UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

July 23, 2015

|

|

|

ENCORE WIRE CORPORATION (Exact name of registrant as specified in its charter) |

|

|

| | | | |

Delaware (State or other jurisdiction of incorporation) | | 000-20278 (Commission File Number) | | 75-2274963 (IRS Employer Identification No.) |

| | | | |

1329 Millwood Road McKinney, Texas (Address of principal executive offices) | | | | 75069 (Zip Code) |

Registrant’s telephone number, including area code: (972) 562-9473

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| | |

¨ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| | |

¨ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| | |

¨ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| | |

¨ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition.

On July 23, 2015, Encore Wire Corporation, a Delaware corporation (the “Company”), issued an earnings release describing selected financial results of the Company for the second quarter of 2015 (the “Earnings Release”). A copy of the Earnings Release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

Limitation on Incorporation by Reference:

In accordance with general instruction B.2 of Form 8-K, the information in this report, including exhibits, is furnished pursuant to Item 2.02 and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liability of that section.

Item 7.01 Regulation FD Disclosure.

On July 23, 2015, the Company issued the Earnings Release. A copy of the Earnings Release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

Limitation on Incorporation by Reference:

In accordance with general instruction B.2 of Form 8-K, the information in this report, including exhibits, is furnished pursuant to Item 7.01 and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liability of that section.

Item 9.01 Financial Statements and Exhibits.

| |

99.1 | July 23, 2015 Earnings Release by Encore Wire Corporation regarding results for the second quarter of 2015. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| ENCORE WIRE CORPORATION |

| | |

July 23, 2015 | By: | | /s/ FRANK J. BILBAN |

| | | Frank J. Bilban, Vice President – Finance, Treasurer, Secretary and Chief Financial Officer |

INDEX TO EXHIBITS

|

| | |

Item | | Exhibit |

| |

99.1 | | July 23, 2015 Earnings Release by Encore Wire Corporation regarding results for the second quarter of 2015. |

Exhibit 99.1

|

| | | | | | | |

Encore Wire Corporation | | PRESS RELEASE | | | | July 23, 2015 | |

1329 Millwood Road | | | | | | | |

McKinney, Texas 75069 | | | | Contact: | | Frank J. Bilban | |

972-562-9473 | | | | | | Vice President & CFO | |

| | | | |

| | For Immediate Release | | | | | |

ENCORE WIRE REPORTS SECOND QUARTER RESULTS

MCKINNEY, TX - Encore Wire Corporation (NASDAQ Global Select: WIRE) today announced results for the second quarter of 2015.

Net sales for the second quarter ended June 30, 2015 were $253.7 million compared to $307.1 million during the second quarter of 2014. Copper unit volume, measured in pounds of copper contained in the wire sold, decreased 13.4% in the second quarter of 2015 versus the second quarter of 2014. Aluminum building wire sales constituted 9.4% of net sales dollars for the second quarter of 2015 versus 8.9% in the second quarter of 2014. Aluminum unit volume was down 14.9% in the second quarter of 2015 versus the second quarter of 2014. The average selling price of wire per copper pound sold dropped 5.1% in the second quarter of 2015 versus the second quarter of 2014, also contributing to the decrease in net sales dollars. Copper wire sales prices declined primarily due to lower copper prices, which declined 11.1% versus the second quarter of 2014. Net income for the second quarter of 2015 was $11.4 million versus $10.2 million in the second quarter of 2014. Fully diluted net earnings per common share were $0.54 in the second quarter of 2015 versus $0.49 in the second quarter of 2014.

Net sales for the six months ended June 30, 2015 were $504.0 million compared to $584.3 million during the same period in 2014. The average selling price of wire per copper pound sold dropped 8.3%, while copper unit volume sold declined 6.9% in the six months ended June 30, 2015 versus the six months ended June 30, 2014. Copper wire sales prices followed the price of copper purchased, which declined 14.1%. Aluminum building wire sales constituted 9.4% of net sales dollars for the six months ended June 30, 2015 versus 8.4% in the six months ended June 30, 2014. Net income for the six months ended June 30, 2015 was $22.1 million versus $21.0 million in the same period in 2014. Fully diluted net earnings per common share were $1.06 for the six months ended June 30, 2015 versus $1.01 in the same period in 2014.

On a sequential quarter comparison, net sales for the second quarter of 2015 were $253.7 million versus $250.3 million during the first quarter of 2015. Sales dollars increased, due to a 2.4% increase in the average selling price per pound of copper wire sold, offset slightly by a 1% unit volume decrease of copper building wire sold on a sequential quarter comparison. Net income for the second quarter of 2015 increased to $11.4 million versus $10.8 million in the first quarter of 2015. Fully diluted net income per common share was $0.54 in the second quarter of 2015 versus $0.52 in the first quarter of 2015.

Commenting on the results, Daniel L. Jones, Chairman, President and Chief Executive Officer of Encore Wire Corporation, said, “We are pleased with the second quarter earnings results. Margins improved in both copper and aluminum wire sales. Unit volumes were down somewhat in 2015 compared to 2014 as we continue to see the overall construction and building wire markets appear to be trying to break out to higher levels. We believe rough spring weather contributed to the soft unit volumes during the quarter. We also know that we passed on a number of orders during the quarter that did not meet our margin criteria. We believe this strategy of attempting to be an industry pricing leader clearly contributed to our improved margins during the quarter. One of the key metrics to our earnings is the “spread” between the price of copper wire sold and the cost of raw copper purchased in any given period. That spread increased 11.0% in the second quarter of 2015 versus the second quarter of 2014, and 1.2% on a sequential quarter comparison. The copper spread expanded 11.0% as the average price of copper purchased decreased 11.1% in the second quarter of 2015 versus the second quarter of 2014, but the average selling price of wire sold decreased only 5.1%, as a result of somewhat improved pricing discipline in the industry. The aluminum building wire products grew to 9.4% of net sales in the quarter versus 8.9% in the second quarter of 2014.

We continue to strive to lead and support industry price increases in an effort to maintain and increase margins. We believe our superior order fill rates continue to enhance our competitive position, as our electrical distributor customers are holding lean inventories in the field. As orders come in from electrical contractors, the distributors can count on our order fill rates to ensure quick deliveries from coast to coast. We have been able to accomplish this despite holding what are historically lean inventories for us.

Our balance sheet is very strong. We have no long term debt, and our revolving line of credit is paid down to zero. In addition, we had $45.6 million in cash at the end of the quarter. We also declared another cash dividend during the quarter.

Our low cost structure and strong balance sheet have enabled us to withstand difficult periods in the past, and we believe are continuing to prove valuable now. We thank our employees and associates for their outstanding effort and our shareholders for their continued support.”

Encore Wire Corporation is a leading manufacturer of a broad range of electrical building wire for interior wiring in commercial and industrial buildings, homes, apartments, and manufactured housing. The Company is focused on maintaining a high level of customer service with low-cost production and the addition of new products that complement its current product line. The matters discussed in this news release, other than the historical financial information, including statements about the copper pricing environment, profitability and stockholder value, may include forward-looking statements that involve risks and uncertainties, including payment of future dividends, future purchases of stock, fluctuations in the price of copper and other raw materials, the impact of competitive pricing and other risks detailed from time to time in the Company’s reports filed with the Securities and Exchange Commission. Actual results may vary materially from those anticipated.

Additional Disclosures:

The term “EBITDA” is used by the Company in presentations, quarterly conference calls and other instances as appropriate. EBITDA is defined as net income before interest, income taxes, depreciation and amortization. The Company presents EBITDA because it is a required component of financial ratios reported by the Company to the Company’s banks, and is also frequently used by securities analysts, investors and other interested parties, in addition to and not in lieu of Generally Accepted Accounting Principles (GAAP) results to compare to the performance of other companies who also publicize this information. EBITDA is not a measurement of financial performance under GAAP and should not be considered an alternative to net income as an indicator of the Company’s operating performance or any other measure of performance derived in accordance with GAAP.

The Company has reconciled EBITDA with net income for fiscal years 1996 to 2014 on previous current reports on Form 8-K filed with the Securities and Exchange Commission. EBITDA for each period pertinent to this press release is calculated and reconciled to net income as follows:

|

| | | | | | | | | | | | | | | | |

| | Quarter Ended June 30, | | Six Months Ended June 30, |

In Thousands | | 2015 | | 2014 | | 2015 | | 2014 |

Net Income | | $ | 11,353 |

| | $ | 10,154 |

| | $ | 22,141 |

| | $ | 21,007 |

|

Income Tax Expense | | 5,711 |

| | 5,126 |

| | 11,421 |

| | 11,012 |

|

Interest Expense | | 62 |

| | 82 |

| | 124 |

| | 146 |

|

Depreciation and Amortization | | 3,951 |

| | 3,918 |

| | 7,848 |

| | 7,813 |

|

EBITDA | | $ | 21,077 |

| | $ | 19,280 |

| | $ | 41,534 |

| | $ | 39,978 |

|

Encore Wire Corporation

Condensed Consolidated Balance Sheets

(In Thousands)

|

| | | | | | | |

| June 30, 2015 | | December 31, 2014 |

| (Unaudited) | | |

ASSETS | | | |

Current Assets | | | |

Cash | $ | 45,603 |

| | $ | 54,664 |

|

Receivables, net | 200,306 |

| | 206,908 |

|

Inventories | 92,562 |

| | 78,251 |

|

Prepaid Expenses and Other | 3,003 |

| | 5,492 |

|

Total Current Assets | 341,474 |

| | 345,315 |

|

Property, Plant and Equipment, net | 243,375 |

| | 226,506 |

|

Other Assets | 275 |

| | 930 |

|

Total Assets | $ | 585,124 |

| | $ | 572,751 |

|

| | | |

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

Current Liabilities | | | |

Accounts Payable | $ | 24,915 |

| | $ | 31,147 |

|

Accrued Liabilities and Other | 25,681 |

| | 28,191 |

|

Total Current Liabilities | 50,596 |

| | 59,338 |

|

Long Term Liabilities | | | |

Non-Current Deferred Income Taxes | 19,221 |

| | 20,226 |

|

Total Long Term Liabilities | 19,221 |

| | 20,226 |

|

Total Liabilities | 69,817 |

| | 79,564 |

|

Stockholders’ Equity | | | |

Common Stock | 267 |

| | 267 |

|

Additional Paid in Capital | 51,406 |

| | 50,598 |

|

Treasury Stock | (88,134 | ) | | (88,134 | ) |

Retained Earnings | 551,768 |

| | 530,456 |

|

Total Stockholders’ Equity | 515,307 |

| | 493,187 |

|

Total Liabilities and Stockholders’ Equity | $ | 585,124 |

| | $ | 572,751 |

|

Encore Wire Corporation

Condensed Consolidated Statements of Income

(Unaudited)

(In Thousands, Except Per Share Data)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended June 30, | | Six Months Ended June 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

| | | | | | | | | | | | | | | |

Net Sales | $ | 253,747 |

| | 100.0 | % | | $ | 307,088 |

| | 100.0 | % | | $ | 504,010 |

| | 100.0 | % | | $ | 584,286 |

| | 100.0 | % |

Cost of Sales | 220,842 |

| | 87.0 | % | | 273,576 |

| | 89.1 | % | | 438,674 |

| | 87.0 | % | | 518,598 |

| | 88.8 | % |

Gross Profit | 32,905 |

| | 13.0 | % | | 33,512 |

| | 10.9 | % | | 65,336 |

| | 13.0 | % | | 65,688 |

| | 11.2 | % |

| | | | | | | | | | | | | | | |

Selling, General and Administrative Expenses | 15,857 |

| | 6.2 | % | | 18,235 |

| | 5.9 | % | | 31,889 |

| | 6.3 | % | | 33,688 |

| | 5.8 | % |

Operating Income | 17,048 |

| | 6.7 | % | | 15,277 |

| | 5.0 | % | | 33,447 |

| | 6.6 | % | | 32,000 |

| | 5.5 | % |

| | | | | | | | | | | | | | | |

Net Interest & Other Expense | (16 | ) | | — | % | | (3 | ) | | — | % | | (115 | ) | | — | % | | (19 | ) | | — | % |

Income before Income Taxes | 17,064 |

| | 6.7 | % | | 15,280 |

| | 5.0 | % | | 33,562 |

| | 6.7 | % | | 32,019 |

| | 5.5 | % |

| | | | | | | | | | | | | | | |

Income Taxes | 5,711 |

| | 2.3 | % | | 5,126 |

| | 1.7 | % | | 11,421 |

| | 2.3 | % | | 11,012 |

| | 1.9 | % |

Net Income | $ | 11,353 |

| | 4.5 | % | | $ | 10,154 |

| | 3.3 | % | | $ | 22,141 |

| | 4.4 | % | | $ | 21,007 |

| | 3.6 | % |

| | | | | | | | | | | | | | | |

Basic Earnings Per Share | $ | 0.55 |

| | | | $ | 0.49 |

| | | | $ | 1.07 |

| | | | $ | 1.01 |

| | |

Diluted Earnings Per Share | $ | 0.54 |

| | | | $ | 0.49 |

| | | | $ | 1.06 |

| | | | $ | 1.01 |

| | |

Weighted Average Number of Common and Common Equivalent Shares Outstanding: |

| | | |

| | | | | | | | | | |

Basic | 20,737 |

| | | | 20,715 |

| | | | 20,731 |

| | | | 20,709 |

| | |

Diluted | 20,836 |

| | | | 20,835 |

| | | | 20,809 |

| | | | 20,837 |

| | |

Dividend Declared per Share | $ | 0.02 |

| | | | $ | 0.02 |

| | | | $ | 0.04 |

| | | | $ | 0.04 |

| | |

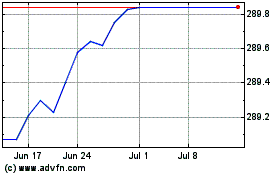

Encore Wire (NASDAQ:WIRE)

Historical Stock Chart

From Mar 2024 to Apr 2024

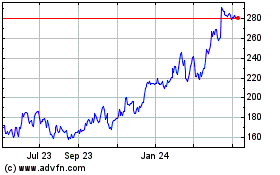

Encore Wire (NASDAQ:WIRE)

Historical Stock Chart

From Apr 2023 to Apr 2024