U.S. Treasury: Zions Bancorp Securities Sale to Reap $7.7 Million

November 30 2012 - 8:40AM

Dow Jones News

WASHINGTON--The U.S. Treasury Department Friday said it planned

to reap nearly $7.7 million in the sale of Zions Bancorp (ZION)

securities as it continues to wind down programs dating to the 2008

financial crisis.

Treasury said it priced the 5,789,909 warrants, securities that

give the right to purchase common stock, at $1.35 per warrant. It

expects to close the sale Dec. 5. Deutsche Bank Securities is

managing the book for the sale.

Treasury said the proceeds provide an additional return to the

U.S. taxpayer from its investment in the company beyond the

dividend payments received related to the preferred stock.

The government has turned a profit on the investments it made in

banks under the Troubled Asset Relief Program. But the overall

program, which also includes the auto bailout and housing

initiatives, is likely to cost taxpayers. The Congressional Budget

Office has estimated the final price tag will be $24 billion.

Write to Ian Talley at ian.talley@dowjones.com

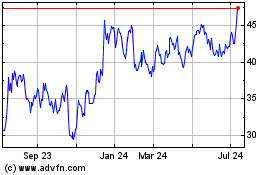

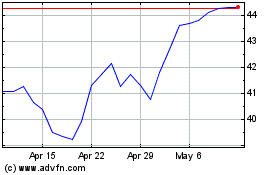

Zions Bancorporation NA (NASDAQ:ZION)

Historical Stock Chart

From Mar 2024 to Apr 2024

Zions Bancorporation NA (NASDAQ:ZION)

Historical Stock Chart

From Apr 2023 to Apr 2024