|

| | | | | |

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 |

FORM 8-K

|

CURRENT REPORT |

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934 |

Date of Report (Date of earliest event reported) | April 20, 2015 |

ZIONS BANCORPORATION |

(Exact name of registrant as specified in its charter) |

Utah | 001-12307 | 87-0227400 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

One South Main, 15th Floor, Salt Lake City, Utah | 84133 |

(Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code | 801-844-7637 |

|

(Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13a-4(c)) |

Item 2.02 Results of Operations and Financial Condition.

On April 20, 2015, Zions Bancorporation (“the Company”) announced its financial results for the quarter ended March 31, 2015. The press release announcing the financial results for the quarter ended March 31, 2015 is filed as Exhibit 99.1 and incorporated herein by reference.

Item 8.01 Other Events.

The information provided in this Item 8.01 is incorporated by reference to Item 2.02 of this Current Report on Form 8-K, including the exhibit.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The following exhibit is filed as part of this Current Report on Form 8-K:

Exhibit 99.1 Press Release dated April 20, 2015

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| ZIONS BANCORPORATION |

| | |

| | |

| By: | /s/ Doyle L. Arnold |

| Name: | Doyle L. Arnold |

| Title: | Vice Chairman and Chief Financial Officer |

Date: April 20, 2015

***FOR IMMEDIATE RELEASE***

|

| | | | | |

For: ZIONS BANCORPORATION | | | | | Contact: James Abbott |

One South Main, 15th Floor | | | | | Tel: (801) 844-7637 |

Salt Lake City, Utah | | | | | April 20, 2015 |

Harris H. Simmons | | | | | |

Chairman/Chief Executive Officer | | | | | |

ZIONS BANCORPORATION REPORTS EARNINGS OF $0.37

PER DILUTED COMMON SHARE FOR FIRST QUARTER 2015

SALT LAKE CITY, April 20, 2015 – Zions Bancorporation (NASDAQ: ZION) (“Zions” or “the Company”) today reported first quarter net earnings applicable to common shareholders of $75.3 million, or $0.37 per diluted common share, compared to $66.8 million, or $0.33 per diluted common share, for the fourth quarter of 2014.

First Quarter 2015 Highlights

| |

• | Credit quality metrics remained in line with expectations. However, as expected, energy-related nonperforming and classified loans increased and are expected to increase further in a continued low energy price environment. The Company experienced $17 million in net recoveries on loans. |

| |

• | Total noninterest expenses improved to $397 million from $423 million in the prior quarter due in part to reduced costs from CCAR preparation. |

| |

• | Net interest income declined somewhat, due primarily to fewer days of income and lower yields on loans as a result of continued pricing pressure on loan production particularly for larger commercial loans. |

| |

• | The estimated Basel III common equity tier 1 capital ratio at March 31, 2015 was 11.81% on a 2015 phase-in basis, essentially unchanged from 11.82% at December 31, 2014. |

ZIONS BANCORPORATION

Press Release – Page 2

April 20, 2015

“The first quarter results were generally in line with our expectations. We continued to strengthen reserves in light of continuing stress in the energy sector. We are nonetheless pleased to see the proactive and rapid steps many in that industry are taking to adjust to the current environment, including raising significant amounts of capital. We are encouraged by other credit trends and notably experienced recoveries net of charge-offs of $17 million during the quarter,” said Harris H. Simmons, chairman and chief executive officer.

Mr. Simmons continued, “Loan growth was subdued during the quarter; however, we continue to exercise caution with regard to underwriting standards and remain disciplined with respect to pricing. Finally, we are pleased to have announced an increase in the quarterly dividend on common stock to $0.06 per share from the previous $0.04 quarterly rate.”

Loans

Net loans and leases held for investment increased $116 million, or 0.3%, to $40.2 billion at March 31, 2015 from $40.1 billion at December 31, 2014. Increases included $101 million in commercial and industrial loans and $59 million in construction real estate loans. Commercial and industrial loan increases occurred primarily in Utah and Colorado.

Average loans and leases held for investment of $40.2 billion during the first quarter of 2015 increased $334 million, or 0.8%, from $39.8 billion during the fourth quarter. Unfunded lending commitments were $17.5 billion at March 31, 2015, compared to $17.6 billion at December 31, 2014.

ZIONS BANCORPORATION

Press Release – Page 3

April 20, 2015

Energy-Related Exposure

The following table presents the distribution of energy-related loans by customer market segment:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

ENERGY-RELATED EXPOSURE* | | | | | % of total loans | | | | | | % of total loans | | | | | | % of total loans |

(In millions) | March 31, 2015 | | | December 31, 2014 | | | September 30, 2014 | |

| | | | | | | | | | | | | | | | | |

Loans and leases | | | | | | | | | | | | | | | | | |

Oil and gas-related | | $ | 3,157 |

| | | 7.9 | % | | | $ | 3,073 |

| | | 7.7 | % | | | $ | 2,992 |

| | | 7.5 | % |

Alternative energy | | 232 |

| | | | | | 225 |

| | | | | | 208 |

| | | |

Total loans and leases | | 3,389 |

| | | | | | 3,298 |

| | | | | | 3,200 |

| | | |

Unfunded commitments to extend credit | | 2,451 |

| | | | | | 2,731 |

| | | | | | 2,659 |

| | | |

Total credit exposure | | $ | 5,840 |

| | | | | | $ | 6,029 |

| | | | | | $ | 5,859 |

| | | |

| | | | | | | | | | | | | | | | | |

Private equity investments | | $ | 20 |

| | | | | | $ | 21 |

| | | | | | $ | 20 |

| | | |

|

| | | | | | | | | | | | | | | | | |

Distribution of oil and gas-related balances | | | | | | | | | | | | | | |

Upstream – exploration and production | | 34 | % | | | | | | 34 | % | | | | | | 36 | % |

Midstream – marketing and transportation | | 21 | % | | | | | | 19 | % | | | | | | 19 | % |

Downstream – refining | | 4 | % | | | | | | 4 | % | | | | | | 3 | % |

Other non-services | | 2 | % | | | | | | 2 | % | | | | | | 1 | % |

Oilfield services | | 30 | % | | | | | | 31 | % | | | | | | 30 | % |

Energy service manufacturing | | 9 | % | | | | | | 10 | % | | | | | | 11 | % |

Total loans and leases | | 100 | % | | | | | | 100 | % | | | | | | 100 | % |

| |

* | Because many borrowers operate in multiple businesses, judgment has been applied in characterizing a borrower as energy-related, including a particular segment of energy-related activity, e.g., upstream or downstream. The September 30, 2014 and December 31, 2014 numbers in the preceding table have been adjusted to remove certain credits which, upon review, were determined not to be energy-related. |

A number of the Company’s customers took significant steps to mitigate risk during the quarter, including pay-downs resulting from refinancing that was driven in part by stronger capital markets activities within the energy sector (including issuance of additional public and private equity and debt). The Company’s overall balance of oil and gas-related loans increased 2.7% to $3,157 million. Exploration and production balances increased approximately 2.6%, while energy services loan balances declined approximately 3.9% from the prior quarter. Unfunded energy-related commitments to lend declined by $280 million, or 10% during the quarter; a majority of this reduction occurred in non-reserve-based commitments.

At March 31, 2015, consistent with expectations, approximately $65 million, or 2.1%, of the oil and gas-related loan balances were nonaccruing, compared to $17 million, or 0.5%, at December 31, 2014. Approximately 93% of the March 31, 2015 energy-related nonaccruing loans were current. Classified energy-related credits increased to $295 million at March 31, 2015 from $134 million at December 31, 2014.

Consistent with discussions during the Company’s fourth quarter 2014 earnings call on January 26, 2015, and due to continued weakness in oil and gas prices, the Company took steps this quarter to review a number of energy-related

ZIONS BANCORPORATION

Press Release – Page 4

April 20, 2015

credits prior to the regularly scheduled borrowing base re-determination. This action resulted in some credits being regraded. These steps were consistent with the Company’s effort to mitigate credit risks. The pattern of a significant increase in graded or classified energy loans as well as the increase in nonaccrual energy loans is generally consistent with prior cycles.

However, adjustments made by energy industry participants appear to be occurring more rapidly in this cycle, including for example, reducing drilling activity and raising additional capital. In past cycles, actual loan losses relative to the classified loan portfolio have been relatively small. Additional adjustments such as increases in energy-related classified loans and decreases in unfunded commitments may occur during the second quarter of 2015 as the Company completes its semiannual borrowing base re-determination process. The Company considers these and other factors when establishing the level of the allowance for credit losses.

Asset Quality

Gross loan and lease charge-offs declined to $20 million in the first quarter of 2015, compared to $35 million in the fourth quarter of 2014. Recoveries were $37 million in the first quarter, compared to $18 million in the fourth quarter. More than half of the gross recoveries were from non-energy-related loans at Amegy Bank.

Deterioration in various credit quality metrics was primarily related to energy-related loans at Amegy Bank; other credit metric trends not related to energy lending were generally stable. Nonperforming lending-related assets increased to $399 million at March 31, 2015 from $326 million at December 31, 2014. Classified loans increased to $1.3 billion at March 31, 2015 from $1.1 billion at December 31, 2014, also driven by energy-related credits. The ratio of nonperforming lending-related assets to loans and leases and other real estate owned increased to 0.99% at March 31, 2015, compared to 0.81% at December 31, 2014.

The allowance for credit losses increased $16 million to $702 million, or 1.75% of loans and leases at March 31, 2015, compared to $686 million, or 1.71%, of loans and leases at December 31, 2014. The provision for credit losses consists of the provision for loan losses – a negative $(1.5) million in the first quarter – plus the provision for unfunded lending commitments – $1.2 million in the first quarter – resulting in a net negative provision of $(0.3) million. During the six-month period beginning September 30, 2014, as energy prices have declined significantly, Amegy Bank has increased its allowance for credit losses by $55 million. This increase was partially offset by a reduction in the allowance elsewhere, due to favorable changes in credit quality outside of the energy industry.

ZIONS BANCORPORATION

Press Release – Page 5

April 20, 2015

Deposits

Total deposits increased $275 million to $48.1 billion at March 31, 2015, compared to $47.8 billion at December 31, 2014, and resulted primarily from increased noninterest-bearing deposits. Average total deposits of $47.5 billion for the first quarter of 2015 slightly decreased from the fourth quarter of 2014.

Shareholders’ Equity

Accumulated other comprehensive income (loss) improved to $(115) million at March 31, 2015 from $(128) million at December 31, 2014 primarily as a result of the securities reclassification discussed subsequently.

Tangible book value per common share improved by approximately 2% to $26.64 at March 31, 2015, compared to $26.23 at December 31, 2014. Compared to March 31, 2014, tangible book value per common share improved by approximately 9%.

Effective January 1, 2015, the Company began using Basel III risk weighted capital ratios. The estimated Basel III common equity tier 1 capital ratio on a 2015 phase-in basis was 11.81%, essentially unchanged from 11.82% at December 31, 2014.

Investments

The March 31, 2015 balance sheet compared to December 31, 2014 primarily reflects purchases of medium duration agency mortgage-backed securities that were generally funded through reduction of interest-bearing deposits, as well as an increase in available-for-sale (“AFS”) securities due to the reclassification of CDO securities previously designated as held-to-maturity (“HTM”) securities.

During the first quarter of 2015, the Company reclassified all of its remaining HTM CDO securities, or approximately $79 million at amortized cost, to AFS securities. This was the result of the Company’s Dodd-Frank Act stress test results and the CDO securities’ treatment under Basel III capital and risk weighting rules that became effective January 1, 2015. The reclassification provides the Company with greater flexibility with regard to the management of these securities. This reclassification improved other comprehensive income (“OCI”) by approximately $18 million pretax, because the fair value of these securities on the date of reclassification exceeded carrying value by that amount. Approximately half of this increase was offset during the first quarter by slight declines in fair values of the CDO securities. No gain or loss was recognized in earnings at the time of reclassification.

The Company recognized an immaterial amount of net realized losses on sales, paydowns and payoffs of CDO securities in the first quarter, compared to $11 million in net realized losses in the fourth quarter.

ZIONS BANCORPORATION

Press Release – Page 6

April 20, 2015

Net Interest Income

Net interest income decreased to $417 million in the first quarter of 2015 from $430 million in the fourth quarter of 2014, primarily as a result of two fewer days of income. The net interest margin decreased to 3.22% in the first quarter of 2015, compared to 3.25% in the fourth quarter of 2014, primarily due to lower loan yields on new production.

Noninterest Income

Noninterest income for the first quarter of 2015 was $122 million, compared to $129 million for the fourth quarter of 2014. The decrease was mostly attributable to the recognition in the fourth quarter of unrealized gains on Small Business Investment Company investments in both dividends and other investment income and in equity securities gains; excluding the securities gains, noninterest income declined moderately primarily due to lower service charges, which is largely attributable to seasonal effects.

Noninterest Expense

Noninterest expense for the first quarter of 2015 was $397 million, compared to $423 million for the fourth quarter of 2014 and $398 million for the first quarter of 2014. The decrease compared to the fourth quarter related to (1) the recognition of the litigation settlement in the fourth quarter in other noninterest expense and (2) decreased professional and legal services following the Company’s CCAR submission in January 2015. The $5 million quarterly increase to $244 million in salary and employee benefits expense was primarily due to the cyclical first quarter increase in payroll taxes.

Conference Call

Zions will host a conference call to discuss these first quarter results at 5:30 p.m. ET this afternoon (April 20, 2015). Media representatives, analysts and the public are invited to listen to this discussion by calling 253-237-1247 (domestic and international) and entering the passcode 10432053, or via on-demand webcast. A link to the webcast will be available on the Zions Bancorporation website at zionsbancorporation.com. The webcast of the conference call will also be archived and available for 30 days.

About Zions Bancorporation

Zions Bancorporation is one of the nation’s premier financial services companies, consisting of a collection of great banks in select Western markets. Zions operates its banking businesses under local management teams and community identities in 11 Western and Southwestern states: Arizona, California, Colorado, Idaho, Nevada, New Mexico, Oregon, Texas, Utah, Washington, and Wyoming. The Company is a national leader in Small Business Administration lending and received 24 “Excellence” awards by Greenwich Associates for the 2014 survey. In

ZIONS BANCORPORATION

Press Release – Page 7

April 20, 2015

addition, Zions is included in the S&P 500 and NASDAQ Financial 100 indices. Investor information and links to subsidiary banks can be accessed at zionsbancorporation.com.

Forward-Looking Information

Statements in this press release that are based on other than historical data or that express the Company’s expectations regarding future events or determinations are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. Statements based on historical data are not intended and should not be understood to indicate the Company’s expectations regarding future events. Forward-looking statements provide current expectations or forecasts of future events or determinations. These forward-looking statements are not guarantees of future performance or determinations, nor should they be relied upon as representing management’s views as of any subsequent date. Forward-looking statements involve significant risks and uncertainties, and actual results may differ materially from those presented, either expressed or implied, in this press release. Factors that could cause actual results to differ materially from those expressed in the forward-looking statements include the actual amount and duration of declines in the price of oil and gas as well as other factors discussed in the Company’s most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q, filed with the Securities and Exchange Commission (“SEC”) and available at the SEC’s Internet site (http://www.sec.gov).

Except as required by law, the Company specifically disclaims any obligation to update any factors or to publicly announce the result of revisions to any of the forward-looking statements included herein to reflect future events or developments.

ZIONS BANCORPORATION

Press Release – Page 8

April 20, 2015

FINANCIAL HIGHLIGHTS

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

(In thousands, except share, per share, and ratio data) | March 31,

2015 | | December 31,

2014 | | September 30,

2014 | | June 30,

2014 | | March 31,

2014 |

BALANCE SHEET | | | | | | | | | |

Loans and leases, net of allowance | $ | 39,560,101 |

| | $ | 39,458,995 |

| | $ | 39,129,295 |

| | $ | 38,954,172 |

| | $ | 38,460,917 |

|

Total assets | 57,555,931 |

| | 57,208,874 |

| | 55,458,870 |

| | 55,111,275 |

| | 56,080,844 |

|

Deposits | 48,123,360 |

| | 47,848,075 |

| | 46,266,562 |

| | 45,672,140 |

| | 46,533,305 |

|

Total shareholders’ equity | 7,454,298 |

| | 7,369,530 |

| | 7,322,159 |

| | 6,700,090 |

| | 6,586,216 |

|

| | | | | | | | | |

STATEMENT OF INCOME | | | | | | | | | |

Net interest income | $ | 417,346 |

| | $ | 430,430 |

| | $ | 416,819 |

| | $ | 416,284 |

| | $ | 416,471 |

|

Taxable-equivalent net interest income | 421,581 |

| | 434,789 |

| | 420,850 |

| | 420,202 |

| | 420,305 |

|

Provision for loan losses | (1,494 | ) | | 11,587 |

| | (54,643 | ) | | (54,416 | ) | | (610 | ) |

Total noninterest income | 121,822 |

| | 129,396 |

| | 116,071 |

| | 124,849 |

| | 138,313 |

|

Total noninterest expense | 397,461 |

| | 422,666 |

| | 438,536 |

| | 406,027 |

| | 398,063 |

|

Net earnings applicable to common shareholders | 75,279 |

| | 66,761 |

| | 79,127 |

| | 104,490 |

| | 76,190 |

|

| | | | | | | | | |

PER COMMON SHARE | | | | | | | | | |

Net earnings per diluted common share | $ | 0.37 |

| | $ | 0.33 |

| | $ | 0.40 |

| | $ | 0.56 |

| | $ | 0.41 |

|

Dividends | 0.04 |

| | 0.04 |

| | 0.04 |

| | 0.04 |

| | 0.04 |

|

Book value per common share 1 | 31.74 |

| | 31.35 |

| | 31.14 |

| | 30.77 |

| | 30.19 |

|

Tangible book value per common share 1 | 26.64 |

| | 26.23 |

| | 26.00 |

| | 25.13 |

| | 24.53 |

|

| | | | | | | | | |

SELECTED RATIOS | | | | | | | | | |

Return on average assets | 0.66 | % | | 0.57 | % | | 0.69 | % | | 0.87 | % | | 0.74 | % |

Return on average common equity | 4.77 | % | | 4.06 | % | | 5.10 | % | | 7.30 | % | | 5.52 | % |

Tangible return on average tangible common equity | 5.80 | % | | 4.95 | % | | 6.19 | % | | 9.07 | % | | 6.96 | % |

Net interest margin | 3.22 | % | | 3.25 | % | | 3.20 | % | | 3.29 | % | | 3.31 | % |

Ratio of nonperforming lending-related assets to loans and leases and other real estate owned | 0.99 | % | | 0.81 | % | | 0.84 | % | | 0.95 | % | | 1.12 | % |

Annualized ratio of net loan and lease charge-offs to average loans | (0.17 | )% | | 0.17 | % | | 0.11 | % | | 0.06 | % | | 0.08 | % |

Ratio of total allowance for credit losses to loans and leases outstanding 1 | 1.75 | % | | 1.71 | % | | 1.74 | % | | 1.95 | % | | 2.11 | % |

| | | | | | | | | |

Capital Ratios 1 | | | | | | | | | |

Tangible common equity ratio | 9.58 | % | | 9.48 | % | | 9.70 | % | | 8.60 | % | | 8.24 | % |

Basel III: 2,3 | | | | | | | | | |

Common equity tier 1 capital | 11.81 | % | | 11.82 | % | | | | | | |

Tier 1 leverage | 11.77 | % | | 11.59 | % | | | | | | |

Tier 1 risk-based capital | 13.99 | % | | 14.03 | % | | | | | | |

Total risk-based capital | 16.04 | % | | 16.08 | % | | | | | | |

Basel I: | | | | | | | | | |

Tier 1 common equity |

|

| | 11.92 | % | | 11.86 | % | | 10.45 | % | | 10.56 | % |

Tier 1 leverage |

|

| | 11.82 | % | | 11.87 | % | | 11.00 | % | | 10.71 | % |

Tier 1 risk-based capital |

|

| | 14.47 | % | | 14.43 | % | | 13.00 | % | | 13.19 | % |

Total risk-based capital |

|

| | 16.27 | % | | 16.28 | % | | 14.90 | % | | 15.11 | % |

| | | | | | | | | |

Weighted average common and common-equivalent shares outstanding | 202,944,209 |

| | 203,277,500 |

| | 197,271,076 |

| | 185,286,329 |

| | 185,122,844 |

|

Common shares outstanding 1 | 203,192,991 |

| | 203,014,903 |

| | 202,898,491 |

| | 185,112,965 |

| | 184,895,182 |

|

| |

2 | Ratios for March 31, 2015 are estimates. |

| |

3 | Basel III capital ratios became effective January 1, 2015 and are based on a 2015 phase-in. December 31, 2014 ratios are pro forma. |

ZIONS BANCORPORATION

Press Release – Page 9

April 20, 2015

CONSOLIDATED BALANCE SHEETS

|

| | | | | | | | | | | | | | | | | | | |

(In thousands, except shares) | March 31,

2015 | | December 31,

2014 | | September 30,

2014 | | June 30,

2014 | | March 31,

2014 |

| (Unaudited) | | | | (Unaudited) | | (Unaudited) | | (Unaudited) |

ASSETS | | | | | | | | | |

Cash and due from banks | $ | 720,858 |

| | $ | 841,942 |

| | $ | 585,672 |

| | $ | 1,381,262 |

| | $ | 1,338,930 |

|

Money market investments: | | | | | | | | | |

Interest-bearing deposits | 6,791,762 |

| | 7,178,097 |

| | 7,467,884 |

| | 6,389,222 |

| | 8,160,226 |

|

Federal funds sold and security resell agreements | 1,519,352 |

| | 1,386,291 |

| | 355,844 |

| | 478,535 |

| | 379,947 |

|

Investment securities: | | | | | | | | | |

Held-to-maturity, at adjusted cost (approximate fair value $602,355, $677,196, $642,529, $643,926, and $635,379) | 590,950 |

| | 647,252 |

| | 609,758 |

| | 615,104 |

| | 606,279 |

|

Available-for-sale, at fair value | 4,450,502 |

| | 3,844,248 |

| | 3,563,408 |

| | 3,462,809 |

| | 3,423,205 |

|

Trading account, at fair value | 71,392 |

| | 70,601 |

| | 55,419 |

| | 56,572 |

| | 56,172 |

|

| 5,112,844 |

| | 4,562,101 |

| | 4,228,585 |

| | 4,134,485 |

| | 4,085,656 |

|

| | | | | | | | | |

Loans held for sale | 128,946 |

| | 132,504 |

| | 109,139 |

| | 164,374 |

| | 126,344 |

|

| | | | | | | | | |

Loans and leases, net of unearned income and fees | 40,180,114 |

| | 40,063,658 |

| | 39,739,572 |

| | 39,630,079 |

| | 39,197,870 |

|

Less allowance for loan losses | 620,013 |

| | 604,663 |

| | 610,277 |

| | 675,907 |

| | 736,953 |

|

Loans, net of allowance | 39,560,101 |

| | 39,458,995 |

| | 39,129,295 |

| | 38,954,172 |

| | 38,460,917 |

|

| | | | | | | | | |

Other noninterest-bearing investments | 870,125 |

| | 865,950 |

| | 855,743 |

| | 854,978 |

| | 848,775 |

|

Premises and equipment, net | 844,900 |

| | 829,809 |

| | 811,127 |

| | 803,214 |

| | 785,519 |

|

Goodwill | 1,014,129 |

| | 1,014,129 |

| | 1,014,129 |

| | 1,014,129 |

| | 1,014,129 |

|

Core deposit and other intangibles | 23,162 |

| | 25,520 |

| | 28,160 |

| | 30,826 |

| | 33,562 |

|

Other real estate owned | 17,256 |

| | 18,916 |

| | 27,418 |

| | 27,725 |

| | 39,248 |

|

Other assets | 952,496 |

| | 894,620 |

| | 845,874 |

| | 878,353 |

| | 807,591 |

|

| $ | 57,555,931 |

| | $ | 57,208,874 |

| | $ | 55,458,870 |

| | $ | 55,111,275 |

| | $ | 56,080,844 |

|

| | | | | | | | | |

LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | | | | | |

Deposits: | | | | | | | | | |

Noninterest-bearing demand | $ | 20,854,630 |

| | $ | 20,529,124 |

| | $ | 19,771,631 |

| | $ | 19,611,516 |

| | $ | 19,259,108 |

|

Interest-bearing: | | | | | | | | | |

Savings and money market | 24,540,927 |

| | 24,583,636 |

| | 23,742,911 |

| | 23,308,114 |

| | 23,097,351 |

|

Time | 2,344,818 |

| | 2,406,924 |

| | 2,441,756 |

| | 2,500,303 |

| | 2,528,735 |

|

Foreign | 382,985 |

| | 328,391 |

| | 310,264 |

| | 252,207 |

| | 1,648,111 |

|

| 48,123,360 |

| | 47,848,075 |

| | 46,266,562 |

| | 45,672,140 |

| | 46,533,305 |

|

| | | | | | | | | |

Federal funds and other short-term borrowings | 203,597 |

| | 244,223 |

| | 191,798 |

| | 258,401 |

| | 279,837 |

|

Long-term debt | 1,089,321 |

| | 1,092,282 |

| | 1,113,677 |

| | 1,933,136 |

| | 2,158,701 |

|

Reserve for unfunded lending commitments | 82,287 |

| | 81,076 |

| | 79,377 |

| | 95,472 |

| | 88,693 |

|

Other liabilities | 603,068 |

| | 573,688 |

| | 485,297 |

| | 452,036 |

| | 434,092 |

|

Total liabilities | 50,101,633 |

| | 49,839,344 |

| | 48,136,711 |

| | 48,411,185 |

| | 49,494,628 |

|

| | | | | | | | | |

Shareholders’ equity: | | | | | | | | | |

Preferred stock, without par value, authorized 4,400,000 shares | 1,004,032 |

| | 1,004,011 |

| | 1,004,006 |

| | 1,004,006 |

| | 1,003,970 |

|

Common stock, without par value; authorized 350,000,000 shares; issued and outstanding 203,192,991, 203,014,903, 202,898,491, 185,112,965, and 184,895,182 shares | 4,728,556 |

| | 4,723,855 |

| | 4,717,295 |

| | 4,192,136 |

| | 4,185,513 |

|

Retained earnings | 1,836,619 |

| | 1,769,705 |

| | 1,711,785 |

| | 1,640,785 |

| | 1,542,195 |

|

Accumulated other comprehensive income (loss) | (114,909 | ) | | (128,041 | ) | | (110,927 | ) | | (136,837 | ) | | (145,462 | ) |

Total shareholders’ equity | 7,454,298 |

| | 7,369,530 |

| | 7,322,159 |

| | 6,700,090 |

| | 6,586,216 |

|

| $ | 57,555,931 |

| | $ | 57,208,874 |

| | $ | 55,458,870 |

| | $ | 55,111,275 |

| | $ | 56,080,844 |

|

ZIONS BANCORPORATION

Press Release – Page 10

April 20, 2015

CONSOLIDATED STATEMENTS OF INCOME

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

(In thousands, except per share amounts) | March 31,

2015 | | December 31,

2014 | | September 30,

2014 | | June 30,

2014 | | March 31,

2014 |

Interest income: | | | | | | | | | |

Interest and fees on loans | $ | 415,755 |

| | $ | 431,084 |

| | $ | 430,416 |

| | $ | 433,802 |

| | $ | 434,350 |

|

Interest on money market investments | 5,218 |

| | 5,913 |

| | 5,483 |

| | 4,888 |

| | 5,130 |

|

Interest on securities | 27,473 |

| | 24,963 |

| | 24,377 |

| | 24,502 |

| | 28,094 |

|

Total interest income | 448,446 |

| | 461,960 |

| | 460,276 |

| | 463,192 |

| | 467,574 |

|

Interest expense: | | | | | | | | | |

Interest on deposits | 12,104 |

| | 12,548 |

| | 12,313 |

| | 12,096 |

| | 12,779 |

|

Interest on short- and long-term borrowings | 18,996 |

| | 18,982 |

| | 31,144 |

| | 34,812 |

| | 38,324 |

|

Total interest expense | 31,100 |

| | 31,530 |

| | 43,457 |

| | 46,908 |

| | 51,103 |

|

Net interest income | 417,346 |

| | 430,430 |

| | 416,819 |

| | 416,284 |

| | 416,471 |

|

Provision for loan losses | (1,494 | ) | | 11,587 |

| | (54,643 | ) | | (54,416 | ) | | (610 | ) |

Net interest income after provision for loan losses | 418,840 |

| | 418,843 |

| | 471,462 |

| | 470,700 |

| | 417,081 |

|

Noninterest income: | | | | | | | | | |

Service charges and fees on deposit accounts | 41,194 |

| | 42,224 |

| | 43,468 |

| | 41,400 |

| | 41,199 |

|

Other service charges, commissions and fees | 47,486 |

| | 50,130 |

| | 51,639 |

| | 47,959 |

| | 44,250 |

|

Wealth management income | 7,615 |

| | 8,078 |

| | 7,438 |

| | 7,980 |

| | 7,077 |

|

Loan sales and servicing income | 7,706 |

| | 7,134 |

| | 7,592 |

| | 7,332 |

| | 7,096 |

|

Capital markets and foreign exchange | 5,501 |

| | 6,266 |

| | 5,400 |

| | 5,875 |

| | 5,043 |

|

Dividends and other investment income | 9,372 |

| | 16,479 |

| | 11,324 |

| | 7,995 |

| | 7,864 |

|

Fair value and nonhedge derivative income (loss) | (1,088 | ) | | (961 | ) | | 44 |

| | (1,934 | ) | | (8,539 | ) |

Equity securities gains, net | 3,353 |

| | 9,606 |

| | 440 |

| | 2,513 |

| | 912 |

|

Fixed income securities gains (losses), net | (239 | ) | | (11,620 | ) | | (13,901 | ) | | 5,026 |

| | 30,914 |

|

Impairment losses on investment securities | — |

| | — |

| | — |

| | — |

| | (27 | ) |

Less amounts recognized in other comprehensive income | — |

| | — |

| | — |

| | — |

| | — |

|

Net impairment losses on investment securities | — |

| | — |

| | — |

| | — |

| | (27 | ) |

Other | 922 |

| | 2,060 |

| | 2,627 |

| | 703 |

| | 2,524 |

|

Total noninterest income | 121,822 |

| | 129,396 |

| | 116,071 |

| | 124,849 |

| | 138,313 |

|

Noninterest expense: | | | | | | | | | |

Salaries and employee benefits | 243,519 |

| | 238,731 |

| | 245,518 |

| | 238,760 |

| | 233,402 |

|

Occupancy, net | 29,339 |

| | 29,962 |

| | 28,495 |

| | 28,939 |

| | 28,305 |

|

Furniture, equipment and software | 29,713 |

| | 30,858 |

| | 28,524 |

| | 27,986 |

| | 27,944 |

|

Other real estate expense | 374 |

| | (3,467 | ) | | 875 |

| | (266 | ) | | 1,607 |

|

Credit-related expense | 5,939 |

| | 7,518 |

| | 6,508 |

| | 7,161 |

| | 6,947 |

|

Provision for unfunded lending commitments | 1,211 |

| | 1,699 |

| | (16,095 | ) | | 6,779 |

| | (1,012 | ) |

Professional and legal services | 11,483 |

| | 26,257 |

| | 16,588 |

| | 12,171 |

| | 10,995 |

|

Advertising | 6,975 |

| | 5,805 |

| | 6,094 |

| | 6,803 |

| | 6,398 |

|

FDIC premiums | 8,119 |

| | 8,031 |

| | 8,204 |

| | 8,017 |

| | 7,922 |

|

Amortization of core deposit and other intangibles | 2,358 |

| | 2,640 |

| | 2,665 |

| | 2,736 |

| | 2,882 |

|

Debt extinguishment cost | — |

| | — |

| | 44,422 |

| | — |

| | — |

|

Other | 58,431 |

| | 74,632 |

| | 66,738 |

| | 66,941 |

| | 72,673 |

|

Total noninterest expense | 397,461 |

| | 422,666 |

| | 438,536 |

| | 406,027 |

| | 398,063 |

|

Income before income taxes | 143,201 |

| | 125,573 |

| | 148,997 |

| | 189,522 |

| | 157,331 |

|

Income taxes | 51,176 |

| | 43,759 |

| | 53,109 |

| | 69,972 |

| | 56,121 |

|

Net income | 92,025 |

| | 81,814 |

| | 95,888 |

| | 119,550 |

| | 101,210 |

|

Preferred stock dividends | (16,746 | ) | | (15,053 | ) | | (16,761 | ) | | (15,060 | ) | | (25,020 | ) |

Net earnings applicable to common shareholders | $ | 75,279 |

| | $ | 66,761 |

| | $ | 79,127 |

| | $ | 104,490 |

| | $ | 76,190 |

|

| | | | | | | | | |

Weighted average common shares outstanding during the period: | | | | | | | | |

Basic shares | 202,603 |

| | 202,783 |

| | 196,687 |

| | 184,668 |

| | 184,440 |

|

Diluted shares | 202,944 |

| | 203,278 |

| | 197,271 |

| | 185,286 |

| | 185,123 |

|

Net earnings per common share: | | | | | | | | | |

Basic | $ | 0.37 |

| | $ | 0.33 |

| | $ | 0.40 |

| | $ | 0.56 |

| | $ | 0.41 |

|

Diluted | 0.37 |

| | 0.33 |

| | 0.40 |

| | 0.56 |

| | 0.41 |

|

ZIONS BANCORPORATION

Press Release – Page 11

April 20, 2015

Note: FDIC-supported/PCI loans previously disclosed separately have been reclassified to their respective loan segments and classes due to declining materiality. Subsequent schedules presented herein reflect, as applicable, these reclassifications.

Loan Balances Held for Investment by Portfolio Type

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(In millions) | March 31,

2015 | | December 31,

2014 | | September 30,

2014 | | June 30,

2014 | | March 31,

2014 |

Commercial: | | | | | | | | | | | | | | | | | | | |

Commercial and industrial | | $ | 13,264 |

| | | | $ | 13,163 |

| | | | $ | 12,874 |

| | | | $ | 12,789 |

| | | | $ | 12,493 |

| |

Leasing | | 407 |

| | | | 409 |

| | | | 405 |

| | | | 415 |

| | | | 390 |

| |

Owner occupied | | 7,310 |

| | | | 7,351 |

| | | | 7,430 |

| | | | 7,499 |

| | | | 7,460 |

| |

Municipal | | 555 |

| | | | 521 |

| | | | 518 |

| | | | 522 |

| | | | 482 |

| |

Total commercial | | 21,536 |

| | | | 21,444 |

| | | | 21,227 |

| | | | 21,225 |

| | | | 20,825 |

| |

| | | | | | | | | | | | | | | | | | | |

Commercial real estate: | | | | | | | | | | | | | | | | | | | |

Construction and land development | | 2,045 |

| | | | 1,986 |

| | | | 1,895 |

| | | | 2,343 |

| | | | 2,267 |

| |

Term | | 8,088 |

| | | | 8,127 |

| | | | 8,259 |

| | | | 8,093 |

| | | | 8,239 |

| |

Total commercial real estate | | 10,133 |

| | | | 10,113 |

| | | | 10,154 |

| | | | 10,436 |

| | | | 10,506 |

| |

| | | | | | | | | | | | | | | | | | | |

Consumer: | | | | | | | | | | | | | | | | | | | |

Home equity credit line | | 2,315 |

| | | | 2,321 |

| | | | 2,266 |

| | | | 2,215 |

| | | | 2,177 |

| |

1-4 family residential | | 5,213 |

| | | | 5,201 |

| | | | 5,156 |

| | | | 4,830 |

| | | | 4,800 |

| |

Construction and other consumer real estate | | 373 |

| | | | 371 |

| | | | 350 |

| | | | 339 |

| | | | 330 |

| |

Bankcard and other revolving plans | | 407 |

| | | | 401 |

| | | | 389 |

| | | | 381 |

| | | | 365 |

| |

Other | | 203 |

| | | | 213 |

| | | | 198 |

| | | | 204 |

| | | | 195 |

| |

Total consumer | | 8,511 |

| | | | 8,507 |

| | | | 8,359 |

| | | | 7,969 |

| | | | 7,867 |

| |

Total loans | | $ | 40,180 |

| | | | $ | 40,064 |

| | | | $ | 39,740 |

| | | | $ | 39,630 |

| | | | $ | 39,198 |

| |

Nonperforming Lending-Related Assets

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | |

(Amounts in thousands) | March 31,

2015 | | December 31,

2014 | | September 30,

2014 | | June 30,

2014 | | March 31,

2014 |

| | | | | | | | | |

Nonaccrual loans | $ | 382,066 |

| | $ | 306,648 |

| | $ | 307,230 |

| | $ | 351,447 |

| | $ | 401,666 |

|

Other real estate owned | 17,256 |

| | 18,916 |

| | 27,418 |

| | 27,725 |

| | 39,248 |

|

Total nonperforming lending-related assets | $ | 399,322 |

| | $ | 325,564 |

| | $ | 334,648 |

| | $ | 379,172 |

| | $ | 440,914 |

|

| | | | | | | | | |

Ratio of nonperforming lending-related assets to loans1 and leases and other real estate owned | 0.99 | % | | 0.81 | % | | 0.84 | % | | 0.95 | % | | 1.12 | % |

| | | | | | | | | |

Accruing loans past due 90 days or more | $ | 31,552 |

| | $ | 29,228 |

| | $ | 30,755 |

| | $ | 46,769 |

| | $ | 38,190 |

|

Ratio of accruing loans past due 90 days or more to loans1 and leases | 0.08 | % | | 0.07 | % | | 0.08 | % | | 0.12 | % | | 0.10 | % |

| | | | | | | | | |

Nonaccrual loans and accruing loans past due 90 days or more | $ | 413,618 |

| | $ | 335,876 |

| | $ | 337,985 |

| | $ | 398,216 |

| | $ | 439,856 |

|

Ratio of nonaccrual loans and accruing loans past due 90 days or more to loans1 and leases | 1.03 | % | | 0.84 | % | | 0.85 | % | | 1.00 | % | | 1.12 | % |

| | | | | | | | | |

Accruing loans past due 30-89 days | $ | 97,242 |

| | $ | 86,488 |

| | $ | 89,081 |

| | $ | 108,083 |

| | $ | 114,405 |

|

| | | | | | | | | |

Restructured loans included in nonaccrual loans | 110,364 |

| | 97,779 |

| | 109,673 |

| | 103,157 |

| | 130,534 |

|

Restructured loans on accrual | 199,065 |

| | 245,550 |

| | 264,994 |

| | 320,206 |

| | 318,886 |

|

| | | | | | | | | |

Classified loans | 1,268,981 |

| | 1,147,106 |

| | 1,187,407 |

| | 1,304,077 |

| | 1,379,501 |

|

1 Includes loans held for sale.

ZIONS BANCORPORATION

Press Release – Page 12

April 20, 2015

Allowance for Credit Losses

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

(Amounts in thousands) | March 31,

2015 | | December 31,

2014 | | September 30,

2014 | | June 30,

2014 | | March 31,

2014 |

Allowance for Loan Losses | | | | | | | | | |

Balance at beginning of period | $ | 604,663 |

| | $ | 610,277 |

| | $ | 675,907 |

| | $ | 736,953 |

| | $ | 746,291 |

|

Add: | | | | | | | | | |

Provision for losses | (1,494 | ) | | 11,587 |

| | (54,643 | ) | | (54,416 | ) | | (610 | ) |

Adjustment for FDIC-supported/PCI loans | (38 | ) | | (19 | ) | | (25 | ) | | (444 | ) | | (817 | ) |

Deduct: | | | | | | | | | |

Gross loan and lease charge-offs | (20,188 | ) | | (35,544 | ) | | (26,471 | ) | | (23,400 | ) | | (20,795 | ) |

Recoveries | 37,070 |

| | 18,362 |

| | 15,509 |

| | 17,214 |

| | 12,884 |

|

Net loan and lease (charge-offs) recoveries | 16,882 |

| | (17,182 | ) | | (10,962 | ) | | (6,186 | ) | | (7,911 | ) |

Balance at end of period | $ | 620,013 |

| | $ | 604,663 |

| | $ | 610,277 |

| | $ | 675,907 |

| | $ | 736,953 |

|

| | | | | | | | | |

Ratio of allowance for loan losses to loans and leases, at period end | 1.54 | % | | 1.51 | % | | 1.54 | % | | 1.71 | % | | 1.88 | % |

| | | | | | | | | |

Ratio of allowance for loan losses to nonperforming loans, at period end | 162.28 | % | | 197.18 | % | | 198.64 | % | | 192.32 | % | | 183.47 | % |

| | | | | | | | | |

Annualized ratio of net loan and lease charge-offs to average loans | (0.17 | )% | | 0.17 | % | | 0.11 | % | | 0.06 | % | | 0.08 | % |

| | | | | | | | | |

Reserve for Unfunded Lending Commitments | | | | | | | | | |

Balance at beginning of period | $ | 81,076 |

| | $ | 79,377 |

| | $ | 95,472 |

| | $ | 88,693 |

| | $ | 89,705 |

|

Provision charged (credited) to earnings | 1,211 |

| | 1,699 |

| | (16,095 | ) | | 6,779 |

| | (1,012 | ) |

Balance at end of period | $ | 82,287 |

| | $ | 81,076 |

| | $ | 79,377 |

| | $ | 95,472 |

| | $ | 88,693 |

|

| | | | | | | | | |

Total Allowance for Credit Losses | | | | | | | | | |

Allowance for loan losses | $ | 620,013 |

| | $ | 604,663 |

| | $ | 610,277 |

| | $ | 675,907 |

| | $ | 736,953 |

|

Reserve for unfunded lending commitments | 82,287 |

| | 81,076 |

| | 79,377 |

| | 95,472 |

| | 88,693 |

|

Total allowance for credit losses | $ | 702,300 |

| | $ | 685,739 |

| | $ | 689,654 |

| | $ | 771,379 |

| | $ | 825,646 |

|

| | | | | | | | | |

Ratio of total allowance for credit losses to loans and leases outstanding, at period end | 1.75 | % | | 1.71 | % | | 1.74 | % | | 1.95 | % | | 2.11 | % |

ZIONS BANCORPORATION

Press Release – Page 13

April 20, 2015

Nonaccrual Loans by Portfolio Type

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(In millions) | March 31,

2015 | | December 31,

2014 | | September 30,

2014 | | June 30,

2014 | | March 31,

2014 |

| | | | | | | | | | | | | | | | | | | |

Loans held for sale | | $ | — |

| | | | $ | — |

| | | | $ | — |

| | | | $ | 29 |

| | | | $ | — |

| |

| | | | | | | | | | | | | | | | | | | |

Commercial: | | | | | | | | | | | | | | | | | | | |

Commercial and industrial | | 163 |

| | | | 106 |

| | | | 88 |

| | | | 83 |

| | | | 111 |

| |

Leasing | | — |

| | | | — |

| | | | 1 |

| | | | 1 |

| | | | 1 |

| |

Owner occupied | | 98 |

| | | | 87 |

| | | | 98 |

| | | | 101 |

| | | | 128 |

| |

Municipal | | 1 |

| | | | 1 |

| | | | 8 |

| | | | 9 |

| | | | 10 |

| |

Total commercial | | 262 |

| | | | 194 |

| | | | 195 |

| | | | 194 |

| | | | 250 |

| |

| | | | | | | | | | | | | | | | | | | |

Commercial real estate: | | | | | | | | | | | | | | | | | | | |

Construction and land development | | 22 |

| | | | 24 |

| | | | 25 |

| | | | 24 |

| | | | 29 |

| |

Term | | 38 |

| | | | 25 |

| | | | 30 |

| | | | 44 |

| | | | 60 |

| |

Total commercial real estate | | 60 |

| | | | 49 |

| | | | 55 |

| | | | 68 |

| | | | 89 |

| |

| | | | | | | | | | | | | | | | | | | |

Consumer: | | | | | | | | | | | | | | | | | | | |

Home equity credit line | | 10 |

| | | | 12 |

| | | | 12 |

| | | | 11 |

| | | | 10 |

| |

1-4 family residential | | 48 |

| | | | 50 |

| | | | 43 |

| | | | 45 |

| | | | 48 |

| |

Construction and other consumer real estate | | 2 |

| | | | 2 |

| | | | 2 |

| | | | 2 |

| | | | 3 |

| |

Bankcard and other revolving plans | | — |

| | | | — |

| | | | — |

| | | | 1 |

| | | | 1 |

| |

Other | | — |

| | | | — |

| | | | — |

| | | | 1 |

| | | | 1 |

| |

Total consumer | | 60 |

| | | | 64 |

| | | | 57 |

| | | | 60 |

| | | | 63 |

| |

Subtotal nonaccrual loans | | 382 |

| | | | 307 |

| | | | 307 |

| | | | 322 |

| | | | 402 |

| |

Total nonaccrual loans | | $ | 382 |

| | | | $ | 307 |

| | | | $ | 307 |

| | | | $ | 351 |

| | | | $ | 402 |

| |

Net Charge-Offs by Portfolio Type

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

(In millions) | March 31,

2015 | | December 31,

2014 | | September 30,

2014 | | June 30,

2014 | | March 31,

2014 |

Commercial: | | | | | | | | | | | | | | | | | | | |

Commercial and industrial | | $ | (5 | ) | | | | $ | 18 |

| | | | $ | 9 |

| | | | $ | 7 |

| | | | $ | 1 |

| |

Leasing | | — |

| | | | — |

| | | | — |

| | | | — |

| | | | (1 | ) | |

Owner occupied | | — |

| | | | — |

| | | | 2 |

| | | | (2 | ) | | | | 2 |

| |

Municipal | | — |

| | | | — |

| | | | — |

| | | | — |

| | | | — |

| |

Total commercial | | (5 | ) | | | | 18 |

| | | | 11 |

| | | | 5 |

| | | | 2 |

| |

| | | | | | | | | | | | | | | | | | | |

Commercial real estate: | | | | | | | | | | | | | | | | | | | |

Construction and land development | | (3 | ) | | | | (1 | ) | | | | (2 | ) | | | | (3 | ) | | | | (2 | ) | |

Term | | (10 | ) | | | | (1 | ) | | | | 2 |

| | | | 3 |

| | | | 7 |

| |

Total commercial real estate | | (13 | ) | | | | (2 | ) | | | | — |

| | | | — |

| | | | 5 |

| |

| | | | | | | | | | | | | | | | | | | |

Consumer: | | | | | | | | | | | | | | | | | | | |

Home equity credit line | | (1 | ) | | | | — |

| | | | — |

| | | | 1 |

| | | | — |

| |

1-4 family residential | | 1 |

| | | | 1 |

| | | | (1 | ) | | | | (1 | ) | | | | 1 |

| |

Construction and other consumer real estate | | — |

| | | | — |

| | | | — |

| | | | — |

| | | | (1 | ) | |

Bankcard and other revolving plans | | 1 |

| | | | — |

| | | | 1 |

| | | | 1 |

| | | | 2 |

| |

Other | | — |

| | | | — |

| | | | — |

| | | | — |

| | | | (1 | ) | |

Total consumer loans | | 1 |

| | | | 1 |

| | | | — |

| | | | 1 |

| | | | 1 |

| |

Total net charge-offs (recoveries) | | $ | (17 | ) | | | | $ | 17 |

| | | | $ | 11 |

| | | | $ | 6 |

| | | | $ | 8 |

| |

ZIONS BANCORPORATION

Press Release – Page 14

April 20, 2015

CONSOLIDATED AVERAGE BALANCE SHEETS, YIELDS AND RATES

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| March 31, 2015 | | December 31, 2014 | | September 30, 2014 |

(In thousands) | Average balance | | Average rate | | Average balance | | Average rate | | Average balance | | Average rate |

ASSETS | | | | | | | | | | | |

Money market investments | $ | 8,013,355 |

| | 0.26 | % | | $ | 8,712,588 |

| | 0.27 | % | | $ | 8,492,772 |

| | 0.26 | % |

Securities: | | | | | | | | | | | |

Held-to-maturity | 632,927 |

| | 5.12 | % | | 634,973 |

| | 4.97 | % | | 612,244 |

| | 5.13 | % |

Available-for-sale | 4,080,004 |

| | 2.06 | % | | 3,676,403 |

| | 1.98 | % | | 3,383,618 |

| | 2.10 | % |

Trading account | 69,910 |

| | 3.47 | % | | 69,323 |

| | 3.02 | % | | 50,970 |

| | 3.14 | % |

Total securities | 4,782,841 |

| | 2.49 | % | | 4,380,699 |

| | 2.43 | % | | 4,046,832 |

| | 2.57 | % |

| | | | | | | | | | | |

Loans held for sale | 105,279 |

| | 3.52 | % | | 115,372 |

| | 3.53 | % | | 124,347 |

| | 3.76 | % |

Loans and leases 1 | 40,179,007 |

| | 4.21 | % | | 39,845,470 |

| | 4.31 | % | | 39,567,425 |

| | 4.33 | % |

Total interest-earning assets | 53,080,482 |

| | 3.46 | % | | 53,054,129 |

| | 3.49 | % | | 52,231,376 |

| | 3.53 | % |

Cash and due from banks | 743,618 |

| | | | 764,518 |

| | | | 858,179 |

| | |

Allowance for loan losses | (609,233 | ) | | | | (607,317 | ) | | | | (674,590 | ) | | |

Goodwill | 1,014,129 |

| | | | 1,014,129 |

| | | | 1,014,129 |

| | |

Core deposit and other intangibles | 24,355 |

| | | | 26,848 |

| | | | 29,535 |

| | |

Other assets | 2,564,199 |

| | | | 2,692,339 |

| | | | 2,669,260 |

| | |

Total assets | $ | 56,817,550 |

| | | | $ | 56,944,646 |

| | | | $ | 56,127,889 |

| | |

| | | | | | | | | | | |

LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | | | | | | | |

Interest-bearing deposits: | | | | | | | | | | | |

Savings and money market | $ | 24,214,265 |

| | 0.16 | % | | $ | 24,089,519 |

| | 0.16 | % | | $ | 23,637,158 |

| | 0.16 | % |

Time | 2,372,492 |

| | 0.43 | % | | 2,426,878 |

| | 0.45 | % | | 2,466,552 |

| | 0.45 | % |

Foreign | 351,873 |

| | 0.14 | % | | 325,013 |

| | 0.15 | % | | 254,549 |

| | 0.16 | % |

Total interest-bearing deposits | 26,938,630 |

| | 0.18 | % | | 26,841,410 |

| | 0.19 | % | | 26,358,259 |

| | 0.19 | % |

Borrowed funds: | | | | | | | | | | | |

Federal funds and other short-term borrowings | 219,747 |

| | 0.14 | % | | 205,507 |

| | 0.13 | % | | 176,383 |

| | 0.12 | % |

Long-term debt | 1,091,706 |

| | 7.03 | % | | 1,102,673 |

| | 6.81 | % | | 1,878,247 |

| | 6.57 | % |

Total borrowed funds | 1,311,453 |

| | 5.87 | % | | 1,308,180 |

| | 5.76 | % | | 2,054,630 |

| | 6.01 | % |

Total interest-bearing liabilities | 28,250,083 |

| | 0.45 | % | | 28,149,590 |

| | 0.44 | % | | 28,412,889 |

| | 0.61 | % |

Noninterest-bearing deposits | 20,545,395 |

| | | | 20,706,849 |

| | | | 19,933,228 |

| | |

Other liabilities | 612,752 |

| | | | 563,014 |

| | | | 556,416 |

| | |

Total liabilities | 49,408,230 |

| | | | 49,419,453 |

| | | | 48,902,533 |

| | |

Shareholders’ equity: | | | | | | | | | | | |

Preferred equity | 1,004,015 |

| | | | 1,004,006 |

| | | | 1,004,012 |

| | |

Common equity | 6,405,305 |

| | | | 6,521,187 |

| | | | 6,221,344 |

| | |

Total shareholders’ equity | 7,409,320 |

| | | | 7,525,193 |

| | | | 7,225,356 |

| | |

Total liabilities and shareholders’ equity | $ | 56,817,550 |

| | | | $ | 56,944,646 |

| | | | $ | 56,127,889 |

| | |

| | | | | | | | | | | |

Spread on average interest-bearing funds | | | 3.01 | % | | | | 3.05 | % | | | | 2.92 | % |

| | | | | | | | | | | |

Net yield on interest-earning assets | | | 3.22 | % | | | | 3.25 | % | | | | 3.20 | % |

1 Net of unearned income and fees, net of related costs. Loans include nonaccrual and restructured loans.

ZIONS BANCORPORATION

Press Release – Page 15

April 20, 2015

GAAP to Non-GAAP Reconciliations

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | |

(In thousands, except per share amounts) | March 31,

2015 | | December 31,

2014 | | September 30,

2014 | | June 30,

2014 | | March 31,

2014 |

Tangible Book Value per Common Share | | | | | | | | |

| | | | | | | | | |

Total shareholders’ equity (GAAP) | $ | 7,454,298 |

| | $ | 7,369,530 |

| | $ | 7,322,159 |

| | $ | 6,700,090 |

| | $ | 6,586,216 |

|

Preferred stock | (1,004,032 | ) | | (1,004,011 | ) | | (1,004,006 | ) | | (1,004,006 | ) | | (1,003,970 | ) |

Goodwill | (1,014,129 | ) | | (1,014,129 | ) | | (1,014,129 | ) | | (1,014,129 | ) | | (1,014,129 | ) |

Core deposit and other intangibles | (23,162 | ) | | (25,520 | ) | | (28,160 | ) | | (30,826 | ) | | (33,562 | ) |

Tangible common equity (non-GAAP) (a) | $ | 5,412,975 |

| | $ | 5,325,870 |

| | $ | 5,275,864 |

| | $ | 4,651,129 |

| | $ | 4,534,555 |

|

| | | | | | | | | |

Common shares outstanding (b) | 203,193 |

| | 203,015 |

| | 202,898 |

| | 185,113 |

| | 184,895 |

|

| | | | | | | | | |

Tangible book value per common share (non-GAAP) (a/b) | $ | 26.64 |

| | $ | 26.23 |

| | $ | 26.00 |

| | $ | 25.13 |

| | $ | 24.53 |

|

| | | | | | | | | |

| Three Months Ended |

(Dollar amounts in thousands) | March 31,

2015 | | December 31,

2014 | | September 30,

2014 | | June 30,

2014 | | March 31,

2014 |

Tangible Return on Average Tangible Common Equity | | | | | | | | |

| | | | | | | | | |

Net earnings applicable to common shareholders (GAAP) | $ | 75,279 |

| | $ | 66,761 |

| | $ | 79,127 |

| | $ | 104,490 |

| | $ | 76,190 |

|

| | | | | | | | | |

Adjustments, net of tax: | | | | | | | | | |

Amortization of core deposit and other intangibles | 1,496 |

| | 1,676 |

| | 1,690 |

| | 1,735 |

| | 1,827 |

|

Net earnings applicable to common shareholders, excluding the effects of the adjustments, net of tax (non-GAAP) (a) | $ | 76,775 |

| | $ | 68,437 |

| | $ | 80,817 |

| | $ | 106,225 |

| | $ | 78,017 |

|

| | | | | | | | | |

Average common equity (GAAP) | $ | 6,405,305 |

| | $ | 6,521,187 |

| | $ | 6,221,344 |

| | $ | 5,744,696 |

| | $ | 5,595,363 |

|

Average goodwill | (1,014,129 | ) | | (1,014,129 | ) | | (1,014,129 | ) | | (1,014,129 | ) | | (1,014,129 | ) |

Average core deposit and other intangibles | (24,355 | ) | | (26,848 | ) | | (29,535 | ) | | (32,234 | ) | | (35,072 | ) |

Average tangible common equity (non-GAAP) (b) | $ | 5,366,821 |

| | $ | 5,480,210 |

| | $ | 5,177,680 |

| | $ | 4,698,333 |

| | $ | 4,546,162 |

|

| | | | | | | | | |

Number of days in quarter (c) | 90 |

| | 92 |

| | 92 |

| | 91 |

| | 90 |

|

Number of days in year (d) | 365 |

| | 365 |

| | 365 |

| | 365 |

| | 365 |

|

| | | | | | | | | |

Tangible return on average tangible common equity (non-GAAP) (a/b/c*d) | 5.80 | % | | 4.95 | % | | 6.19 | % | | 9.07 | % | | 6.96 | % |

This press release presents the non-GAAP financial measures previously shown. The adjustments to reconcile from the applicable GAAP financial measures to the non-GAAP financial measures are included where applicable in financial results presented in accordance with GAAP. The Company considers these adjustments to be relevant to ongoing operating results.

The Company believes that excluding the amounts associated with these adjustments to present the non-GAAP financial measures provides a meaningful base for period-to-period and company-to-company comparisons, which will assist regulators, investors, and analysts in analyzing the operating results or financial position of the Company and in predicting future performance. These non-GAAP financial measures are used by management to assess the performance of the Company’s business or its financial position for evaluating bank reporting segment performance, for presentations of Company performance to investors, and for other reasons as may be requested by investors and analysts. The Company further believes that presenting these non-GAAP financial measures will permit investors and analysts to assess the performance of the Company on the same basis as that applied by management.

Non-GAAP financial measures have inherent limitations, are not required to be uniformly applied, and are not audited. Although non-GAAP financial measures are frequently used by stakeholders to evaluate a company, they have limitations as an analytical tool and should not be considered in isolation or as a substitute for analysis of results reported under GAAP.

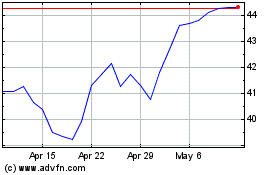

Zions Bancorporation NA (NASDAQ:ZION)

Historical Stock Chart

From Mar 2024 to Apr 2024

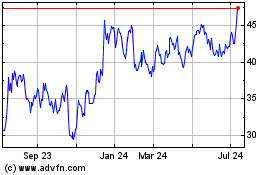

Zions Bancorporation NA (NASDAQ:ZION)

Historical Stock Chart

From Apr 2023 to Apr 2024