Fed's Tarullo Says Central Bank Is Considering 'Stress Test' Changes

November 05 2015 - 4:10PM

Dow Jones News

CHICAGO—Federal Reserve governor Daniel Tarullo said the central

bank could change the way its "stress tests" work for banking firms

with close to $50 billion in assets.

Mr. Tarullo, providing a bit more detail than he has in the

past, said the Fed is specifically rethinking the "capital

planning" portion of the test, which oversees if and how the banks

return money to shareholders through dividends and buybacks.

"We are trying to think of how we might reshape the capital

planning part of it, which is more within our discretion, to make

it somewhat less burdensome for the banks that are closer" to $50

billion in assets, he said during a conference on international

banking at the Federal Reserve Bank of Chicago.

The Wall Street Journal reported in June that the Fed was

seeking feedback on the tests, which apply to about 30 banks from

Zions Bancorp., with about $58 billion in assets, to J.P. Morgan

Chase & Co., which is the largest U.S. bank by assets more than

$2 trillion.

The banks on the lower end of that spectrum have been pushing

both the Fed and Congress to make the tests less costly for them.

The tests examine a bank's ability to weather a recession, and the

2010 Dodd-Frank law mandates them for banks with more than $50

billion in assets.

On Wednesday, Fed Chairwoman Janet Yellen reiterated that she

would support some modest changes to that part of the law,

including possibly raising the $50 billion threshold.

Mr. Tarullo also agreed with Ms. Yellen's assessment that, for

the very largest banks, the Fed isn't prepared to ease rules. "We

think there is still work to be done with respect to the largest,

most systemically important institutions," he said.

Separately, Mr. Tarullo pushed back against criticism of the

central bank's rules for foreign-owned banking firms doing business

in the U.S., saying the old regulatory approach allowed banks to

pursue "unsustainable activity that eventually ran badly

aground."

Mr. Tarullo, in remarks prepared for the conference, took on

detractors who say the Fed's regulatory regime for foreign-owned

firms has unnecessarily restricted the firms' flexibility to do

business across borders.

The remarks didn't address the Fed's interest-rate policy.

Since the 2008 financial crisis, the Fed has forced global banks

doing a large amount of business in the U.S. to consolidate their

U.S. organizations into one holding company that holds more

loss-absorbing capital to protect against losses in a downturn.

Last week, the Fed proposed adding a new requirement that those

holding companies issue loss-absorbing debt.

"The overarching guideline is that each jurisdiction should take

responsibility for protecting the financial stability of its own

markets as its contribution to achieving global financial

stability," Mr. Tarullo said, repeating an argument he has made

previously in support of the rules. The U.S. has a particular

responsibility to protect stability, he said, because "the extent

of this responsibility obviously increases with the size and

significance of the jurisdiction's financial markets."

Mr. Tarullo also called for greater international cooperation on

enforcing financial rules that global regulators have agreed to

implement since the 2008 crisis. Countries that have expertise in

jobs, such as assessing risky assets and running "stress tests,"

should share staff with countries that have less experience, he

said. This will help countries trust one another if they have to

deal with a crisis, he added.

Write to Ryan Tracy at ryan.tracy@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 05, 2015 15:55 ET (20:55 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

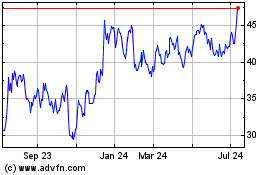

Zions Bancorporation NA (NASDAQ:ZION)

Historical Stock Chart

From Mar 2024 to Apr 2024

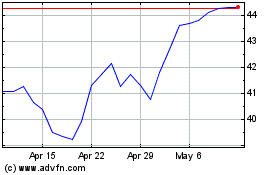

Zions Bancorporation NA (NASDAQ:ZION)

Historical Stock Chart

From Apr 2023 to Apr 2024