Current Report Filing (8-k)

February 13 2015 - 5:01PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 13, 2015

VISION-SCIENCES, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

000-20970 |

13-3430173 |

|

(State or other jurisdiction |

(Registration number) |

(IRS employer |

|

of incorporation) |

identification no.) |

identification no.) |

|

40 Ramland Road South

Orangeburg, NY |

|

10962 |

|

(Address of principal executive offices) |

|

(Zip code) |

Registrant’s telephone number, including area code: (845) 365-0600

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 3.01. Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On February 13, 2015, Vision-Sciences, Inc. (the "Company") received a notification letter from the Listing Qualifications Department of The NASDAQ Stock Market ("NASDAQ") indicating that, for the last 30 consecutive business days, the Company failed to comply with NASDAQ Marketplace Rule 5550(b)(2), which requires the Company to maintain a minimum Market Value of Listed Securities ("MVLS") of $35 million for continued listing on the NASDAQ Capital Market. The letter also noted that the Company did not meet the alternative requirements under NASDAQ Marketplace Rules 5550(b)(1) or 5550(b)(3).

In accordance with NASDAQ Marketplace Rule 5810(c)(3), the Company has 180 calendar days, or until August 12, 2015, to regain compliance with NASDAQ Marketplace Rule 5550(b)(2). To regain compliance, any time before August 12, 2015, the Company's MVLS must close at $35 million or more for a minimum of 10 consecutive business days. NASDAQ's notification letter has no effect on the listing of the Company's common stock at this time.

If the Company does not regain compliance with NASDAQ Marketplace Rule 5550(b)(2) prior to the expiration of the compliance period, NASDAQ will provide the Company with written notification that its common stock will be delisted. Upon such notice, the Company may appeal the NASDAQ Staff's determination to a Hearings Panel pursuant to the procedures set forth in the applicable NASDAQ Marketplace Rules. There can be no assurance that, if the Company appeals the NASDAQ Staff's determination, such appeal would be successful.

The Company is currently evaluating its alternatives to resolve this listing deficiency. There can be no assurance that the Company will be able to regain compliance with applicable NASDAQ listing requirements.

On January 27, 2015, the Company filed with the Securities and Exchange Commission a registration statement on Form S-4 that includes a preliminary joint proxy statement of the Company and Uroplasty, Inc. (“Uroplasty”) relating to a special meeting of stockholders on a date to be determined. Among the proposals that the Company intends to submit to its stockholders at the special meeting are (i) approval of the merger between the Company and Uroplasty and the issuance of new shares of the Company’s common stock in exchange for all outstanding shares of Urpolasty common stock, and (ii) an amendment to the Company’s Amended and Restated Certificate of Incorporation to effect a reverse split of the Company’s common stock. The Company believes that, if the stockholders approve such proposals, the Company’s board of directors will be able to effect a reverse stock split that would raise the bid price on the Company’s common stock to above $1.00 and to issue sufficient shares of the Company’s common stock in connection with the merger to raise the MVLS to above $35 million. There can be no assurance, however, that the Company will be able to regain compliance with such requirements.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, Vision-Sciences, Inc. has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

VISION-SCIENCES, INC.

By: /s/ Gary Siegel

Name: Gary Siegel

Title: Vice President, Finance

Date: February 13, 2015

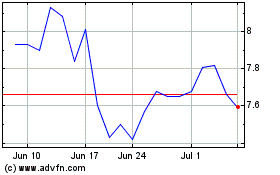

Cognyte Software (NASDAQ:CGNT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cognyte Software (NASDAQ:CGNT)

Historical Stock Chart

From Apr 2023 to Apr 2024