397 5,341

0.57 % 3,734,322 5,606 0.60 % 3,532,627 4,806 0.54 %

Noninterest-bearing deposits 995,747 959,796 907,666 Other

liabilities 60,931 61,406 47,274 Shareholders’ equity

675,915 670,006

647,027

Total liabilities and shareholders’ equity $

5,461,990 $ 5,425,530

$ 5,134,594

Less: Fully tax-equivalent adjustments (454 )

(450 ) (457 ) Net interest income/margin (GAAP-derived)(1)

$ 43,383 3.39 % $

42,694 3.35 % $ 43,211

3.58 % Fully tax-equivalent adjustments 454 450 457 Net

interest income/margin - FTE(1) $ 43,837

3.42 % $ 43,144

3.39 % $ 43,668 3.61 %

(1) See “Reconciliation of Non-GAAP

Financial Measures” for more information on this performance

measure/ratio.

1st SOURCE

CORPORATION DISTRIBUTION OF ASSETS, LIABILITIES AND

SHAREHOLDERS’ EQUITY INTEREST RATES AND INTEREST

DIFFERENTIAL (Unaudited - Dollars in thousands)

Twelve Months Ended December 31, 2016 December 31,

2015 Interest Interest Average

Income/ Yield/ Average Income/

Yield/ Balance Expense

Rate Balance Expense

Rate

ASSETS

Investment securities available-for-sale: Taxable $ 684,503 $

11,777 1.72 % $ 664,480 $ 11,929 1.80 % Tax-exempt(1) 127,998 3,981

3.11 % 122,500 4,406 3.60 % Mortgages held for sale 12,396 467 3.77

% 11,099 439 3.96 % Loans and leases, net of unearned discount(1)

4,113,508 176,116 4.28 % 3,837,149 168,611 4.39 % Other investments

65,517 1,244 1.90 %

33,583 997 2.97 % Total earning

assets(1) 5,003,922 193,585 3.87 % 4,668,811 186,382 3.99 % Cash

and due from banks 60,753 61,400 Reserve for loan and lease losses

(90,206 ) (87,208 ) Other assets 386,216

351,205

Total assets $ 5,360,685

$ 4,994,208

LIABILITIES AND

SHAREHOLDERS’ EQUITY

Interest-bearing deposits $ 3,358,827 $ 15,267 0.45 % $ 3,106,990 $

11,489 0.37 % Short-term borrowings 210,876 525 0.25 % 236,940 484

0.20 % Subordinated notes 58,764 4,220 7.18 % 58,764 4,220 7.18 %

Long-term debt and mandatorily redeemable securities 66,842

2,089 3.13 % 57,245

1,970 3.44 % Total interest-bearing

liabilities 3,695,309 22,101 0.60 % 3,459,939 18,163 0.52 %

Noninterest-bearing deposits 943,874 854,070 Other liabilities

57,799 44,702 Shareholders’ equity 663,703

635,497

Total liabilities and shareholders’ equity $

5,360,685 $ 4,994,208

Less: Fully tax-equivalent

adjustments (1,825 ) (1,698 ) Net interest income/margin

(GAAP-derived)(1) $ 169,659 3.39

% $ 166,521 3.57 % Fully

tax-equivalent adjustments 1,825 1,698 Net interest income/margin -

FTE(1) $ 171,484 3.43 %

$ 168,219 3.60 %

(1) See “Reconciliation of Non-GAAP

Financial Measures” for more information on this performance

measure/ratio.

1st SOURCE

CORPORATION RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES (Unaudited - Dollars in thousands, except per share

data)

Three Months Ended Twelve Months Ended

December 31, September 30, December 31,

December 31, December 31,

2016 2016 2015

2016 2015

Calculation of

Net Interest Margin

(A) Interest income (GAAP) $ 48,724 $ 48,300 $ 48,017 $ 191,760 $

184,684 Fully tax-equivalent adjustments: (B) - Loans and leases

150 150 113 584 284 (C) - Tax-exempt investment securities

304 300 344 1,241

1,414 (D) Interest income - FTE (A+B+C) 49,178

48,750 48,474 193,585 186,382 (E) Interest expense (GAAP) 5,341

5,606 4,806 22,101 18,163 (F) Net interest income (GAAP)

(A–E) 43,383 42,694 43,211

169,659 166,521 (G) Net

interest income - FTE (D–E) 43,837 43,144

43,668 171,484 168,219

(H) Annualization factor 3.978 3.978 3.967 1.000 1.000 (I)

Total earning assets $ 5,097,192 $ 5,066,375 $ 4,792,553 $

5,003,922 $ 4,668,811 Net interest margin (GAAP-derived) (F*H)/I

3.39 % 3.35 % 3.58 % 3.39 % 3.57 % Net interest margin - FTE

(G*H)/I 3.42 % 3.39 % 3.61 % 3.43 % 3.60 %

Calculation of

Efficiency Ratio

(F) Net interest income (GAAP) $ 43,383 $ 42,694 $ 43,211 $ 169,659

$ 166,521 (G) Net interest income - FTE 43,837 43,144 43,668

171,484 168,219 (J) Plus: noninterest income (GAAP) 22,356 22,665

20,902 88,945 83,316 (K) Less: gains/losses on investment

securities and partnership investments (974 ) (1,046 ) (249 )

(3,873 ) (2,130 ) (L) Less: depreciation - leased equipment

(5,563 ) (5,570 ) (4,938 ) (21,678 )

(18,280 ) (M) Total net revenue (GAAP) (F+J)

65,739 65,359 64,113

258,604 249,837 (N) Total net revenue -

adjusted (G+J–K–L) 59,656 59,193

59,383 234,878 231,125 (O)

Noninterest expense (GAAP) 41,761 41,145 41,744 163,645 159,114 (L)

Less: depreciation - leased equipment (5,563 ) (5,570 ) (4,938 )

(21,678 ) (18,280 ) (P) Less: contribution expense limited

to gains on investment securities in (K) (484 ) —

— (484 ) — (Q)

Noninterest expense - adjusted (O–L–P) 35,714 35,575 36,806 141,483

140,834 Efficiency ratio (GAAP-derived) (O/M) 63.53 % 62.95 % 65.11

% 63.28 % 63.69 % Efficiency ratio - adjusted (Q/N) 59.87 % 60.10 %

61.98 % 60.24 % 60.93 %

End of Period December

31, September 30, December 31,

2016 2016 2015

Calculation of

Tangible Common Equity-to-Tangible Assets Ratio

(R) Total common shareholders’ equity (GAAP) $ 672,650 $ 670,259 $

644,053 (S) Less: goodwill and intangible assets

(84,102 ) (84,244 ) (84,676 ) (T) Total

tangible common shareholders’ equity (R–S) $ 588,548

$ 586,015 $ 559,377 (U) Total assets

(GAAP) 5,486,268 5,447,911 5,187,916 (S) Less: goodwill and

intangible assets (84,102 ) (84,244 ) (84,676

) (V) Total tangible assets (U–S) $ 5,402,166

$ 5,363,667 $ 5,103,240 Common

equity-to-assets ratio (GAAP-derived) (R/U) 12.26 % 12.30 % 12.41 %

Tangible common equity-to-tangible assets ratio (T/V) 10.89 % 10.93

% 10.96 %

Calculation of

Tangible Book Value per Common Share

(R) Total common shareholders’ equity (GAAP) $ 672,650 $ 670,259 $

644,053 (W) Actual common shares outstanding

25,875,765 25,867,093 26,027,584

Book value per common share (GAAP-derived) (R/W)*1000 $ 26.00 $

25.91 $ 24.75 Tangible common book value per share (T/W)*1000 $

22.75 $ 22.65 $ 21.49

The NASDAQ Stock Market National Market Symbol: “SRCE” (CUSIP

#336901 10 3)

Please contact us at shareholder@1stsource.com

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170119006112/en/

1st Source CorporationAndrea Short, 574-235-2000

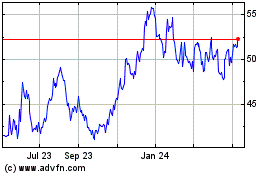

1st Source (NASDAQ:SRCE)

Historical Stock Chart

From Mar 2024 to Apr 2024

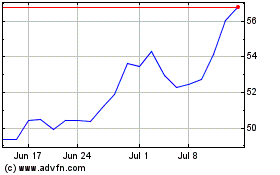

1st Source (NASDAQ:SRCE)

Historical Stock Chart

From Apr 2023 to Apr 2024