WPP Makes Strategic Investment in Refinery29 Inc.

April 28 2015 - 7:00AM

Business Wire

WPP and Scripps Networks Interactive Partner in

US$50 Million Series D Funding Round for Leading Media Company for

Millennial Women in the U.S.

WPP (NASDAQ:WPPGY), the world’s leading communications services

group, has made a strategic investment in Refinery29 Inc.

(“Refinery29”), a leading privately-held fashion and lifestyle

media company that provides content, shopping solutions and social

networking opportunities primarily in the fashion, shopping and

beauty categories targeted towards millennial women.

The investment is being made through WPP Ventures, which is

based in Silicon Valley and explores investments in new technology

companies that offer innovative solutions to WPP clients and

strengthen the capabilities of WPP. WPP Ventures partnered with

Scripps Networks Interactive in the investment.

Refinery29’s advertisers include Procter & Gamble, Revlon,

Neiman Marcus and Luxottica. The company employs over 250 people

and is based in New York with an office in Los Angeles. Founded in

2005, it is the leading content platform for millennial women with

a loyal following of 25 million monthly unique viewers, reaching

one out of every four millennial women.

"Refinery29 operates at the intersection of content, commerce

and social media - all areas of focus for WPP Ventures. We're

delighted to make this investment alongside Scripps," said Tom

Bedecarré, President of WPP Ventures.

This investment continues WPP's strategy of investing in fast

growing sectors such as digital and content. WPP's digital revenues

were US$6.9 billion in 2014, representing 36% of the Group's total

revenues of US$19 billion. WPP has set a target of 40-45% of

revenue to be derived from digital in the next five years.

In addition to Refinery29, WPP has invested in leading digital

content companies like China Media Capital, Fullscreen, Indigenous

Media, Imagina (a content rights and media company based in Spain),

Media Rights Capital and VICE.

WPP is a leader in the application of technology to marketing.

Its digital assets include companies like Acceleration (marketing

technology consultancy), Cognifide (content management technology),

Salmon (e-commerce), Hogarth (digital production technology) and

Xaxis (the world’s largest programmatic media platform). WPP also

has investments in a number of innovative technology services

companies such as Globant, Mutual Mobile, Polestar (a specialist

Alibaba e-commerce company in China) and Rentrak (the film and

television measurement company). It has also invested in ad

technology companies such as AppNexus, comScore (the US-based

internet audience measurement company), eCommera, DOMO,

mySupermarket and Percolate. WPP’s wholly-owned Chinese e-commerce

company Kuvera recently entered into a strategic partnership with

Paipai, China’s leading social commerce platform on mobile and a

wholly-owned subsidiary of JD.com. WPP investments in technology,

data and content companies are valued at over US$1 billion.

WPP also owns digital agencies AKQA, Blue State Digital, F.biz

in Brazil, OgilvyOne, POSSIBLE, Rockfish, VML and Wunderman.

In North America, WPP companies (including associates)

collectively generate revenues of almost US$7 billion and employ

around 27,000 people.

WPPFeona McEwan, + 44(0) 207 408 2204orWPPKevin McCormack, +1

(212) 632 2239

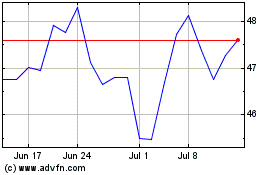

WPP (NYSE:WPP)

Historical Stock Chart

From Mar 2024 to Apr 2024

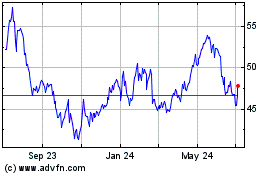

WPP (NYSE:WPP)

Historical Stock Chart

From Apr 2023 to Apr 2024